Half a century ago, Chemical Bank was running ads for trust and investment services that portrayed men and sometimes women of means.

This example features a member of the Greatest Generation – the men who came home from war and prospered in the quarter century that followed. His $830,000 wasn't chicken feed – it's equivalent to almost $6 million today.

Chemical's ads series became familiar enough to inspire this playful variation – a Trust Fund Baby from the soon-to-be-notorious Baby Boom generation.

Showing posts with label trust ads. Show all posts

Showing posts with label trust ads. Show all posts

Wednesday, May 15, 2019

Monday, May 22, 2017

Stock Picking, Fifty Years Ago and Now

Today, stock pickers need not hit the road. The digital revolution offers access to zillions of facts in the form of big data, and quants use algorithms to massage the data and generate investment decisions.

"Prognosticators imagined a time when data-driven traders who live by algorithms rather than instincts would become the kings of Wall Street," The Wall Street Journal($) recalls. "That time has arrived." Quantitative hedge funds "are now responsible for 27% of all U.S. stock trades by investors, up from 14% in 2013,"

"Prognosticators imagined a time when data-driven traders who live by algorithms rather than instincts would become the kings of Wall Street," The Wall Street Journal($) recalls. "That time has arrived." Quantitative hedge funds "are now responsible for 27% of all U.S. stock trades by investors, up from 14% in 2013,"

WSJ subscribers can view the anatomy of an investment algorithm here.

Friday, February 12, 2016

The Thoroughly Modern 'Sixties

Technical progress has slowed, some claim. Life around 1910, when many homes still lacked electricity, was primitive compared to the 1960's. Five decades later, we have computers and smartphones, but really, are we living much better than they did in the 'Sixties?

You couldn't Skype in 1966. But as the Bell System boasted, you could talk with most anyone, anywhere, who had a telephone.

Winter recreation? In 1966 the new adult toy of choice was the snowmobile, featured in this Chase Manhattan ad.

All in all, life in 1966 was pretty good, if you didn't mind hippies or second-hand cigarette smoke.

You couldn't Skype in 1966. But as the Bell System boasted, you could talk with most anyone, anywhere, who had a telephone.

Winter recreation? In 1966 the new adult toy of choice was the snowmobile, featured in this Chase Manhattan ad.

All in all, life in 1966 was pretty good, if you didn't mind hippies or second-hand cigarette smoke.

Thursday, January 07, 2016

The More Things Change . . .

. . . the more they stay the same. Two ads from fifty years ago prove the point.

Manny Hanny urged men of wealth to consider not only their net worth but their legacy. "What will happen to your accumulated property when it becomes the inherited property of your family?"

With the revelation of VW's "clean diesel" finagling, this headline couldn't be more timely

Manny Hanny urged men of wealth to consider not only their net worth but their legacy. "What will happen to your accumulated property when it becomes the inherited property of your family?"

With the revelation of VW's "clean diesel" finagling, this headline couldn't be more timely

Friday, November 20, 2015

Nest Eggs of Autumn, 1965

In the 1950's Chase Manhattan's nest-eggers sailed and skied and hunted. By 1965, as the iconic ad campaign was winding down, guns and yachts gave way to agriculture and animal husbandry.

Wednesday, September 30, 2015

Wealth Management Ads, Fall of ’65

A few ads from the year When Wall Street Was Sitting Pretty.

New England had lots of antique shops five decades ago; visiting them was a popular fall pastime.

Boston Safe Deposit and Trust, alas, did not survive but was subsumed into what's now BNY/Mellon.

New England had lots of antique shops five decades ago; visiting them was a popular fall pastime.

In the 1960's, only Merrill Lynch's thundering herd was bigger than Bache and Co.

"To manage capital profitably, someone must know the score…." Where but in Boston would you have found a wealth manager who considered being off key to be a fate worse than death?

Here's a BNY ad from the fall of '65. Like Merrill Anderson's founder, BNY's agency favored illustrations over photos in ads.

Here's another fall tradition. Last Saturday morning my daughter's neighbor and a couple of friends were working away in the driveway with bushel baskets of apples and a cider press.

Tuesday, May 26, 2015

Rise of the Woman Investor

When my bride opens Martha Stewart Living, she expects the first ad to feature bedclothes or kitchen appliances. In the June issue, surprise! Instead of an ad for deluxe domestic items, a two-page spread from US Trust.

Presumably the socially responsible investment service is for her, the art financing for him. (No, Martha, US Trust definitely will not advocate insider trading.)

Even in the Mad Men era, women were beginning to catch the attention of investment managers. Here are two examples from Chase Manhattan. The first is from 1963. The second, more mod, dates from 1966.

Presumably the socially responsible investment service is for her, the art financing for him. (No, Martha, US Trust definitely will not advocate insider trading.)

Even in the Mad Men era, women were beginning to catch the attention of investment managers. Here are two examples from Chase Manhattan. The first is from 1963. The second, more mod, dates from 1966.

Wednesday, April 29, 2015

Advertising Rule From Mad Men Days

If Sterling Cooper (the Mad Men agency now swallowed up by McCann) had a wealth management account, they would have known the rule well:

The bigger the bull market, the greater the ad spending.

Corollary: When bears emerge, wealth managers lose the urge to splurge.

True half a century ago, and probably true still.

The rule may seem illogical. Investors fear loss more than they desire gain, so bear markets should make them more willing to seek expert help. Wealth managers take the contrary view: They find new accounts easiest to come by near market highs because bull markets make investors greedy.

This year, with the market near nominal highs, ads for wealth management are plentiful. Both BNY Mellon and Bessemer Trust had ads in last Sunday's NY Times magazine. Half a century ago, when the Dow flirted with highs it would not reach again until the 1980's, fiduciaries also were advertising briskly. For example:

In 1965 senior execs were paid a pittance by today's compensation standards, but this one didn't suffer. He got to fly on the new company plane! Chase Manhattan chose a more leisurely theme:

Vintage autos are just as appealing today as they were fifty years ago. Here's a bonus ad from the same issue of The New Yorker, featuring a car that's still fondly remembered. So fondly that Lincoln may bring out a new Continental.

Art directors probably haven't received their due on Mad Men. It was the art director who realized the Continental ad required lots of white space and an understated headline.

Finally, one more colorful collage from Irving Trust:

The bigger the bull market, the greater the ad spending.

Corollary: When bears emerge, wealth managers lose the urge to splurge.

True half a century ago, and probably true still.

The rule may seem illogical. Investors fear loss more than they desire gain, so bear markets should make them more willing to seek expert help. Wealth managers take the contrary view: They find new accounts easiest to come by near market highs because bull markets make investors greedy.

This year, with the market near nominal highs, ads for wealth management are plentiful. Both BNY Mellon and Bessemer Trust had ads in last Sunday's NY Times magazine. Half a century ago, when the Dow flirted with highs it would not reach again until the 1980's, fiduciaries also were advertising briskly. For example:

In 1965 senior execs were paid a pittance by today's compensation standards, but this one didn't suffer. He got to fly on the new company plane! Chase Manhattan chose a more leisurely theme:

Vintage autos are just as appealing today as they were fifty years ago. Here's a bonus ad from the same issue of The New Yorker, featuring a car that's still fondly remembered. So fondly that Lincoln may bring out a new Continental.

Art directors probably haven't received their due on Mad Men. It was the art director who realized the Continental ad required lots of white space and an understated headline.

Finally, one more colorful collage from Irving Trust:

Note the elephant on the Thailand medal at lower right.

Friday, April 03, 2015

Mad Men Ads of 1970 (the Worst Was Yet to Come)

Watching the last half of Mad Men's final season? Reportedly the story picks up in 1970, a bad year that ushered in a worse decade.

How bad? It was the year the Beatles broke up. The 1970s brought long lines at gas stations, double-digit drops in the purchasing power of a dollar, and the worst stock market bust, in real terms, since the Great Depression.

The 1970s are remembered as the decade that taste forgot. For good reason. See ad at right. (To all who were offended by my 1970s' plaid suit, sincere apologies.)

The 1970s are remembered as the decade that taste forgot. For good reason. See ad at right. (To all who were offended by my 1970s' plaid suit, sincere apologies.)

Even the 1970 ads from trust companies seemed to lose their zing.

This US Trust ad is OK, I guess (I may have written it) but it falls far short of the psychological insights that Merrill Anderson's founder crafted. (Had to look up congenerics. They are companies in the same or similar industry that offer noncompeting products or services. Investopedia labels Citigroup's merger with Travelers Insurance, now undone, as congeneric.)

By 1970 Chase Manhattan's iconic nest eggs had been replaced by a mess of pottery:

Is there a museum that would have accepted such a collection in 1970? What about now?

More than a nest egg is missing from the ad. Chase's trust division has become the "planning division."

How bad? It was the year the Beatles broke up. The 1970s brought long lines at gas stations, double-digit drops in the purchasing power of a dollar, and the worst stock market bust, in real terms, since the Great Depression.

The 1970s are remembered as the decade that taste forgot. For good reason. See ad at right. (To all who were offended by my 1970s' plaid suit, sincere apologies.)

The 1970s are remembered as the decade that taste forgot. For good reason. See ad at right. (To all who were offended by my 1970s' plaid suit, sincere apologies.)Even the 1970 ads from trust companies seemed to lose their zing.

This US Trust ad is OK, I guess (I may have written it) but it falls far short of the psychological insights that Merrill Anderson's founder crafted. (Had to look up congenerics. They are companies in the same or similar industry that offer noncompeting products or services. Investopedia labels Citigroup's merger with Travelers Insurance, now undone, as congeneric.)

Is there a museum that would have accepted such a collection in 1970? What about now?

More than a nest egg is missing from the ad. Chase's trust division has become the "planning division."

Monday, March 16, 2015

Three Bank Ads From Spring, 1965

OK, Boston has set a new record for the amount of snow falling in one winter. Time to think spring. For inspiration, three ads from half a century ago.

The country gentleman in the Chase nest egg ad contrasts with the urbane financier portrayed by Citi, or as it was known in those days, First National City:

Note the double sales pitch: We'd like to manage your personal portfolio, and we want your company's pension plan, too.

Fifty years ago, pension plans actually had genuine, full service trustees. Corporate fiduciaries eventually lost the business because they were perceived as too timid, too dull. MBAs told companies they should regard their pension plans as profit centers. In hindsight, it wasn't the MBAs' finest hour.

Though the Irving ad below doesn't feature fiduciary services, the salute to world's fairs reminds us of what people were looking forward to in the spring of 1965. New York's 1964-65 World's Fair was not as grand as the 1939-40 extravaganza, but as the fair's Disney exhibit sang, "It's a small world, after all."

Fifty years ago, pension plans actually had genuine, full service trustees. Corporate fiduciaries eventually lost the business because they were perceived as too timid, too dull. MBAs told companies they should regard their pension plans as profit centers. In hindsight, it wasn't the MBAs' finest hour.

Though the Irving ad below doesn't feature fiduciary services, the salute to world's fairs reminds us of what people were looking forward to in the spring of 1965. New York's 1964-65 World's Fair was not as grand as the 1939-40 extravaganza, but as the fair's Disney exhibit sang, "It's a small world, after all."

Thursday, February 26, 2015

Wealth Management for the Deluxe Lifestyle

Jim Gust called my attention to the premiere issue of the redesigned New York Times Magazine, thick with ads. Four million dollar condos. Watches with unmentionable prices. And a surprising number of marketing messages from wealth managers catering to the upper crust.

BNY Mellon boasts of a 97% client retention rate. First Republic spotlights one of its entrepreneur banking customers. Bessemer Trust expresses willingness to manage new wealth alongside old wealth. Glenmede, despite having dropped "Trust" from its logo, features its status as a privately-held trust company.

For readers of the magazine who are not yet really rich, Fidelity, Fisher, Schwab and Merrill Edge also offer wealth-management help.

Back in Mad Men days, nobody would have expected to see those ads in the Sunday Times magazine. A quick look at the comparable magazine section for February, 1965 reveals that ads for women's fashion and home furnishings dominated. Men were offered stereo record players.

Ads for investment services and products? Back then they were found in the Sunday business pages. Mutual funds were a hot topic, as shown at right.

Ads for investment services and products? Back then they were found in the Sunday business pages. Mutual funds were a hot topic, as shown at right.

One reason for the migration of investment ads to the magazine section of the Sunday NY Times was the need to reach women. Equally important, wealth managers to the truly wealthy wanted to burnish their upper-crust image: "We manage family fortunes for the sort of people who own multimillion-dollar condos and buy expensive watches without looking at the price tag."

Neither of those motivations is new. As we've shown you from time to time, back in the 1960s Chase Manhattan and U.S. Trust regularly advertised in The New Yorker. On that magazine's pages their messages mingled with ads from purveyors of women's fashions and suppliers of all manner of upscale merchandise. And, of course, Chase ads could run in full color.

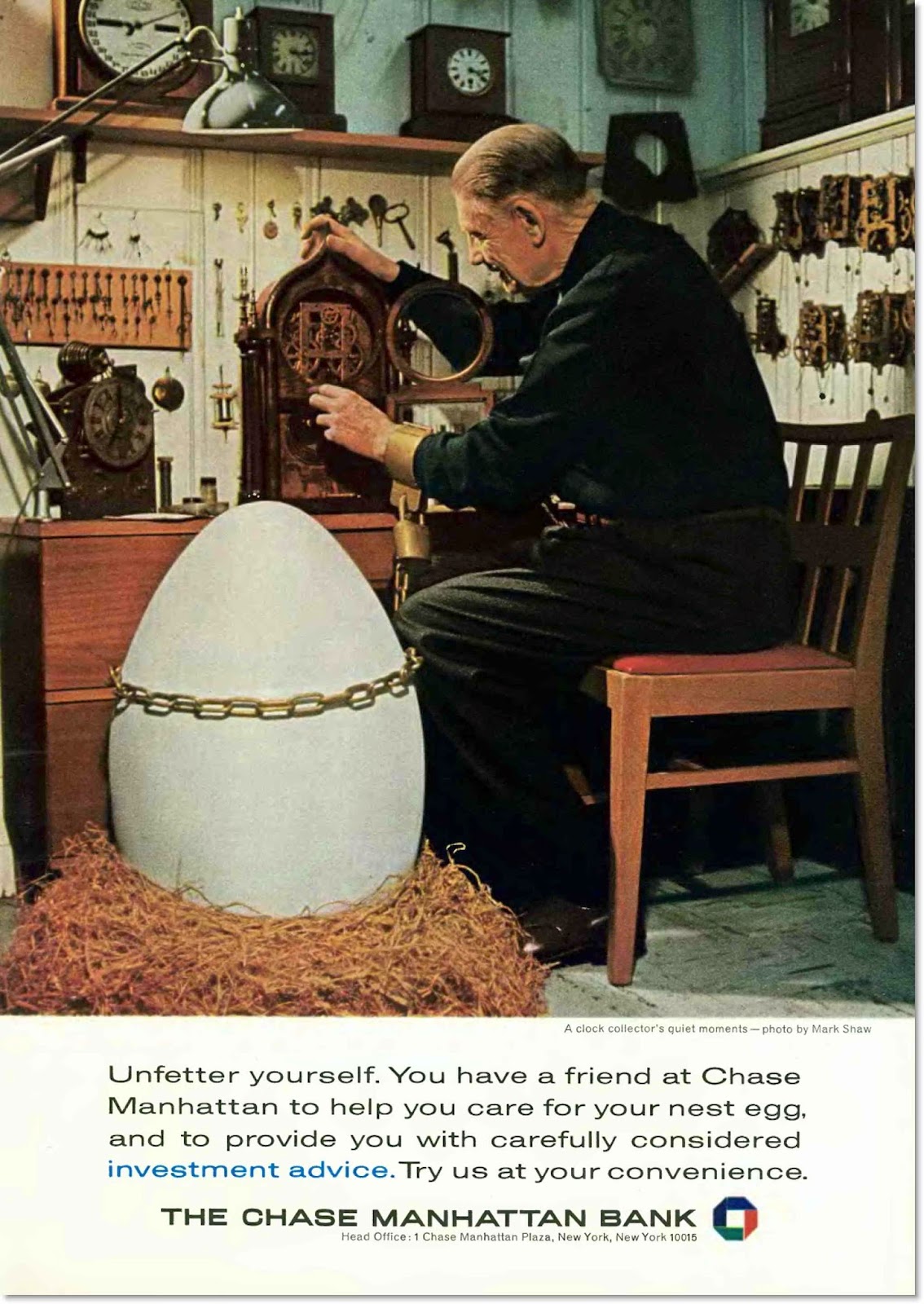

Here's a nest egg ad from the winter of 1964-65, portraying a clock collector. Does he seem a bit stolid for the Swinging Sixties?

BNY Mellon boasts of a 97% client retention rate. First Republic spotlights one of its entrepreneur banking customers. Bessemer Trust expresses willingness to manage new wealth alongside old wealth. Glenmede, despite having dropped "Trust" from its logo, features its status as a privately-held trust company.

For readers of the magazine who are not yet really rich, Fidelity, Fisher, Schwab and Merrill Edge also offer wealth-management help.

Back in Mad Men days, nobody would have expected to see those ads in the Sunday Times magazine. A quick look at the comparable magazine section for February, 1965 reveals that ads for women's fashion and home furnishings dominated. Men were offered stereo record players.

Ads for investment services and products? Back then they were found in the Sunday business pages. Mutual funds were a hot topic, as shown at right.

Ads for investment services and products? Back then they were found in the Sunday business pages. Mutual funds were a hot topic, as shown at right.One reason for the migration of investment ads to the magazine section of the Sunday NY Times was the need to reach women. Equally important, wealth managers to the truly wealthy wanted to burnish their upper-crust image: "We manage family fortunes for the sort of people who own multimillion-dollar condos and buy expensive watches without looking at the price tag."

Neither of those motivations is new. As we've shown you from time to time, back in the 1960s Chase Manhattan and U.S. Trust regularly advertised in The New Yorker. On that magazine's pages their messages mingled with ads from purveyors of women's fashions and suppliers of all manner of upscale merchandise. And, of course, Chase ads could run in full color.

Here's a nest egg ad from the winter of 1964-65, portraying a clock collector. Does he seem a bit stolid for the Swinging Sixties?

Wednesday, October 15, 2014

Mobile Video, Live-Banker Mortgages, Gunless Hunting

Fifty years is only yesterday or ancient history, depending on which ads from 1964 you look at.

Video on the run. In the 1950's Texas Instruments and an Indiana company developed a popular novelty: a little transistor radio. Sony took the idea and ran with it. Now Sony was taking the next step, a portable TV. (You thought mobile viewers didn't start falling off curbs until iPhones came along?)

Live-Banker Mortgages. Five decades ago, private banking aspired to meet the requirements of elite borrowers who didn't always fit the standard mold. Their needs would be evaluated and perhaps met by actual bankers wearing suits. Those days must seem long, long ago to Ben Bernanke, who couldn't talk a computer into refinancing his mortgage.

Gunless hunting. Men with guns were a staple of Chase Manhattan's nest egg ads. But times were changing. Wildlife needed conserving, some said. Chase responded by offering this new age hunter.

Monday, September 01, 2014

1954: So Near And Yet . . .

Sixty years ago Container Corp. was running ads featuring contemporary artworks. Some still look pretty cool. This one, for instance, with a portrait of Teddy Roosevelt by Joseph Hirsch.

By contrast, this 1954 Bankers Trust ad shows every one of its 60 years. A married woman with business judgment? Tax savvy? Foresight? Financial literacy? How unthinkable!

Give BT a little credit, though. It was willing to settle for a co-executorship.

By contrast, this 1954 Bankers Trust ad shows every one of its 60 years. A married woman with business judgment? Tax savvy? Foresight? Financial literacy? How unthinkable!

Give BT a little credit, though. It was willing to settle for a co-executorship.

Thursday, July 24, 2014

From Ladies of Leisure to Women CEO’s

Sallie Krawcheck, in partnership with Pax World Management, is launching a fund to invest in enterprises with a better-than-average proportion of women in key positions.

What a difference half a century makes. Ladies of leisure like the ones depicted in these 1964 ads certainly didn't expect their daughters or granddaughters to be CEOs of major companies.

What a difference half a century makes. Ladies of leisure like the ones depicted in these 1964 ads certainly didn't expect their daughters or granddaughters to be CEOs of major companies.

Monday, July 07, 2014

Chase Nest Egg Ads: the Cliche and the Exotica

Imagine you're a Mad Man in Sterling Cooper's early days, the 1950s. Your client needs photos of individuals engaged in off-duty pursuits that appeal to the moneyed class.

"Golf, of course," you say.

"Forget golf. Too obvious. Think of something that's not a cliché."

Most likely, that's why none of the Chase Manhattan nest egg ads we've shown you over the years has included a golf club.

By 1964 the ads were in their post-classic phase. Most every upscale pastime involving wind, water or wildlife had been portrayed. So we come to the last resort:

A more characteristic nest egg ad from 1964 was this, featuring a Charolais calf. Imports of this prized French breed had been banned since the 1940s for fear of hoof and mouth disease.

"Golf, of course," you say.

"Forget golf. Too obvious. Think of something that's not a cliché."

Most likely, that's why none of the Chase Manhattan nest egg ads we've shown you over the years has included a golf club.

By 1964 the ads were in their post-classic phase. Most every upscale pastime involving wind, water or wildlife had been portrayed. So we come to the last resort:

A more characteristic nest egg ad from 1964 was this, featuring a Charolais calf. Imports of this prized French breed had been banned since the 1940s for fear of hoof and mouth disease.

Wednesday, May 28, 2014

Trust and Investment Ads From 25 Years Ago

This blog has displayed numerous financial ads from the 1960s, the Mad Men era. Here are three from just 25 years ago.

Buy a mutual fund from Xerox? In 1989 you could. (Van Kampen's founder pioneered insurance coverage for tax-exempt bond funds.)

Great changes have reshaped financial services in the last quarter century. Each of the three advertisers above has changed hands. US Trust was acquired by Charles Schwab, then sold to Bank of America. Merrill Lynch, of course, also became a Bank of America brand. Van Kampen eventually passed to Morgan Stanley and was sold to Invesco in 2009.

Buy a mutual fund from Xerox? In 1989 you could. (Van Kampen's founder pioneered insurance coverage for tax-exempt bond funds.)

How do you appeal to he-man investors yet gain cultural creds? In 1989 Merrill Lynch pulled off the double play by sponsoring a Frederick Remington exhibit.

US Trust was struggling in the 1980s, but the trust company wasn't going to let people forget its impressive heritage. "Multi-generational financial counselling is nothing new at U.S. Trust. We've been doing it for nearly seven generations."

Great changes have reshaped financial services in the last quarter century. Each of the three advertisers above has changed hands. US Trust was acquired by Charles Schwab, then sold to Bank of America. Merrill Lynch, of course, also became a Bank of America brand. Van Kampen eventually passed to Morgan Stanley and was sold to Invesco in 2009.

Sunday, May 11, 2014

1969: More Ads from the Mad Men Era

In the spring of 1969 Merrill Lynch joined the rush to promote hot new go-go stocks:

It used to be that practically all you needed to sniff out a growth stock was a good nose for technology. Xerox smelled good to some people. Polaroid smelled good to others. And sure enough, both rose higher than a soufflé at Pavillon.Young and small was the way to go, Merrill Lynch figured, because "we wanted companies that could show dramatic gains in earnings. That’s a lot easier for Davids than for Goliaths."

Alas, go-go shares were about to collapse. Investors soon decided the only trustworthy stocks were the Goliaths, the Nifty Fifty.

US Trust must have sensed market uncertainty, for it reran one of its classic ads. Could any headline be more timeless?

Instead of spotlighting an affluent adult as usual, this Chemical ad features a kid. In current dollars the lucky lad's trust is worth way over $1 million. Would an ad calling attention to that much youthful good fortune prove problematic today?

Friday, March 07, 2014

Ads From the Growth Stock Era

"Stocks yield more than bonds because stocks are riskier." That folk wisdom prevailed for the first half of the twentieth century, wavering only in 1929. You know what happened then.

By 1964, however, the new era of Growth Stocks had kept stock yields lower than bond yields for half a decade. Chase Manhattan's nest egg ads responded. No more beating around the bush with loss leaders like custody. This March 1964 ad makes a simple pitch for investment advisory service.

Personal note: The old pumper is from my old home town.

Also from March 1964, this ad from a Greenwich, Connecticut trust company. Putnam was a classy wealth manager in its day. Bank of New York Mellon acquired Putnam in the late 1990s.

In 1964, the Putnam ad tells us, the most expensive residential property in Greenwich was priced at $450,000. Today the most expensive is the waterfront estate we showed you here. Then offered at $190 million, the 50-acre waterfront property is now available for $130 million.

A bonus March 1664 ad: This Irving Trust message didn't enable Irving to succeed as a major commercial bank, but it sure looked good.

By 1964, however, the new era of Growth Stocks had kept stock yields lower than bond yields for half a decade. Chase Manhattan's nest egg ads responded. No more beating around the bush with loss leaders like custody. This March 1964 ad makes a simple pitch for investment advisory service.

Personal note: The old pumper is from my old home town.

Also from March 1964, this ad from a Greenwich, Connecticut trust company. Putnam was a classy wealth manager in its day. Bank of New York Mellon acquired Putnam in the late 1990s.

In 1964, the Putnam ad tells us, the most expensive residential property in Greenwich was priced at $450,000. Today the most expensive is the waterfront estate we showed you here. Then offered at $190 million, the 50-acre waterfront property is now available for $130 million.

A bonus March 1664 ad: This Irving Trust message didn't enable Irving to succeed as a major commercial bank, but it sure looked good.

Friday, January 24, 2014

A Mysterious Chase Nest Egg Ad

Watching Rafa trounce Federer at the Australian Open reminded me of this 1963 Chase Manhattan ad, one that I've been puzzling over since last summer.

"Saturday afternoon with the young fry" is the photo caption. A young boy stands on what appears to be a private tennis court. He is poised to volley at net. But we see no net, no other players, no tennis instructor. Just the boy, alone on a tennis court without a net.

No wonder Dad isn't paying attention. His chair is turned slightly away, next to a small table on which sits a pitcher. Is he sharing the contents (fruity and perhaps rum based?) with someone to the right of the picture frame? Who? The boy's mother? The tennis instructor? A girl friend? We have no clue.

What do you think is going on?

"Saturday afternoon with the young fry" is the photo caption. A young boy stands on what appears to be a private tennis court. He is poised to volley at net. But we see no net, no other players, no tennis instructor. Just the boy, alone on a tennis court without a net.

No wonder Dad isn't paying attention. His chair is turned slightly away, next to a small table on which sits a pitcher. Is he sharing the contents (fruity and perhaps rum based?) with someone to the right of the picture frame? Who? The boy's mother? The tennis instructor? A girl friend? We have no clue.

What do you think is going on?

Monday, December 23, 2013

Two Ads Celebrating the Season

During the middle third of the Twentieth Century, at this time of year Coca Cola virtually appropriated Santa Claus. This ad, from 1963, features the next-to-last portrayal of Santa by Haddon Sundblom, the illustrator who brought the jolly old elf of The Night Before Christmas to life.

Christmas holiday ads by banks and trust companies half a century ago were rare. This Chase nest-egg ad was an unusual if partial exception. The ad copy is standard. The photo illustration isn't. It's the only example we've seen of a nest-egg ad where the egg plays second fiddle to the scenery. It's as if Chase were saying, "We want your business but gosh, isn't this an evocative holiday scene?'

Christmas holiday ads by banks and trust companies half a century ago were rare. This Chase nest-egg ad was an unusual if partial exception. The ad copy is standard. The photo illustration isn't. It's the only example we've seen of a nest-egg ad where the egg plays second fiddle to the scenery. It's as if Chase were saying, "We want your business but gosh, isn't this an evocative holiday scene?'

Subscribe to:

Posts (Atom)