Last weekend brought us Prairie Home Companion's annual Joke Show:

How can you defend yourself when a bunch of clowns attack?

Go for the juggler!

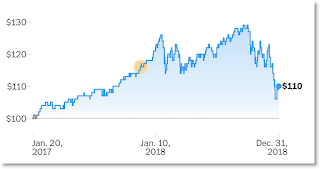

Not to be outdone, The New York Times suggested a way to avoid coming up short when investing for retirement. As the

article (much read on the Times web site) points out, the stock market's Lost Decade hit hardest at those near retirement age. The bigger your stock portfolio, the greater your dollar loss when its value doesn't keep growing as "average returns" led you to expect.

Solution? The Times offered this advice from William Bernstein:

What the wise person does is save a large amount of money when they are young.

Simple, isn't it? Accumulate several million before age 40 (doable if you were one of

Google's original employees) and you can get out of the market.

Must have been a real thigh-slapper for young couples struggling to pay off college loans and mortgages.

Check out

the graphs accompanying the Times article. See also the comments to a related

blog post.

Although the magic of compounding may turn into black magic when market values fall, compounding does work wonders when the market booms. Ask those who retired in 1999, a time when long-term investors could scarcely believe their good fortune.

But those lucky retirees then had to suffer through the Lost Decade, unless they had cashed out. So maybe they weren't so lucky. And those who unluckily retired at the end of the Lost Decade have already seen their net worth grow significantly if they stayed invested.

Moral: wealth fluctuates. Whether you run your own business or invest in shares of a lot of businesses, your net worth will keep changing. What J. Paul Getty said about billionaires applies to mere High Net Worth Individuals as well.