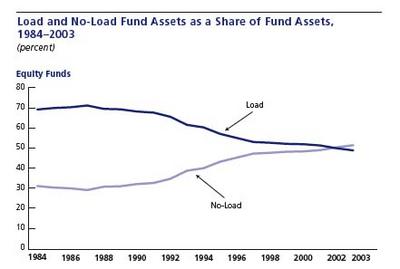

A generation ago, that thought never would have occured to most investors. Load funds were the norm. Without brokers, mutual funds never would have gained traction in the first place. Now the tide is turning, as this chart from the Mutual Fund Fact Book shows.

A generation ago, that thought never would have occured to most investors. Load funds were the norm. Without brokers, mutual funds never would have gained traction in the first place. Now the tide is turning, as this chart from the Mutual Fund Fact Book shows.But managers of no-load funds, except for index funds, shouldn't feel smug. Take a look at the new book by David Swensen, Yale's all-star endowment manager. Here's an excerpt from the publisher's blurb:

In Unconventional Success, investment legend David F. Swensen offers incontrovertible evidence that the for-profit mutual-fund industry consistently fails the average investor. From excessive management fees to the frequent "churning" of portfolios, the relentless pursuit of profits by mutual-fund management companies harms individual clients. Perhaps most destructive of all are the hidden schemes that limit investor choice and reduce returns, including "pay-to-play" product-placement fees, stale-price trading scams, soft-dollar kickbacks, and 12b-1 distribution charges.To read more about Swenson, see Joseph Nocera's column in The New York Times.

No comments:

Post a Comment