t stocks as trust investments.

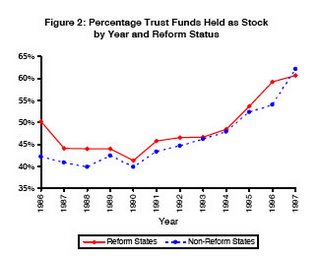

t stocks as trust investments.Too bad the authors of the study couldn't find useful data for the 1998-2004 period, when unitrusts began to get more recognition. But I'm guessing the lines on the chart shown here would have simply moved on up, with little divergence, through 1999, then headed down.

I've assumed that unitrusts were a useful idea, expecially in recent years, when both bond yields and dividend yields gave income beneficiaries slim pickings. But that was before I came across this article from last year's Real Property, Probate and Trust Journal, by Joel C. Dobris.

The author's particular quarrel is with the widely-used unitrust withdrawal rate of 5%. Dobris rightly argues that the rate is too high and likely to shortchange the remainder beneficiaries in the long run.

If Dobris writes short articles, this isn't one of them. Even so, give it a read when you have time. He touches on a lot of the psychological quirks that lead investors, and trust settlors, to illogical assumptions.

No comments:

Post a Comment