Investment advisers, not to mention brokers, appear redundant. – useless or worse. William Berstein sees them as a threat to financial health and happiness:

As an investor, you must recognize the monsters that populate the financial industry. *** … most “finance professionals” don’t even realize that they’re moral cripples, since in order to function they’ve had to tell themselves a story about how they’re really helping their customers.Some critics are less polite.

Polite or not, the critics ignore a key reality: Most people cannot invest sensibly on their own. At best, perhaps a third are willing and able to put their money into a few diversified, low-cost funds and stay the course.

Others need somebody to hold their hands and discourage them from buying high, selling low. Some are reluctant investors. In begone times they would have been contented savers, putting their money into 3.5-percent savings accounts and 6-percent CDs. Nowadays they must seek investment help or grow poorer.

In short, most people with money to invest still need advisers. What’s different is the adviser’s mission. Instead of tilting with windmills and seeking to beat the market, the adviser’s aim should be to produce better results for the investor than the investor would achieve on his or her own.

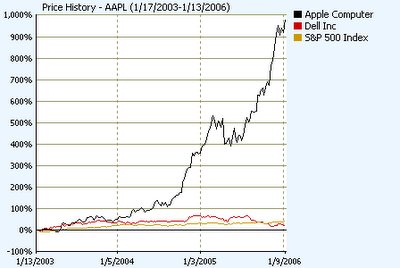

And that goal should be often achievable;. The bar is set surprisingly low. From 1994 through 2013, the S&P 500 produced an annualized return of 9 percent. The average stock fund investor earned 5 percent.

Some estimates suggest the gap in returns is even greater after accounting for all fees and other expenses.

Does a 20 percent increase in investment performance sound worthwhile? By controlling expenses with ETFs and limiting fruitless trading, an adviser could achieve that impressive improvement merely by increasing the investor’s annualized return from 5 percent to 6 percent. A low-cost, exceptionally patient adviser might achieve 7 percent – a 40 percent improvement!

Helping clients beat the average investor rather than beat the market doesn’t sound glamorous. It won’t earn advisers enough to acquire a beach house in Malibu. But it is doable.

Like politics, investing is the art of the possible.