BNY Mellon boasts of a 97% client retention rate. First Republic spotlights one of its entrepreneur banking customers. Bessemer Trust expresses willingness to manage new wealth alongside old wealth. Glenmede, despite having dropped "Trust" from its logo, features its status as a privately-held trust company.

For readers of the magazine who are not yet really rich, Fidelity, Fisher, Schwab and Merrill Edge also offer wealth-management help.

Back in Mad Men days, nobody would have expected to see those ads in the Sunday Times magazine. A quick look at the comparable magazine section for February, 1965 reveals that ads for women's fashion and home furnishings dominated. Men were offered stereo record players.

Ads for investment services and products? Back then they were found in the Sunday business pages. Mutual funds were a hot topic, as shown at right.

Ads for investment services and products? Back then they were found in the Sunday business pages. Mutual funds were a hot topic, as shown at right.One reason for the migration of investment ads to the magazine section of the Sunday NY Times was the need to reach women. Equally important, wealth managers to the truly wealthy wanted to burnish their upper-crust image: "We manage family fortunes for the sort of people who own multimillion-dollar condos and buy expensive watches without looking at the price tag."

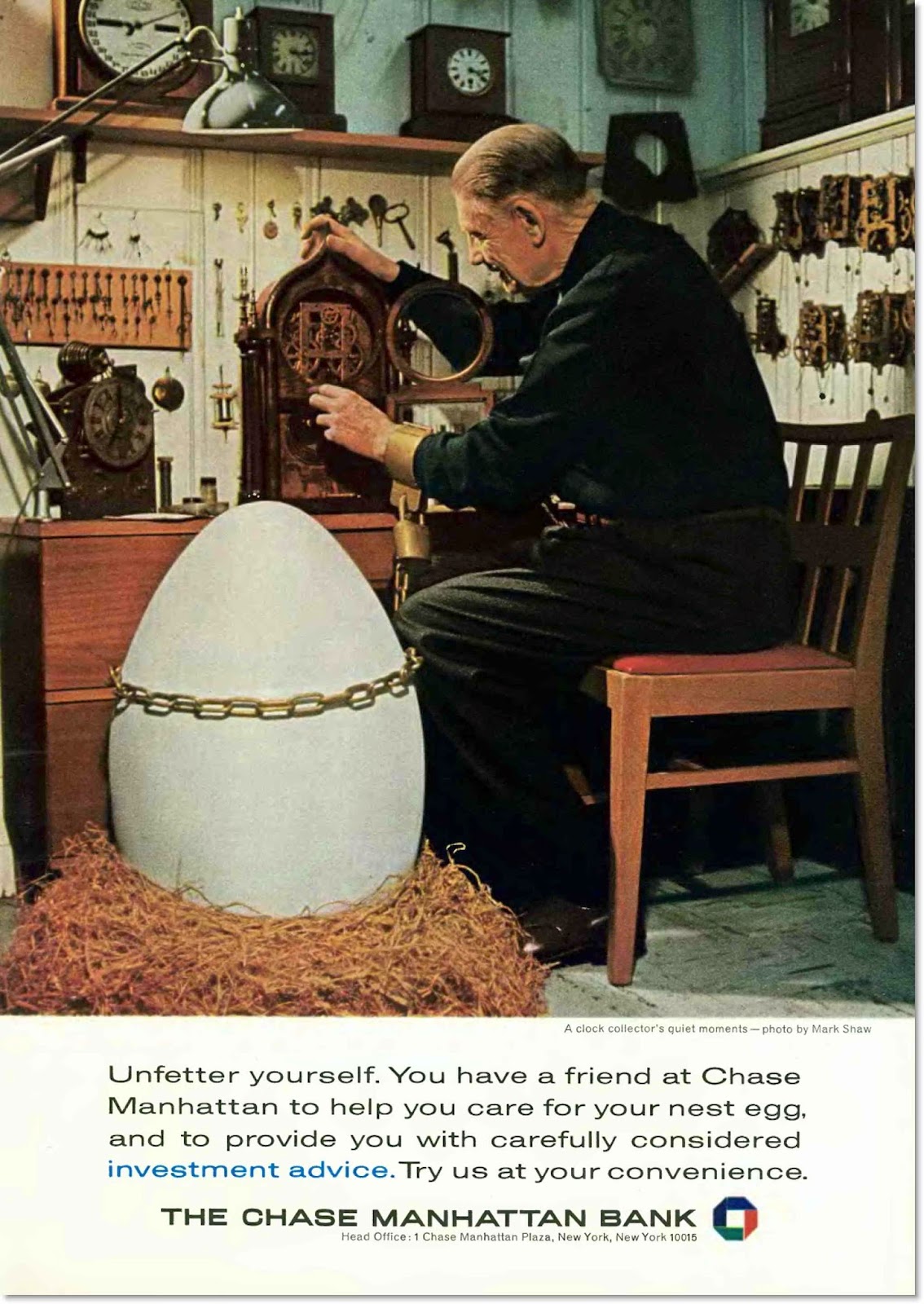

Neither of those motivations is new. As we've shown you from time to time, back in the 1960s Chase Manhattan and U.S. Trust regularly advertised in The New Yorker. On that magazine's pages their messages mingled with ads from purveyors of women's fashions and suppliers of all manner of upscale merchandise. And, of course, Chase ads could run in full color.

Here's a nest egg ad from the winter of 1964-65, portraying a clock collector. Does he seem a bit stolid for the Swinging Sixties?

No comments:

Post a Comment