Back in the old century, trust marketers learned that married folks took one of two approaches to estate planning:

The untutored left everything outright to their spouses.

The tutored set aside an amount equal to the available estate-tax credit in a bypass trust (income to spouse, remainder to kids) and left the rest to their spouses.

In reality, affluent married folks have been taking a different approach, according to financial planners asked to comment on the ill-fated PETRA. As yesterday's New York Times indicates, affluent marrieds have tended to use their available estate tax credits for direct bequests to the kids (middle-aged kids, typically).

Guess that's not surprising. In a good number of cases, John and Mary raised a family but John is now married to Jessica. His second wife is not too much older than his children.

Even if no pre-nup is involved, John is wise to leave the kids an inheritance at his death. To defer any payout until Jessica's death would scarcely make the kids fonder of their stepmother.

Because of these non-tax considerations, is it really likely that John would change his estate plan and leave everything to Jessica if PETRA became law? I doubt it.

Any contrary opinions?

Friday, June 30, 2006

Tuesday, June 27, 2006

Estate tax relief: Is PETRA dead?

From a Bloomberg dispatch:

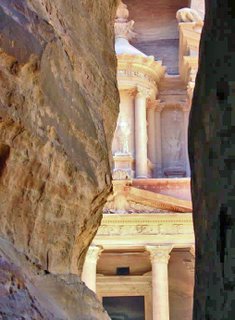

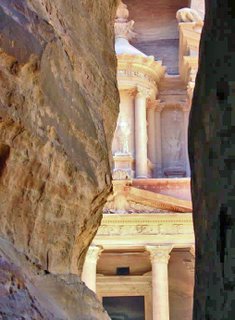

ve up just yet. The tax-bill writers who named this one PETRA (Permanent Estate Tax Relief Act) must have been aware of the link to Petra, the ancient city in Jordan that flourished under Roman rule, and hence to Indiana Jones, who always comes through in the clutch.

ve up just yet. The tax-bill writers who named this one PETRA (Permanent Estate Tax Relief Act) must have been aware of the link to Petra, the ancient city in Jordan that flourished under Roman rule, and hence to Indiana Jones, who always comes through in the clutch.

As Indiana's fans know, Petra was where the world's greatest treasure was hidden, under the guard of a Crusader knight portrayed by a real knight, Sir Laurence Olivier: The Holy Grail.

Estate-tax relief is not in quite the same league. Still, Republicans should feel inspired to continue their quest.

Senate Majority Leader Bill Frist postponed a vote on a measure to exempt most multimillionaires from federal estate taxes after conceding Republicans lack the votes to pass legislation adopted by the House last week. The delay is the third since Frist began his quest to repeal or reduce the tax last year and the second time this month his ambitions were thwarted by Democrats who say the government needs the revenue generated by the tax.But let's not gi

ve up just yet. The tax-bill writers who named this one PETRA (Permanent Estate Tax Relief Act) must have been aware of the link to Petra, the ancient city in Jordan that flourished under Roman rule, and hence to Indiana Jones, who always comes through in the clutch.

ve up just yet. The tax-bill writers who named this one PETRA (Permanent Estate Tax Relief Act) must have been aware of the link to Petra, the ancient city in Jordan that flourished under Roman rule, and hence to Indiana Jones, who always comes through in the clutch.As Indiana's fans know, Petra was where the world's greatest treasure was hidden, under the guard of a Crusader knight portrayed by a real knight, Sir Laurence Olivier: The Holy Grail.

Estate-tax relief is not in quite the same league. Still, Republicans should feel inspired to continue their quest.

Barron's weighs in also

While we're on the subject of media coverage of trust planning, Barron's ($) offers Playing it Safe, a review of the utility of bypass trusts, as well as the income tax traps that may be sprung when couples own their property jointly.

Monday, June 26, 2006

Trust planning is hot, hot, hot

The opening paragraphs of this  Wall Street Journal article ($) could have been taken from one of Merrill Anderson's newsletters:

Wall Street Journal article ($) could have been taken from one of Merrill Anderson's newsletters:

Wall Street Journal article ($) could have been taken from one of Merrill Anderson's newsletters:

Wall Street Journal article ($) could have been taken from one of Merrill Anderson's newsletters:The article goes on to explore the non-tax benefits of trust planning. Is this the decade of the trust department? Seems like a record amount of trust topics in the mainstream press lately.Not long ago, few Americans had access to, or even knew about, financial tools like 401(k)s, college savings plans and reverse mortgages. Today, many families turn to these products without a second thought.

Within a few years, the same might be said for trusts.

Often associated with the vast wealth of families like the Kennedys and the Rockefellers, trusts are finding a place in more Americans' estate plans, no matter what the size of their assets.

Saturday, June 24, 2006

Good estate-planning advice (from Guam!)

In a Gannett News Service column that turned up on a web site of Guam's Pacific Daily News, Sandra Block offers these wise words:

More than one-third of Americans with investment portfolios of $10 million or more don't have wills, according to a survey by PNC Advisors.

Worrying about estate taxes when you don't have a will is like fretting about contracting African sleeping sickness while you smoke a pack of Camels.

Friday, June 23, 2006

Will the Senate let estate tax rates fall? Timber-r-r!

The House of Representatives not only passed the Permanent Estate Tax Relief Act of 2006, it also indexed the tax threshholds ($5 million for the 15%-20% rate, $25 million for the double rate) for inflation.

Will the Relief Act pass the Senate next week? It should. Congress is considering a sensible bill. (When did you last read "sensible" and "Congress" in the same sentence?) It removes the estate-tax yoke from the merely well-to-do, preserves the convenience of stepped-up basis for inherited assets, collects the equivalent of tax on unrealized capital gains (and more) from the semi-rich, and soaks the really rich at a rate high enough to encourage philanthropy as an alternative to tax payments.

My enthusiasm is not universally shared. The Washington Post rants editorially about a terrible stench:

"Like the ghoul in the horror movie that refuses to die, estate tax repeal has returned from the grave to stalk the halls of Congress."

Still, joke writers for Leno and Letterman have got to love this legislation.

The name "Permanent Estate Tax Relief Act" is an inspired comic touch. Everybody knows that "permanent," in Congress-speak, means "We won't start messing with this legislation for at least twelve months."

And the addition of a capital-gains tax cut for the timber industry, to whom certain Democratic Senators happen to be beholden, is a real thigh-slapper.

Q. What is it called when lobbiyists grant expensive favors to members of Congress in order to get certain legislation passed?

A. Criminal.

Q. What is it called when Republican members of Congress grant expensive favors to Democratic members of Congress in order to get certain legislation passed?

A. Politics as usual.

Will the Relief Act pass the Senate next week? It should. Congress is considering a sensible bill. (When did you last read "sensible" and "Congress" in the same sentence?) It removes the estate-tax yoke from the merely well-to-do, preserves the convenience of stepped-up basis for inherited assets, collects the equivalent of tax on unrealized capital gains (and more) from the semi-rich, and soaks the really rich at a rate high enough to encourage philanthropy as an alternative to tax payments.

My enthusiasm is not universally shared. The Washington Post rants editorially about a terrible stench:

"Like the ghoul in the horror movie that refuses to die, estate tax repeal has returned from the grave to stalk the halls of Congress."

Still, joke writers for Leno and Letterman have got to love this legislation.

The name "Permanent Estate Tax Relief Act" is an inspired comic touch. Everybody knows that "permanent," in Congress-speak, means "We won't start messing with this legislation for at least twelve months."

And the addition of a capital-gains tax cut for the timber industry, to whom certain Democratic Senators happen to be beholden, is a real thigh-slapper.

Q. What is it called when lobbiyists grant expensive favors to members of Congress in order to get certain legislation passed?

A. Criminal.

Q. What is it called when Republican members of Congress grant expensive favors to Democratic members of Congress in order to get certain legislation passed?

A. Politics as usual.

Thursday, June 22, 2006

Planning a family trust? Pick your state!

With a few soak-the-rich exceptions, most states used to collect inoffensive "death taxes" covered by the state tax credit mentioned in the preceding post. In essence, these state tax payments didn't cost families anything because the IRS otherwise would have added the same amount to the federal estate tax bill.

Now, with no more state tax credit, wealthy families have reason to compare state tax climates as they plan their estates, or as they decide which state to call home. What's more, as an article (subscribers) in today's Wall Street Journal reports, wealthy families are checking out various states to see whether they encourage family trusts.

Good news for banks and trust companies in "favorable" states? The WSJ seems to think so.

A few factoids from the article:

Trust assets. In 2005 banks held about $843 billion in personal-trust assets, almost double the $471 billion or so they held in 1995.

Dynasty trusts. More than 20 states now allow the creation of trusts that last for centuries, or "forever."

Asset Protection. Affluent legal targets don't have to move assets off-shore any more. Nine states allow "asset-protection trusts."

Unitrusts. More than 20 states permit unitrusts, usually with payout rates of 3% to 5%. More than 40 states give trustees some discretion to supplement income with principal.

Now, with no more state tax credit, wealthy families have reason to compare state tax climates as they plan their estates, or as they decide which state to call home. What's more, as an article (subscribers) in today's Wall Street Journal reports, wealthy families are checking out various states to see whether they encourage family trusts.

Good news for banks and trust companies in "favorable" states? The WSJ seems to think so.

A few factoids from the article:

Trust assets. In 2005 banks held about $843 billion in personal-trust assets, almost double the $471 billion or so they held in 1995.

Dynasty trusts. More than 20 states now allow the creation of trusts that last for centuries, or "forever."

Asset Protection. Affluent legal targets don't have to move assets off-shore any more. Nine states allow "asset-protection trusts."

Unitrusts. More than 20 states permit unitrusts, usually with payout rates of 3% to 5%. More than 40 states give trustees some discretion to supplement income with principal.

Tuesday, June 20, 2006

But wait, there's more

The new estate tax reform bill introduced in the House, H.R. 5638, the Permanent Estate Tax Relief Act of 2006, sets the estate tax rate for estates of up to $25 million equal to the rate on long-term capital gains. For most of the revenue-scoring window, that will be 20%. For amounts above $25 million, the rate doubles, to 40%. When you consider that under the new law revenue will be collected during 2010, compared to no collections under current law, the "cost" of this reform should be modest.

Another revenue raiser: Back in 2001 the credit for state death taxes was converted to a deduction, which had the practical effect of passing most of the "revenue cost" of the estate tax reductions down to the states. About half of the states no longer collect death taxes, as a result of the change. The proposed law eliminates the deduction for state taxes also, after 2009. The old credit is not restored, and IRC Sec. 2011 (which included the table for calculating the state death tax credit) is deleted as "deadwood." Also deleted as deadwood, IRC Sec. 2057, the paltry relief offered to small businesses that's already been overshadowed by larger exemption amounts.

More good news: The estate and gift taxes will be reunified. That means that beginning in 2010 the federal exemption for gift taxes jumps to $5 million, from the currently scheduled $1 million. So the tax disincentive for lifetime execution of estate planning strategies will be abolished.

Another revenue raiser: Back in 2001 the credit for state death taxes was converted to a deduction, which had the practical effect of passing most of the "revenue cost" of the estate tax reductions down to the states. About half of the states no longer collect death taxes, as a result of the change. The proposed law eliminates the deduction for state taxes also, after 2009. The old credit is not restored, and IRC Sec. 2011 (which included the table for calculating the state death tax credit) is deleted as "deadwood." Also deleted as deadwood, IRC Sec. 2057, the paltry relief offered to small businesses that's already been overshadowed by larger exemption amounts.

More good news: The estate and gift taxes will be reunified. That means that beginning in 2010 the federal exemption for gift taxes jumps to $5 million, from the currently scheduled $1 million. So the tax disincentive for lifetime execution of estate planning strategies will be abolished.

Monday, June 19, 2006

Bye-Bye to Bypass Trusts?

When last heard from, Senate Republicans said it was estate tax repeal or nothing. Nothing is what they got. Now signs of flexibility are emerging.

This Washington Post story reports that House Ways and Means Committee Chairman Bill Thomas, at the request of Senate Republican leader Bill Frist, has introduced a bill that would raise the estate tax exemption to $5 million. If a married person died without using all or part of his or her exemption, the surviving spouse could claim the unused exemption along with his or her own exemption.

Does this mean bypass trusts will be history?

This Washington Post story reports that House Ways and Means Committee Chairman Bill Thomas, at the request of Senate Republican leader Bill Frist, has introduced a bill that would raise the estate tax exemption to $5 million. If a married person died without using all or part of his or her exemption, the surviving spouse could claim the unused exemption along with his or her own exemption.

Does this mean bypass trusts will be history?

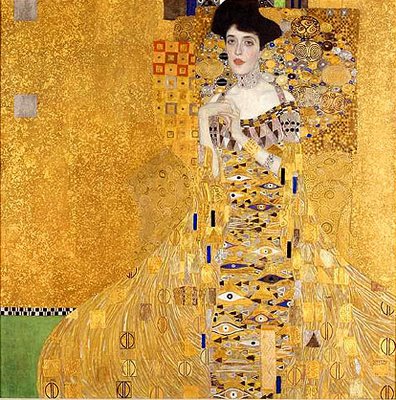

Of wills and war, and the world's most expensive painting

Art just keeps jumping into the news, doesn't it? As Jim Gust comments below, cosmetics magnate and former ambassador to Austria Ronald S. Lauder has purchased the painting shown here, Gustav Klimpt's 1907 portrait,"Adele Bloch-Bauer I," for a record $135 million. The painting will become "the Mona Lisa" of Lauder's Neue Galeria, a small NYC museum devoted to German and Austrian arts.

You can read all about it in this New York Times story.

Briefly, Adele Bloch-Bauer, wife of a Jewish sugar magnate, presided over a noted Vienna salon at the beginning of the 20th century. She may have been Klimpt's lover as well as admirer. His portrait suggests old, imperial Vienna rushing into a gold-flecked new century, full of promise, or perhaps full of decadence and, as we now know, full of war.

Adele's three children died in infancy, and she herself died of meningitis at age 43. Her will expressed the wish that this portrait, and four other works by Klimpt that she and her husband owned, pass to Austria at his death.

In 1938, Hitler annexed Austria into the Third Reich. Mr. Bloch-Bauer fled, leaving the family possessions behind. The Nazis sold some of the works but placed this one, and two others, in an Austrian museum.

Mr. Bloch-Bauer reached safety in Switzerland. Before he died in 1945, he revoked all previous wills and made a new one, leaving everything to his brother's three children. Maria, the only surviving child, is now 90 and lives in Los Angeles.

After the war, Maria and her remaining relatives sought to reclaim the Klimpt paintings the Nazis had looted. The Austrian authorities eventually ruled that Adele had essentially bequeathed the Klimpts to Austria. But in 1998, a Viennese journalist researching the case for the Boston Globe found various documents, including Adele's will, which showed she was merely expressing a wish, not making a binding bequest.

In January, an Austrian arbitration panel awarded Adele's portrait and four other paintings to Maria and her relatives.

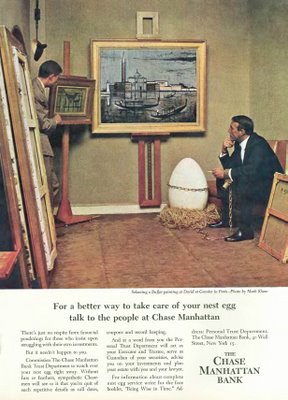

Invest nest eggs in art?

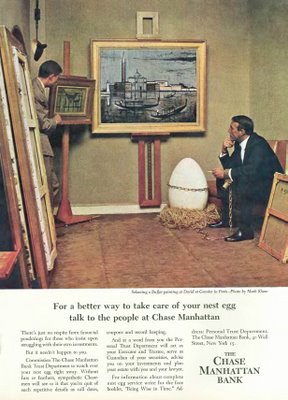

"Not since [the 1980s] has so much Wall Street money flowed steadily into the art market, prompting artists to scamper from gallery to gallery in pursuit of riches and fame. "

So says an article in yesterday's New York Times. Looks like the right time to share another of Chase Manhattan's classic (and now collectible) nest-egg ads.

Notice the added snob appeal (as it would have been called in the early 1960's) of the credit-line under the photo. No photographer's set-up, this, but rather an actual shot of a Buffet being inspected at the David et Garnier gallery in Paris.

Notice the added snob appeal (as it would have been called in the early 1960's) of the credit-line under the photo. No photographer's set-up, this, but rather an actual shot of a Buffet being inspected at the David et Garnier gallery in Paris.

Worried that some of your clients may be investing in art not wisely but too well? Refer them to this Financial Page from The New Yorker:

If you browse the site, admire the liberal use of slide shows to create ambience.

So says an article in yesterday's New York Times. Looks like the right time to share another of Chase Manhattan's classic (and now collectible) nest-egg ads.

Notice the added snob appeal (as it would have been called in the early 1960's) of the credit-line under the photo. No photographer's set-up, this, but rather an actual shot of a Buffet being inspected at the David et Garnier gallery in Paris.

Notice the added snob appeal (as it would have been called in the early 1960's) of the credit-line under the photo. No photographer's set-up, this, but rather an actual shot of a Buffet being inspected at the David et Garnier gallery in Paris.Worried that some of your clients may be investing in art not wisely but too well? Refer them to this Financial Page from The New Yorker:

So should we all dump our shares of ExxonMobil in order to own a few square inches of a Manet canvas? Not quite. . . . [T]he vast majority of paintings that people have bought in the past never make it to resale. According to one estimate, a mere 0.5 per cent of new paintings are worth anything at auction thirty years later. Relying on auction prices to calculate a return on investment for art ignores all the money people spent on the other 99.5 per cent.The market for art, and indeed for anything tangible, heated up in the high-inflation 1970s. Citibank started an art advisory service for wealthy clients in 1979. Seems to be still going, and its site displays more advanced web design than the rest of Citibank Private Bank.

If you browse the site, admire the liberal use of slide shows to create ambience.

Wednesday, June 14, 2006

Six out of seven investors don't want to think about investing

From Fund Investors Don't Want To Go It Alone, Jonathan Clements' column in the WSJ:

Yes, index funds are growing rapidly, especially exchange-traded index funds. Still, the Bogle Center calculates that these index funds account for less than 16% of the money in stock funds, hardly a huge percentage.

Similarly, among folks who invest in mutual funds outside their employer's retirement plan, a mere 14% do so without any help from a financial adviser, according to the Investment Company Institute. Indeed, the Institute's Mr. Reid says there have never been large numbers of true do-it-yourself, no-load-fund investors.

That's good news if you are a financial adviser. What if you are a personal-finance columnist? I've got to tell you, it's sort of depressing.

Yes, index funds are growing rapidly, especially exchange-traded index funds. Still, the Bogle Center calculates that these index funds account for less than 16% of the money in stock funds, hardly a huge percentage.

Similarly, among folks who invest in mutual funds outside their employer's retirement plan, a mere 14% do so without any help from a financial adviser, according to the Investment Company Institute. Indeed, the Institute's Mr. Reid says there have never been large numbers of true do-it-yourself, no-load-fund investors.

That's good news if you are a financial adviser. What if you are a personal-finance columnist? I've got to tell you, it's sort of depressing.

Saturday, June 10, 2006

Why wealth-management and trust marketers love the halls of Ivy

Well over 90% of U. S. households are not millionaire households.

Only perhaps 3 or 4 million Americans are millionaires in their own right, not counting their spouses' assets.

Seems like finding new HNW clients would require a lot of searching. Happily, there's a short cut. As The Wall Street Journal reported recently, Harvard estimates that more than half its 300,000-odd alumni are millionaires. Yale and Princeton alums must offer almost equally good pickings.

No wonder savvy workers in the HNW market hold the membership lists of their local Ivy alumni clubs in such high esteeem.

Nostal gia note: "Halls of Ivy" is a name that will resonate with Gramps and Granny. The popular post-WWII radio show, starring Ronald Coleman and his wife, migrated to TV for two seasons. Coleman played the president of Ivy College. You can listen to one of the radio shows here.

gia note: "Halls of Ivy" is a name that will resonate with Gramps and Granny. The popular post-WWII radio show, starring Ronald Coleman and his wife, migrated to TV for two seasons. Coleman played the president of Ivy College. You can listen to one of the radio shows here.

Ivy College alums can even sing along with the Alma Mater. All together now! "We love the halls of Ivy that surround us here today . . . "

Extra-credit trivia question: On Jack Benny's radio show, who played his next-door neighbors?

Only perhaps 3 or 4 million Americans are millionaires in their own right, not counting their spouses' assets.

Seems like finding new HNW clients would require a lot of searching. Happily, there's a short cut. As The Wall Street Journal reported recently, Harvard estimates that more than half its 300,000-odd alumni are millionaires. Yale and Princeton alums must offer almost equally good pickings.

No wonder savvy workers in the HNW market hold the membership lists of their local Ivy alumni clubs in such high esteeem.

Nostal

gia note: "Halls of Ivy" is a name that will resonate with Gramps and Granny. The popular post-WWII radio show, starring Ronald Coleman and his wife, migrated to TV for two seasons. Coleman played the president of Ivy College. You can listen to one of the radio shows here.

gia note: "Halls of Ivy" is a name that will resonate with Gramps and Granny. The popular post-WWII radio show, starring Ronald Coleman and his wife, migrated to TV for two seasons. Coleman played the president of Ivy College. You can listen to one of the radio shows here.Ivy College alums can even sing along with the Alma Mater. All together now! "We love the halls of Ivy that surround us here today . . . "

Extra-credit trivia question: On Jack Benny's radio show, who played his next-door neighbors?

Friday, June 09, 2006

Hedge managers can play, but do their funds really work?

The Who played at Woodstock, and according to this New York Times report, they were back on the job at Hedgestock, an alternative festival for wealthy fund stars and their vassals held north of London. Bentleys may have been more numerous than VWs.

The Who played at Woodstock, and according to this New York Times report, they were back on the job at Hedgestock, an alternative festival for wealthy fund stars and their vassals held north of London. Bentleys may have been more numerous than VWs.Hedge fund stars lap up luxuries despite bad press about the results they achieve. According to The Times of London, last year hedge fund returns averaged anywhere from 3% to 9% or so, depending on the index one consulted.

What's more, as Ben Stein reported in a New York Times column, "research by Burton G. Malkiel, a professor at Princeton, and Atanu Saha, a principal at the Analysis Group, found that over long periods hedge funds significantly underperform index funds, like those based on the Standard & Poor's 500-stock index."

Stein adds, "Other commentators . . . say that even these results overstate hedge fund results. For one thing, there is survivorship bias — always a problem in the back alleys of finance — because only the hedge funds that survive report at all. If you take into account the ones that fail, the results would be worse."

But what about hedge funds that do so well they close their doors to new investors and stop reporting results? According to a Mark Hulbert column, a new study suggests that hedge fund returns would look better, and more persistant, if these overachieving dropouts were taken into account.

Or maybe not. Lacking hard data on the actual returns generated by closed-door funds, the study is based on "intelligent guesses."

Thursday, June 08, 2006

Death and taxes debated on national TV!

Jim Lehrer's Newshour offers a weird form of TV news. Even arcane subjects such as estate tax legislation receive minutes and minutes and minutes of coverage. On the commercial networks, only the onset of World War III will get that much notice.

Wednesday evening's Newshour coverage of death and taxes featured the Heritage Foundation's William Beach and Seattle lawyer William Gates Sr. Both did a good job of advocacy.

Two interesting twists: Beach suggested that higher income taxes would be a better way to soak the rich. Gates Sr. voiced strong support for raising the estate-tax exemption.

Two questions: Why do fans of the estate tax talk about the extremely temporary higher exemptions of the next few years, not the $1 million default exemption from 2011 onward? Why do they insist that the estate tax is "paid" by only a few dead people, not their more numerous heirs?

For streaming video of the coverage, go here.

Wednesday evening's Newshour coverage of death and taxes featured the Heritage Foundation's William Beach and Seattle lawyer William Gates Sr. Both did a good job of advocacy.

Two interesting twists: Beach suggested that higher income taxes would be a better way to soak the rich. Gates Sr. voiced strong support for raising the estate-tax exemption.

Two questions: Why do fans of the estate tax talk about the extremely temporary higher exemptions of the next few years, not the $1 million default exemption from 2011 onward? Why do they insist that the estate tax is "paid" by only a few dead people, not their more numerous heirs?

For streaming video of the coverage, go here.

Monday, June 05, 2006

Could the life insurance lobby thwart estate tax repeal?

The Senate may vote on estate tax repeal this week. If repeal fails, this National Review column suggests, you can blame the life insurance industry.

Saturday, June 03, 2006

Stop reading this silly blog. Start a hedge fund!

You'll probably never get rich selling CRATs or rollover IRAs. But here's the good news. Anybody who can get pension fund managers or Bentley owners to hand over some money can start a hedge fund.

The rewards can be enormous. Last year, according to this New York Times report ($$$) a top 26 hedge fund manager (there was a tie at the bottom of the top-25 list) made at least $130 million. That's up from a minimum of $100 million in 2004.

The average guy in the top 26 for 2005 made $363 million!

The highest-paid? James Simon of Renaissance Technologies, at $1.5 billion.

No special training or credentials are required to manage a hedge fund, though it does help to live in or near Greenwich, CT. Most important, you have to know how to dress the part. That's why you need to pick up a copy of today's Wall Street Journal or check out Hedge Fund Chic via your online subscription.

Two rules to remember:

1. Ditch your briefcase and get a messenger bag . (This may be a NYC thing; the bags were popularized by the city's rampaging bicycle messengers.) The Adobe model shown here would be especially cool if your fund is going to focus on creative areas such as media.

2. Ditch your suits in favor of neatly pressed slacks and dress shirts. If you can afford it, look for labels like Ermenegildo Zegna, Armani Collezioni and Incotex. If you can't, go Lands' End.

The Journal's article offers no specific tips for women. Probably aren't any women among the top 25. Hedge funds are all about Alpha, and what woman wants to act like an Alpha Male?

The rewards can be enormous. Last year, according to this New York Times report ($$$) a top 26 hedge fund manager (there was a tie at the bottom of the top-25 list) made at least $130 million. That's up from a minimum of $100 million in 2004.

The average guy in the top 26 for 2005 made $363 million!

The highest-paid? James Simon of Renaissance Technologies, at $1.5 billion.

No special training or credentials are required to manage a hedge fund, though it does help to live in or near Greenwich, CT. Most important, you have to know how to dress the part. That's why you need to pick up a copy of today's Wall Street Journal or check out Hedge Fund Chic via your online subscription.

Two rules to remember:

1. Ditch your briefcase and get a messenger bag . (This may be a NYC thing; the bags were popularized by the city's rampaging bicycle messengers.) The Adobe model shown here would be especially cool if your fund is going to focus on creative areas such as media.

2. Ditch your suits in favor of neatly pressed slacks and dress shirts. If you can afford it, look for labels like Ermenegildo Zegna, Armani Collezioni and Incotex. If you can't, go Lands' End.

The Journal's article offers no specific tips for women. Probably aren't any women among the top 25. Hedge funds are all about Alpha, and what woman wants to act like an Alpha Male?

Thursday, June 01, 2006

Referral blog-a-thon

An outfit called Horsesmouth, in the business of helping financial advisors build sales, is in the midst of a month-long blog fest on the subject of referrals. Here's an interesting one from a captive broker who seeks HNW referrals from his banker colleagues!

Daily updates to the blog may be found here.

Daily updates to the blog may be found here.

Subscribe to:

Posts (Atom)