We didn't really have 2.8% annualized GDP growth in the fourth quarter, according to John Crudele in the NY Post. He argues that the numbers were fudged with an underestimate of inflation for the quarter, and that annualized growth was closer to an imperceptible 0.6%. What's more, 75% of the 2.8% growth number was a restocking of inventories.

I think this means we need to be braced for bad news in this quarter.

Tuesday, January 31, 2012

Monday, January 30, 2012

Wealth managers are creating captive trust companies

Says Scott Martin of The Trust Advisor. Most of the action seems to be in South Dakota, Delaware and Nevada. Apparently, all you need is about $100 million in assets under management.

Friday, January 27, 2012

The Badges of Davos

Do your wealth-management labors take place within an organization important enough to send the boss to Davos? If so, you'll enjoy Felix Salmon's guide to Davos Status Levels.

Wednesday, January 25, 2012

Ameriprise, an Eager Trustee

Ameriprise wants new trust business. And existing trust business, too. "If you have an existing trust," says this Ameriprise video, "consider the advantages of moving it to Ameriprise Financial."

Should other banks and trust companies be doing more to generate successor-trustee business?

Should other banks and trust companies be doing more to generate successor-trustee business?

Monday, January 23, 2012

Wall Street in Winter – 1830s

|

| Wall Street, N. Y. Public Library Digital Gallery |

Sometimes simpler is better. (Say, is there an asset-allocation moral there?)

Sunday, January 22, 2012

Eccentricities of Affluence: Frostbiting

Why do some affluent men, even one-percenters, choose diversions that most poor guys would call cruel and unusual punishment? Frostbiting, for instance. Fortunately, marketers don't have to answer that question, just accept the reality. Hence this January, 1962 ad from Chase.

Friday, January 20, 2012

New Estate Tax Break For the One Percent

As this estate planning article reminds us, the federal estate tax exemption jumped from $5 million to $5,120,000 this year. Why aren't wealthy old people celebrating? Probably because wealth is not real popular these days. Other people's wealth, that is.

Thursday, January 19, 2012

“Someday All This Will Be Yours”

From what little I heard, Diane Rehms' program with guest author Hendrick Hartog sounds inteesting. Topic: Children who look after aged parents and the inheritance expectations of those children.

Hartog's book: Someday All This Will Be Yours: A History of Inheritance and Old Age.

One listener called in to say he disliked receiving a hefty inheritance from his father. He felt uncomfortable "profiting" from his parents. But not uncomfortable enough to disclaim his new wealth, apparently.

Hartog's book: Someday All This Will Be Yours: A History of Inheritance and Old Age.

One listener called in to say he disliked receiving a hefty inheritance from his father. He felt uncomfortable "profiting" from his parents. But not uncomfortable enough to disclaim his new wealth, apparently.

Merrill Lynch, Discount Broker?

Just stumbled on this news item by accident. Is B of A, through Merrill Lynch, getting serious about discount brokerage?

B of A changing fees for Merrill Edge

B of A changing fees for Merrill Edge

Wednesday, January 18, 2012

Hedge Funds or Treasury Bills?

A Bloomberg dispatch quotes Simon Lack, author of The Hedge Fund Mirage:

A Bloomberg dispatch quotes Simon Lack, author of The Hedge Fund Mirage:"If all the money that's ever been invested in hedge funds had been put in Treasury bills instead, the results would have been twice as good."

Other studies have been slightly kinder, indicating long-term performance that lagged the S&P 500 by 50% or so. Certainly last year was one most fund managers are glad to be rid of. The average hedge fund dropped almost 5%. Long/short equity funds lost more than 7%.

Here is the mystery:

If hedge funds do this badly despite a growing number of arrests for insider trading, how badly would they have done without inside information?

Tuesday, January 17, 2012

How Much Investment Protection for the 1%?

"Who's Rich (or Smart) Enough for High-Risk Investments? asks Paul Sullivan in his Wealth Matters column. My first thought was, "Who cares?" Millionaires should fend for themselves.

Second thoughts:

The wealth requirement for an "accredited investor" – that is, someone deemed rich and smart enough to be allowed to buy private stock placements, hedge funds and other goodies – hasn't been substantially changed in a generation. Adjusting for inflation, the $1-million minimum ought to be more than $2 million now.

One or two million bucks doesn't make an investor smart. In seeming acknowledgement, really hot offerings seem restricted to a more elite group of "qualified" investors – individuals with at least $5 million and institutions with at least $100 million.

"Originally," Sullivan notes, "the Securities Act of 1933 aimed to provide more information on securities to prevent investors from being manipulated. Those who were exempted from these requirements were believed to possess enough knowledge to make informed choices." Really? Can general knowledge compensate for lack of specific information? (Look at the "accredited investors" who put their money with Bayou or Madoff, and sometimes both!)

Second thoughts:

The wealth requirement for an "accredited investor" – that is, someone deemed rich and smart enough to be allowed to buy private stock placements, hedge funds and other goodies – hasn't been substantially changed in a generation. Adjusting for inflation, the $1-million minimum ought to be more than $2 million now.

One or two million bucks doesn't make an investor smart. In seeming acknowledgement, really hot offerings seem restricted to a more elite group of "qualified" investors – individuals with at least $5 million and institutions with at least $100 million.

"Originally," Sullivan notes, "the Securities Act of 1933 aimed to provide more information on securities to prevent investors from being manipulated. Those who were exempted from these requirements were believed to possess enough knowledge to make informed choices." Really? Can general knowledge compensate for lack of specific information? (Look at the "accredited investors" who put their money with Bayou or Madoff, and sometimes both!)

* * *

On the whole, the net-worth 1% probably should be left to look out for themselves. Still, it's scary to read of legislation that would allow brokers to peddle private placements via cold calls. Just imagine how frenetic the Silicon Valley Feeding Frenzy would become.

Monday, January 16, 2012

The United Debtors of America

Spend, Spend, Spend. It's the American Way. Explaining how this happened requires expertise beyond our pay grade, but we can provide context:

Tales From the Twentieth Century: Borrowing Trouble.

Live Rich to Get Rich?

Tales From the Twentieth Century: Borrowing Trouble.

Live Rich to Get Rich?

Silicon Valley Wealth Triggers Feeding Frenzy

Goldman Sachs and various megabanks may be in lay-off mode elsewhere, but they're hiring in Northern California. The irresistible lure, according to a page-one story in today's New York Times: The Ripe Scent of New Money.

To win a piece of wealth in the feeding frenzy, the Times reports, brokers and private bankers start courting young techies as soon as liquidity events appear on the horizon. Will financially unsophisticated young people be a match for Wall Street's pros? Or will they be sorry they missed the education provided by Google?

To win a piece of wealth in the feeding frenzy, the Times reports, brokers and private bankers start courting young techies as soon as liquidity events appear on the horizon. Will financially unsophisticated young people be a match for Wall Street's pros? Or will they be sorry they missed the education provided by Google?

Thursday, January 12, 2012

Language May Help Or Hurt Retirement Saving

An item (not yet available online) in the Jan/Feb issue of Yale Alumni Magazine spotlights a fascinating bit of research by Keith Chen of the Yale School of Management.

The language you speak, Chen suggests, affects your prudence – your ability to take the long view. Speakers of languages that grammatically distinguish between present and future events (strong FTR languages) tend to take fewer future-oriented actions. Speakers of these strong future-time-reference languages "save less, hold less retirement wealth, smoke more, are more likely to be obese, and suffer worse long-run health."

English, wouldn't you know, is a strong-FTR language. The way we speak clearly distinguishes between "I own a 3D HDTV" and "I will own a 3D HDTV someday." German speakers, by contrast, often rely on context to indicate present or future action.

You can read Professor Chen's working paper here.

The language you speak, Chen suggests, affects your prudence – your ability to take the long view. Speakers of languages that grammatically distinguish between present and future events (strong FTR languages) tend to take fewer future-oriented actions. Speakers of these strong future-time-reference languages "save less, hold less retirement wealth, smoke more, are more likely to be obese, and suffer worse long-run health."

English, wouldn't you know, is a strong-FTR language. The way we speak clearly distinguishes between "I own a 3D HDTV" and "I will own a 3D HDTV someday." German speakers, by contrast, often rely on context to indicate present or future action.

You can read Professor Chen's working paper here.

Should “The Rich” Go Into Hiding?

Regulate the banking industry more strictly

Ban high-frequency trading

Arrest the "financial fraudsters" responsible for the 2008 crash

Form a Presidential commission to investigate corruption in politicsThose were the demands Kalle Lasn and Micah White of Adbusters proposed as goals for Occupy Wall Street. The Occupiers demurred. The movement became known for generalized opposition to big business and, more broadly, to the "rich" 1%. "We are the 99%!"

OWS's real target was the top 0.1%. For a helpful analysis of wealth levels, see this column by an investment manager whose clients typically have $5 million or more.

(Actually, the author notes, the Occupiers didn't stray that far from Adbusters' original Wall Street target. "Folks in the top 0.1% come from many backgrounds but it's infrequent to meet one whose wealth wasn't acquired through direct or indirect participation in the financial and banking industries.")

With all the media attention OWS eventually gained, nobody should be surprised by a new poll's finding: Almost two-thirds of American now see "very strong" or "strong" conflicts between rich and poor.

Will this new attitude fade quickly or last until Election Day?

What about an Occupier who protested her college-loan debt last year but now finds unexpectedly lucrative employment and soon has enough money to invest. Will she feel right opening an account with a (yuck!) "wealth manager"?

Monday, January 09, 2012

Copyrights as extended estate assets

JLM's post below reminded me of something I spotted over the weekend. Back in 1976 (taking effect in 1978) the copyright law was amended to grant longer periods of protection for intellectual property. Something about the Mickey Mouse copyright approaching its end, as I recall. From Duke Law, here's a list of items from the 1950s that would have entered the public domain this year, but for that legislative amendment.

For the estates of creative types, copyrights could be the most valuable of estate assets.

For the estates of creative types, copyrights could be the most valuable of estate assets.

Estate Assets You Can Hum

The Songs Remain the Same, but Broadway Heirs Call the Shots

Few recent Broadway seasons have had as much estate-driven handiwork as this one, a reflection of the rising entrepreneurship of heirs and the affection of audiences for song standards. Heirs are increasingly hands-on in trying to wrest moneymaking shows out of their ancestral trunks . . . .

|

| AWESOME AUDRA MCDONALD IS BESS IN THE REWORKED “PORGY AND BESS” |

Saturday, January 07, 2012

Trusts For Vacation Homes

How best can a lengthening line of descendants share use or ownership of the family vacation home? Methods mentioned in this WSJ column include an LLC (limited liability company) or various trusts –such as insurance trusts, qualified personal residence trusts (QPRTs) or dynasty trusts.

|

| Mitt Romney's vacation home |

Friday, January 06, 2012

"I Am Woman, Watch Me Retire"

"It's underappreciated how much better one large cohort of aging boomers should do financially during the traditional retirement years," writes Chris Farrell in BloombergBusinessweek: "The college-educated stalwarts of the feminist movement."

These professional women have been slightly better than men at taking advantage of 401(k) plans, he notes. And they don't have to hurry into retirement.

Many of these women should be prospects for investment services of fiduciary quality.

These professional women have been slightly better than men at taking advantage of 401(k) plans, he notes. And they don't have to hurry into retirement.

The vanguard generation of the women’s movement is well-suited to work long into the traditional retirement years. Baby boomers are healthier and better educated than earlier generations. Survey after survey shows that they don’t think of themselves as old and they’re well-positioned to earn a paycheck.They're well-suited to investing, too, Farrell contends. "A University of Michigan Retirement Research Center study found that men trade 56 percent more than their female counterparts in 401(k) plans, and the more men traded, the worse they did."

Many of these women should be prospects for investment services of fiduciary quality.

Wednesday, January 04, 2012

Saving Uncle Sam From Bankruptcy

Henry Blodget examines a plethora of GAO charts and offers a sensible (or as Congress would say, "outrageous and unacceptable") solution to Uncle's woes.

Yes, It's A New Year, And The United States Is Still Broke.

Yes, It's A New Year, And The United States Is Still Broke.

Monday, January 02, 2012

Dave Barry's year in review

I'm only half way through it, and already I want to post the link.

I'm disappointed in United Airlines

But the saga is not yet over. Details to follow.

Flying today is a miserable experience, made worse when the airline you choose is incompetent. Highest prices, missed connections, lost luggage, indifferent employees inured to passenger complaints—what's not to like about United?

Flying today is a miserable experience, made worse when the airline you choose is incompetent. Highest prices, missed connections, lost luggage, indifferent employees inured to passenger complaints—what's not to like about United?

Investing With Index Funds Sensible but Difficult

Inspired by Henry Blodget's latest warning not to play The Losers' Game, Felix Salmon praises index investing. But, he admits, the investment world doesn't make it easy to practice the discipline.

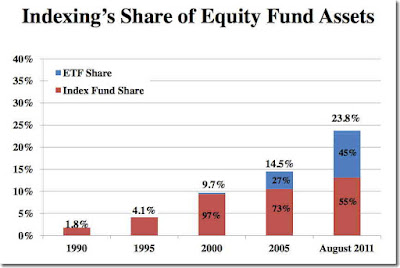

In a Bogleheads presentation last fall, John Bogle indicated that investment in indexed stock funds has grown steadily over the last two decades. Nevertheless, Most wealth in stock funds is actively managed.

If index funds represent passive investing, ETFs (to the dismay of Bogle and others) are poster children for rapid-fire trading and speculation. Still nervous from those stock market zig-zags in recent months? All those aimless gyrations surely didn't come from trading in individual stocks.

Average holding period for shares in the SPDR S&P 500, according to Bogle's presentation: 3.2 days.

Are pros with algorithms and amateurs with INDX TRADR license plates making the market too scary for ordinary investors, men and women who might otherwise be able to build enough long-term wealth to need a trust officer?

Subscribe to:

Posts (Atom)