Jim Gust and I share an annual enjoyment of Dave Barry’s Year in Review. For a while, Barry writes, president Trump’s trade war with China made the Dow Jones industrial average flit up and down “like a butterfly on meth.”

The market recovered, and you may feel better about 2019 after reading Barry’s recap.

Sunday, December 29, 2019

Wednesday, December 11, 2019

Inheritance: Many Hope, Few are Chosen

"The Boomers…are expected to inherit trillions of dollars.” Merrill Anderson’s newsletter clients received that alert back in 2004. As 2020 approaches we hear of another great wave of inheritance. By one estimate, boomers could pass $68 trillion to millennials and others over the next decade.

But these deluges of wealth from generation to generation aren’t orderly. Some boomers are still waiting for their bequests. Many members of the silent generation are still around, including presidential hopefuls Biden, Bloomberg, Sanders and Weld. As of last year, almost 22 million Americans were 75 or older.

Over half of millennials say they expect an inheritance. Most won’t get anything beyond trinkets. According to a United Income study, only about one out of five households receives an inheritance, and that ratio has held steady over 30 years. Only about one in ten receives more than $55,000.

Over half of millennials say they expect an inheritance. Most won’t get anything beyond trinkets. According to a United Income study, only about one out of five households receives an inheritance, and that ratio has held steady over 30 years. Only about one in ten receives more than $55,000.

Hoping for a million or more? The chances are maybe one in three hundred.

Even millennials lucky enough to make the inheritance cut may have to wait longer than they expect. From 1989 to 2016, the average age of inheritance rose from 41 to 51, and it seems certain to keep climbing.

The few millennials who inherit millions will become Old Money. Meanwhile, some of their peers are building new wealth. Over 600,000 millennials, mostly in their 30s, are already millionaires.

But these deluges of wealth from generation to generation aren’t orderly. Some boomers are still waiting for their bequests. Many members of the silent generation are still around, including presidential hopefuls Biden, Bloomberg, Sanders and Weld. As of last year, almost 22 million Americans were 75 or older.

Over half of millennials say they expect an inheritance. Most won’t get anything beyond trinkets. According to a United Income study, only about one out of five households receives an inheritance, and that ratio has held steady over 30 years. Only about one in ten receives more than $55,000.

Over half of millennials say they expect an inheritance. Most won’t get anything beyond trinkets. According to a United Income study, only about one out of five households receives an inheritance, and that ratio has held steady over 30 years. Only about one in ten receives more than $55,000.Hoping for a million or more? The chances are maybe one in three hundred.

Even millennials lucky enough to make the inheritance cut may have to wait longer than they expect. From 1989 to 2016, the average age of inheritance rose from 41 to 51, and it seems certain to keep climbing.

The few millennials who inherit millions will become Old Money. Meanwhile, some of their peers are building new wealth. Over 600,000 millennials, mostly in their 30s, are already millionaires.

Saturday, December 07, 2019

Requiem for the Levitating Comma

Youre probably not alarmed to learn that, after almost two decades, the founder of The Apostrophe Protection Society has decided to give up the fight. You may continue to use the apostrophe not at all when texting. But to avoid the complete loss of the once useful punctuation mark, do observe the post-industrial custom of putting an apostrophe before “s” when creating a plural.

Some us will miss the properly deployed apostrophe, a second-rate comma that tried to rise in the world.

Some us will miss the properly deployed apostrophe, a second-rate comma that tried to rise in the world.

Wednesday, November 06, 2019

Dirigiste Plan Features Pigovian Tax

Learned two new words the other day.

Steven Rattner's op-ed, critiquing Senator Warren's plan for funding universal Medicare by "taxing the rich," introduced me to dirigiste. The noun form is dirigisme, borrowed from the French, and it means state control of economic and social matters. Dirigisme is the opposite of laissez-faire.

Neil Irwin's column describes Warren's proposed 6% annual tax on billionaires' wealth as Pigovian. A Pigovian tax is "intended to reduce the prevalence of whatever it targets." Taxing cigarettes helped to reduce the number of smokers. Taxing billionaires could help to turn them into an endangered species.

Almost nobody (probably including Senator Warren) expects the wealth tax to become a reality in 2021. What might a Democrat controlled Congress do instead to raise revenue from the rich? Here's what Rattner suggests:

Almost nobody (probably including Senator Warren) expects the wealth tax to become a reality in 2021. What might a Democrat controlled Congress do instead to raise revenue from the rich? Here's what Rattner suggests:

Some tax breaks seem indestructible.

Steven Rattner's op-ed, critiquing Senator Warren's plan for funding universal Medicare by "taxing the rich," introduced me to dirigiste. The noun form is dirigisme, borrowed from the French, and it means state control of economic and social matters. Dirigisme is the opposite of laissez-faire.

Neil Irwin's column describes Warren's proposed 6% annual tax on billionaires' wealth as Pigovian. A Pigovian tax is "intended to reduce the prevalence of whatever it targets." Taxing cigarettes helped to reduce the number of smokers. Taxing billionaires could help to turn them into an endangered species.

Almost nobody (probably including Senator Warren) expects the wealth tax to become a reality in 2021. What might a Democrat controlled Congress do instead to raise revenue from the rich? Here's what Rattner suggests:

Almost nobody (probably including Senator Warren) expects the wealth tax to become a reality in 2021. What might a Democrat controlled Congress do instead to raise revenue from the rich? Here's what Rattner suggests:Raise the top federal income tax rate, imposed on incomes over half a million or so, from 37% to at least 42%.

Tax capital gains at regular income tax rates and do away with stepped-up basis for calculating gains on inherited assets.

Close egregious loopholes, like treating fund managers' "carried interest" income as tax-favored capital gain.How many proposals to tax carried interest as regular income have you heard over the years?

Some tax breaks seem indestructible.

Wednesday, October 30, 2019

Sunspot update

Back in 2009 I did two posts on the unexpected decline in the number of sunspots, and wondered whether that might lead to a period of global cooling. The sunspots eventually returned, and there is no general cooling trend as yet.

Here we are ten years later, and the blankness of the sun is even more pronounced. The record for spotlessness is 269 days, set in 2008. We are at 225 spotless days this year, with two months to go, so the record is in jeopardy.

Electroverse provides more data on this, with some analysis and graphs. The next solar cycle is projected to be weakest in 200 years. 200 years ago we had the Dalton minimum, when global temperatures fell by 2 degrees centigrade over 20 years, leading to crop failures and food riots. Some believe that a grand solar minimum operates on a 400-year cycle, and we are at the beginning of just such a cycle.

Perhaps we can put the Green New Deal on hold until we have more data?

Here we are ten years later, and the blankness of the sun is even more pronounced. The record for spotlessness is 269 days, set in 2008. We are at 225 spotless days this year, with two months to go, so the record is in jeopardy.

Electroverse provides more data on this, with some analysis and graphs. The next solar cycle is projected to be weakest in 200 years. 200 years ago we had the Dalton minimum, when global temperatures fell by 2 degrees centigrade over 20 years, leading to crop failures and food riots. Some believe that a grand solar minimum operates on a 400-year cycle, and we are at the beginning of just such a cycle.

Perhaps we can put the Green New Deal on hold until we have more data?

Sunday, October 27, 2019

"Taxing the Rich"

Funding the government by taxing the wealthy has always had political appeal. In 1913 the ancestor of today's federal income tax was introduced to chastise the rich by imposing a tax ranging from 2 percent to 6 percent.

The 2 percent bracket started at an income level, in today's dollars, of over $500,000.

The top rate of 6 percent only hit incomes, again in todays' dollars, of $13 million or more.

Times have changed, haven't they?

Taxes on wealth may trickle down even before they are enacted. Elizabeth Warren's proposed 2 percent tax on wealth over $50 million, for instance. One of her advisers has already suggested a lower tax bracket starting at $l million.

Thursday, October 24, 2019

Dubious Decanting of Grandchildren's Trusts

A potential advantage of decanting, where authorized by state law, is that it may permit a trustee to modify a trust without the consent of the grantor and the beneficiaries or the time, expense, uncertainty, and publicity associated with obtaining court approval of the modification.

– Michael J. Skeary, "The Power of Trust Decanting"

A wealthy grandmother celebrated the birth of her grandchildren by funding a generation-skipping trust for each new arrival. She served as trustee, with Merrill Lynch as custodian.

When grandmother resigned as trustee because of age, the children's father took over. Decades later, when the grandchildren learned they were old enough to draw upon their trust funds, they found their mother had been named co-trustee. And, according to the childrens' lawsuit, she had moved trust assets into a new trust that entitled her “to all net income and as much principal from the trust property as the trustee determines is necessary.”

When grandmother resigned as trustee because of age, the children's father took over. Decades later, when the grandchildren learned they were old enough to draw upon their trust funds, they found their mother had been named co-trustee. And, according to the childrens' lawsuit, she had moved trust assets into a new trust that entitled her “to all net income and as much principal from the trust property as the trustee determines is necessary.”

For other wealthy grandparents the moral is obvious: Naming a reputable bank or trust company is worth the trustee fees.

When grandmother resigned as trustee because of age, the children's father took over. Decades later, when the grandchildren learned they were old enough to draw upon their trust funds, they found their mother had been named co-trustee. And, according to the childrens' lawsuit, she had moved trust assets into a new trust that entitled her “to all net income and as much principal from the trust property as the trustee determines is necessary.”

When grandmother resigned as trustee because of age, the children's father took over. Decades later, when the grandchildren learned they were old enough to draw upon their trust funds, they found their mother had been named co-trustee. And, according to the childrens' lawsuit, she had moved trust assets into a new trust that entitled her “to all net income and as much principal from the trust property as the trustee determines is necessary.”For other wealthy grandparents the moral is obvious: Naming a reputable bank or trust company is worth the trustee fees.

Thursday, October 17, 2019

As Candidates Talk Taxes, Remember Hauser's Law

Jim Gust once called attention to David Ranson's column on Hauser's Law.

We should keep the "law" in mind for the next year or so, as political candidates shout their promises to cut taxes or hint at plans to raise them.

Despite ups and downs in tax rates, Hauser's Law states, federal tax revenues hold more or less steady. The tax take persistently hovers at slightly below 20% of GDP.

All those tax billions the Democrats will be hoping to raise? All those billions Republicans will be hoping to shield from the IRS? Hauser's Law indicates we shouldn't pay them much heed.

We should keep the "law" in mind for the next year or so, as political candidates shout their promises to cut taxes or hint at plans to raise them.

Despite ups and downs in tax rates, Hauser's Law states, federal tax revenues hold more or less steady. The tax take persistently hovers at slightly below 20% of GDP.

All those tax billions the Democrats will be hoping to raise? All those billions Republicans will be hoping to shield from the IRS? Hauser's Law indicates we shouldn't pay them much heed.

Saturday, October 12, 2019

Is the Estate Tax a Good Wealth Redistributer?

The concentration of wealth among the very few is a problem. In a WSJ op-ed ten years ago, Art Laffer argued that estate taxation is not the solution:

Advocates of the estate tax argue that such a tax will reduce the concentrations of wealth in a few families, but there is little evidence to suggest that the estate tax has much, if any, impact on the distribution of wealth. To see the silliness of using the estate tax as a tool to redistribute wealth, realize that those who die and leave estates would be taxed just as much if they bequeathed their money to poor people as they would if they left their money to rich people. If the objective were to redistribute, surely, an inheritance tax (a tax on the recipients) would make far more sense than an estate tax.

Tuesday, October 08, 2019

Brown Beats Harvard, Trounces Yale

We refer, of course, to investment results, not football.

For fiscal 2019, Brown's endowment recorded an investment return of 12.4%

Harvard reported 6.5%.

Yale, a meager 5.7%

Over the same period, a plain vanilla portfolio of 60% stocks, 40% bonds returned 9.4% and the S&P 500 delivered 10.4%.

So take heart! Even the Ivy League elite aren't invincible.

For fiscal 2019, Brown's endowment recorded an investment return of 12.4%

Harvard reported 6.5%.

Yale, a meager 5.7%

Over the same period, a plain vanilla portfolio of 60% stocks, 40% bonds returned 9.4% and the S&P 500 delivered 10.4%.

So take heart! Even the Ivy League elite aren't invincible.

Saturday, October 05, 2019

Whisky – a “Robust" Investment?

Would you pay $20,000 or more for a 50-year-old Glenfiddich? How about this high-design bottle of Glenlivet, with contents that date back to the Battle of Britain?

Welcome to the world of collectible whisky. Sotheby's offers this aspirational guide.

To those of us who go into shock at the price of a decent 12-year-old single malt, the notion of collecting rare bottlings seems daft. On the other hand, the everyday bottles on your liquor store's shelves might not be a bad investment. On October 18th, whisky and other European luxuries are due to be hit with a 25% tariff.

Sunday, September 29, 2019

Elder Abuse for Art and Profit

Elder abuse is usually either physical (neglect and mistreatment) or financial (emptied bank accounts, purloined securities).

In the case of creative artists, there's a third possibility. Reports regarding two celebrated names in the art world, both of whom gained celebrity in the age of Make Love Not War, suggest that abuse may consist of seeking to profit from an artist's name and reputation – his brand.

Robert Indiana's "Love" first appeared on a 1962 Museum of Modern Art holiday card. Recreated in paintings and sculpture, it became an immensely popular icon of the 1960's. Indiana, however, found celebrity uncomfortable. Eventually the artist fled from the pressures to commercialize his work by retreating to Vinelhaven, an island off the coast of Maine. There he died in May of last year, frail and isolated at the age of 89.

In his final years Indiana appeared to lose his distaste for commercialism. A new work

resembling his Love sculpture appeared on the cover of a wine magazine. A giant sculpture of the letters BRAT showed up in front of sausage factory.

Last winter the NY Times reported that a company owning rights to sell designs based on "Love" has gone to court, accusing the artist's caregiver and an associate of "taking advantage of Mr. Indiana’s advanced age and isolation on a remote island off the coast of Maine to produce a bunch of inauthentic works that they sold under Mr. Indiana’s name."

In August, the executor of Indiana's estate, his former lawyer, charged the caretaker had stolen many artworks and more than $l million from Indiana while allowing the wealthy artist to live in squalor and filth.

Peter Max created trendy psychedelic posters for the Make Love Not War generation.

His works seemed to be everywhere, partly because his style was widely imitated. Although Max is now an octogenarian suffering from Alzheimer's, his artistic output appears undiminished. His studio, run by his estranged son and associates, produces Peter Max works that sell briskly on cruise ships – so briskly that one cruise ship is itself adorned with a Peter Max design.

His works seemed to be everywhere, partly because his style was widely imitated. Although Max is now an octogenarian suffering from Alzheimer's, his artistic output appears undiminished. His studio, run by his estranged son and associates, produces Peter Max works that sell briskly on cruise ships – so briskly that one cruise ship is itself adorned with a Peter Max design.

But cruise passengers may be buying works that are Peter Max in name only, according to the Times:

In the case of creative artists, there's a third possibility. Reports regarding two celebrated names in the art world, both of whom gained celebrity in the age of Make Love Not War, suggest that abuse may consist of seeking to profit from an artist's name and reputation – his brand.

Robert Indiana's "Love" first appeared on a 1962 Museum of Modern Art holiday card. Recreated in paintings and sculpture, it became an immensely popular icon of the 1960's. Indiana, however, found celebrity uncomfortable. Eventually the artist fled from the pressures to commercialize his work by retreating to Vinelhaven, an island off the coast of Maine. There he died in May of last year, frail and isolated at the age of 89.

In his final years Indiana appeared to lose his distaste for commercialism. A new work

resembling his Love sculpture appeared on the cover of a wine magazine. A giant sculpture of the letters BRAT showed up in front of sausage factory.

Last winter the NY Times reported that a company owning rights to sell designs based on "Love" has gone to court, accusing the artist's caregiver and an associate of "taking advantage of Mr. Indiana’s advanced age and isolation on a remote island off the coast of Maine to produce a bunch of inauthentic works that they sold under Mr. Indiana’s name."

In August, the executor of Indiana's estate, his former lawyer, charged the caretaker had stolen many artworks and more than $l million from Indiana while allowing the wealthy artist to live in squalor and filth.

His works seemed to be everywhere, partly because his style was widely imitated. Although Max is now an octogenarian suffering from Alzheimer's, his artistic output appears undiminished. His studio, run by his estranged son and associates, produces Peter Max works that sell briskly on cruise ships – so briskly that one cruise ship is itself adorned with a Peter Max design.

His works seemed to be everywhere, partly because his style was widely imitated. Although Max is now an octogenarian suffering from Alzheimer's, his artistic output appears undiminished. His studio, run by his estranged son and associates, produces Peter Max works that sell briskly on cruise ships – so briskly that one cruise ship is itself adorned with a Peter Max design.But cruise passengers may be buying works that are Peter Max in name only, according to the Times:

The scene played out for years. Twice a week, in the late afternoon, above the Shun Lee Chinese restaurant on the Upper West Side of Manhattan, a creaky elevator would open, and out would step an elderly man. Thin as a rail, with a sparse mustache, he would sometimes have little idea about where or who he was. A pair of security doors would buzz unlocked once surveillance cameras identified him as the artist Peter Max.

Inside, he would see painters — some of them recruited off the street and paid minimum wage — churning out art in the Max aesthetic: cheery, polychrome, wide-brushstroke kaleidoscopes on canvas. Mr. Max would be instructed to hold out his hand, and for hours, he would sign the art as if it were his own, grasping a brush and scrawling Max.Nevertheless, sales of works signed Max continue, aboard ship and on land.

•

Putting an ailing artist's name on works made by others and sold for profit certainly seems abusive. Yet in today's art world, who knows?

Artist Damian Hirst (remember his shark in a tank?) happily admits that only a couple of dozen versions of his "Dot" paintings were created by him. To meet perceived demand, he had his assistants turn out more than a thousand more.

Sunday, September 22, 2019

This Tax Deduction Does Matter

Tax deductions don't matter after the Trump tax cuts? Well, that depends on the deduction.

Although far fewer taxpayers were able to claim deductions for mortgage interest or charitable contributions on their income tax returns for 2018, home sales and charitable donations seemed to survive unscathed.

Because of the expanded standard deduction, use of the SALT deduction for state and local taxes also declined. What's more, upper-income taxpayers who did claim the deduction couldn't claim much – the deduction was capped at $10,000 per couple.

As a result of the cap, income-rich residents of New York, California and other high-tax states now have an added incentive to pull up stakes. According to estimates cited by The Wall Street Journal, a Manhattanite couple with income of $500,000 could save $50,000 in state and city income taxes by moving to a no-tax state such as Florida. Californians with $500,000 incomes could save more than $46,000 by establishing residency in no-tax Nevada.

Connecticut, Merrill Anderson's home state, is feeling the pain. (A hypothetical $500,000 Connecticut couple might save over $32,000 in taxes by becoming Floridian). High income Wall Streeters flocked to Connecticut in recent decades, a migration encouraged by the destruction of the World Trade Center. Banks built huge trading floors in Stamford. Hedge funds flocked to Greenwich.

Connecticut, Merrill Anderson's home state, is feeling the pain. (A hypothetical $500,000 Connecticut couple might save over $32,000 in taxes by becoming Floridian). High income Wall Streeters flocked to Connecticut in recent decades, a migration encouraged by the destruction of the World Trade Center. Banks built huge trading floors in Stamford. Hedge funds flocked to Greenwich.

Then came the great recession. Connecticut's role as Wall Street East began to fade. High-income financial types have been leaving – a few involuntarily. Most have departed in search of friendlier tax climates.

Like Florida. Especially the Palm Beach area.

Although far fewer taxpayers were able to claim deductions for mortgage interest or charitable contributions on their income tax returns for 2018, home sales and charitable donations seemed to survive unscathed.

Because of the expanded standard deduction, use of the SALT deduction for state and local taxes also declined. What's more, upper-income taxpayers who did claim the deduction couldn't claim much – the deduction was capped at $10,000 per couple.

As a result of the cap, income-rich residents of New York, California and other high-tax states now have an added incentive to pull up stakes. According to estimates cited by The Wall Street Journal, a Manhattanite couple with income of $500,000 could save $50,000 in state and city income taxes by moving to a no-tax state such as Florida. Californians with $500,000 incomes could save more than $46,000 by establishing residency in no-tax Nevada.

Connecticut, Merrill Anderson's home state, is feeling the pain. (A hypothetical $500,000 Connecticut couple might save over $32,000 in taxes by becoming Floridian). High income Wall Streeters flocked to Connecticut in recent decades, a migration encouraged by the destruction of the World Trade Center. Banks built huge trading floors in Stamford. Hedge funds flocked to Greenwich.

Connecticut, Merrill Anderson's home state, is feeling the pain. (A hypothetical $500,000 Connecticut couple might save over $32,000 in taxes by becoming Floridian). High income Wall Streeters flocked to Connecticut in recent decades, a migration encouraged by the destruction of the World Trade Center. Banks built huge trading floors in Stamford. Hedge funds flocked to Greenwich.Then came the great recession. Connecticut's role as Wall Street East began to fade. High-income financial types have been leaving – a few involuntarily. Most have departed in search of friendlier tax climates.

Like Florida. Especially the Palm Beach area.

Kelly Smallridge, president and CEO of Palm Beach County’s Business Development Board, told FOX Business that more than 70 financial services companies have moved into Palm Beach County within the last three years. Currently, the organization is working with another 15.

“I cannot keep up with the number of companies coming in,” Smallridge said. “Some are headquarters, some of them are regional operations. Many of them, once they get here, within short order establish [Palm Beach] as their home base."

Firms are primarily coming from three main areas – New York, Boston and Connecticut (specifically Greenwich).As Greenwich and Connecticut have discovered, extremely-high-income-people aren't willing to remain sitting targets for state and local taxes. They and their advisers are adept at sheltering wealth from taxation. That's something for Elizabeth Warren to keep in mind if she's able to pursue her idea for an annual wealth tax.

Monday, September 16, 2019

A Corporate Executor and Trustee is Worth Fighting For

Real estate bigwig and philanthropist George Kaufman changed his will shortly before his death, removing his longtime lawyer as executor and trustee. Now the lawyer has gone to court, claiming the changes are the result of elder abuse by Kaufman's wife.

Kaufman's will divides his estate among various individuals and creates a charitable foundation. The final amendment designates Bessemer Trust as executor and trustee.

The choice of a trust company, The Wall Street Journal reports, has drawn the approval of New York State officials:

Kaufman's will divides his estate among various individuals and creates a charitable foundation. The final amendment designates Bessemer Trust as executor and trustee.

The choice of a trust company, The Wall Street Journal reports, has drawn the approval of New York State officials:

The office of New York’s attorney general, which supervises charities in the state, has supported Bessemer, calling it a “disinterested, neutral corporate fiduciary.” The attorney general’s office accused [the lawyer] of being motivated by his own financial interest and holding up the creation of the charity.

Saturday, September 07, 2019

Income Tax Deductions Don't Matter

The Trump income tax cuts abolished personal exemptions but greatly expanded the standard deduction. That meant most taxpayers could gain nothing by itemizing their mortgage interest payments or their charitable contributions. Without these tax breaks, some predicted, home prices would plunge and charitable contributions would shrivel.

Sure enough, far fewer taxpayers claimed itemized deductions on their 2018 returns.

But so far, Felix Salmon points out, the economic impact of those lost deductions has been nil:

Sure enough, far fewer taxpayers claimed itemized deductions on their 2018 returns.

But so far, Felix Salmon points out, the economic impact of those lost deductions has been nil:

Only 8% of taxpayers now deduct mortgage interest, yet home prices continue to rise, with no indication that the new law changed anything at all.

Similarly, the charitable contribution deduction has had no visible effect on charitable contributions. Total giving rose by 0.7% to a new record high in 2018, despite a late-year stock market plunge.

Sunday, August 18, 2019

“The Biggest Blunder in Recent Auction History”

"Anything that can go wrong, will go wrong." It's Murphy's Law. He may have been in the audience at this weekend's RM Sotheby's auction of "the first Porsche."

To begin with, this little 1939 race car wasn't really a Porsche. That brand wasn't launched until after WWII. Ferdinand Porsche, who designed the vehicle, called it his"ancestor" Porsche.

Produced to represent Nazi Germany in a Berlin to Rome race that was cancelled when war broke out, the so-called Porsche Type 64 is more like a Volkswagen, built on the chassis of what would become the VW Beetle and powered by a souped-up VW engine. Over the years the vehicle has been significantly restored and modified. Still, it's one supercool-looking pre-war race car.

On Saturday, August 17, the almost-Porsche was put up for sale, at an expected price of $20 million or more, at RM Sotheby's auction.

And so began "the biggest auction blunder."

To begin with, this little 1939 race car wasn't really a Porsche. That brand wasn't launched until after WWII. Ferdinand Porsche, who designed the vehicle, called it his"ancestor" Porsche.

Produced to represent Nazi Germany in a Berlin to Rome race that was cancelled when war broke out, the so-called Porsche Type 64 is more like a Volkswagen, built on the chassis of what would become the VW Beetle and powered by a souped-up VW engine. Over the years the vehicle has been significantly restored and modified. Still, it's one supercool-looking pre-war race car.

On Saturday, August 17, the almost-Porsche was put up for sale, at an expected price of $20 million or more, at RM Sotheby's auction.

And so began "the biggest auction blunder."

This is the only surviving example personally driven by Ferdinand Porsche,” the evening’s emcee said, then announced that bidding would open at “$30 million,” a figure that was written on the front media screen of the auction theatre. Half of the crowd laughed; the other half cheered. After rapid bidding up to “$70 million,” with the crowd on its feet, iPhones raised, and cheering, the auctioneer announced that he had meant to say “$13 million,” and then “$17 million,” rather than 30 and 70. The media screen was quickly changed to reflect the $17 million sum.At $70 million, the pre-Porsche would have been by far the most expensive vehicle ever sold at auction. At the actual final bid, $17 million, the reserve price was not met. So, no sale.

Boos and shocked yelps and shouts ensued. People walked out.

Monday, August 12, 2019

Phone Scamming: “This is Your Government Calling”

Since 2014, Michelle Singletary writes in The Washington Post, the FTC has received almost 1.3 million reports of scam phone calls from government imposters. Many, many more calls have gone unreported.

Popular current scam, judging from how often I receive the message: "Due to suspicious activity, your Social Security account has been suspended." Correcting the "problem" of course involves cleaning out the individual's bank account.

Singletary's column includes precautionary tips that wealth managers should pass along to their elderly clients.

Popular current scam, judging from how often I receive the message: "Due to suspicious activity, your Social Security account has been suspended." Correcting the "problem" of course involves cleaning out the individual's bank account.

Singletary's column includes precautionary tips that wealth managers should pass along to their elderly clients.

Wednesday, August 07, 2019

Private Equity: for Better or for Worse?

At best, private equity firms acquire so-so-companies and make them better businesses. At worst, they loot and scoot, stripping companies of assets and leaving them buried in debt.

Presidential hopeful Senator Elizabeth Warren sees the worst. She proposes to make private equity firms responsible for the debts and pension liabilities of companies they control.

The SEC chairman sees the best, advocating changes that would allow everyone access to deals now limited to well-heeled investors.

When your obedient blogger was a lad, private equity was truly private – a deal your lawyer or financial adviser put together. Now that private equity is big business, regulatory proposals are inevitable.

Bigness, however, does not necessarily result in superior returns for investors. For the fiscal year ending in June, the median public pension fund earned a return of less than 7%. A plain vanilla portfolio of 60% stocks, 40% bonds would have earned better than 9%.

Apparent reason for the pension funds shortfall? Significant investments in alternative assets, notably private equity.

Presidential hopeful Senator Elizabeth Warren sees the worst. She proposes to make private equity firms responsible for the debts and pension liabilities of companies they control.

The SEC chairman sees the best, advocating changes that would allow everyone access to deals now limited to well-heeled investors.

When your obedient blogger was a lad, private equity was truly private – a deal your lawyer or financial adviser put together. Now that private equity is big business, regulatory proposals are inevitable.

Bigness, however, does not necessarily result in superior returns for investors. For the fiscal year ending in June, the median public pension fund earned a return of less than 7%. A plain vanilla portfolio of 60% stocks, 40% bonds would have earned better than 9%.

Apparent reason for the pension funds shortfall? Significant investments in alternative assets, notably private equity.

Livestreaming funerals

This is not brand new news, but it is the first I've heard of it. According to Wired, more and more funerals are being livestreamed, to allow the more distant to participate. A recording of the stream may be posted for later viewing. Reportedly many families find this very comforting.

One more thing for the estate planner to mention!

One more thing for the estate planner to mention!

Saturday, July 27, 2019

Earth, Fire, Air, Water . . . and Money?

The four elements are global. Money is national, or, in the case of the euro, multinational. But why? Shouldn't something as basic as a medium of exchange be worldwide?

The four elements are global. Money is national, or, in the case of the euro, multinational. But why? Shouldn't something as basic as a medium of exchange be worldwide?That heretical thought is prompted by the sputtering of a French official mentioned in this WSJ column. How dare Facebook propose to create a cryptocurrency, the Libra, that could ignore national controls and become as commonplace as air or water?

Realistically, I can't imagine national governments allowing anything like Libra. Still, it's likely that future generations will be highly amused by our provincialism.

Friday, July 26, 2019

Investors, Beware of Financial Weaklings

Back in the Mad Men era, ads offering the trust and investment services of banks stressed "financial strength" and "financial responsibility." The banks wanted to remind readers that while their competitors went bust in the 1930s, they didn't. And they wanted to reassure potential clients: "We'll do our best not to goof up, but if we do, or if our trust officer loots your trust and runs off to Tahiti, we have the financial resources to make good."

Financial strength remains a desirable attribute in an investment adviser. Unfortunately, The Wall Street Journal warns, it's one that many of today's small advisory firms lack.

Financial strength remains a desirable attribute in an investment adviser. Unfortunately, The Wall Street Journal warns, it's one that many of today's small advisory firms lack.

Many individual investors are using advisers instead of brokers these days, drawn by regulatory and structural changes that favor the advisory-business model of charging steady fees instead of trading commissions. The number of people working as investment advisers has grown 33% since 2008, according to the Financial Industry Regulatory Authority.

***Smaller investment advisers often are thinly capitalized and, in many cases, don’t carry enough insurance to cover a significant legal judgment against them.

Banks and trust companies aren't the sexiest source of investment services, but their capital should enhance their clients' peace of mind.

Monday, July 15, 2019

Is the Smart Money Dumb?

"Professional investors are prone to the same mistakes as mom-and-pop types," writes Jason Zweig in the WSJ.

For example, they hold stocks too long, past their peak prices. (But that merely shows they aren't clairvoyant.)

The smart money's math skills seem shaky, research suggests. And even the pros may accidentally confuse one stock with another of similar name or stock symbol.

If the smart money suffers from the dumbs, can mom and pop investors do better? Yes, according to Warren Buffet in one of his Berkshire-Hathaway shareholder letters:

If the smart money suffers from the dumbs, can mom and pop investors do better? Yes, according to Warren Buffet in one of his Berkshire-Hathaway shareholder letters:

By periodically investing in an index fund, the know-nothing investor can actually out-perform investment professionals. Paradoxically, when `dumb' money acknowledges its limitations, it ceases to be dumb.The smart money doesn't make better decisions, Zweig asserts."They just get paid to make them."

Monday, June 24, 2019

State taxation of trusts curtailed

The U.S. Supreme Court has affirmed that a state cannot impose an income tax on the worldwide income of a trust based only upon the fact that a contingent beneficiary resides in the state.

Good news for trust administrators everywhere. The notion that beneficiary residency alone creates enough nexus for income taxation was a minority rule, and now it has been laid to rest. However, given the unquenchable thirst for tax revenue, issues of the income taxation of trusts will rise again.

Good news for trust administrators everywhere. The notion that beneficiary residency alone creates enough nexus for income taxation was a minority rule, and now it has been laid to rest. However, given the unquenchable thirst for tax revenue, issues of the income taxation of trusts will rise again.

The "Robin Hood Tax"

That's the name Bernie Sanders has for a new tax required to pay for free college for everyone, plus cancel all existing student loan debt. The key element is "a Wall Street speculation fee on investment houses, hedge funds, and other speculators of

0.5% on stock trades (50 cents for every $100 worth of stock), a 0.1% fee on bonds, and a 0.005%

fee on derivatives."

By its terms, the new tax would also apply to 401(k) plans and IRAs, unless they limit their investments to certificates of deposit. So the impact would go far beyond the wolves of Wall Street, reaching the retirement savings of ordinary Americans.

This is a terrible idea.

By its terms, the new tax would also apply to 401(k) plans and IRAs, unless they limit their investments to certificates of deposit. So the impact would go far beyond the wolves of Wall Street, reaching the retirement savings of ordinary Americans.

This is a terrible idea.

Saturday, June 22, 2019

Can You Tell the Broker From the RIA?

Meet Tom and Jerry. One's a broker; the other's a Registered Investment Adviser. Both of them have studied the SEC's new Customer Relationship Summary and will describe their proposed relationship with you, the investor, exactly as the SEC prescribes:

Can you tell which is which?

Tom: "When we act as your investment adviser, we have to act in your best interest and not put our interest ahead of yours."

Jerry: "When we provide you with a recommendation, we have to act in your best interest and not put our interest ahead of yours.”

Yup, Tom's the RIA. Obvious, wasn't it? Can't imagine the slightest risk of investor confusion.

Whatever happened to the fiduciary standard?

Can you tell which is which?

Tom: "When we act as your investment adviser, we have to act in your best interest and not put our interest ahead of yours."

Jerry: "When we provide you with a recommendation, we have to act in your best interest and not put our interest ahead of yours.”

Yup, Tom's the RIA. Obvious, wasn't it? Can't imagine the slightest risk of investor confusion.

Whatever happened to the fiduciary standard?

Wednesday, June 19, 2019

When a Frequent Flier Dies . . .

...do all those frequent-flier miles die as well? Or can that mileage be converted, formally or otherwise, into tickets for heirs?

Rules vary from one airline to another, The Wall Street Journal warns. And rules change. (Delta used to be heir friendly but now isn't.)

Some tips for increasing the odds of getting heirs into the air:

Premortem

The frequent flier's will should include explicit instructions.

Heirs should know how to access account info and passwords.

The FF should sign up for family pooling if the airline (JetBlue, for instance) offers it.

Postmortem

Act quickly! "The best move is to use the miles before an airline figures out the member has died."

Act promptly even if the airline knows it has lost a faithful passenger. The airline may require formal estate procedures to claim the miles, and there may be time limits.

Be aggressive. Airline rules aren't always ironclad. Yelling or sobbing has been known to work.

Rules vary from one airline to another, The Wall Street Journal warns. And rules change. (Delta used to be heir friendly but now isn't.)

Some tips for increasing the odds of getting heirs into the air:

Premortem

The frequent flier's will should include explicit instructions.

Heirs should know how to access account info and passwords.

The FF should sign up for family pooling if the airline (JetBlue, for instance) offers it.

Postmortem

Act quickly! "The best move is to use the miles before an airline figures out the member has died."

Act promptly even if the airline knows it has lost a faithful passenger. The airline may require formal estate procedures to claim the miles, and there may be time limits.

Be aggressive. Airline rules aren't always ironclad. Yelling or sobbing has been known to work.

Monday, June 17, 2019

Social investing?

Calpers is have second thoughts, per The Wall Street Journal.

Individuals can inject politics into their investment strategy freely, but those responsible for public pensions need to put rate of return first.

Individuals can inject politics into their investment strategy freely, but those responsible for public pensions need to put rate of return first.

Friday, June 14, 2019

Thousands and Thousands of Apps for Investors

|

| Number of Android and Apple apps in 2018 that mentioned investing in their descriptions. |

Helping fuel the proliferation of investing apps, the WSJ observes, is the rise of socially-conscious investing.

Does the investment business really need thousands and thousands of apps? Maybe not. But as Mae West once said, "Too much of a good thing can be wonderful."

•

Bankrate's recent list of 5 best investing apps contains one oddity: an app intended not for actual investing but for game playing. Millennials may not take phone calls, but they're ever ready to socialize online.

Thursday, May 30, 2019

Johnny Hallyday’s Domicile? See Instagram!

|

| Hallyday in 1965 photo©ErlingMandelmann.ch |

national icon, right up there with Edith Piaf.

Hallyday died in 2017, leaving two wills, one of which was probated in Los Angeles, where he and his fourth wife had taken up residence in 2007. The will leaves everything to his widow, who has their two adopted children in her care. The will leaves nothing to Hallyday's two older children from previous marriages.

In France, where a form of forced heirship still rules, the older children would not be disinherited. So they went to court in France, seeking to show that Hallyday had still been domiciled in France, not LA.

The French court has now agreed to take up the case, convinced in part by photos Hallyday had posted on his Instagram account from 2012 to 2017. They indicate that he spent more than 150 days in France during both 2015 and 2016. In 2017 he was in France for eight months before his death.

In the age of not only Photoshop but AI, the use of digital photographs as evidence seems destined to become increasingly iffy. No other type of fake news is easier to create.

Wednesday, May 29, 2019

Climate Change: Europe Flooded with Tourists

|

| Photo: Rick Steves Blog |

Travel agents (remember them?) used to tell us to visit Europe in spring or fall, to avoid the crowds of summer. This spring you would have arrived in London, Paris or Rome only to find your access to tourist attractions already blocked by long lines.

Got clients preparing to join the crowds? Do them a favor by sharing the tips offered by travel writer Cameron Hewitt.

More Americans than ever seem to be getting passports and venturing abroad. Newly affluent tourists from China, India and Russia add to the crush. If the world economy is headed downhill as many investors fear, it appears to be starting from an impressive high.

Wednesday, May 22, 2019

Senators Seek Penalties on Brokers Who Inherit

"I'd like your opinion about an inheritance question," a woman told the Ethicist at Investment News. Her aunt had died, leaving a will that named the aunt's financial adviser and his attorney friend as co-executors. The will left 25 percent of her estate to the questioner's father. Another 25 percent was left to the aunt's close friend. The rest went to the financial adviser.

Kosher? No, ruled the Ethicist. The financial adviser should not have assumed the role of executor. As for his inheritance (close to half a million, apparently) "if the financial adviser is wise, he will step down immediately and disclaim any rights to his former client's assets."

Now, another case of questionable inheritance reported by Gretchen Morgenson in The Wall Street Journal has prompted a bipartisan foursome of U.S. Senators to write Finra urging closer regulation. Advisers accepting such gifts “should forfeit the bequests, pay large fines and/or be unable to serve as financial professionals in the future.”

Kosher? No, ruled the Ethicist. The financial adviser should not have assumed the role of executor. As for his inheritance (close to half a million, apparently) "if the financial adviser is wise, he will step down immediately and disclaim any rights to his former client's assets."

Now, another case of questionable inheritance reported by Gretchen Morgenson in The Wall Street Journal has prompted a bipartisan foursome of U.S. Senators to write Finra urging closer regulation. Advisers accepting such gifts “should forfeit the bequests, pay large fines and/or be unable to serve as financial professionals in the future.”

Wednesday, May 15, 2019

1969 Trust Ads Featured Two Historic Generations

Half a century ago, Chemical Bank was running ads for trust and investment services that portrayed men and sometimes women of means.

This example features a member of the Greatest Generation – the men who came home from war and prospered in the quarter century that followed. His $830,000 wasn't chicken feed – it's equivalent to almost $6 million today.

Chemical's ads series became familiar enough to inspire this playful variation – a Trust Fund Baby from the soon-to-be-notorious Baby Boom generation.

This example features a member of the Greatest Generation – the men who came home from war and prospered in the quarter century that followed. His $830,000 wasn't chicken feed – it's equivalent to almost $6 million today.

Chemical's ads series became familiar enough to inspire this playful variation – a Trust Fund Baby from the soon-to-be-notorious Baby Boom generation.

Monday, May 13, 2019

A Private Bank by Any Other Name . . .

Family office services…plus loans to wealthy clients who need quick cash to meet a capital call or buy a villa…plus investment selection and supervision.

The functions of a private bank? Yes. but in this case the tasks are performed by the team Lyon Polk has assembled at Morgan Stanley. They manage over $15 billion.

Banks, trust companies, wirehouses and advisory firms all seek to offer comprehensive services to the wealthy. And it's getting hard to tell them apart.

The functions of a private bank? Yes. but in this case the tasks are performed by the team Lyon Polk has assembled at Morgan Stanley. They manage over $15 billion.

Banks, trust companies, wirehouses and advisory firms all seek to offer comprehensive services to the wealthy. And it's getting hard to tell them apart.

Tuesday, May 07, 2019

Have a will

Nice article in Bloomberg about a millionaire who did not have a will, nor did he have immediate family. An heir-finding company eventually located nieces and nephews. Lots of colorful detail in the article, I won't spoil the punchline.

Sunday, May 05, 2019

Can the IRS be Saved?

Paragraph we never expected to read in the newspaper:

Still, this op-ed by two Politico reporters reminds us that the IRS is an endangered bureaucracy, underfunded and understaffed. Notably lacking: hundreds of highly-trained auditors needed to go toe-to-toe with aggressive tax planners.

Will the IRS receive the many billions needed to restore the agency to fighting trim? Probably not, unless the president is tired of being the only high-income celebrity under constant audit.

One 2020 candidate already has a bold proposal to resuscitate the I.R.S. It’s a plan to pump tens of billions into the agency, enough to fund a second army of agents. That candidate’s name is Donald Trump.In political folklore Republicans are known for disliking federal taxes and fiercely disliking paying taxes, so the future of the president's budget proposal is anyone's guess.

Still, this op-ed by two Politico reporters reminds us that the IRS is an endangered bureaucracy, underfunded and understaffed. Notably lacking: hundreds of highly-trained auditors needed to go toe-to-toe with aggressive tax planners.

Will the IRS receive the many billions needed to restore the agency to fighting trim? Probably not, unless the president is tired of being the only high-income celebrity under constant audit.

Wednesday, April 24, 2019

Few Millionaires are Rich These Days

When Bernie Sanders released his tax returns, he triggered taunts about being a millionaire – a rich socialist! Bernie did achieve richness temporarily: for two years his success as an author made him a income millionaire. Presumably his net worth is also well over a million. But unlike demi-billionaires, ordinary millionaires don't live rich.

Median U.S. household income is a bit over $60,000. As Thomas Heath points out in The Washington Post, a retiree with $1 million probably can't reach that income level. Even retirees with two or three million shouldn't expect to live large.

These days living rich probably requires at least $20 or $30 million. According to Spectrem, almost 12 million U.S. households have at least one million in investable assets, but only about 170,000 have more than $25 million.

Median U.S. household income is a bit over $60,000. As Thomas Heath points out in The Washington Post, a retiree with $1 million probably can't reach that income level. Even retirees with two or three million shouldn't expect to live large.

These days living rich probably requires at least $20 or $30 million. According to Spectrem, almost 12 million U.S. households have at least one million in investable assets, but only about 170,000 have more than $25 million.

Sunday, March 31, 2019

Private Equity, Intriguing and…Complicated

Private equity is a passion investment with a difference, observes Paul Sullivan in the NY Times. Unlike art, cars or collectibles, "it is a financial investment, not a tangible asset. You can’t hang it on your wall, park it in your garage or serve it with dinner. But it has a cachet from the past successes of other investors, and the high barrier to entry creates an air of intrigue."

That air of intrigue covers a wide field – vaster than some investors may realize. The Washington Post's David Ignatius has been studying the murder of his friend and colleague Jamal Khashoggi. He finds that some members of the Saudi hit team that killed Khashoggi may have been trained, under U.S. government auspices, by companies owned by affiliates of a major private equity firm. He also notes that an Israeli-founded company noted for its phone-hacking capabilities is now a British private equity holding.

The appeal of private equity, writes Sullivan, is "the promise of exclusive deals, outsize returns and enviable cocktail parties." Some deals, however, may not be appropriate cocktail party conversation.

That air of intrigue covers a wide field – vaster than some investors may realize. The Washington Post's David Ignatius has been studying the murder of his friend and colleague Jamal Khashoggi. He finds that some members of the Saudi hit team that killed Khashoggi may have been trained, under U.S. government auspices, by companies owned by affiliates of a major private equity firm. He also notes that an Israeli-founded company noted for its phone-hacking capabilities is now a British private equity holding.

The appeal of private equity, writes Sullivan, is "the promise of exclusive deals, outsize returns and enviable cocktail parties." Some deals, however, may not be appropriate cocktail party conversation.

Tuesday, March 26, 2019

Two Ways to Wear a Suit Like a CEO

As annual reports for 2018 appear, notice the crumbling of the business dress code. White shirt and tie is giving way to tieless blue shirt.

Pfizer's CEO photo shows him in suit and tie. Ditto for Bank of America's CEO. But AT&T's CEO photo shows that he has joined the tieless, unbuttoned blue-shirt rebellion. So has Citi's.

CEOs of troubled companies, however, need to look as somber and serious as possible. Leaders of GE and Wells Fargo still wear ties.

JPMorgan Chase's report isn't online yet, but Jamie Dimon presumably will appear with tieless blue shirt as he did a year ago.

For traditionalists, worse is yet to come. The disappearing tie, the WSJ suggests, will be followed by the disappearing business suit. Already, shoppers at the Joseph A. Banks store in NYC have to sidle past displays of khakis and jeans and head upstairs in order to find suits.

West Coast techies are to blame, of course. Judging from photo evidence, the only time Apple's Tim Cook wears a suit is when he visits the White House.

The crumbling dress code leaves wealth managers with a serious challenge, Which fashion look will impress the client – Armani or Lululemon?

Pfizer's CEO photo shows him in suit and tie. Ditto for Bank of America's CEO. But AT&T's CEO photo shows that he has joined the tieless, unbuttoned blue-shirt rebellion. So has Citi's.

|

| AT&T's CEO |

CEOs of troubled companies, however, need to look as somber and serious as possible. Leaders of GE and Wells Fargo still wear ties.

JPMorgan Chase's report isn't online yet, but Jamie Dimon presumably will appear with tieless blue shirt as he did a year ago.

For traditionalists, worse is yet to come. The disappearing tie, the WSJ suggests, will be followed by the disappearing business suit. Already, shoppers at the Joseph A. Banks store in NYC have to sidle past displays of khakis and jeans and head upstairs in order to find suits.

West Coast techies are to blame, of course. Judging from photo evidence, the only time Apple's Tim Cook wears a suit is when he visits the White House.

The crumbling dress code leaves wealth managers with a serious challenge, Which fashion look will impress the client – Armani or Lululemon?

Sunday, March 24, 2019

Where‘s Your Teddy Bear Domiciled?

High net worth folks with several homes often strive to avoid being counted as a resident of a high-tax state. Traditionally, that's meant keeping careful count of how many days are spent in said state, and there are apps for that. But as Paul Sullivan reports in his Wealth Matters column, states such as New York and California have become more sophisticated in their efforts to tax the rich.

Days spent in state represent only one of five tests New York applies. "The state also looks at the size and cost of the New York home compared with those in other states, a person’s business and family ties to the state, and a category that looks at where 'near and dear' items are kept."

That last category is popularly known as the teddy bear test.

The new federal income tax cap on SALT deductions has further motivated the rich to flee their domiciles in high tax states. It has also motivated the high-tax states to fight back. In addition to checking for stuffed animals, New York may examine cell phone records and Facebook posts.

From a revenue standpoint the stakes are high. New York gets 46 percent of its income tax take from the top one percent of taxpayers.

Even top one percent New Yorkers who establish domicile elsewhere could be snared by a new proposed revenue raiser: a pied-à-terre tax on second homes worth over $5 million.

|

|

teddy bears, is now domiciled

in New York, at the Public Library.

|

That last category is popularly known as the teddy bear test.

The new federal income tax cap on SALT deductions has further motivated the rich to flee their domiciles in high tax states. It has also motivated the high-tax states to fight back. In addition to checking for stuffed animals, New York may examine cell phone records and Facebook posts.

From a revenue standpoint the stakes are high. New York gets 46 percent of its income tax take from the top one percent of taxpayers.

Even top one percent New Yorkers who establish domicile elsewhere could be snared by a new proposed revenue raiser: a pied-à-terre tax on second homes worth over $5 million.

Saturday, March 16, 2019

The Pioneer Who Discovered Growth Stocks

Long before Jack Bogle, the father of index funds, there was T. Rowe Price, the father of growth investing. He and Bogle are probably the only two investment managers to popularize an entire theory of investing.

Born March 16, 1898, T. Rowe Price was a chemist by training but a stock picker at heart. While working at a brokerage he decided he wanted to sell advice, not stocks. In 1937 he opened his own investment counseling firm, a bold move in those times. Fee-based investment counsel was rare. The seeds of war were sprouting in Asia and in Europe. In the U.S. four years of painful recovery from the Great Depression had relapsed into a new recession.

Somehow, Price survived and prospered, propelled by his belief that he could outperform the market by selecting stocks whose earnings were growing faster than inflation and faster than the general economy.

After World War II ended, high wartime income tax rates lived on. Price's clients wanted to ease their tax burden by moving money into accounts for their children. (In those days Daddy's Little Taxpayers were entitled to their own low tax brackets.) To facilitate small accounts Price started a mutual fund, the T. Rowe Price Growth Stock Fund.

Brokers working on commission didn't sell the Growth Stock Fund. Investors had to buy shares: Send for a prospectus. Fill out the accompanying new-account form. Return it with a check to Price in Maryland. Nevertheless, the fund's performance led to phenomenal success. In the 1970's, when Jack Bogle decided to make his index fund no load, Price's accomplishment must have bolstered his belief that his index fund could flourish without the help of a commissioned sales force.

Brokers working on commission didn't sell the Growth Stock Fund. Investors had to buy shares: Send for a prospectus. Fill out the accompanying new-account form. Return it with a check to Price in Maryland. Nevertheless, the fund's performance led to phenomenal success. In the 1970's, when Jack Bogle decided to make his index fund no load, Price's accomplishment must have bolstered his belief that his index fund could flourish without the help of a commissioned sales force.

|

| T. Rowe Price |

Somehow, Price survived and prospered, propelled by his belief that he could outperform the market by selecting stocks whose earnings were growing faster than inflation and faster than the general economy.

After World War II ended, high wartime income tax rates lived on. Price's clients wanted to ease their tax burden by moving money into accounts for their children. (In those days Daddy's Little Taxpayers were entitled to their own low tax brackets.) To facilitate small accounts Price started a mutual fund, the T. Rowe Price Growth Stock Fund.

Brokers working on commission didn't sell the Growth Stock Fund. Investors had to buy shares: Send for a prospectus. Fill out the accompanying new-account form. Return it with a check to Price in Maryland. Nevertheless, the fund's performance led to phenomenal success. In the 1970's, when Jack Bogle decided to make his index fund no load, Price's accomplishment must have bolstered his belief that his index fund could flourish without the help of a commissioned sales force.

Brokers working on commission didn't sell the Growth Stock Fund. Investors had to buy shares: Send for a prospectus. Fill out the accompanying new-account form. Return it with a check to Price in Maryland. Nevertheless, the fund's performance led to phenomenal success. In the 1970's, when Jack Bogle decided to make his index fund no load, Price's accomplishment must have bolstered his belief that his index fund could flourish without the help of a commissioned sales force.

•

Jack Bogle was a successful author and a beloved commentator on personal investing. If T. Rowe Price did TV interviews or authored op-eds, I must have missed them. He is said to have disliked public speaking. Thirty-six years after his death, his public image may be getting an overdue boost. Wiley is publishing a bio, T. Rowe Price, the Man, the Company and the Investment Philosophy.

Thursday, March 14, 2019

Fleecing Retirees by Phone

Read the comments from bedeviled retirees and weep.

Wednesday, March 13, 2019

Seeing Helps Investors Believe

MarketWatch offers two graphics that investment advisers may want to add to their educational materials.

This one shows how often and how vigorously stock returns go up and down.

A second graphic (a lively GIF) shows the likelihood of stock investors making money over various time periods. Investors holding for 20 years can't lose – at least they never have. But remember, that perfect success rate assumes all dividends are reinvested.

This one shows how often and how vigorously stock returns go up and down.

A second graphic (a lively GIF) shows the likelihood of stock investors making money over various time periods. Investors holding for 20 years can't lose – at least they never have. But remember, that perfect success rate assumes all dividends are reinvested.

Saturday, March 02, 2019

Are Both Hawaiian War Gods Worth Millions?

Unlike regular investments – stocks, ETFs, bonds – alternative investments such as art can be difficult to value. Perhaps that's why they're alternative investments.

Current illustration: doubts about the value of a wooden statue bought at a Christie's auction by billionaire Marc Benioff for about $7.5 million and donated to a Hawaiian museum.

Is Benioff's purchase, at left, the equal of the similar statue in the British Museum at right? Or is it "the sort of thing you see in a tiki bar"?

Current illustration: doubts about the value of a wooden statue bought at a Christie's auction by billionaire Marc Benioff for about $7.5 million and donated to a Hawaiian museum.

Is Benioff's purchase, at left, the equal of the similar statue in the British Museum at right? Or is it "the sort of thing you see in a tiki bar"?

Tuesday, February 12, 2019

Will Your Robo Adviser Plan Your Estate?

|

| Illustration: Sydney Morning Herald |

According to Steve Lockshin of Adviceperiod in this Barron's interview, human estate planners should start feeling nervous:

We are beginning to work on automation for estate planning—the one area that advisors love to insist cannot be automated. We are using our access to data to build out the algorithms to automate estate-planning recommendations and then create the appropriate legal documents. It’s all rules-based, and when it comes to most lawyers, it’s an antiquated industry.

Tuesday, February 05, 2019

Should Retirement Savers Slow Down?

Most Americans aren't building adequate retirement nest eggs. Investment providers usually urge them to save more. So how do you explain this T. Rowe Price mailing?

Why on earth would a mutual fund firm want enthusiastic retirement savers to slow down – to trot rather than gallop as they add to their investments?

Turns out it doesn't. "Rein in" is seldom taken literally in an age when few of us ride or drive a horse to work. The phrase has become a figure of speech. If you're a nervous wreck, you're urged to rein in your emotions. If you're deep in debt, you're advised to rein in your credit card usage.

As figures of speech age, their meaning sometimes goes astray. What T. Rowe Price really wants, according to the next page of the mailer, is for retirement investors to consolidate their accounts.

Maybe their headline should have been E Pluribus Unum.

Our advice to retirement savers? Give yourself free rein.

Why on earth would a mutual fund firm want enthusiastic retirement savers to slow down – to trot rather than gallop as they add to their investments?

Turns out it doesn't. "Rein in" is seldom taken literally in an age when few of us ride or drive a horse to work. The phrase has become a figure of speech. If you're a nervous wreck, you're urged to rein in your emotions. If you're deep in debt, you're advised to rein in your credit card usage.

As figures of speech age, their meaning sometimes goes astray. What T. Rowe Price really wants, according to the next page of the mailer, is for retirement investors to consolidate their accounts.

Maybe their headline should have been E Pluribus Unum.

Our advice to retirement savers? Give yourself free rein.

Saturday, February 02, 2019

Imagine a Thundering Herd of Fiduciaries

When Blair duQuesnay, an investment adviser, wrote a NY Times op-ed in praise of female investment advisers, the headline read: Consider Firing Your Male Broker. Some readers accused her of fudging the distinction between registered representatives of brokerage firms, who traditionally work on commission, and registered investment advisers, who as fiduciaries are pledged to put their clients' interests above their own.

But these days the dividing line between brokers and RIAs is not so clear. Some wear both hats, and more and more "brokers" now work for fees, not commissions. In reality, duQuesnay asserts, "the investing public uses the words broker/advisor/adviser interchangeably. They do not know the difference…."

Maybe the public is on to something. David DeVoe, a San Francisco investment banker, notes the rising competition that wirehouses like Merrill Lynch and Morgan Stanley face from large RIA organizations and offers a provocative thought:

But these days the dividing line between brokers and RIAs is not so clear. Some wear both hats, and more and more "brokers" now work for fees, not commissions. In reality, duQuesnay asserts, "the investing public uses the words broker/advisor/adviser interchangeably. They do not know the difference…."

Maybe the public is on to something. David DeVoe, a San Francisco investment banker, notes the rising competition that wirehouses like Merrill Lynch and Morgan Stanley face from large RIA organizations and offers a provocative thought:

What if one of the wirehouses decided to become a full-blown RIA, to embrace fiduciary and independence? I think that could be a fascinating development.If it happens, will females be well represented in the crew?

The wirehouses have done a pretty good job over the years of mimicking the independent model in many regards, but they’ve done it slowly. I’ve said this before: It takes a long time to turn a battleship, but once it does turn, you have a lot of artillery pointed at you.

Tuesday, January 22, 2019

Crypto Bungling, Crypto Greed, Crypto Fear

CNN's article on how a crypto exchange mistakenly doled out $5 million in Bitcoin carried this sidebar.

Choose one: Get rich quick? Get really, really poor?

Choose one: Get rich quick? Get really, really poor?

Wednesday, January 16, 2019

John Bogle (1929-2019)

“In investing, you get what you don’t pay for. Costs matter. So intelligent investors will use low-cost index funds to build a diversified portfolio of stocks and bonds, and they will stay the course. "

Heckerling

The last time I attended the Heckerling Institute on Estate Planning was the final year it was held in Miami. More than a decade ago, I believe.

It's great, really great. More than 3,400 attendees, a new record. Even so, the Orlando convention center is so huge it doesn't feel crowded. I need to attend more than once every 10 years. I ran into Merrill Anderson's former client and good friend, Dave Folz.

I note with interest an increase in nontax subjects being discussed. Guardianships, for example. Choosing the right trustee, which is what caused me to send in my registration. Things that are important, but that I suspect will be hard to charge a suitable fee for, given the time it takes.

Selling estate planning was easier when the tax savings of a simple plan was 100 times larger than the fee being charged.

Also noted, an increasing push toward choosing corporate trustees. Use of trusts has exploded in recent years, according to several of the lecturers.

It's great, really great. More than 3,400 attendees, a new record. Even so, the Orlando convention center is so huge it doesn't feel crowded. I need to attend more than once every 10 years. I ran into Merrill Anderson's former client and good friend, Dave Folz.

I note with interest an increase in nontax subjects being discussed. Guardianships, for example. Choosing the right trustee, which is what caused me to send in my registration. Things that are important, but that I suspect will be hard to charge a suitable fee for, given the time it takes.

Selling estate planning was easier when the tax savings of a simple plan was 100 times larger than the fee being charged.

Also noted, an increasing push toward choosing corporate trustees. Use of trusts has exploded in recent years, according to several of the lecturers.

Monday, January 14, 2019

How Tax Refunds Drive the Economy

Unhappy taxpayers may not be the only victims of the winter of tax discontent. Last year the new tax

law made folks feel flush – and automobile sales, a key driver of the U.S. economy, exceeded expectations. This year millions of Americans are expected to receive lower refunds or, worse, owe more to the IRS.

"Without that seasonal bounce," Axios warns, "2019 auto sales may be lower, making a recession more likely."

law made folks feel flush – and automobile sales, a key driver of the U.S. economy, exceeded expectations. This year millions of Americans are expected to receive lower refunds or, worse, owe more to the IRS.

"Without that seasonal bounce," Axios warns, "2019 auto sales may be lower, making a recession more likely."

Sunday, January 06, 2019

A Winter of Tax Discontent?

One reason: the new tax law created a much larger standard deduction – $12,00 for singles, $24,000 for married couples. Though some taxpayers will benefit, others accustomed to itemizing their deductions may feel shortchanged. A couple whose state and local taxes, mortgage interest and donations add up to, say, $22,000 will find that their accustomed deductions are worthless.

According to estimates cited by the WSJ, the number of returns claiming the mortgage-interest deduction for 2018 will drop to 16 million from almost 40 million. Returns claiming deductions for charitable contributions also are expected to drop by more than 50%.

Tax withholding could be another sore spot. The withholding tables for 2018 may result in some taxpayers receiving smaller refunds or owing more at tax time.

And, smaller or not, taxpayers' refunds will be delayed if the partial government shutdown persists.

Friday, January 04, 2019

A novel way to beat the estate tax

According to this report, a couple owned a department store together in France. When the wife died in 1934, the husband should have paid a death tax of 38% on her half of the business. To avoid that tax, he reported instead that his daughter died, and the daughter then assumed the identity of the wife. Bingo, no death tax.

How did this story come to light? The daughter had a very long life. So long that she became famous for it, apparently living for 122 years and 164 days. Subsequent investigation turned up the possible fraud, the daughter may actually have died at age 100.

The woman was Jeanne Calment, a name that JLM may remember. She was the one who sold her apartment for a life annuity at age 90, only to outlive the buyer. Talk about buyer's remorse! His estate had to keep paying the annuity, so the final price for apartment was double its initial value, according to Wikipedia.

Not everyone is buying the story that a daughter could adopt the identity of her mother in a small town and everyone in town would either not notice or keep the secret. The evidence for fraud is thin—inconsistent passport descriptions, stories that don't match known facts, and the observation that in her 100s she seemed about 20 years younger.

I'd like the story to be true.

How did this story come to light? The daughter had a very long life. So long that she became famous for it, apparently living for 122 years and 164 days. Subsequent investigation turned up the possible fraud, the daughter may actually have died at age 100.

The woman was Jeanne Calment, a name that JLM may remember. She was the one who sold her apartment for a life annuity at age 90, only to outlive the buyer. Talk about buyer's remorse! His estate had to keep paying the annuity, so the final price for apartment was double its initial value, according to Wikipedia.

Not everyone is buying the story that a daughter could adopt the identity of her mother in a small town and everyone in town would either not notice or keep the secret. The evidence for fraud is thin—inconsistent passport descriptions, stories that don't match known facts, and the observation that in her 100s she seemed about 20 years younger.

I'd like the story to be true.

Tuesday, January 01, 2019

The Trump Market’s Still Up (a Little)

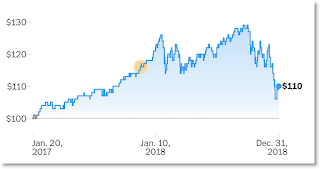

|

| $100 invested in stocks when President Trump took office would have been worth $110 when the market closed out 2018. |

Subscribe to:

Posts (Atom)