Why does an institution of higher learning have $35 billion in its back pocket anyway? Why has it become customary for universities to spend only a small fraction of their interest income - and not even the endowment funds themselves - for daily operations? Why do American taxpayers continue to subsidize schools that increasingly operate like for-profit companies - and less like tax-exempt educational foundations that are charged with educating the next generation?My question is slightly different—why do I have to pay tax on investment income, while Harvard and Yale don't?

Monday, December 31, 2007

Uh-oh

The Bull and the Bear, 1892

From the December 31, 1892 issue of Punch:

Bulls and Bears. City Men: "Well, come, you are better off than I am," said the City Man. "If I hadn't now and again to appear before the Registrar in the Bankruptcy Court, I don't know what I should do with my time! I am stone broke. That's about it—stone broke! Knocked out of the 'House,' and without a scrap of credit: I am done for!"

And it was agreed that none of them had any prospects. Then they separated, or rather, were on the eve of separating.

"By the way—fancy forgetting to do it!" said one of them.

And then they rectified the omission, and wished one another, "A Happy New Year!"

What We Learned in 2007

We learned "liquidtiy" and "risk" don't mean what many of us thought they meant.

Liquidity

The transition from cash to credit has been so pervasive as to go unmentioned – until this year's "liquidity crisis." Henry Kaufman called attention to the New Financial Order in a WSJ op-ed:

In the decades that followed World War II, liquidity was by and large an asset-based concept. For business corporations, it meant the size of cash and very liquid assets, the maturity of receivables, the turnover of inventory, and the relationship of these assets to total liabilities. For households, liquidity primarily meant the maturity of financial assets being held for contingencies along with funds that reliably would be available later in life. In contrast, firms and households today often blur the distinction between liquidity and credit availability. When thinking about liquid assets, present and future, it is now commonplace to think in terms of access to liabilities.That's why this year's meltdown is now more accurately called a "credit crisis."

Risk

Wall Street took pride in its ability to assess, measure and manage risk. Wall Street not only failed, it didn't know what it was up against. In an earlier post, we referred you to a John Bogle's talk containing an instructive quotation from the late University of Chicago economist Frank H. Knight:

. . . uncertainty must be taken in a sense radically distinct from the familiar notion of Risk, from which it has never been properly separated. The term “risk,” as loosely used in everyday speech and in economic discussion, really covers two things which . . . are categorically different. The essential fact is that “risk” means in some cases a quantity susceptible of measurement, while at other times it is something distinctly not of this character. A measurable uncertainty, or “risk” proper, is so far different from an immeasurable one that it is not in effect an uncertainty at all.Wall Street believed measurable risk was divisible. If packages of risky loans were sold to hundreds of investors, no one investor could run more than a modest risk of loss. Turned out that real risk–uncertainty –is viral. The more you spread it around, the more there is.* * *The facts of life in this regard are in a superficial sense obtrusively obvious and are a matter of common observation. It is a world of change in which we live, and a world of uncertainty.

In a recent Washington Post column, Robert Samuelson described the 2007 crisis this way:

Since 1980, America's financial system has changed dramatically in ways that are now arousing widespread anxieties. Many loans once made directly by banks are "securitized": packaged into bondlike securities and sold to investors (pension funds, investment houses, hedge funds and banks themselves). There's been an explosion of bewildering financial instruments -- currency swaps, interest-rate swaps and other "derivatives" -- that are used for hedging and speculative trading.Will the new year bring high-net-worth investors who are more reluctant to borrow from their private bankers?

Until recently, the transformation seemed a splendid success. Credit markets had broadened; risk was being spread to a larger spectrum of investors. So it was said. This was an illusion.

Today's Wall Street Journal sees a "flight to simplicity." Will investors amateur and professional turn from complexity to the simple comforts of stocks and bonds?

We'll find out in the new year.

There are known unknowns.

That is to say, there are things that we know we don't know.

But there are also unknown unknowns.

There are things we don't know we don't know.

– Donald Rumsfeld

Friday, December 28, 2007

For Higher Returns, Fire Your Broker?

According to Investor Timing and Fund Distribution Channels, a study sponsored by the Zero Alpha Group, investors in load funds fare especially poorly.

We find that investors who transact through investment professionals using conventional distribution arrangements experience substantially poorer timing performance than investors who purchase pure no-load funds. Investors in all three principal load-carrying retail share classes (A, B, and C) significantly underperform a buy-and-hold strategy. Among all load funds, Class B investors suffer from the poorest cash flow timing, underperforming a buy-and-hold strategy by 2.28 percentage points annually,The study was co-authored by Mercer Bullard, a securities law professor at the University of Mississippi School of Law; Geoff Friesen, assistant professor of finance at the University of Nebraska-Lincoln; and Travis Sapp, assistant professor of finance at Iowa State.

Perhaps the most intriguing finding, highlighted by The Wall Street Journal, is that Index-Fund Tortoises Are Long-Term Winners. "Investors in no-load (that is, no-commission) index funds actually beat the returns of the funds they hold by 0.42 percentage point annually."

How can investors in a fund that matches the market return wind up with a return four-tenths of a percent higher? Must be that they not only buy and hold but also tend to invest new money regularly.

If you put $500 per month or $3,000 per annum into an index fund, year after year, you are dollar-cost averaging. That is, you cannot avoid buying more shares when the market is down, fewer when the market is up.

Just don't listen to those hot tips on sector rotation from brokers or registered investment advisers.

IRS was crying wolf

* Form 8863, Education Credits.

* Form 5695, Residential Energy Credits.

* Form 1040A's Schedule 2, Child and Dependent Care Expenses for Form 1040A Filers.

* Form 8396, Mortgage Interest Credit.

* Form 8859, District of Columbia First-Time Homebuyer Credit.

These Forms have difficult interactions with the AMT that will take the extra time to program. An estimated 13 million taxpayers will be affected. Almost none of them will be "rich."

Thursday, December 27, 2007

Fiduciary Duty: the Tattered Standard

WITHOUT trust, there can be no free-market capitalism. Capitalism took root in Europe when wealthy families had excess income to invest, and they entrusted their money to managers who would treat their funds with due care.Where Bogle's concern is with the overcharging and underserving of individual investors, Stein criticizes investment banks for selling mortgage derivatives they didn't even understand themselves. Or if they did understand, as in at least one case, they shorted the same stuff they were selling.

Such standards of care required that those handling someone else’s money behave with extreme rigor and honesty. The standards, which came to be known as fiduciary duty, were the same duty a court required of, say, a trustee dealing with the property of a widow or a child.

"Today," writes Stein, "in the midst of the mortgage mess, we see people breaching their fiduciary duty and getting away with it."

Is the world of finance really sinking as low as Bogle and Stein fear?

Monday, December 24, 2007

Christmas on the Frontier

Here and there on the wild investment frontier, stock prices have doubled in 2007, as The Wall Street Journal notes here.

Long overlooked by all but the most intrepid investors, frontier markets are attracting increasing attention in spite of their small size and often patchy infrastructure. In terms of geography, they are a diverse bunch, ranging from quasideveloped markets in Eastern Europe, to oil exporters in the Persian Gulf, to countries in sub-Saharan Africa and beyond.Half a century ago, Brooks Brothers had Paul Brown sketch this Christmas scene from our own, early-1800s frontier. The inspiration, no doubt, was the immense popularity of a Disney mini-series, Davy Crockett.

Bigger and better-known developing markets such as India and China are famous for their rapid economic growth, but a similar process is also unfolding in many out-of-the-way markets. The countries of sub-Saharan Africa, for instance, are projected to grow 6.8% in 2008, according to the International Monetary Fund, while Kazakhstan is set to expand by nearly 8%. Booming commodity prices, growing investment, and efforts to rein in debt have contributed to the rosier picture.

Good luck, frontier investors. Keep your powder dry, and watch out for bears.

Saturday, December 22, 2007

IRS Cracks Down on Wash Sale Gambit

OK. But I can still deduct the loss I realize in my taxable portfolio if I immediately repurchase the security through my Roth IRA, right?

Wrong, says the IRS. You can read the IRS reasoning here.

Friday, December 21, 2007

Bill Strauss: The Lawyer Who Became Beloved

To curry favor, Federated threw great parties during trust conferences. The one I remember best, in Washington, D. C., featured an orchestra of angels – well, they had wings – and a performance by the Capitol Steps.

My wife and I have loved that merry band of Capitol Hill pranksters ever since.

Sadly, today's Washington Post reports that Capitol Steps co-founder Bill Strauss died December 18th at age 60, after years of battling pancreatic cancer.

Strauss was a graduate of Harvard and Harvard Law, with a Master's from the Kennedy School of Government, who wound up working on the staff of Senator Charles Percy. At a Christmas party in 1981, he and other Senate staffers performed some silly songs. The rest is . . . The Capitol Steps.

At a tribute to Strauss on the Steps web site, you can hear a sampling of songs, including two classic Christmas numbers.

Thursday, December 20, 2007

It's Not the Same Old Philanthropy

The New Money favors hands-on philanthropy. Where the Old Money might merely underwrite a new gym at his or her college, Andre Agassi has launched his own school, Agassi Prep. Tiger Woods' tournament win last Sunday generated another million dollars plus for his Learning Centers, in which he takes justifiable pride.

If a member of the New Money considers supporting good works not organized personally, he or she wants to know the funds will be spent efficiently. The New York Times profiles two ex-hedgies who quit their jobs and now work for walking-around money in order to facilitate that effort:

As hedge-fund analysts, Holden Karnofsky and Elie Hassenfeld made six-figure incomes deciding which companies to invest in. Now they are doing the same thing with charities, for a lot less pay.You can sample of new-wave style of their venture on The GiveWell Blog.

Mr. Karnofsky and Mr. Hassenfeld, both 26, are the founders and sole employees of GiveWell, which studies charities in particular fields and ranks them on their effectiveness. GiveWell is supported by a charity they created, the Clear Fund, which makes grants to charities they recommend in their research.

Their efforts are shaking up the field of philanthropy, generating the kind of buzz more typically devoted to Bill Gates and Warren E. Buffett, as charities ponder what, if anything, their rigorous approach to evaluation means for the future.

Merry Christmas, IRS

Note that the temporary AMT patch will be a bit higher for the 2007 tax year than it was in 2006: $44,350 singles, $66,250 marrieds filing joint. So once again we haven't failed to inflation-adjust the AMT exemption, we only failed to do the right thing on a permanent basis.

Same time, next year?

Wednesday, December 19, 2007

Rangel concedes for this year

I would rather see the people not hit by the AMT [and] then come back and fight again for pay-go and to close the loopholes and pay for the AMT probably with the extenders.That's the comment by Charles Rangel after the Senate rejected by 48 - 46 an attempt to attach his "paid for" AMT patch as an amendment to the omnibus spending bill. He's now willing to drop the pay-go requirement for the one-year extension, and would bring it back for next year's round. Reportedly it's the "blue dog" conservative Democrats in the House who are now resisting this change of course.

Congress was hoping to start Christmas vacation tomorrow. There's not much time to get this AMT mess solved for the 2007 tax year. But they must enjoy it, or they would simply eliminate this tax anachronism.

Tuesday, December 18, 2007

Gold Up, Partridge Unchanged

The cost of acquiring one-each of the gifts mentioned in "The Twelve Days of Christmas" rose 3.1%, PNC Mellon reports. That's precisely the same rate of inflation reported last year.

The cost of acquiring one-each of the gifts mentioned in "The Twelve Days of Christmas" rose 3.1%, PNC Mellon reports. That's precisely the same rate of inflation reported last year.

You can read more about the whimsical price index here.

Partridge prices held steady, but expensive corn heated up the price of geese. Gold rings shot up more than 20%.

Monday, December 17, 2007

Gift tax valuations

In any event, the IRS valued the transfers over two years at $105 million (I'm guessing that figure is close to the current value of the trusts). Accordingly, they would like $65 million in additional gift tax payments. Topfer is resisting with a Tax Court suit. I'm looking forward to reading that decision.

Somehow I suspect that Mr. Topfer won't be joining Warren Buffett in arguing for a retention of the federal estate and gift tax systems.

Hat tip to Professor Beyer.

Sunday, December 16, 2007

A Few Trillion Here, A Few Trillion There . . .

Jim Gust commented that he hadn't realized they could generate mortgage loans that fast. It does seem amazing, but cursory research suggests that "they" sure could.

From an IMF study a few years ago (emphasis added):

The size of the U.S. mortgage and agency debt market has grown rapidly in recent years to surpass that of U.S. treasury securities . . . . At the end of March 2003, securities directly issued by U.S. government-sponsored agencies (including, but not limited to, Fannie Mae and Freddie Mac) totaled $2.4 trillion and mortgage-backed securities issued by the agencies totaled $3.2 trillion. The total of these two amounts was 161 percent of the size of outstanding U.S. treasury securities, compared with 73 percent as recently as 1996.Graphic from a NY Times story last March (click for larger image):

Could all this shaky debt mean recession? Several observers offer their views in today's NY Times. Here are two:

Could all this shaky debt mean recession? Several observers offer their views in today's NY Times. Here are two:Economist Laura Tyson

The resetting of interest rates on more than 2 million subprime loans will prompt a large number of foreclosures, perhaps a million a year in both 2008 and 2009. These huge waves of foreclosures will depress the price of residential real estate still further. Plummeting real estate values and escalating foreclosures will cause further losses on mortgage-related securities and will further burden American consumers already dealing with higher energy prices and substantial debt.

Given the dampening effects of these developments on both consumption and investment spending, it is increasingly likely that the economy will slip into recession next year. The Federal Reserve should continue to cut interest rates and to experiment with new ways to pump liquidity into the financial system.

James Grant

Though deficient in the powers of foresight and observation, economists do believe they know how to treat an economy on the brink of recession, as this one seems to be. They administer what non-economists know as the “hair of the dog that bit you.”Grant points out that occasional economic corrections are good for us, even if we hate the taste of the medicine.

But booms not only precede busts, they also cause them. Bargain-basement interest rates are a potent stimulant. Borrowing more than they might at higher rates, people stretch. Businesses stock up on labor, machinery and buildings. Consumers buy cars and houses — houses, especially, these past five years. The G.D.P. takes flight.

Then unwelcome facts intrude. Easy money, it seems, was an illusion. Society was not so rich as it seemed. The prosperous future for which people had collectively prepared is slow to arrive. The inflation rate picks up. Supposedly creditworthy consumers and businesses turn out to be risky. They were creditworthy only so long as lenders were willing to advance them more and more funds at those ever-so-affordable low rates.

Who knows? In a couple of years, stocks may be bargains. And young couples may be able to afford starter homes.

Saturday, December 15, 2007

Liquidity Moment

Thursday, December 13, 2007

Sober thinking on the effect of huge education endowments

Once again, remind me why this deserves to be a tax-free enterprise?

AMT: It's all about who is to blame

The White House has threatened a veto, but more importantly the bill seems unlikely to gain much traction in the Senate, given the 88-5 expression last week that a simpler plan of one-year relief is the better way to go. That bill was also nearly blocked by Senate Republicans, until Max Baucus issued a blistering press release on the consequences of their failure to take yes for an answer. The press release made crystal that Republicans would get—and deserve—all of the blame for the increased AMT if they didn't drop their intransigence. So they did.

Where will the blame fall now? House Democrats are trying to deflect the blame back to Republicans with assertions that they are being "fiscally responsible" by incorporating a tax increase into their plan.

By the way, everyone seems to agree that the extenders part of the bill is dead for the rest of this year.

Corporate fiduciaries are doing well

Average asset growth in the first nine months of 2007 increased to 7 percent compared to 6 percent in the first half of the year.

For the same time periods, average income growth slowed to 8 percent, down by 2 percentage points . However, median income growth remained at 10 percent suggesting that over half of all institutions are still seeing income rise faster than assets. Median asset growth was 7 percent.

Wednesday, December 12, 2007

Hedge fund manager, cocaine, unstable marriage, death at age 44

More AMT pain

According to Tax Notes, there was supposed to be a vote last night, but I don't see any sign that it happened. There are also rumors that the AMT patch legislation might get coupled to Medicare legislation to make a Senate filibuster harder for Republicans to sustain.

In all my years of observing the tax legislative process, I've never seen anything like this.

Meanwhile, the IRS has announced that its usual date to start processing returns, January 15, will be pushed well into February. There had been hope that non-AMT returns could be processed on time, but IRS lacks any systems or processes to identify and separate such returns. I think that the delay warning assumes an AMT patch is enacted—if time runs out, and we impose the AMT on another 25 million taxpayers in coastal states, there shouldn't be any reason for IRS delay. But their announcement is ambiguous on that point. They may have halted reprogramming the computers until they know which tax rules will apply.

Even though the start date could be delayed, IRS has rejected the idea of extending the April 15 filing deadline. That means returning processing time will be severely compressed.

They are hoping that a big increase in electronic filings will help to bail them out.

Tuesday, December 11, 2007

A Few Billion Here, A Few Billion There . . .

The Journal looks on the bright side: Nations we've flooded with dollars now have something (banks) to buy with them.

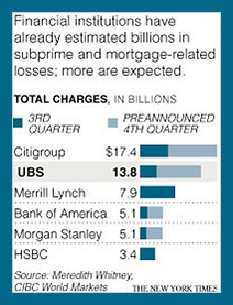

The Times, in this table, shows that UBS at least lost less (so far) than Citi (so far).

The Times, in this table, shows that UBS at least lost less (so far) than Citi (so far).Still, the $13.8 billion lost by UBS is no small sum. Multi-billion-dollar losses have become common, and we'll be seeing more of them, but even taken individually, they are enormous.

Imagine, please, that you are given $13.8 billion. You head straight for Vegas, determined to lose your vast fortune at the rate of $1 million a day. Seven days a week, week after week, month after month, year after year, you lose a million every day.

How long will it take you to lose all $13.8 billion? Twenty years? Thirty years?

Even longer! More than a third of a century will pass until, sometime in 2045, you finally go broke.

Monday, December 10, 2007

To sell to the rich, first study them?

Now Wells Fargo wants to get into the act as well. This link leads to their press release about their survey, but you'll have to call or e-mail if you want to see the actual report.

I was intrigued by the fact that in their "wealth life cycle analysis," Wells came up with categories essentially identical to Merrill Anderson's Wealth Management Article Library:

The study uniquely categorized HNW individuals into four distinct groups based on their stage in the wealth lifecycle. These stages are Building, Managing, Preserving and Transferring.Great minds think alike.

Chinese Restaurateurs Inherit UK Fortune

How Ancient Rockers Turned a Broker into a Fiduciary

His ability to be wrong about the direction of an individual stock was uncanny, even to him. At first, he didn’t understand why his customers didn’t fire him, but soon he came to take their inertia for granted. "It was amazing, the gullibility of the investor," he says. "When you got a new customer, all you needed to do was get three trades out of him. Because one of them is going to work. But you have to get the second one done before the first one goes bad."Ebenezeer Scrooge saw the light after visits from the spirits of Christmas Past, Christmas Present and Christmas yet to come.

It wasn't exactly the career he’d hoped for. Once, he confessed to his boss his misgivings about the performance of his customers' portfolios. His boss told him point-blank, "Blaine, you're confused about your job." A fellow broker added, "Your job is to turn your clients' net worth into your own." Blaine wrote that down in his journal.

Blaine Lourd's conversion came via The Rolling Stones.

Hey, whatever works!

If you have finished your holiday shopping and have time to spare, read his story.

Teaching Children How to Invest

Mr. Rogerson, 51, the father of two girls and two boys, has them off to an early start. Six years ago, when they ranged in age from 5 to 15, he and his wife decided to entrust them with $5,000 each year. The children were to invest the money, which would be used for the family’s summer vacation. If the fund prospered, they might “go to Disney World,” he said. “If it stayed flat, we would go around the country and visit family members,” he added. “If the investment fell, there was always a camping trip.”Presumably, Mr. Rogerson was teaching his kids how not to invest. (Surely he wouldn't have gambled a BNY Mellon client's money on stocks as a short-term investment.) With luck, they have learned that equities should be held for the long term.* * *Mr. Rogerson turned his kids into investing guinea pigs in 2001 — a bad year for the domestic stock market, as it turned out. “The kids knew nothing,” he recalled. “They bought stocks like Apple and Hasbro and all these penny stocks at high-tech and toy companies. Their pile went down from $5,000 to $2,000.” That year, he said, “we went camping.”

During the second year, the children were so nervous about “putting Mom and Dad back in a tent again that they eventually put all the money in money market accounts,” he said. “They made $50,” he added. “That year we drove down to Florida to visit family. “Since we were six people, we stayed at Holiday Inns along the way. We spent the money on motels, food and entertainment. My father lived in Daytona and my wife’s mother lives in Naples. Along the way, the kids made decisions about what kinds of restaurants we could go to.”

By the third year, the investing bug had bitten, and the children wondered, “How do we invest so maybe we can do something more fantastic?” he said. They had stocks that were more conservative: a diversified portfolio that included large-capitalization stocks. They also had fixed-income investments like bonds. The young investors earned $600 on their $5,000 that year, and the family rented a catamaran and went boating near Mystic, Conn. (choosing it over Disney World).

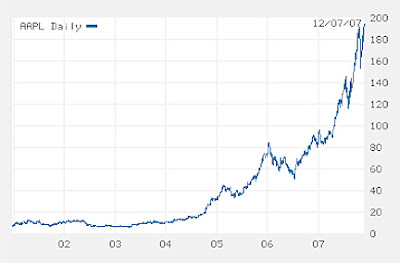

Example: Look what would have happened if the family had skipped its 2001 vacation and held onto the shares of Apple:

Sunday, December 09, 2007

Medicare: Drug Insurance Swindlers

Holiday season coincides with the open enrollment period for Medicare prescription drug coverage, and regulators are warning that an increasing number of unscrupulous insurance agents also view it as open season for preying on older adults.Most popular scam: Selling Medicare Advantage programs disguised as regular prescription-drug programs.

The wrongdoing, among other activities, involves violating federal regulations against door-to-door selling of coverage and the forging of signatures. "It's the wild, wild West out there," says Mary Jo Hudson, director of the Ohio Department of Insurance.

Like the subprime-mortgage brokers of yesteryear, drug swindlers have visions of the Good Life dancing in their heads: "Critics say that driving the unscrupulous sales practices are commission structures that favor promoting one plan over another no matter what the needs of an applicant. Insurance companies also hold contests to push their products that promise salespeople prizes like trips to Las Vegas."

Friday, December 07, 2007

Senate Republicans take yes for an answer

Ways and Means Chairman Rangel has offered to modify the offsets in the House bill, to eliminate most but not all of the changes that will affect hedge fund managers (the "prevailing party" in the Senate, apparently). If Rangel wanted to do some horse trading, he should have started the process earlier than November.

All eyes now turn to the House, and to the Democratic leadership.

Thursday, December 06, 2007

The AMT blame game begins

To put this into perspective, the increase alone in AMT collections slated for next year is nearly $50 billion. That's 23 million taxpayers paying an extra of $2,000 each. The entire federal estate tax, on the other hand, will raise a scant $21 billion.

Wednesday, December 05, 2007

AMT deal falls apart

Tuesday, December 04, 2007

Down to the wire on the AMT

Reid told reporters that the Senate would take up a temporary AMT patch and so-called extenders package "as soon as we can," and added there were "a lot of balancing balls." Reid also took issue with what he characterized as GOP obstructionism and blamed the delay in action on AMT relief on the Republicans' "57 filibusters."I'm sorry, but I don't see how earlier filibusters on other legislation caused the House Ways and Means Committee to delay beginning work on the AMT patch until November. That was rank irresponsibility, and no one has called them on it, or apparently will. Congress has put itself in a box on this, because they will want credit for handing out a tax cut when what they are really doing is preventing a tax increase, one that will fall hardest in the bluest states.

Here's a bit of refreshing common sense about the AMT:

"I think most Republicans would like to repeal the whole thing, period, without paying for it. Why would you want to have to raise taxes on somebody else in order to discontinue a kind of phantom levy that we've been preventing from going into effect every year anyway and never intend to collect?"That's from Senate Minority Leader Mitch McConnell. Too bad he didn't exhibit that same common sense when he was in the majority.

UPDATE: The Senate will evidently be in session until December 21. Republicans are predicting that an AMT patch without offsets will pass in the Senate, which means it has to go back for passage in the House, or there has to be a Conference to iron out differences.

Monday, December 03, 2007

More on Networking Millionaires

A question for the class-conscious: Does the emergence of this phenomenon break down class barriers, or reinforce them by helping the rich to more fully isolate themselves?What's more, while the sites claim to be exclusive, they're opening their doors wider and wider to please advertisers and investors, who often prefer quantity over quality. And the sites can't ensure that all their members are what they say they are, despite verification systems from fellow members and the sites themselves. All this has rankled some members, who say the sites have become simply well-dressed Facebooks.

A question for trust marketers: Any way we can break into the sites?

Friday, November 30, 2007

Lloyds's Expat Quarterly

Take a look at Shoreline, Lloyds quarterly magazine for expats. Livelier art direction than most U.S. bank pubs. Relatively short articles. Both trends worth emulating.

The online version of the current issue is limited to subscribers, but you can check out past issues. In last summer's, you'll meet an American who's gone to India to help run those call centers, plus the expats below in Australia. (Click on pic for larger image.)

Thursday, November 29, 2007

Do your clients trust you?

According to a survey released this morning by Spectrem Group, which polled investors worth $25 million or more, close to half of all respondents believe they could do a better job of financial planning than their advisers. And only about half were satisfied with the “knowledge and expertise” of their adviser and his or her ability to “deal with complex financial issues and problems.”Why? Most of the respondents were self-made millionaires, they didn't inherit their wealth. Contrary to what Merrill Anderson preaches, these people believe that if they have proven themselves in a business or a profession, mastering investment skills should not present a problem. But even worse,

They believe (fairly or not) that private banks and Wall Street firms today are more interested in products than providing custom financial advice.Maybe all that cross selling wasn't such a good idea?

UPDATE: Don't miss the comments to the above-noted post, they provide a fascinating look into the minds of your prospects. Best observation, from Paul in NY:

I once had an “old-timer” from Wall Street sum up the investment banking/advisory business to me, as follows: “We don’t want to steal your money, but we will if we have to.”

Wednesday, November 28, 2007

“The Case of the Astor Will” is Woefully Miscast

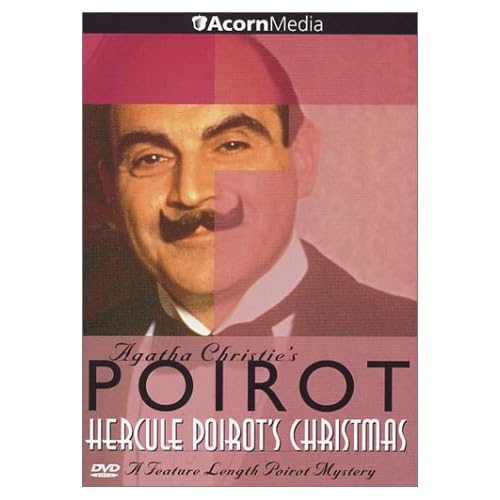

Yes, miscast. So we realized last evening after watching "Hercule Poirot's Christmas."

Yes, miscast. So we realized last evening after watching "Hercule Poirot's Christmas."A movie length Agatha Christie mystery, "Hercule Poirot's Christmas" takes place in an English country home at Christmastime, 1936. The family patriarch, age 70+, has grown incredibly rich mining African diamonds. Now he summons his children, including a long-lost black sheep, plus a 20-ish granddaughter from Argentina, to join him for Yuletide. When they arrive, he let's it be known that he intends to change his will. He'll make a new one right after Boxing Day.

As the rigid conventions of English country-house mysteries require, he is promptly murdered.

After Poirot solved the crime. we turned to the news. There was Anthony Marshall, stooped and noticeably frailer, appearing in court to be charged with pillaging the estate of his mother, Brooke Astor, and forging her signature on changes to her will.

The casting couldn't be more wrong. The Astor matriarch was well over 100 when the amendments to her will were made. Marshall, assigned the role of the suspect son with black-sheep tendencies, is 83. (He could have been a 12-year-old choir boy in 1936, the year in which "Hercule Poirot's Christmas" is set.) Marshall's spouse, cast as "the scandalous young second wife," is now 65, presumably eligible for Social Security. And the role of grandchild is filled not by a student-age young person but by Philip Marshall, a professor in his mid-fifties.

All wrong! One wishes that, instead of a trial, the God of Equity might descend to the stage and settle things properly. Send the old folks to a first-rate assisted-living facility. Give the aging grandchildren sufficient bequests to top off their retirement funds. Then bestow the bulk of the estate upon the charities Mrs. Astor designated in her pre-amended will.

One member of the cast does seem to fit his part. Attorney Francis X. Morrissey Jr. allegedly has a talent Agatha Christie would have loved. Reportedly, he just can't help attracting elderly clients who want to remember him in their wills.

Tuesday, November 27, 2007

Newly Opened Investment Tax Gift

How do you turn dividend and interest income into tax-deferred capital gain? Temporarily, anyway, the answer seems to be ETNs (Exchange-Traded Notes).

How do you turn dividend and interest income into tax-deferred capital gain? Temporarily, anyway, the answer seems to be ETNs (Exchange-Traded Notes).Allen Sloan explains here.

Monday, November 26, 2007

The Battle for the Ultra-High-Net-Worth Market Heats Up

Now Tully and two other former Merrill Lynch CEOs, together with other Wall Street heavyweights, are backing a new private bank: Fieldpoint Bank and Trust of Greenwich, slated to open in February. You can read the Dow Jones Newswire story here:

Fieldpoint will administer funds worth billions at the outset, offering banking, investment and estate management advice. Chief Executive Kevin McCabe, who used to work at JP Morgan Chase (JPM), believes Fieldpoint will also offer its clients excellent networking opportunities. Clients will be offered the opportunity to share ideas with each other, including investment opportunities.The Dow Jones story also notes that Rockefeller & Co., the outgrowth of the old Rockefeller family office, is gearing up to seek more outside business. Judging from their web site, that definitely includes trust and estate business:

Wealthy individuals often express their dislike of established private banks, citing poor service and product pushing . . . .

Because of our firm’s heritage, we are particularly attuned to the needs of families managing wealth transfer across generations. We understand the nuances of administering long-term trusts and the role that education and mentoring play in helping children and grandchildren to manage the responsibilities of wealth.Overall, Dow Jones notes, total wealth serviced by private banks grew by 25% last year.

As a corporate fiduciary, we offer impartiality and objectivity in administering payments. We are experienced and flexible when working with individual co-trustees or outside advisors.

Our subsidiaries, The Rockefeller Trust Company (New York) and The Rockefeller Trust Company (Delaware) deliver a cost-effective full range of trust and estate services . . . .

Hedge Funds: Less Than Meets the Eye?

Leverage, double counting (as when a manager's fund of funds invests in the firm's own hedge funds) and valuation issues make the size of the hedge-fund market hard to judge. Estimates range from $2.48 billion down to $1.25 billion.When reporting their assets under management, hedge funds typically refer to the amount of money they have attracted from investors -- a practice long established by mutual funds and other investment firms. Many hedge funds also borrow money to increase their "leverage," which amplifies their potential returns (and potential losses). In recent months, as the market turmoil has forced many funds to cut back on their borrowing, it has become evident that some were adding in the borrowed money when reporting their size. For example, bond fund Y2K said it had assets under management of $2 billion as recently as July. But after a tough summer, London-based parent Wharton Asset Management UK Ltd. said the fund actually had less than $100 million in investor capital, and that most of the rest had been borrowed.

Ultra-high-net-worth investors like to talk the hedge-fund talk. To what extent are they walking the walk?

Sunday, November 25, 2007

“Lifestyle” Sells. What Can Fee-Based Advisers Learn?

Learn what? You 'll have to figure that out yourself. The Senior Assistant Blogger is way too 20th century.

When You Need Another You:

Three years ago, [Ezra] Glass co-founded a lifestyle-management company in Rockville named Serenity Now, a name inspired by an episode of the television show "Seinfeld." It's modeled on similar lifestyle-management firms in vogue in Europe, where clients pay a membership fee for round-the-clock advisers who can cater to their every need, including entree into chic clubs and restaurants. Glass's clients pay a membership fee that ranges from $450 to $1,500 a month.Apple Retail Stores Revamp:

It's not uncommon to find people dropping in to hang out, use the Internet or let their children play on the Macs on low-legged tables. Personal blog entries, complete with snapshots of the authors in the store, are sometimes written on the spot.

"We try to pattern the feeling to a 5-star hotel," said Apple's retail chief, Ron Johnson. "It's not about selling. It's about creating a place where you belong."* * *The "one-to-one" personal training service that Apple stores launched two years ago is also becoming more popular, Johnson said. He declined to give specific growth figures.

For $99 a year, a customer gets up to one hour a week to learn about a wide-range of subjects tailored to the customer's interest or abilities. The program is for beginners and experts alike and can cover how to set up computers, make movies, build Web sites or put together a scrapbook or family newsletter.

Saturday, November 24, 2007

Public Radio: Happy Medium for Reaching Wealth?

Serious music (classical and jazz) hasn't vanished from the airwaves, however. It's moved to public radio, along with most serious public-affairs programing. As a result, non-profit radio attracts educated, affluent listeners – prime prospects for investment and financial-planning services.

Most all the major financial-services companies seem to sponsor something on NPR occasionally. BofA Wealth Management pops up on Morning Edition. But it's smaller banks and trust companies that may benefit most from public radio sponsorships. At relatively modest cost they can introduce their brand to considerable number of potential clients.

Here in New Hampshire, I hear Charter Trust Company and Laconia Savings Bank mentioned on NHPR.

What about you marketers in other parts of the country? Do you find public radio a useful, cost-efficient way to keep your brand name in the public ear?

Is Mary's Little Computer Getting Mugged?

From its inception, One Laptop Per Child posed a threat to the personal-computing dominance of software giant Microsoft and chip maker Intel. Mr. Negroponte's team, drawn from MIT, designed a machine that didn't use Windows or Intel chips. It uses the Linux operating system and other nonproprietary, open-source software, which users are allowed to tinker with.This year, says the WSJ, Bill Gates announced Microsoft would offer developing countries a software package that includes Windows, a student version of Microsoft Office and educational programs. Total price? $3.00.

Last year, Intel, which normally doesn't sell computers, introduced a small laptop for developing countries called the Classmate, which currently goes for between $230 and $300. It has marketed the computer aggressively, although it stands to make little money on the initiative. But it hopes to prevent rival Advanced Micro Devices Inc., or AMD, whose chips are in Mr. Negroponte's competing computer, from becoming a standard in the developing world.

For a helpful comparison of Intel's Classmate and the XO, see this ars technica article.

Incidental intelligence: There's a Bull Market for XO laptops on eBay. This morning the bidding on one XO, to be delivered only after the seller, who participated in Give One, Get One, receives the machine, had climbed above $600!

Thursday, November 22, 2007

Give Thanks . . . and Mary's Little Computer

Mary has a little XO,What's the XO? It's the brainchild of a certified nut case, Nicholas Negroponte, founder of the MIT Media Lab.

It's powered by the sun.

And everywhere that Mary goes,

She learns and has some fun.

Professor Negroponte and his fellow nuts have a dream: Create an indestructable, solar-powered laptop computer that is so cheap ($100 or so) that one can be provided to every kid in the world. Undernourished kids in Africa? Yes! Shoeless kids in South America? Yes!

"Impossible!" everybody said.

Everybody was right. The impossible will take a little longer. You can't make an indestructible, solar-powered laptop for $100.

OK. How does $200 strike you?

Welcome to the impossible dream: The unix-operated surfing, chatting, words and graphics and whatever else a kid can think of XO laptop now being produced by OLPC (One Laptop Per Child):

While children are by nature eager for knowledge, many countries have insufficient resources to devote to education—sometimes less than $20 per year per child (compared to an average of $7,500 in the United States). By giving children their very own connected XO laptop, we are giving them a window to the outside world, access to vast amounts of information, a way to connect with each other, and a springboard into their future.Wealth managers and their clients talk a lot these days about leaving legacies that amount to more than just money. One Laptop Per Child sure seems to fill the bill.

Give One, Get One. This weekend only, through November 26, you can help fund the impossible dream. For $400 plus shipping, you can donate the revolutionary XO laptop to a child in a developing nation, and also receive one for the child in your life in recognition of your contribution. Nov. 23 update: Give One, Get One has been extended to year's end. The program also got important face time from Negroponte's appearance on the Thanksgiving edition of the PBS News Hour.

Hey, big spenders! By donating a mere $250,000, you can have a thousand XO's sent to a thousand kids in the country of your choice. And I bet that offer is good even after November 26!

Sunday, November 18, 2007

Social Security: How to Double Dip

Did you know, for instance, that a married man who waits until age 70 to collect his retirement benefit (thus qualifying for a significantly larger monthly payment) may be able to collect a spousal benefit in the meantime?

Here's how the WSJ explains it:

George, at his full retirement age of 66, expects a benefit of $2,000 a month. His wife, Martha, at her full retirement age of 66, expects a benefit of $1,000 a month.Caution: Serial double-dipping is such a cool gambit that even some Social Security officials don't know about it.

The strategy: Martha files for a reduced benefit on her own at age 63, or $800 a month. George, at age 66, files for just a spousal benefit, based on Martha's earnings. He would get $500 a month as Martha's spouse. (Yes, Social Security allows George to get half of what Martha was projected to receive at her full retirement age.) Then, at age 70, George applies for benefits based on his earnings history. With the "delayed retirement credit" (the additional dollars one receives for waiting until age 70 to claim Social Security), George's benefit would be 32% higher, or $2,640 a month.

Social Security would stop George's spousal benefit of $500 a month because he's entitled to the $2,640, based on his own earnings, at age 70. Again, for this to work, George must wait until his full retirement age or later to file for a spousal benefit.

Friday, November 16, 2007

Brokers are talking up charitable giving

Philanthropy is a core element of wealth management for most families. Registered Rep magazine reports that more and more brokers are recognizing that fact and discussing the subject with their clients. According to a survey done by the magazine with Schwab, some 79% of brokers say that they will talk about philanthropy, though a much smaller number feel comfortable initiating such discusssions.

Philanthropy is a core element of wealth management for most families. Registered Rep magazine reports that more and more brokers are recognizing that fact and discussing the subject with their clients. According to a survey done by the magazine with Schwab, some 79% of brokers say that they will talk about philanthropy, though a much smaller number feel comfortable initiating such discusssions.What would it take to get more brokers to break the ice on charitable giving topics? This graph tells the story (click to enlarge).

The wealthier the client, the more important a role philanthropy is likely to play. And at higher wealth levels, charitable trusts are playing a big role, according to the study.

Elaine E. Bedel, a fee-only financial advisor with Bedel Financial Consulting in Indianapolis, says her background working in the trust department of a bank gave her the knowledge to speak confidently with clients about charitable giving. It’s usually a discussion that takes place in her initial meeting with a client, she says.What if the client isn't charitably minded?

Raymond F. Rivas, a financial advisor with Atherton Wealth Planning in Atherton, Calif. says, in fact, that he takes a rather blunt approach. “I usually say, ‘Look, you have a lot of money here. What are you going to do for others? You have two choices when you pass away. Are you going to give your social capital to the IRS, so they can decide how to distribute it, or are you going to take your social capital and decide yourself how to distribute it among your fellow Americans.’”That's been Jim Macdonald's defense of the unlimited charitable deduction—who wants to let Washington spend the money? But they keep spending it whether they have it or not. I'm wondering whether my taxes might go down a bit if we share some of the charitable largess with the IRS?

Maybe Santa will bring us an AMT patch?

Reid's unanimous consent request stipulated that after two hours of debate, the Senate would either vote to cut off discussion of the measure or move on to consider competing amendments by Assistant Minority Leader Trent Lott, R-Miss., and Finance Committee Chair Max Baucus, D-Mont.

Lott's amendment would repeal the AMT outright and extend expiring tax provisions by one year. Baucus's amendment would provide a one-year AMT patch without offsets and a two-year, offset extenders package.

The fact that Baucus was willing to drop offsets for the AMT patch indicated possible movement toward compromise and resolution of this long-overdue tax problem. But Minority Leader Mitch McConnell objected (and it only takes one to defeat a unanimous consent motion), arguing for a "clean" bill with no offsets at all.

Remember how upset Senators got when the Iraqi parliament took a vacation last summer, leaving important legislative work unfinished? Were they just kidding around then, or do those standards not apply to our Congress?

Is there some reason I've missed for why the AMT couldn't have been responsibly addressed six months ago?

Our prior commentary and comments on the AMT fiasco are here, here and here.

Estate Tax Valuation: Digital Doubts

The lead item in the November Briefs caught my eye. The U.S. Court of Appeals, Second Circuit was confronted by an estate-tax valuation dispute in which the IRS had claimed one fifth of a closely-held business was worth $32 million.

The estate set the value at only $1.75 million.

(The Tax court, which loves to compromise, set the value at $13 million).

The disparity was so great that the IRS sought an underpayment penalty.

Two questions sprang to mind:

What could trigger such a great disparity in valuation?

Why did the disparity seem less shocking that it would have in the past?

The trigger

Estate of Thompson v. Comm'r deals with the valuation of a one-fifth interest in Thomas Publishing Co., "a century-old, closely held corporation which produces business-to business publications." The one-fifth interest belonged to Josephine T. Thompson, who died in May, 1998.

In effect, the estate defended its low valuation by saying, "The Internet is killing us!" Discounts applied in calculating the valuation included one for "Internet and management risk."

The IRS argued that its high valuation was realistic as of 1998, especially since the company seemed to be adapting well to the digital world: its own web site was attracting lots of traffic.

Bet this isn't the last valuation dispute to be triggered by the need for businesses to move online.

The shock absorber

Why do outlandish differences in presumed value seem less shocking? Probably because we're getting used to derivatives. This year we're certainly getting used to CDOs (collateralized debt obligations) derived from what The Wall Street Journal likes to call "tainted mortgages."

Marked to model, the CDO may be worth $5 million.

Street value? Maybe five or six grande lattes.

Thursday, November 15, 2007

Tactical Estate Planning?

"They say we can go there for Thanksgiving or they can cut us out of the will. Our choice."

Monday, November 12, 2007

Why Google's Multitude of Multimillionaires Stay Rich

The best investment advice you'll never get appeared in last December's San Francisco magazine:

As Google’s historic August 2004 IPO approached, the company’s senior vice president, Jonathan Rosenberg, realized he was about to spawn hundreds of impetuous young multimillionaires. They would, he feared, become the prey of Wall Street brokers, financial advisers, and wealth managers, all offering their own get-even-richer investment schemes. Scores of them from firms like J.P. Morgan Chase, UBS, Morgan Stanley, and Presidio Financial Partners were already circling company headquarters in Mountain View with hopes of presenting their wares to some soon-to-be-very-wealthy new clients.The teachers were among the greatest investment thinkers and scholars:

Rosenberg didn’t turn the suitors away; he simply placed them in a holding pattern. Then, to protect Google’s staff, he proposed a series of in-house investment teach-ins, to be held before the investment counselors were given a green light to land.

Nobel Laureate Bill Sharpe

Random Walker Burton Malkiel

And, of course, "Saint Jack," the Old Tiger himself, John Bogle.

Those poor brokers, private bankers and assorted wealth managers waiting in the wings! They must have had tough sledding when they finally got to make their sales pitches.

Death by Greed?

Whybrow is the author of American Mania: When More Is Not Enough.

Sunday, November 11, 2007

Where Multimillionaires Grow Like Weeds

So reports The New York Times, illustrating the point with the case of Bonnie Brown. Newly divorced in 1999, on a lark Ms. Brown answered Google's ad for an in-house masseuse.

Ms. Brown . . .now lives in a 3,000-square-foot house in Nevada, gets her own massages at least once a week and has a private Pilates instructor. She has traveled the world to oversee a charitable foundation she started with her Google wealth and has written a book, still unpublished, “Giigle: How I Got Lucky Massaging Google.”By unofficial estimate, "1,000 people each have more than $5 million worth of Google shares from stock grants and stock options."

Saturday, November 10, 2007

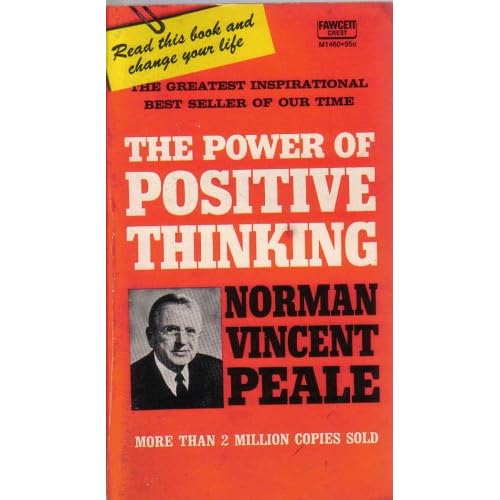

To Build Wealth, Use Positive Thinking

In his Science Journal column (subscription), The Wall Street Journal's Robert Lee Hotz reports on recent studies suggesting that our brains are built to look on the bright side.

In his Science Journal column (subscription), The Wall Street Journal's Robert Lee Hotz reports on recent studies suggesting that our brains are built to look on the bright side. Research by economists at Duke indicates that optimism pays, at least when applied in moderation:

Optimists, the Duke finance scholars discovered, worked longer hours every week, expected to retire later in life, were less likely to smoke and, when they divorced, were more likely to remarry. They also saved more, had more of their wealth in liquid assets, invested more in individual stocks and paid credit-card bills more promptly.In only one profession does optimism seem a drawback: The law. Pessimistic law students at UVa "got better grades, were more likely to make law review and, upon graduation, received better job offers."

Yet those who saw the future too brightly -- people who in the survey overestimated their own likely lifespan by 20 years or more -- behaved in just the opposite way, the researchers discovered. Rather than save, they squandered. They postponed bill-paying. Instead of taking the long view, they barely looked past tomorrow. Statistically, they were more likely to be day traders. "Optimism is a little like red wine," said Duke finance professor and study co-author Manju Puri. "In moderation, it is good for you; but no one would suggest you drink two bottles a day."

Friday, November 09, 2007

Baby boomers being left out of parents' wills

It has been said that Generation Y, people born between 1978 and 1992, are likely to be the first generation in history that are financially worse off than their parents," said [Robert Monahan, senior estate planner at Australian Executor Trustee].Have you noticed a similar trend in this country?

Grandparents seem to be picking up on this dramatic shift in fortunes and using their wills to do something about it.

AMT patch uncertainties increase

Now, according to Tax Analysts ($), the White House has threatened to veto the House bill if it includes those provisions.

That's a pretty high stakes game of chicken. I begin to believe that the reason the AMT patch has been delayed for so long was precisely to be able to call the President's bluff on this. If the bill is passed and vetoed before Thanksgiving, which would seem to be very unlikely to me, they would have time to come back in December with a compromise version. IRS is already making plenty of noise about the problems of a December tax code change, so it's clear they are preparing for it.

But what if the House bill is presented to the President in December? A veto then would most likely kill the chance to fix the AMT for 2007, so 20 million more taxpayers would really get to pay this tax. Who would win and lose in the political fallout? It's not obvious to me, especially when you consider that the majority, perhaps the vast majority, of those who will be paying the AMT for the first time will be Democrats. (The impact of the AMT is highest on the coastal states with the highest state tax regimes, recently the blue states.)

Do the Democrats shore up their base by taxing it, because they can blame Bush for a veto they will paint as protecting extravagently compensated hedge fund managers? Or will the esteem for Congressional incumbents fall even lower than it is already?

Thursday, November 08, 2007

Are the New Rich Different?

A new study from U.K.-based Davies Hickman, commissioned by British Telecom, says the old view of money is “formal, conservative, ‘leather and wood,’ exotic locatons, polo, Bentleys and yachts.” The new rich, by contrast, are more interested in “stealth wealth” and “demonstrating their individuality and uniqueness.”Perhaps we should let the experts have the last word:

True — to some extent. Today’s rich are obviously different from Old Money. Yet I’m always surprised at how thoroughly today’s rich try to mimic the established wealthy. The aristocratic sport of polo, for instance, is thriving in Palm Beach and the Hamptons — Old Money haunts taken over by New Money.* * *Nelson Aldrich, the Aldrich scion and author of “Old Money,” explained to me once how New Money craves the respect and status of Old. New Money may make fun of the “snooty blue-bloods,” but privately the new rich spend much of their time trying to join their boards, win their friendships and, most of all, get their approval. And considering the alternative, all New Money wants to be Old Money some day.

_(photo_by_Carl_van_Vechten).jpg) Fitzgerald (updated): "The new rich are very different."

Fitzgerald (updated): "The new rich are very different." Hemingway: "Yes. They have more money."

Hemingway: "Yes. They have more money."Love, Hate and Estate Planning

Horton Foote's Dividing the Estate, a play about family interdependence, love, hate and estate planning, had a limited run, Sept. 27 to Oct. 28, to critical acclaim in New York City. The producers are hoping to bring it back in the spring. If it's on the boards again, wealth advisors and their clients are well-advised to see the production.

What should IRS do in the countdown to an AMT patch?

There's a difference of opinion, Tax Analysts ($) reports:

Acting IRS Commissioner Linda Stiff, echoing her predecessor, former IRS Commissioner Mark Everson, has maintained that the IRS must prepare its forms and processes for the filing season strictly according to current law, regardless of impending tax legislation. Stiff has said the IRS will need 10 weeks from the date of any currently pending tax bill's enactment to begin processing returns. Late enactment will affect return processing for up to 50 million taxpayers and will delay up to $75 billion in refunds, Stiff said.I can't agree with Olson's assessment. It might make sense to do nothing, to suspend the printing of the forms, to avoid incurring costs that will almost certainly be wasted, and perhaps to focus Congressional attention on the urgency of the situation, but relying on the heads of the taxwriting committees for preparing tax forms would be foolish.

But [National Taxpayer Advocate Nina] Olson said at a National CPA/IRS Tax Issues Meeting in Washington that she has received no satisfactory response after repeatedly requesting clarification on what prevents the IRS from preparing for the filing season by anticipating legislation.

Olson acknowledged that 'putting odds on what Congress will do is very, very difficult.' However, the heads of the congressional taxwriting committees have written to the IRS outlining the parameters of alternative minimum tax relief they intend to pass before the end of the year. Olson said it makes sense, given the circumstances, to program the systems in anticipation of the law changes.

BTW, the House draft includes an "extra standard deduction" for those taxpayers who own their homes and pay real estate taxes but don't itemize their deductions. Married taxpayers would get a $700 bump. You gotta love that tax simplification.