You're being put in charge of a sibling's money. Your parents may think your brother will waste his inheritance -- and maybe it's true, particularly if the sib has addiction problems, mental illness or is developmentally disabled. But leaving one child in the gatekeeper role is often a bad solution. . . .

If you can't convince your folks to give the money outright -- or if it's really not in your sibling's best interest to do so -- try to convince them to let you hire a professional co-trustee such as a bank. That way, the professional can be the "bad cop" and you might still get invited to family dinners.

Thursday, August 31, 2006

When a bank trust department should be co-trustee

From Liz Pulliam Weston's MSN Money column:

When a bank trust department is the best executor

From the comments to this Business week article on executorship:

Nickname: not_looking_fwd

I just agreed to be a co-executor of my father's estate. My co-executor is his new wife (Mom passed away). I see trouble on the horizon for myself and my brother/sisters.

Nickname: professional_executor

Dear not_looking_fwd, If you anticipate trouble now, then show this article to your father and urge him to insert a professional executor in the mix. A bank trust department will be happy to serve in most cases and its usually worth the fee. Good Luck!

Wednesday, August 30, 2006

Seniors, put your money in trust!

From the Getting Going column in today's Wall Street Journal:

Financial swindles are one of the fastest-growing forms of elder abuse. . . .At the branch level, Terry Savage reports, banks are trying to combat such abuse.

Yet it's not dodgy financial experts or crooked caregivers who are the biggest threat. It's family. Children, siblings, grandchildren, nieces and nephews, and even spouses are the people most likely to rob the elderly, according to elder-law advocates and attorneys. The data that exist -- albeit in a spotty manner -- suggest that financial crimes rank as the third-most prevalent abuse of the elderly.

BITS, the business strategy and technology division of the Financial Services Roundtable, has created a "fraud prevention tool kit" designed to help banks educate their employees to protect their senior customers.Seniors who are prime targets for family financial abuse are also prime candidates for revocable trusts overseen by responsible corporate trustees. Any ideas on how better to meet this need?

"Banks are now focusing on elder-scams," Catherine A. Allen, BITS CEO, says. "While financial institutions are not legally responsible for monitoring potential exploitation of customers, this is an area in which banks can make a positive contribution to the well-being of vulnerable customers."

Tuesday, August 29, 2006

Groucho quoted on Wealth Mismanagement

In The New Age of Hedge Funds, Lindsay Williams in Johannesburg interviews derivitives guru Satyajit Das:

SATYAJIT DAS: One hot hedge fund charges 5% on assets under management, and 35% of profits.

LINDSAY WILLIAMS: So that’s 5% without even walking into the office - and 35% if they happen to do well?

SATYAJIT DAS: That probably helps explain what Groucho Marx once said - that as an investor you can work yourself up from nothing to a state of extreme poverty.

Saturday, August 26, 2006

Where there's a death tax, there's life (insurance)

Below, Jim Gust hints that the insurance industry is responsible for keeping the estate tax on life support. Immediate confirmation appears in today's Wall Street Journal. Subscribers can turn to Estate-Tax Plans Get Tricker:"

Despite a full-throttle effort, Congress has so far failed to kill the estate tax -- or even enact a compromise that would permanently reduce the hit. Though there's still time for a compromise deal, the tax is currently scheduled to disappear in 2010 and then bounce back again, at higher rates, in 2011.Of course, as the article also notes, that dratted estate tax isn't exactly bad for trust business:

That's making it trickier than ever to formulate an estate-tax plan, which often includes buying a life-insurance policy. Such a policy often plays a central role in estate planning, whether it is used to pay off a big estate-tax bill after you die or to leave something to a child who didn't get a piece of the family business.

Once you figure out what you need, advisers say it is wise to make the contract payable to an irrevocable life-insurance trust, so that the insurance proceeds -- which aren't subject to income tax -- don't become part of the estate and thus subject to estate tax. It also keeps proceeds safe from your children's or heirs' spouses in the event of a divorce.

Thursday, August 24, 2006

No more partial interests in art?

The Pension Protection Act of 2006 resembles Forest Gump's box of chocolates, it's so full of surprises. Here's one that affects art collectors.

It's long been the case that collectors can't take an immediate tax deduction for giving a remainder interest in their art collections to charity while they retain life estates. One alternative is to split the interest in the collection vertically instead of horizontally, using a time-sharing model. For example, a collector might donate a 1/3 fractional interest in a valuable painting to a museum, giving the museum the absolute right to display the painting for 4 months per year. If a donor spends part of the year living apart from his collection anyway, this can be an ideal solution. A current income tax deduction was allowed for fractional interest--if the painting is worth $3 million, the deduction would be $1 million for a 1/3 inerest.

Two provisions of the new law may kill this strategy.

First, no deduction will be allowed unless 100% ownerships vests within ten years, or at the death of the owner if earlier. If the complete transfer of ownership does not materialize as promised, all tax benefits are recaptured and a 10% penalty is imposed. Also, a prior Tax Court decision that allowed the deduction for the legal right to use the painting, as opposed to the actual use of the painting for a portion of the year, has been overturned. The museum must at least take possession of the painting.

Second, when the additional fractional interests are eventually given away, the charitable deduction will be limited to lesser of fair market value or a fraction of the value of the initial contribution. In other words, the remaining fraction can't apply to any appreciation.

An example should make that more vivid. Say that a 1/3 interest in a $3 million painting is given to a museum in year 1, and that at the owner's death in year 9 the painting has doubled in value (that's only 8% per year, after all). The 2/3 value included in the estate is $4 million. but the charitable deduction for the estate is limited to $2 million. Estate tax will be owed on the remaining $2 million, even though that also is passing to the charity.

This is an unfortunate result for museums who want to lock in future accessations today. I've already seen plans for buying more life insurance to deal with the problem. As if we didn't already know who killed estate tax reform?

It's long been the case that collectors can't take an immediate tax deduction for giving a remainder interest in their art collections to charity while they retain life estates. One alternative is to split the interest in the collection vertically instead of horizontally, using a time-sharing model. For example, a collector might donate a 1/3 fractional interest in a valuable painting to a museum, giving the museum the absolute right to display the painting for 4 months per year. If a donor spends part of the year living apart from his collection anyway, this can be an ideal solution. A current income tax deduction was allowed for fractional interest--if the painting is worth $3 million, the deduction would be $1 million for a 1/3 inerest.

Two provisions of the new law may kill this strategy.

First, no deduction will be allowed unless 100% ownerships vests within ten years, or at the death of the owner if earlier. If the complete transfer of ownership does not materialize as promised, all tax benefits are recaptured and a 10% penalty is imposed. Also, a prior Tax Court decision that allowed the deduction for the legal right to use the painting, as opposed to the actual use of the painting for a portion of the year, has been overturned. The museum must at least take possession of the painting.

Second, when the additional fractional interests are eventually given away, the charitable deduction will be limited to lesser of fair market value or a fraction of the value of the initial contribution. In other words, the remaining fraction can't apply to any appreciation.

An example should make that more vivid. Say that a 1/3 interest in a $3 million painting is given to a museum in year 1, and that at the owner's death in year 9 the painting has doubled in value (that's only 8% per year, after all). The 2/3 value included in the estate is $4 million. but the charitable deduction for the estate is limited to $2 million. Estate tax will be owed on the remaining $2 million, even though that also is passing to the charity.

This is an unfortunate result for museums who want to lock in future accessations today. I've already seen plans for buying more life insurance to deal with the problem. As if we didn't already know who killed estate tax reform?

Tuesday, August 22, 2006

Murphy v. U.S., make a note of it

A couple decades ago, a federal District Court held that the federal gift tax could not be applied to the transfer of certain public housing bonds, because those bonds were intended by Congress to be tax free for all purposes. Smart tax lawyers immediately saw that if there was any asset whose transfer was exempt from the gift tax, the entire gift tax must fall. It seems to me that the decision was handed down in late summer, and as soon as the August recess ended Congress prospectively overruled that District Court decision.

I remember thinking at the time that it's quite amazing how quickly a new tax law can be enacted when Congress is properly motivated.

Now another tax decision has been handed down with possibly large consequences.

Here's one of several summaries I've seen, and here's another with some reasonably well informed comments. The question is whether damages for emotional distress and loss of reputation are subject to the income tax. Under the tax code, only damages related to physical injuries are exempt. The Court declares that rule to be unconstitutionally narrow.

The tricky part of the opinion is that the Court bases its conclusion on the understanding of the concept of "income" at the time that the 16th amendment was ratified. The interesting question will be, how far can we run with that logic?

Murphy is the unanimous decision of a three-judge appelate court. Many commenters expect it to be reversed after appeal to the full court or the Supreme Court. I would predict a quick Congressional response, but it might not be so easy to trump the Constitution with a mere statute.

I remember thinking at the time that it's quite amazing how quickly a new tax law can be enacted when Congress is properly motivated.

Now another tax decision has been handed down with possibly large consequences.

Here's one of several summaries I've seen, and here's another with some reasonably well informed comments. The question is whether damages for emotional distress and loss of reputation are subject to the income tax. Under the tax code, only damages related to physical injuries are exempt. The Court declares that rule to be unconstitutionally narrow.

The tricky part of the opinion is that the Court bases its conclusion on the understanding of the concept of "income" at the time that the 16th amendment was ratified. The interesting question will be, how far can we run with that logic?

Murphy is the unanimous decision of a three-judge appelate court. Many commenters expect it to be reversed after appeal to the full court or the Supreme Court. I would predict a quick Congressional response, but it might not be so easy to trump the Constitution with a mere statute.

Monday, August 21, 2006

How's a 40% estate tax on everything over $540,000 strike you?

You don't have to use your imagination. Just ask the Brits. As this column from The Telegraph indicates, some subjects of the Queen aren't too happy about they way their estates are taxed.

Note that the UK version of the marital deduction also benefits the surviving partner in civil unions.

Note that the UK version of the marital deduction also benefits the surviving partner in civil unions.

Saturday, August 19, 2006

Why the Supply of Wealthy Prospects for Trusts and Investment Services is so Limited

From the What's Offline column in today's New York Times:

If you want a simple explanation for why the personal savings rate is so low, consider this from Money magazine: Some 41 percent of Americans surveyed said “it feels like I’m putting money into savings” when they buy something on sale. While getting a bargain is great, it is awfully hard to put children through college or finance your retirement with the deal you get on a new plasma TV.

If you want a simple explanation for why the personal savings rate is so low, consider this from Money magazine: Some 41 percent of Americans surveyed said “it feels like I’m putting money into savings” when they buy something on sale. While getting a bargain is great, it is awfully hard to put children through college or finance your retirement with the deal you get on a new plasma TV.

Wednesday, August 16, 2006

Searching for wealthy prospects? Follow their toys!

If you take our headline's advice, this weekend you'll head for the Pebble Beach Concours d'Elegance and its associated auctions.

Star of Christie's sale: a 1928 Mercedes-Benz Torpedo Roadster.

Skimmed a review of a new BMW roadster the other day. The reviewer liked it OK but thought the Bimmer's nose a bit long.

Dude, you don't know from long-nosed. This is long-nosed:

Star of Christie's sale: a 1928 Mercedes-Benz Torpedo Roadster.

Skimmed a review of a new BMW roadster the other day. The reviewer liked it OK but thought the Bimmer's nose a bit long.

Dude, you don't know from long-nosed. This is long-nosed:

Personal service for wealthy clients: Real or virtual?

When you're paying a bundle for investment management, you expect service. You expect your money manager or broker to learn your quirks and your family circumstances. Know where your kids go to school. Realize that Muffy's wedding next spring is going to cost you a fortune.

Successful investment advisers master the art of personal service. It's not easy, and it gets harder when their corporate overlords pile on heavier and heavier workloads.

Can technology help? That's the question explored in this Wall Street Journal article.

Wachovia, the article notes, is launching an interesting experiment. Technology has been harnessed to create a system for making a good impression on new clients. They'll be showered with virtually personal attention.

Smith Barney has new software to help brokers keep track of client goals and make note of upcoming client expenses such as tuitions or Muffy's wedding.

Historically, problems with harnessing computers to create something like personal service have been data entry (does the harried adviser or broker have time to do the input?) and timely data retrieval (which might be really untimely if Muffy's wedding has been rescheduled or Waldo got kicked out of college).

Let us know if you hear how these experiments are working.

Not likely to work is another attempt at simulating personal attention mentioned in the article: mass-produced "personal notes" to clients in simulated handwriting. Judging from examples of this sort of thing employed by a few charities, the results are tragically unconvincing.

Here's a good tip from the end of the Journal article:

“Regular contact is crucial to client satisfaction. The most-satisfied affluent investors received 28 contacts either in person, by telephone, by mail or by email in a one-year period, according to a study of about 14,000 affluent investors by research firm CEG Worldwide. By contrast, very dissatisfied investors received 17 contacts.”

Need I mention that good newsletters can help keep your best clients satisfied? Good newsletters followed up by genuinely personal notes or calls can help even more.

Successful investment advisers master the art of personal service. It's not easy, and it gets harder when their corporate overlords pile on heavier and heavier workloads.

Can technology help? That's the question explored in this Wall Street Journal article.

Wachovia, the article notes, is launching an interesting experiment. Technology has been harnessed to create a system for making a good impression on new clients. They'll be showered with virtually personal attention.

Smith Barney has new software to help brokers keep track of client goals and make note of upcoming client expenses such as tuitions or Muffy's wedding.

Historically, problems with harnessing computers to create something like personal service have been data entry (does the harried adviser or broker have time to do the input?) and timely data retrieval (which might be really untimely if Muffy's wedding has been rescheduled or Waldo got kicked out of college).

Let us know if you hear how these experiments are working.

Not likely to work is another attempt at simulating personal attention mentioned in the article: mass-produced "personal notes" to clients in simulated handwriting. Judging from examples of this sort of thing employed by a few charities, the results are tragically unconvincing.

Here's a good tip from the end of the Journal article:

“Regular contact is crucial to client satisfaction. The most-satisfied affluent investors received 28 contacts either in person, by telephone, by mail or by email in a one-year period, according to a study of about 14,000 affluent investors by research firm CEG Worldwide. By contrast, very dissatisfied investors received 17 contacts.”

Need I mention that good newsletters can help keep your best clients satisfied? Good newsletters followed up by genuinely personal notes or calls can help even more.

Charitable IRA Rollovers are here

A new tax benefit for seniors is tucked away in the recent pension legislation, notes Registered Rep magazine. Direct transfers of up to $100,000 from an IRA to a charity will not be included in income, but only if done after an individual reaches age 70 1/2 (not in that tax year, after that date, so be careful). The article notes the benefits for the generous affluent seniors--they completely duck the percentage limit on the charitable income tax deduction, and they also don't lose tax benefits that are phased out as income rises, generally in the six-figure area.

Not mentioned but more important to those of more modest means, those who do not itemize will now participate in the tax benefit when they tap an IRA to make charitable gifts. The old rule would have required taking a fully taxable withdrawal from the IRA followed by no charitable deduction for those using the standard deduction. The new rule better recognizes their generosity.

The allows but does not require IRA trustees to be cooperative with this initiative. Some concern has been expressed about whether it makes sense to reprogram the recordkeeping computers to accommodate charitable gifts, especially given the very short term nature of this experiment. The charitable IRA rollover expires in just 16 1/2 months. (Was that needed to keep the revenue estimates in balance? Or were the Congressmen just not confident that this is a really good idea?)

Not mentioned but more important to those of more modest means, those who do not itemize will now participate in the tax benefit when they tap an IRA to make charitable gifts. The old rule would have required taking a fully taxable withdrawal from the IRA followed by no charitable deduction for those using the standard deduction. The new rule better recognizes their generosity.

The allows but does not require IRA trustees to be cooperative with this initiative. Some concern has been expressed about whether it makes sense to reprogram the recordkeeping computers to accommodate charitable gifts, especially given the very short term nature of this experiment. The charitable IRA rollover expires in just 16 1/2 months. (Was that needed to keep the revenue estimates in balance? Or were the Congressmen just not confident that this is a really good idea?)

Tuesday, August 15, 2006

So Your Clients Want to Invest in Show Biz?

Before they do, have them read this L.A. Times story: Actress in Homeland Security Show Scam Must Pay.

Monday, August 14, 2006

How one family spends $27,000 a year to prepare for estate tax

Even if a business owner's heirs can afford to keep a business in the family, the effort isn't cheap, according to this report from MSNBC:

Congress' latest failure to decide the estate tax's future frustrates Kip Coleman, vice president of Hamilton Supply Co., a family-owned building materials company in Hamilton, N.J.And, according to the report, the sons still may have to borrow a couple of million to meet the tax costs.

He and his brothers have been paying about $22,000 a year for a $1 million life insurance policy on their 81-year-old parents so they can pay taxes on the estate when their parents die. They pay attorneys another $5,000 or so a year for estate planning.

Friday, August 11, 2006

Conservation easements

The sweeping pension bill passed by the Senate last week also swept in some useful tax provisions not related to pension plans. For example, the preferential tax treatment of 529 education saving plans, previously scheduled for extinction after 2010, has been made permanent. Another is that permission to convert an inherited IRA to one's own IRA, a priviledge previously limited to surviving spouses, will be extended to all heirs. Sub silentio, the rollover right is therefore available to same-sex couples.

In the estate planning context, the incentives for conservation easements have been expanded for two years, 2006 and 2007. The deduction limit goes from 30% of AGI to 50%, except for full-time farmers, who may get a 100% deduction. Even more important, the carryforward period is nearly tripled, from the prior 6 years to 16 years. Farm incomes are not all that high, while the value of farmland may be, so it's easy to see that it might take more than a decade of tax-free income to work off the full deduction.

Tax publisher CCH notes the incongruity of these incentives against the recent backdrop of IRS testimony before Congress about a wide range of tax abuses of conservation easements.

In the estate planning context, the incentives for conservation easements have been expanded for two years, 2006 and 2007. The deduction limit goes from 30% of AGI to 50%, except for full-time farmers, who may get a 100% deduction. Even more important, the carryforward period is nearly tripled, from the prior 6 years to 16 years. Farm incomes are not all that high, while the value of farmland may be, so it's easy to see that it might take more than a decade of tax-free income to work off the full deduction.

Tax publisher CCH notes the incongruity of these incentives against the recent backdrop of IRS testimony before Congress about a wide range of tax abuses of conservation easements.

Wednesday, August 09, 2006

Word verification has been turned on

Unfortunately, this blog has seen a rise in comment spam lately. There was a rash of 100 spam comments overnight several weeks ago, then it died down, but now we've been getting the same comment added to about six posts every day. To end this phenomenon, to eliminate the chore of deleting the bogus comments, I've had to turn on the word verification, just as most other blogspot blogs have done. Sorry for the inconvenience. Maybe I'll try turning it off in a month or so, to see what happens.

I'm hoping that the process won't discourage genuine comments, which we enjoy receiving.

I'm hoping that the process won't discourage genuine comments, which we enjoy receiving.

Grassley: Estate tax reform not dead

Senate Finance Committee Chair Chuck Grassley believes that the Senate's attention will return to estate tax reform in late September,reports Tax Notes Today ($). However, Grassley's prognostications have been notably weak this year. The new plan?

I don't see Harry Reid being persuaded by that approach, but one never knows.

"I'm going to be pleading with the Democrat leader over the next month to let Democrats vote their conscience, and if he lets Democrats vote their conscience, we will get a compromise estate tax bill passed that will save farms and save family businesses."

I don't see Harry Reid being persuaded by that approach, but one never knows.

Tuesday, August 08, 2006

Brooke Astor's Amazingly Lucky Lawyer

A few years ago, Brooke Astor, now age 104, decided to change lawyers, possibly at the suggestion of her son, Anthony Marshall. She discharged the august firm of Sullivan & Cromwell, who had handled her affairs for 40 years, and engaged Francis Morrissey.

Francis Morrissey has been a very, very lucky fellow. According to The New York Daily News, elderly people are dying to leave him significant shares of their estates.

Around the time Morrissey started advising Astor, he was left an apartment in Manhattan by one client. (After charges of undue influence, an undisclosed settlement was reached.) That was just one example of his extraordinary luck. The Daily News reports that several people wanted him on their list of beneficiaries.

From Kermit the frog we learned that it's not easy being green. From Brooke Astor we're learning that being very old and rich is no piece of cake, either.

Update: In Rich, Old, Unloved, Marketwatch points a moral: Wealthy oldsters need a system of checks and balances to protect them. How to meet that need? A trust institution:

“Impartiality no longer connotes uncaring. That, it seems, more and more, is left to relatives.

Francis Morrissey has been a very, very lucky fellow. According to The New York Daily News, elderly people are dying to leave him significant shares of their estates.

Around the time Morrissey started advising Astor, he was left an apartment in Manhattan by one client. (After charges of undue influence, an undisclosed settlement was reached.) That was just one example of his extraordinary luck. The Daily News reports that several people wanted him on their list of beneficiaries.

Alexandra Gregersen, a psychiatrist, who died on Jan. 4, 2001, at age 90. Morrissey inherited two-fifths of her estate.Morrissey also serves as “primary contact” and, reportedly, a director for the Shepherd Community Foundation. Another director, a lawyer for Marshall told The New York Times, is Marshall's wife. As the Times puts it, An In-Law’s Charity Has One Donor, Astor, and Few Details.

Elizabeth Von Knapitsch, a retired ladies apparel executive, who died at age 91 on Jan. 15, 2000. Morrissey inherited her Park Ave. apartment, two Renoir oil paintings, two other paintings, and an undisclosed amount of money.

Jay Lovestone, a labor leader who helped found the Communist Party of America, and worked with the CIA, died on March 7, 1990, at the age of 90. Morrissey inherited one-third of his estate.

Louise Morris, a housewife, who died on Oct. 22, 2002, at age 98. Morrissey received one-third of her estate.

From Kermit the frog we learned that it's not easy being green. From Brooke Astor we're learning that being very old and rich is no piece of cake, either.

Update: In Rich, Old, Unloved, Marketwatch points a moral: Wealthy oldsters need a system of checks and balances to protect them. How to meet that need? A trust institution:

“Impartiality no longer connotes uncaring. That, it seems, more and more, is left to relatives.

“Sadly, institutions may be better caretakers of money and health care than friends and family.”

Monday, August 07, 2006

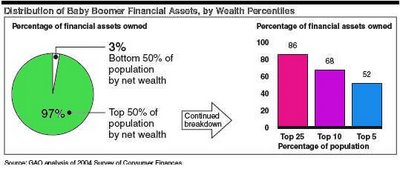

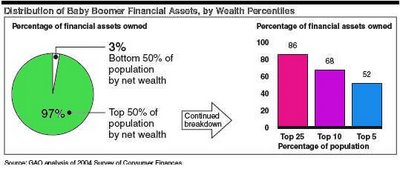

Wealth Management: The Boomer Market May Be Smaller Than You Think

Almost three out of four members of the Baby Boom generation are virtually broke, judging by a GAO study cited in this Marketwatch column.

Oddly enough, that could be good news for the stock market:

Oddly enough, that could be good news for the stock market:

Boomers, says the GAO, will not sell their assets in such a way to cause any major, or minor for that matter, decline in stock and bond prices.The GAO doesn't think much of Boomers' financial literacy, either. You'll find the study here.

The reasons are many and in some cases point to other and different problems that must be addressed. For one, boomers don't have any assets to sell, the GAO reports. And of the small minority of boomers that do own assets, it's unlikely that they will need to sell those stocks and bonds to fund their retirement. The top 5% of boomers control 52% of the financial assets held by their generation.

Friday, August 04, 2006

ETETRA 2006 fails

Republicans came up short in the Senate vote on estate tax reform. Ironically, they had no more votes for the watered down approach than they did for outright repeal of the estate tax. Pairing the bill with the minimum wage hike accomplished exactly zero.

Democrats insist that the minimum wage hike will be taken up again after recess, while Frist is adamant that it won't happen independent of estate tax reform. Ironically, if Frist had gotten all of his Republicans on board, the procedural hurdle would have been cleared.

Democrats insist that the minimum wage hike will be taken up again after recess, while Frist is adamant that it won't happen independent of estate tax reform. Ironically, if Frist had gotten all of his Republicans on board, the procedural hurdle would have been cleared.

Thursday, August 03, 2006

Democrat opposition advances

The New York Times reports a setback for the trifecta bill:

So, can the Republicans drop the special capital gains deduction for timber property that was included just for those two Senators?

Republicans were dealt a blow, however, when two Democrats, Sens. Maria Cantwell and Patty Murray of Washington, announced they planned to oppose the GOP's bill.

So, can the Republicans drop the special capital gains deduction for timber property that was included just for those two Senators?

Robert Novak expects the tax bills to pass

Although most of the commentary suggests that Friday's vote on the estate tax bill will be very, very close, columnist Robert Novak is confident that it will pass. And he's not happy about it. In GOP deserts principles by backing 2 bills, Novak identifies two real world consequences of failure to enact the laws:

• If the extenders portion of the trifecta bill is not enacted by the September 15 corporate tax filing deadline, many large firms will be forced to restate their earnings for the year. That could affect the stock market, and it would infuriate CEOs just as they are being asked for campaign contributions in the run up to November.

• If the pension bill is not passed by September 13, the PBGC inherits the DB plans of Northwest and Delta Airlines. No one wants that.

The only way to meet these deadlines is for the Senate to enact the House versions of the bills, without amendment, before it adjourns.

Novak goes on to itemize a laundry list of tax gimmicks included to lure a few Democrat voters. He characterizes the unusual genesis of these tax bills as indicating weak leadership in the House and Senate and a President not engaged in the legislative process. Novak concludes, "At this writing, it appears all this will pass the Senate untouched by week's end."

• If the extenders portion of the trifecta bill is not enacted by the September 15 corporate tax filing deadline, many large firms will be forced to restate their earnings for the year. That could affect the stock market, and it would infuriate CEOs just as they are being asked for campaign contributions in the run up to November.

• If the pension bill is not passed by September 13, the PBGC inherits the DB plans of Northwest and Delta Airlines. No one wants that.

The only way to meet these deadlines is for the Senate to enact the House versions of the bills, without amendment, before it adjourns.

Novak goes on to itemize a laundry list of tax gimmicks included to lure a few Democrat voters. He characterizes the unusual genesis of these tax bills as indicating weak leadership in the House and Senate and a President not engaged in the legislative process. Novak concludes, "At this writing, it appears all this will pass the Senate untouched by week's end."

“The Estate Tax Twist”

Jeffrey Birnbaum in today's Washington Post:

“For years, organized labor has worked hard to raise the minimum wage, while business groups have campaigned to block such a change. This week in the Senate, however, the AFL-CIO is pushing to kill the wage increase while practically the entire business lobby is demanding that it pass.”

“For years, organized labor has worked hard to raise the minimum wage, while business groups have campaigned to block such a change. This week in the Senate, however, the AFL-CIO is pushing to kill the wage increase while practically the entire business lobby is demanding that it pass.”

Wednesday, August 02, 2006

Frist goes "all in"

The legislation before the Senate that includes estate tax reform, a number of popular tax benefit extensions and an increase in the minimum wage has been nicknamed the "trifecta bill" for its three parts. Majority Leader Frist has apparently decided that this is the last best chance for changing the estate tax rules. According to Tax Notes Today ($), yesterday on the Senate floor Frist said:

Minority Leader Reid remains adamantly opposed to the trifecta bill, and some Democrats have indicated that the increase in the minimum wage it delivers isn't important to their states, where the minimum wage is already well above federal levels. By all accounts, it will be a very close vote.

If the Senate kills the trifecta bill, we will not return to it this year. That means we would have no permanent death tax reform, no tax policy extenders, and no minimum wage increase. It's now or never. It's this week.Democrats are hoping that if they block the trifecta bill, the extenders will be peeled away and attached to the pension legislation that will follow it to the Senate floor. Frist is already at work to block that possibility, and even those who would take this tack acknowledge that such a move would throw the pension bill back into Conference, where it has languished all year.

Minority Leader Reid remains adamantly opposed to the trifecta bill, and some Democrats have indicated that the increase in the minimum wage it delivers isn't important to their states, where the minimum wage is already well above federal levels. By all accounts, it will be a very close vote.

Tuesday, August 01, 2006

Top 7 Reasons Why Estate-Tax Reform Could Die

7. Postponing the $5-million exemption leaves repeal-minded Republicans little but reduced rates of tax to salve their wounds.

6. Everybody realizes that the tax code will be further tinkered with before the $5-million exemption ever takes effect, so what's the point?

5. Reports like today's Washington Post story that bogus tax shelters "saved billionaires a bundle" make it harder for fence-sitting Democratic Senators to vote for reducing the tax on affluent folks’ estates.

4. The bill the Senate will be asked to pass, probably Friday, is the work of "evildoers," according to a New York Times editorial:

2. Republican tactics have p.o.'d Max Baucus, senior Democrat on the Senate Finance Committee and an early proponent of estate-tax reform. "The process stinks. It's a bad idea. Not good at all," said Baucus.

1. Friday is the day Senators leave for summer vacation. Getting 60 Senators to show up may be tough. Getting the 60 votes needed to pass the gucked-up legislation? Lots of luck!

6. Everybody realizes that the tax code will be further tinkered with before the $5-million exemption ever takes effect, so what's the point?

5. Reports like today's Washington Post story that bogus tax shelters "saved billionaires a bundle" make it harder for fence-sitting Democratic Senators to vote for reducing the tax on affluent folks’ estates.

4. The bill the Senate will be asked to pass, probably Friday, is the work of "evildoers," according to a New York Times editorial:

Elected officials presume that voters will judge them by their voting records, not on the behind-the-scenes dealing that actually creates legislation. But lately in Congress things have become so unhinged and outrageous that attention must be paid.3. Senator Frist has lost his marbles. Or as The Wall Street Journal puts it:"Mr. Frist has presidential ambitions and is courting conservative supporters."

At the center of recent evildoing was a conference committee in which House and Senate negotiators were supposed to create a final version of their differing pension reform bills. But by the time the House left for summer break last week, there was no final version, and the process was in a shambles.

2. Republican tactics have p.o.'d Max Baucus, senior Democrat on the Senate Finance Committee and an early proponent of estate-tax reform. "The process stinks. It's a bad idea. Not good at all," said Baucus.

1. Friday is the day Senators leave for summer vacation. Getting 60 Senators to show up may be tough. Getting the 60 votes needed to pass the gucked-up legislation? Lots of luck!

ETETRA 06 status

Tax Notes ($) is reporting that a cloture vote on ETETRA 06 will happen this week, most likely on August 4, the day the Senate plans to adjourn for August (the House is gone already). The vote will be close. If it passes, two more votes will be required, one to limit debate and one for final passage. If the first vote succeeds, adjournment will be delayed, and they may continue into the weekend. If it fails, they will move on to the uncontroversial pension legislation, also passed last week in the House.

If the Senate passes ETETRA 06 as is, it's enacted. If they amend it, a Conference will be needed in September to resolve differences. Thus, Majority Leader Frist is trying to prevent any amendments.

This seems like the irresistable force meeting the immovable object, though Frist has been very resistable to this point.

They cut the "cost" of estate tax reform by more than half by delaying the $5 million exemption until 2015. I understand that part. Here's the part I'd like someone to explain to me. According to Tax Notes, the whizzes who score the legislation for tax impacts have ruled that the increase in minimum wage "would have no federal revenue effect."

How can that be? At a minimum, wouldn't FICA receipts go up, even if the ordinary income tax collections are small? Or did they really decide that the economists are right, the higher minimum wage will cost the economy jobs, and this revenue loss offsets the gains from some taxpayers?

If the Senate passes ETETRA 06 as is, it's enacted. If they amend it, a Conference will be needed in September to resolve differences. Thus, Majority Leader Frist is trying to prevent any amendments.

This seems like the irresistable force meeting the immovable object, though Frist has been very resistable to this point.

They cut the "cost" of estate tax reform by more than half by delaying the $5 million exemption until 2015. I understand that part. Here's the part I'd like someone to explain to me. According to Tax Notes, the whizzes who score the legislation for tax impacts have ruled that the increase in minimum wage "would have no federal revenue effect."

How can that be? At a minimum, wouldn't FICA receipts go up, even if the ordinary income tax collections are small? Or did they really decide that the economists are right, the higher minimum wage will cost the economy jobs, and this revenue loss offsets the gains from some taxpayers?

Subscribe to:

Comments (Atom)