That brings me to today's fun fact. In Malaysia, to call yourself a financial planner, you must be qualified, such as earning the local equivalent of the CFP or the chartered financial consultant designation. But in the U.S., to hang out a shingle as a financial planner, all you need is a shingle and a place to hang it.By the way, what ever happened to brokers called brokers? At Morgan Stanley, according to this WSJ report, they seem to have vanished entirely. The Retail Brokerage unit is now the Global Wealth Management unit. (Hey, welcome to our blog, guys!)

Advisers don't necessarily act in their clients' best interest. This issue has been brought into sharp relief by the heated debate over the Securities and Exchange Commission's so-called Merrill Lynch rule. Under the rule, fee-based advisers at brokerage firms often aren't considered fiduciaries, meaning they are supposed to recommend products that are best for their clients. Instead, they are held to a lower "suitability" standard, which means they are only required to recommend products that are a reasonable choice for their customers.

Wednesday, May 31, 2006

Is there a fiduciary in the house?

Two excerpts from The Five Key Rules To Heed Before Hiring a Financial Adviser in today's WSJ:

Estate planning tidbits

The author of this Washington Post Op-Ed piece certainly doesn't favor estate-tax repeal, but he suggests there's broad Senate support for raising the estate-tax exemption to a permanent $3.5 million ($7 million for couples). Inflation adjusted?

Wall Street Journal subscribers can read about the increasingly common problem of estate planning involving children from previous marriages and stepchildren. The trick is to defuse disputes by treating all the kids fairly. Problem: As the end of the article suggests, a lot depends on what you mean by "fairly."

Where there are a number of surviving spouses or ex-spouses, you can bet one or more will think, "How dare he leave my kids no more than he left his kids by that floozie!"

Wall Street Journal subscribers can read about the increasingly common problem of estate planning involving children from previous marriages and stepchildren. The trick is to defuse disputes by treating all the kids fairly. Problem: As the end of the article suggests, a lot depends on what you mean by "fairly."

Where there are a number of surviving spouses or ex-spouses, you can bet one or more will think, "How dare he leave my kids no more than he left his kids by that floozie!"

Friday, May 26, 2006

I don't know much about art, but . . .

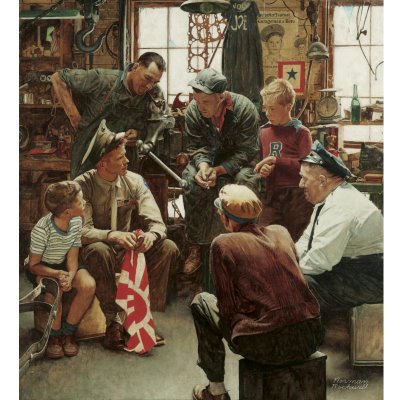

As our salute to veterans and Memorial Day, here's the star of the Sotheby's auction mentioned in the previous post. Norman Rockwell's Homecoming Marine appeared on the cover of The Saturday Evening Post in October, 1945.

Rockwell set the scene in an actual small-town Vermont garage, near where he then lived.

Norman Rockwell wasn't a serious artist, of course, any more than Irving Berlin was a serious composer. Even so, Sotheby's hoped to see this painting sell for as much as $5 million.

Actual price, including buyer's premium: $9.2 million!

Say, you don't suppose the Art World is beginning to take Norman Rockwell seriously?

Wednesday, May 24, 2006

Treasures in your clients' estates?

Collectibles and stuff can be worth a lot these days. Case in point, the life-size bronze of a girl holding a sundial shown here. Five or six copies of the sculpture, created by Harriet Whitney Frishmuth, were cast by Gorham in the 1930's. The provenence is uncertain, but this one just may have decorated the grave site of my wife's Wall-Streeter grandfather, who died in 1939, before passing through the hands of various collectors.

Collectibles and stuff can be worth a lot these days. Case in point, the life-size bronze of a girl holding a sundial shown here. Five or six copies of the sculpture, created by Harriet Whitney Frishmuth, were cast by Gorham in the 1930's. The provenence is uncertain, but this one just may have decorated the grave site of my wife's Wall-Streeter grandfather, who died in 1939, before passing through the hands of various collectors.Today at Sotheby's auction of American art, Roses of Yesterday was expected to fetch between $300,000 and $500,000. She did a bit better than that, selling for $632,000 including buyer's premium.

Some treasures aren't obvious, allowing them to be thrown out in the trash when a home is cleaned out after Grandma dies or moves to a nursing home. This Wall Street Journal article cites an instance where a son threw out the family silver.

An earlier Journal article reports on an executor who junked a collection of antique sewing machines, only to find the collection was worth over $60,000.

Sometimes even junk isn't junk. Not since eBay. See this recent post on Death and Taxes.

An unrelated endorsement

Moving off topic for just a moment, I finally saw United 93 last night with Number Three Son. If you haven't seen it yet, I urge you to do so. The film is outstanding, the subject remains vitally important.

Tuesday, May 23, 2006

An instructive guide to stock market bubbles

The Baker Library of the Harvard Business School offers a resource-rich web site, as I discovered when The Wall Street Journal announced that historical examples from its "Pepper...and Salt" cartoons were on view.

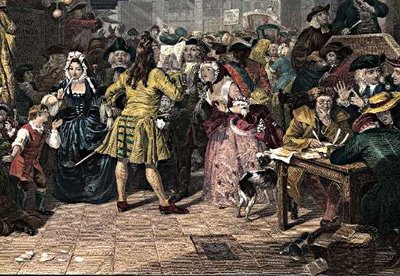

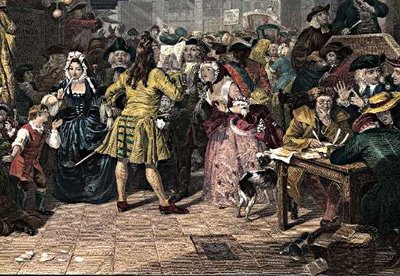

The Baker Library's other offerings include an extensive online exhibit relating to stock market bubbles, illustrating that The South Sea Bubble and the Dot Com Bubble were sisters under the skin. Here's a sample from the exhibit, showing early 18th-century stock jobbers, as traders then were known. (Yes, women of the day pawned their pearls and rushed to buy stocks!)

The Baker Library's other offerings include an extensive online exhibit relating to stock market bubbles, illustrating that The South Sea Bubble and the Dot Com Bubble were sisters under the skin. Here's a sample from the exhibit, showing early 18th-century stock jobbers, as traders then were known. (Yes, women of the day pawned their pearls and rushed to buy stocks!)

Not really news—financial advisors plan to go after the trust market

The business of managing trusts has been coveted by brokers and financial planners since, oh well, long before I arrived on the marketing scene a quarter century ago. Investment News has another "news" item on the subject this week. But I wonder just how much the advisors really want to be trustees. Note these key paragraphs from the article:

Yes, that term "fiduciary responsiblity" has long been scary to those outside the trust industry.

Although some trusts call for relatives to serve as trustees, others are much more complex and require an institution to serve as a corporate trustee. This requires the trustee, or the institution serving as the trustee, to assume fiduciary responsibility.

The issue is dicey for some advisers who are eager for this business but who may not be prepared to take on the responsibility of trustee. In fact, some advisers will oversee trusts only if the client agrees to be the trustee.

Yes, that term "fiduciary responsiblity" has long been scary to those outside the trust industry.

Sunday, May 21, 2006

Learning from Steve Jobs, part II

Despite its popularity in the business world, mediocrity isn't all it's cracked up to be.

To reinforce that lesson, turn to the auto feature in The New York Times this morning. Just reading about the cast of Pixar's new movie, "Cars," has got to be more entertaining than sitting through the entire film of the Da Vinci Code.

Seems that John Lassater, Pixar's (and now Disney's) animation genius, is a long-time car nut. "Cars" is his labor of love. If the movie, which opens in June, lives up to the cast descriptions, it will be HUGE!

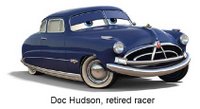

The voice cast includes Paul Newman, retired race car driver, playing Doc Hudson, retired racer. That's how Doc got blue eyes.

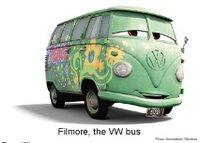

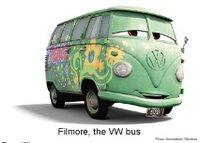

Filmore, the VW only a flower child could love, is voiced by George Carlin.

Like Apple, Steve Jobs' first venture, Pixar was born of the desire to make stuff that is "insanely great." Apple has stumbled from time to time (firing Jobs didn't help) but Pixar' s output has ranged all the way from very good to really great.

ranged all the way from very good to really great.

How does Pixar do it? Two clues that financial-services marketers might find useful:

1. According to this earlier NY Times article ($$$), all employees are encouraged to learn animation at Pixar Univerity. All employees. According to the dean of the university, an ex Flying Karamazov Brother, "We're trying to create a culture of learning, filled with lifelong learners.

"Why teach drawing to accountants? Because drawing class doesn't just teach people to draw. It teaches them to be more observant. There's no company on earth that wouldn't benefit from having people become more observant."

Arguably, knowledge of investing and financial planning is at least as necessary as knowing how to draw and animate. Does your IT guy know a derivative from a debenture? Can your receptionist participate in a discussion of disclaimers? Steve Jobs might tell you that the answers should be "yes."

2. Today's Times story says John Lasseter and his group visited design studios for the Big Three automakers and particularly hit it off with J Mays, the Ford design chief.

To reinforce that lesson, turn to the auto feature in The New York Times this morning. Just reading about the cast of Pixar's new movie, "Cars," has got to be more entertaining than sitting through the entire film of the Da Vinci Code.

Seems that John Lassater, Pixar's (and now Disney's) animation genius, is a long-time car nut. "Cars" is his labor of love. If the movie, which opens in June, lives up to the cast descriptions, it will be HUGE!

The voice cast includes Paul Newman, retired race car driver, playing Doc Hudson, retired racer. That's how Doc got blue eyes.

Filmore, the VW only a flower child could love, is voiced by George Carlin.

Like Apple, Steve Jobs' first venture, Pixar was born of the desire to make stuff that is "insanely great." Apple has stumbled from time to time (firing Jobs didn't help) but Pixar' s output has

ranged all the way from very good to really great.

ranged all the way from very good to really great.How does Pixar do it? Two clues that financial-services marketers might find useful:

1. According to this earlier NY Times article ($$$), all employees are encouraged to learn animation at Pixar Univerity. All employees. According to the dean of the university, an ex Flying Karamazov Brother, "We're trying to create a culture of learning, filled with lifelong learners.

"Why teach drawing to accountants? Because drawing class doesn't just teach people to draw. It teaches them to be more observant. There's no company on earth that wouldn't benefit from having people become more observant."

Arguably, knowledge of investing and financial planning is at least as necessary as knowing how to draw and animate. Does your IT guy know a derivative from a debenture? Can your receptionist participate in a discussion of disclaimers? Steve Jobs might tell you that the answers should be "yes."

2. Today's Times story says John Lasseter and his group visited design studios for the Big Three automakers and particularly hit it off with J Mays, the Ford design chief.

Mr. Mays and Mr. Lasseter bonded and exchanged studio visits. Mr. Lasseter learned how real cars are designed. Mr. Mays was impressed with Pixar's obsessive attention to detail. "They want to get things right even if no one can tell," he said. "If it was wrong, they would know."How obsessive? The Pixar team hunted down vintage Hudson Hornet paint chips to make sure Doc Hudson is the correct shade of blue!

Friday, May 19, 2006

The Steve Jobs Code: what can marketers learn?

May 19, 2006. A day that will live in conspiracy theory:

Item: On this day, The Da Vinci Code opened in movie complexes all across the land. The film's plot circles around the Louvre Museum. At the Louvre, a contemporary addition to the former royal palace features a large glass pyramid in a courtyard.

Item: On this day, at 6. p.m. EDT, Steve Jobs opened his new flagship store on Fifth Avenue in New York City, across from the French-looking Plaza Hotel. The new store, located below street level in the contemporary courtyard of the GM building,is topped by a giant glass cube.

Coincidence? We think not. Just one more illustration of Steve Job's marketing genius. You can check out a few photos of the cube's unwrapping here.

For an informative article on the man in charge of Apple's stores and the creative thinking that goes into them, see this NY Times article.

Note, for instance, that the size of Apple's stores relates to "the size of the brand," not the sizes of iPods or macBooks.

Designing "wealth-management stores" is a different challenge, but here, too, creativity could pay off. A few banks have picked up on the coffee-shop approach suggested on this blog last year.

Note also that Apple found it unexpectedly easy to recruit expert staff and Apple Geniuses from the community of Mac lovers.

How do you build a community among your clients and prospects? You might emulate Mac User Groups like Seacoastmac.org and start a discusssion board. Theirs draws over 150 participants from as far away as Australia.

Might work like this: Your clients, after logging in to your online facility, are able to join a discussion group. The group might also include a few friendly attorneys and CPAs. The professionals could chip in on taxes and such; clients would discuss the people side of financial planning for the affluent:

"Should I have a pre-mup before remarrying?"

"At what age should a trust for my daughter end? Or should it be for life?"

"Should affluent grandparents feel obliged to shell out for private schools?

"We're thinking of making a sizable donation to such-and-such local charity. Is it as worthy as we think?"

You get the idea. Got a better one? Go for it.

May The Steve Be With You!

Item: On this day, The Da Vinci Code opened in movie complexes all across the land. The film's plot circles around the Louvre Museum. At the Louvre, a contemporary addition to the former royal palace features a large glass pyramid in a courtyard.

Item: On this day, at 6. p.m. EDT, Steve Jobs opened his new flagship store on Fifth Avenue in New York City, across from the French-looking Plaza Hotel. The new store, located below street level in the contemporary courtyard of the GM building,is topped by a giant glass cube.

Coincidence? We think not. Just one more illustration of Steve Job's marketing genius. You can check out a few photos of the cube's unwrapping here.

For an informative article on the man in charge of Apple's stores and the creative thinking that goes into them, see this NY Times article.

Note, for instance, that the size of Apple's stores relates to "the size of the brand," not the sizes of iPods or macBooks.

Designing "wealth-management stores" is a different challenge, but here, too, creativity could pay off. A few banks have picked up on the coffee-shop approach suggested on this blog last year.

Note also that Apple found it unexpectedly easy to recruit expert staff and Apple Geniuses from the community of Mac lovers.

How do you build a community among your clients and prospects? You might emulate Mac User Groups like Seacoastmac.org and start a discusssion board. Theirs draws over 150 participants from as far away as Australia.

Might work like this: Your clients, after logging in to your online facility, are able to join a discussion group. The group might also include a few friendly attorneys and CPAs. The professionals could chip in on taxes and such; clients would discuss the people side of financial planning for the affluent:

"Should I have a pre-mup before remarrying?"

"At what age should a trust for my daughter end? Or should it be for life?"

"Should affluent grandparents feel obliged to shell out for private schools?

"We're thinking of making a sizable donation to such-and-such local charity. Is it as worthy as we think?"

You get the idea. Got a better one? Go for it.

May The Steve Be With You!

Thursday, May 18, 2006

Fugitive hedge fund manager finally nabbed

As we noted back in March, Hedge-fund manager KIrk Wright drew money from NFL players and other wealthy investors who liked the idea of 27% returns.

Shame the returns weren't real.

After nearly three months on the lam, Wright was arrested today at a Miami-area hotel.

Shame the returns weren't real.

After nearly three months on the lam, Wright was arrested today at a Miami-area hotel.

Tuesday, May 16, 2006

Really, mark your calendar

CCH offers the useful reminder, in their summary of the new tax law, that 2010, in addition to being the first year in which high-income taxpayers may convert their IRAs to Roth IRAs, will also be the last year we enjoy the lower tax rates and wider brackets from the 2001 tax law. In other words, Congress has already legislated 2011 to be the mother of all tax hike years, unless we can talk them into putting the gun down.

Friday, May 12, 2006

Mark your calendar

If you have a traditional IRA that you'd like to convert to a Roth IRA, Congress has some great news for you. The somewhat arbitrary AGI cap on who is eligible for such a conversion ($100,000 for both singles and marrieds filing jointly) will be eliminated.

It's a revenue raising measure, see, because the conversion will be a fully taxable transaction. And to ease the pain, the taxes can be paid over two years. But as it turns out, Congress also realized that the new money isn't needed right away, because today's deficit is in a tolerable range. But in 2010, boy, that's when we're really gonna need the dough. So that's the year that the income cap comes off.

I'm marking my calendar now.

It's a revenue raising measure, see, because the conversion will be a fully taxable transaction. And to ease the pain, the taxes can be paid over two years. But as it turns out, Congress also realized that the new money isn't needed right away, because today's deficit is in a tolerable range. But in 2010, boy, that's when we're really gonna need the dough. So that's the year that the income cap comes off.

I'm marking my calendar now.

Thursday, May 11, 2006

What am I missing about the AMT?

The one-year "hold harmless" patch to the AMT that House has approved (Senate concurrence expected momentarily) boosts the exemption for a married couple from $45,000 to $62,550 for the 2006 tax year only. That creates the certainty that we get to enjoy a rerun of this debate a year from now, which I know we all will greet with joyous anticipation.

But given that the change takes effect only in 2006, why is it scored as a $12 billion revenue loss in 2006 and another $18 billion revenue loss in 2007? I thought these calculations were done on a tax year basis--even if the added AMT isn't paid until 2007, shouldn't it be credited to 2006, when the liability is incurred? Alternatively, if they are really accounting for cash flow and not liability, why isn't the whole cost in 2007? No one can know until the tax year is over whether any AMT will be due or not.

One additional issue: given that the cut in the tax rate on capital gains and dividends was followed by an increase in tax revenue from these categories, why is the extension of that rate scored as losing revenue? Why isn't the past prologue? I realize that the revenue increase is partly because economic growth was better than expected, and that the exact relationship between that growth and the lowered tax rates can't be quantified with precision (the old static v. dynamic scoring debate). Still, given the actual experience I think that the extension should be scored as, at worst, a neutral on revenue.

But given that the change takes effect only in 2006, why is it scored as a $12 billion revenue loss in 2006 and another $18 billion revenue loss in 2007? I thought these calculations were done on a tax year basis--even if the added AMT isn't paid until 2007, shouldn't it be credited to 2006, when the liability is incurred? Alternatively, if they are really accounting for cash flow and not liability, why isn't the whole cost in 2007? No one can know until the tax year is over whether any AMT will be due or not.

One additional issue: given that the cut in the tax rate on capital gains and dividends was followed by an increase in tax revenue from these categories, why is the extension of that rate scored as losing revenue? Why isn't the past prologue? I realize that the revenue increase is partly because economic growth was better than expected, and that the exact relationship between that growth and the lowered tax rates can't be quantified with precision (the old static v. dynamic scoring debate). Still, given the actual experience I think that the extension should be scored as, at worst, a neutral on revenue.

Wednesday, May 10, 2006

What tax rate do your clients pay on capital gains? Are you sure?

Looks like the 15% tax rate on dividends and long-term investment gains will survive for at least another two years.

But your affluent clients won't necessarily be paying that low rate. Why? This New York Times article explains:

"Because of the alternative minimum tax, more than a third of investors last year paid taxes higher than the 15 percent rate sponsored by President Bush on their long-term capital gains, a new Congressional report shows.

"These investors paid more than $7 billion in higher federal and state taxes than they would have under the regular income tax system, according to calculations by The New York Times based on the new report."

But your affluent clients won't necessarily be paying that low rate. Why? This New York Times article explains:

"Because of the alternative minimum tax, more than a third of investors last year paid taxes higher than the 15 percent rate sponsored by President Bush on their long-term capital gains, a new Congressional report shows.

"These investors paid more than $7 billion in higher federal and state taxes than they would have under the regular income tax system, according to calculations by The New York Times based on the new report."

Tuesday, May 09, 2006

The Dilbert Portfolio

Scott Adams, the creator of the Dilbert comic strip, has a Blog. The blog is about as funny as Dilbert, which I've always enjoyed.

A few days ago, Scott asked his blog readers for some investment tips. Scott's amateur investment observations are pretty clever. When the readers suggested some trends worth investing in, Scott asked for stock recommendations. He picked four stocks that sounded reasonable, bought 500 shares of each for about $75,000.

After just two days his portfolio was up 7%. Beginners luck, or are we in a really good market right now?

A few days ago, Scott asked his blog readers for some investment tips. Scott's amateur investment observations are pretty clever. When the readers suggested some trends worth investing in, Scott asked for stock recommendations. He picked four stocks that sounded reasonable, bought 500 shares of each for about $75,000.

After just two days his portfolio was up 7%. Beginners luck, or are we in a really good market right now?

Misled about risk, affluent clients win $900,000 in arbitration

In March of 2000, Suzanne Carruthers and her husband placed several million dollars in a managed-investment program overseen by Smith Barney, via Citigroup's Fiduciary Services Affiliated Managers Program.

By October, 2003, the Carruthers' portfolio showed a loss of $1.23 million. The couple went to arbitration seeking to have their loss made good, charging that they had been misled as to the riskiness of the investment mix they were sold.

According to a former SEC economist who testified on the couple's behalf, their loss would have been only $330,000 had their money been invested in a balanced fund of 60% stocks, 40% bonds.

What's more,, said economist Craig McCann: "The presentation materials I reviewed were, false and misleading is a strong term, but were very close to that, if not that. They are based on assumptions that are not just differences of opinion, but are factually wrong, and, more importantly," the analysis was "framed in such a way to lead investors to choose more risky portfolios than they otherwise would."

The three-member arbitration panel ruled that Smith Barney should pay the Carruthers $900,000 — that is, $1.23 million less the hypothetical $330,000 they would have lost anyway.

According to a press release from the law firm that represented the Carruthers, they were presented with grossly misleading asset-allocation numbers:

The Wall Street Journal (subscribers only) warns that the award "may lead to similar cases being brought by affluent investors who lost money in portfolios that contained more risk than they say they were led to believe."

What were the odds that a hypothetical 60-40 stock-bond mix would have met the Carruthers' retirement goals? On that question the news reports are (oddly?) silent.

By October, 2003, the Carruthers' portfolio showed a loss of $1.23 million. The couple went to arbitration seeking to have their loss made good, charging that they had been misled as to the riskiness of the investment mix they were sold.

According to a former SEC economist who testified on the couple's behalf, their loss would have been only $330,000 had their money been invested in a balanced fund of 60% stocks, 40% bonds.

What's more,, said economist Craig McCann: "The presentation materials I reviewed were, false and misleading is a strong term, but were very close to that, if not that. They are based on assumptions that are not just differences of opinion, but are factually wrong, and, more importantly," the analysis was "framed in such a way to lead investors to choose more risky portfolios than they otherwise would."

The three-member arbitration panel ruled that Smith Barney should pay the Carruthers $900,000 — that is, $1.23 million less the hypothetical $330,000 they would have lost anyway.

According to a press release from the law firm that represented the Carruthers, they were presented with grossly misleading asset-allocation numbers:

The Carruthers had been shown figures indicating that the asset mix recommended by the broker had a better than 75% chance of achieving their target return. According to McCann, that mix actually had less than a 38% chance of providing the retirement income the Carruthers wanted. McCann testified that the entire sales presentation appeared to be "tactically designed" to push a potential customer in the direction of a riskier portfolioSaid one of the firm's lawyers: "Citigroup claimed that our arguments had to be wrong because they and their predecessors have been doing business this way since 1973. In my opinion, this award sends a message that you aren't entitled to mislead customers, no matter how long you've followed your successful business model."

The Wall Street Journal (subscribers only) warns that the award "may lead to similar cases being brought by affluent investors who lost money in portfolios that contained more risk than they say they were led to believe."

What were the odds that a hypothetical 60-40 stock-bond mix would have met the Carruthers' retirement goals? On that question the news reports are (oddly?) silent.

Monday, May 08, 2006

Saving Boomers (and Depression Babies) from "Free Lunches"

In the good old days of the Twentieth Century, like 12 or 15 years ago, the Trust Department of The First National Bank of Portsmouth, NH, held an annual investment seminar and luncheon for clients and friends. They presented good programs (I remember Stu Varney as one guest speaker) and pretty good food.

The bank is long gone. Even the venue, Yoken's Conference Center, lost a fight with bulldozers a year or two ago.

These days, seniors who answer invitations to "seminars" with "free lunches" find themselves swimming with sharks, not chatting with trust officers. So great is the danger that the SEC, in partnership with NASAA, has announced a new program to protect senior investors.

Sobering thought from SEC Chairman Christopher Cox: "Another American baby boomer will turn 60 every eight seconds for the next 20 years."

The bank is long gone. Even the venue, Yoken's Conference Center, lost a fight with bulldozers a year or two ago.

These days, seniors who answer invitations to "seminars" with "free lunches" find themselves swimming with sharks, not chatting with trust officers. So great is the danger that the SEC, in partnership with NASAA, has announced a new program to protect senior investors.

Sobering thought from SEC Chairman Christopher Cox: "Another American baby boomer will turn 60 every eight seconds for the next 20 years."

Do your clients face higher taxes?

Ben Stein, in his latest New York Times column, praises the good life that high incomes make possible. But he's also concerned:

Look here to see how the share of tax paid by the 30% of U.S. taxpayers with the highest incomes compares with taxpayers in other nations around the world.

Look here to see how relatively little the poorest 30% of American taxpayers pay.

Moral: In Scandanavian countries and others where both poverty and $100-million incomes are rare, average citizens of necessity have to bear a larger portion of the tax burden.

But let's also remember that even poor Americans are wealthy beyond the dreams of avarice by world standards. Look here at how GDP per capita varies around the world.

On my way back [from the Yale Club], two young men accosted me in front of Rockefeller Center. They told me they were recent Yale graduates who were making a great living working at hedge funds. They told me that their boss made $100 million a year trading currencies, and that there were dozens like him making more money than I could imagine. (I have my doubts, but that's what they said.)"It's fine that there are rich people," Stein acknowledges. "It's even fine that there are superrich people."

Suddenly, as the men happily walked away from me, I had a vision. Here we all are under the gorgeous crystal dome of prosperity, drinking, making money, eating swordfish, changing money at the temple, showing off ourselves to others, bragging — and all of it, every bit of it, is made possible by the men and women who wear the uniform.

Every bit of it is done under the protection of the Marines, the Army, the Navy, the Air Force and the Coast Guard, serving and offering up their lives for pennies. And we're also under the protection of the police and the firefighters and the F.B.I., who offer up their lives for nothing compared with what others make trading money on computer screens.

But if they are superrich, they derive special benefits from life in the United States that the nonrich don't. For one thing, they can make the money in a safe environment, which is not true for the rich in many countries. It is just common decency that they should pay much higher income taxes than they do. Taxes for the rich are lower than they have been since at least World War II — that is to say, in 60 years.For the record, high-income Americans already fork over the bulk of U.S. tax revenue. That's one insight to be gained at a web site recommended by Randy Cassingham, Nationmaster.com.* * *Whatever rationale there may have been in 2001 for lowering their taxes is long gone. It's time for them — us, because it includes me — to pay their (our) share.

Look here to see how the share of tax paid by the 30% of U.S. taxpayers with the highest incomes compares with taxpayers in other nations around the world.

Look here to see how relatively little the poorest 30% of American taxpayers pay.

Moral: In Scandanavian countries and others where both poverty and $100-million incomes are rare, average citizens of necessity have to bear a larger portion of the tax burden.

But let's also remember that even poor Americans are wealthy beyond the dreams of avarice by world standards. Look here at how GDP per capita varies around the world.

Friday, May 05, 2006

Vickie Victorious

For those who are interested, here's more detail on the U.S. Supreme Court's unanimous decision in Marshall v. Marshall (thanks to POC for suggesting the headline for this post).

Our story thus far: Vickie Lynn Marshall, a former topless dancer and the 1993 Playboy Playmate of the Year using the name Anna Nicole Smith, met oil billionaire and former Yale Law School Assistant Dean J. Howard Marshall II in October 1991. She was in her mid-20s, he was approaching 90. Following a courtship of more than two years, the couple married on June 27, 1994. J. Howard lavished gifts upon Vickie, promised her a trust fund, and apparently ordered his attorneys to begin the paperwork for the trust. Unfortunately for Vickie, J. Howard’s estate plan (a living trust coupled with a pourover will) did not yet include her when he died on August 4, 1995.

Vickie’s attorneys publicly asserted that J. Howard’s youngest son, Pierce, had engaged in forgery and fraud to prevent the promised gift to her from her husband. When Vickie filed for bankruptcy in California, Pierce asserted that he had a defamation claim against her for the statements, a claim that should not be discharged by the bankruptcy proceeding. Vickie responded that truth was a defense against the defamation claim, and filed a counterclaim for Pierce’s tortious interference with her expected gift. The Bankruptcy Court heard the case and awarded Vickie $449 million in compensatory damages and $25 million in punitive.

Meanwhile, back in Texas, following a jury trial the probate court declared J. Howard’s will and trust arrangement to be valid.

Pierce next sought federal District Court review of the Bankruptcy Court judgment, arguing that the federal courts were without power to resolve the matter because of the “probate exception” to federal jurisdiction. The District Court rejected that argument, but held that adjudicating the tort was not a “core proceeding” of the Bankruptcy Court. Therefore, the District Court reviewed the case de novo.

Compensatory damages were reduced to $44.3 million, as the Court found J. Howard had promised Vickie half of the appreciation in the value of his assets from the date of their marriage (not half the value of all his assets). However, with overwhelming evidence of Pierce’s “willfulness, maliciousness and fraud,” the Court awarded an equal amount as punitive damages.

On appeal, the Ninth Circuit Court of Appeals reversed, holding that despite the framing of the issue as a tort, the underlying cause of action was so closely related to probate that the probate exception stripped the federal courts of jurisdiction. A unanimous decision by the U.S. Supreme Court now restores Vickie’s access to the federal courts, holding that the Ninth Circuit was wrong to read the probate exception so expansively. “Vickie seeks an in personam judgment against Pierce, not the probate or annulment of a will,” writes Justice Ruth Bader Ginsburg for the majority. “No ‘sound policy considerations’ militate in favor of extending the probate exception to cover the case at hand.”

Concurring, Justice John Paul Stevens would have gone further, eliminating the doctrine of a probate exception to federal jurisdiction altogether. “I would provide the creature with a decent burial in a grave adjacent to the resting place of the Rooker-Feldman doctrine.”

However, the story is not over yet, not when a $1.4 billion estate is at stake. The parties next return to the Ninth Circuit to explore Pierce’s arguments concerning claim and issue preclusion and whether Vickie’s claim was “core.”. Stay tuned.

Our story thus far: Vickie Lynn Marshall, a former topless dancer and the 1993 Playboy Playmate of the Year using the name Anna Nicole Smith, met oil billionaire and former Yale Law School Assistant Dean J. Howard Marshall II in October 1991. She was in her mid-20s, he was approaching 90. Following a courtship of more than two years, the couple married on June 27, 1994. J. Howard lavished gifts upon Vickie, promised her a trust fund, and apparently ordered his attorneys to begin the paperwork for the trust. Unfortunately for Vickie, J. Howard’s estate plan (a living trust coupled with a pourover will) did not yet include her when he died on August 4, 1995.

Vickie’s attorneys publicly asserted that J. Howard’s youngest son, Pierce, had engaged in forgery and fraud to prevent the promised gift to her from her husband. When Vickie filed for bankruptcy in California, Pierce asserted that he had a defamation claim against her for the statements, a claim that should not be discharged by the bankruptcy proceeding. Vickie responded that truth was a defense against the defamation claim, and filed a counterclaim for Pierce’s tortious interference with her expected gift. The Bankruptcy Court heard the case and awarded Vickie $449 million in compensatory damages and $25 million in punitive.

Meanwhile, back in Texas, following a jury trial the probate court declared J. Howard’s will and trust arrangement to be valid.

Pierce next sought federal District Court review of the Bankruptcy Court judgment, arguing that the federal courts were without power to resolve the matter because of the “probate exception” to federal jurisdiction. The District Court rejected that argument, but held that adjudicating the tort was not a “core proceeding” of the Bankruptcy Court. Therefore, the District Court reviewed the case de novo.

Compensatory damages were reduced to $44.3 million, as the Court found J. Howard had promised Vickie half of the appreciation in the value of his assets from the date of their marriage (not half the value of all his assets). However, with overwhelming evidence of Pierce’s “willfulness, maliciousness and fraud,” the Court awarded an equal amount as punitive damages.

On appeal, the Ninth Circuit Court of Appeals reversed, holding that despite the framing of the issue as a tort, the underlying cause of action was so closely related to probate that the probate exception stripped the federal courts of jurisdiction. A unanimous decision by the U.S. Supreme Court now restores Vickie’s access to the federal courts, holding that the Ninth Circuit was wrong to read the probate exception so expansively. “Vickie seeks an in personam judgment against Pierce, not the probate or annulment of a will,” writes Justice Ruth Bader Ginsburg for the majority. “No ‘sound policy considerations’ militate in favor of extending the probate exception to cover the case at hand.”

Concurring, Justice John Paul Stevens would have gone further, eliminating the doctrine of a probate exception to federal jurisdiction altogether. “I would provide the creature with a decent burial in a grave adjacent to the resting place of the Rooker-Feldman doctrine.”

However, the story is not over yet, not when a $1.4 billion estate is at stake. The parties next return to the Ninth Circuit to explore Pierce’s arguments concerning claim and issue preclusion and whether Vickie’s claim was “core.”. Stay tuned.

Wednesday, May 03, 2006

The Rukeyser legacy

Louis Rukeyser died yesterday. If Ronald Reagan was "The Great Communicator" in the White House, Lou was surely The Great Communicator of Wall Street (from the safe distance of Owings Mills, MD).

Louis Rukeyser died yesterday. If Ronald Reagan was "The Great Communicator" in the White House, Lou was surely The Great Communicator of Wall Street (from the safe distance of Owings Mills, MD).All who wish to communicate effectively about investing and wealth management can learn from Lou's success on TV and the lecture circuit. His AP obituary quotes a primary lesson:

"We have in America a bad tendency that things have to be either serious or fun. Whereas in real life, this isn't true. The teachers we all remember in high school and college were not the ones who put us to sleep."

We'll miss Lou's irreverence. Recently, for instance, a Member of Congress had an idea for a really cool Flat Tax. His flat tax would be different, he said, because it would have three progressive tax rates!

With Lou gone, who will give such creativity the attention it deserves?

Lou also made TV starlets out of people we would not have gotten to know otherwise. John Templeton, for instance. And James Grant, whose obituary of Lou is in Tbe New York Times.

Tuesday, May 02, 2006

Compromise likely on estate tax

From today's Washington Post, an indication that Republicans will be willing to settle for half a loaf of estate-tax relief:

Arizona Republican Sen. Jon Kyl said he was proposing a compromise because those who favor permanently repealing the estate tax -- who are mostly Republicans -- were unlikely to win. "We do not have the votes," he said.

* * *Kyl argued for a compromise that would set an exemption amount at $5 million for an individual and $10 million for a couple, indexed to inflation. He said the estates that are taxed should be taxed at the same rate as capital gains, currently 15 percent.

Monday, May 01, 2006

The case against the estate tax

Tasted a Milky Way lately? It probably didn't seem much different (except in size) from those you had as a kid.

Tasted a Milky Way lately? It probably didn't seem much different (except in size) from those you had as a kid.Perhaps it was even comparable to the first Milky Ways, dreamed up by Fred Mars back in 1923. Those were the days when most drug stores had soda fountains, and Fred thought of the Milky Way as a portable chocolate malted.

Today's Snickers bars aren't bad, either. Why else would the Scots love to deep-fry them?

Even products developed by others but now owned by Mars Inc. seem to have held up pretty well. The last Dove bar I sampled certainly wasn't as big as the original, but it tasted good.

Maintaining quality from generation to generation is a distinguishing characteristic of the best privately-owned companies. Even when family-owned businesses grow immense, as Mars has, they march to a different drummer.

To an unfortunate extent, publicly-held companies are now in the business of manufacturing quarterly earnings as specified by Wall Street. Family-run firms can stick to the business of making stuff, like candy.

Plenty of consultants have marched into Mars Inc. over the decades, peddling ideas for increasing quarterly earnings by cutting corners here and there. ("You guys don't need to use all that real chocolate. With this new additive, you can save a bundle, and few customers will ever notice the difference.")

The Mars boys (Fred's grandsons) have felt free to tell such consultants to close the door on the way out. Could the CEO of a publicly-traded company be equally upstanding? Possibly, but only at his peril. Eventually the consultants would start comparing notes and realize they had enough ideas for bulking up profits, at least temporarily, to take to a private-equity fund or corporate raider. Pretty soon, goodbye CEO!

The Mars family is one of the infamous 18 wealthy families cited in Jim Gust's recent post. Like other families on the list, they're too rich to be worried about the dollar cost of estate taxation. They're seeking to stay in business, even though their family businesses have gotten awfully big.

Tech businesses are a special case. Microsoft isn't the sort of business one would try to keep in the family. I'd guess that Steve Jobs felt the same way about Pixar and Apple.

Paul Newman, the Sage of Westport and founder of the remarkably successful Newman's Own, is unabashedly pro-tax:

“For those of us lucky enough to be born in this country and to have flourished here, the estate tax is a reasonable and appropriate way to return something to the common good. I’m proud to be among those supporting preservation of this tax, which is one of the fairest taxes we have.”

Why isn't Paul worried about keeping Newman's Own in the family? Maybe he doesn't have to worry. The value of a business rests on earnings. Newman's Own has never earned a cent, save what goes to charity. Can't we at least argue that the estate-tax value of the business should therefore be zero?

John and Forrest Mars, you and your sister just might have found a Plan B!

Anna Nicole Smith wins a day in federal court

In a unanimous decision authored by Ruth Bader Ginsburg, the U.S. Supreme Court has reversed the Ninth Circuit Court of Appeals in the Anna Nicole Smith case. To review, Anna's 89-year-old husband allegedly had promised her a trust to take care of her for the rest of her life, but the arrangements were not completed before his death. She was not provided for in his will.

When Anna declared bankruptcy in California, her stepson, E. Pierce Marshall, brought an action alleging that her comments about his attempts to grab control of his father's estate amounted to defamation and alleging that his claim would not be discharged in bankruptcy. Anna asserted truth as a defense, and brought a counterclaim for tortious interference with her inheritance. She won.

Note that her claim wasn't against the estate--if it had been, she would likely have lost, because the federal courts don't normally do probate law. But they may entertain lawsuits such as Smith's, the Supreme Court now rules.

When Anna declared bankruptcy in California, her stepson, E. Pierce Marshall, brought an action alleging that her comments about his attempts to grab control of his father's estate amounted to defamation and alleging that his claim would not be discharged in bankruptcy. Anna asserted truth as a defense, and brought a counterclaim for tortious interference with her inheritance. She won.

Note that her claim wasn't against the estate--if it had been, she would likely have lost, because the federal courts don't normally do probate law. But they may entertain lawsuits such as Smith's, the Supreme Court now rules.

Closing the gender gap

Men are catching up, reports National Center for Health Statistics according to this NY Times piece. The life expectancy gap has shrunk to 5 years, and could close completely in 50 years. Given that men often marry younger women, there would still be more widows than widowers.

Any implications here for trust marketing?

Any implications here for trust marketing?

Remember the Beardstown Ladies?

The Wall Street Journal does, and we can always use a reminder that investors in general, not just the pros, tend to fib about their stellar returns.

In 1983, when 16 Beardstown ladies, average age 70, started the Beardstown Business and Professional Women's Investment Club, they did so partly because they were sick of being told by men that they shouldn't worry their pretty heads about stock-buying and finance and such.Who did those ladies think they were, fibbing like that? Hedge-fund managers?

They weren't the world's first women's investment club. But they are arguably the most famous – not that you could have predicted that by watching them from the start. They were hardly throwing around LTCM money, after all; each member kicked in $100 of seed money and added another $25 a month thereafter. They invested in companies they knew. When Wal-Mart moved to town, they noticed its parking lots were always fuller than Kmart's, so they bought the stock. One member had a Medtronic pacemaker installed and bought the device maker's shares from her hospital bed the next day.

And they were successful. They were recognized as one of the National Association of Investors Corp.'s "All-Star Investment Clubs" for six years running. CBS put them on the "This Morning" show in 1991 and again the next year. In 1993, they were commissioned to make a video, "The Beardstown Ladies: Cooking Up Profits on Wall Street." That led to more TV appearances, which led to a book, published in 1994, called "The Beardstown Ladies' Common-Sense Investment Guide," which included stock-picking tips and recipes.* * *In fact, their publisher, Walt Disney's Hyperion, raised hopes that the average person could be very successful, indeed -- and that's how the trouble began. Their first book's jacket claimed the group had averaged 23.4% returns annually from 1984 to 1993, nearly double the Dow Jones Industrial Average's returns during the same period. But in 1998, Chicago magazine noticed that the group's returns included the fees the women paid every month. Without them, the returns dwindled to just 9%, underperforming the Dow. An article in the Wall Street Journal led the ladies to hire an outside auditor, which proved they had indeed misstated their returns.

The fall was abrupt. Time magazine (kiddingly) suggested they be jailed. Hyperion was sued and took the Ladies' books out of print. Four years ago, it settled the case by offering to swap any Beardstown book for other Hyperion titles, including "116 Ways to Spoil Your Dog," by Margaret Svete and "I'm Not Really Here," by comedian Tim Allen. Only used copies of the Ladies' books are available now, on Amazon.com and eBay, often for pennies.

Subscribe to:

Posts (Atom)