CNN's article on how a crypto exchange mistakenly doled out $5 million in Bitcoin carried this sidebar.

Choose one: Get rich quick? Get really, really poor?

Tuesday, January 22, 2019

Wednesday, January 16, 2019

John Bogle (1929-2019)

“In investing, you get what you don’t pay for. Costs matter. So intelligent investors will use low-cost index funds to build a diversified portfolio of stocks and bonds, and they will stay the course. "

Heckerling

The last time I attended the Heckerling Institute on Estate Planning was the final year it was held in Miami. More than a decade ago, I believe.

It's great, really great. More than 3,400 attendees, a new record. Even so, the Orlando convention center is so huge it doesn't feel crowded. I need to attend more than once every 10 years. I ran into Merrill Anderson's former client and good friend, Dave Folz.

I note with interest an increase in nontax subjects being discussed. Guardianships, for example. Choosing the right trustee, which is what caused me to send in my registration. Things that are important, but that I suspect will be hard to charge a suitable fee for, given the time it takes.

Selling estate planning was easier when the tax savings of a simple plan was 100 times larger than the fee being charged.

Also noted, an increasing push toward choosing corporate trustees. Use of trusts has exploded in recent years, according to several of the lecturers.

It's great, really great. More than 3,400 attendees, a new record. Even so, the Orlando convention center is so huge it doesn't feel crowded. I need to attend more than once every 10 years. I ran into Merrill Anderson's former client and good friend, Dave Folz.

I note with interest an increase in nontax subjects being discussed. Guardianships, for example. Choosing the right trustee, which is what caused me to send in my registration. Things that are important, but that I suspect will be hard to charge a suitable fee for, given the time it takes.

Selling estate planning was easier when the tax savings of a simple plan was 100 times larger than the fee being charged.

Also noted, an increasing push toward choosing corporate trustees. Use of trusts has exploded in recent years, according to several of the lecturers.

Monday, January 14, 2019

How Tax Refunds Drive the Economy

Unhappy taxpayers may not be the only victims of the winter of tax discontent. Last year the new tax

law made folks feel flush – and automobile sales, a key driver of the U.S. economy, exceeded expectations. This year millions of Americans are expected to receive lower refunds or, worse, owe more to the IRS.

"Without that seasonal bounce," Axios warns, "2019 auto sales may be lower, making a recession more likely."

law made folks feel flush – and automobile sales, a key driver of the U.S. economy, exceeded expectations. This year millions of Americans are expected to receive lower refunds or, worse, owe more to the IRS.

"Without that seasonal bounce," Axios warns, "2019 auto sales may be lower, making a recession more likely."

Sunday, January 06, 2019

A Winter of Tax Discontent?

One reason: the new tax law created a much larger standard deduction – $12,00 for singles, $24,000 for married couples. Though some taxpayers will benefit, others accustomed to itemizing their deductions may feel shortchanged. A couple whose state and local taxes, mortgage interest and donations add up to, say, $22,000 will find that their accustomed deductions are worthless.

According to estimates cited by the WSJ, the number of returns claiming the mortgage-interest deduction for 2018 will drop to 16 million from almost 40 million. Returns claiming deductions for charitable contributions also are expected to drop by more than 50%.

Tax withholding could be another sore spot. The withholding tables for 2018 may result in some taxpayers receiving smaller refunds or owing more at tax time.

And, smaller or not, taxpayers' refunds will be delayed if the partial government shutdown persists.

Friday, January 04, 2019

A novel way to beat the estate tax

According to this report, a couple owned a department store together in France. When the wife died in 1934, the husband should have paid a death tax of 38% on her half of the business. To avoid that tax, he reported instead that his daughter died, and the daughter then assumed the identity of the wife. Bingo, no death tax.

How did this story come to light? The daughter had a very long life. So long that she became famous for it, apparently living for 122 years and 164 days. Subsequent investigation turned up the possible fraud, the daughter may actually have died at age 100.

The woman was Jeanne Calment, a name that JLM may remember. She was the one who sold her apartment for a life annuity at age 90, only to outlive the buyer. Talk about buyer's remorse! His estate had to keep paying the annuity, so the final price for apartment was double its initial value, according to Wikipedia.

Not everyone is buying the story that a daughter could adopt the identity of her mother in a small town and everyone in town would either not notice or keep the secret. The evidence for fraud is thin—inconsistent passport descriptions, stories that don't match known facts, and the observation that in her 100s she seemed about 20 years younger.

I'd like the story to be true.

How did this story come to light? The daughter had a very long life. So long that she became famous for it, apparently living for 122 years and 164 days. Subsequent investigation turned up the possible fraud, the daughter may actually have died at age 100.

The woman was Jeanne Calment, a name that JLM may remember. She was the one who sold her apartment for a life annuity at age 90, only to outlive the buyer. Talk about buyer's remorse! His estate had to keep paying the annuity, so the final price for apartment was double its initial value, according to Wikipedia.

Not everyone is buying the story that a daughter could adopt the identity of her mother in a small town and everyone in town would either not notice or keep the secret. The evidence for fraud is thin—inconsistent passport descriptions, stories that don't match known facts, and the observation that in her 100s she seemed about 20 years younger.

I'd like the story to be true.

Tuesday, January 01, 2019

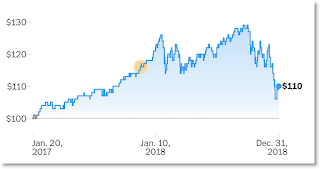

The Trump Market’s Still Up (a Little)

|

| $100 invested in stocks when President Trump took office would have been worth $110 when the market closed out 2018. |

Subscribe to:

Posts (Atom)