According to this Forbes item, even the bussers have to refer customers at Las Vegas nightclubs.

I'm basing an optional Stay In Touch memo on this.

Thursday, June 30, 2011

Wednesday, June 29, 2011

Fiduciary Thought For the Day

In a networked world, trust is the most important currency.

– Eric Schmidt, University of Pennsylvania Commencement Address, 2009

Tuesday, June 28, 2011

Who Was the Greatest Tax Cutter of Them All?

After reading Do Tax Cuts Ever Increase Government Revenues? my nominee is Andrew Mellon:

"Gentlemen prefer bonds."

[B]ack in the 1920s, Treasury Secretary Andrew Mellon pushed Congress to enact a series of tax cuts. The U.S. dropped the top marginal income-tax rate from 73 percent to 25 percent. Tax receipts from the wealthiest Americans rose. According to Treasury data, income taxes paid by Americans making more than $100,000 per year increased from $302 million to $714 million between 1922 and 1928, with the rich's share of income taxes paid rising from 35 to 61 percent.For good measure Mellon gave us the National Gallery of Art. Also, he told us how to be classy investors:

"Gentlemen prefer bonds."

Don't Count the Boomers Out

Think young entrepreneurs are the only successful entrepreneurs? Think again.

H/T to Randy Cassingham of This is True.

…the Kauffman Foundation conducted a survey of 549 startups operating in "high-growth" industries—including aerospace, defense, health care, and computer and electronics—and found that people over 55 are nearly twice as likely to launch startups in these industries.Some Boomers dare to take the plunge because they have already achieved financial security. That makes them prospects for trust and investment services.

H/T to Randy Cassingham of This is True.

Saturday, June 25, 2011

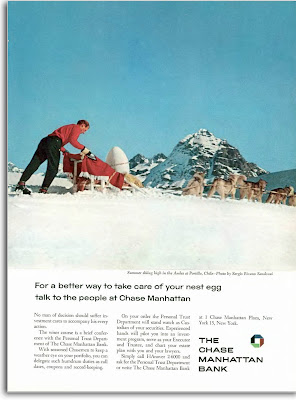

Summer Skiing, Anyone?

Fifty years ago, judging by this Chase nest egg ad, you had to be rich enough to travel to the Southern Hemisphere in order to spend the Fourth of July on the ski slopes.

This year? Forget the Andes! Just mush on over to Lake Tahoe or Snowbird.

This year? Forget the Andes! Just mush on over to Lake Tahoe or Snowbird.

Thursday, June 23, 2011

Huguette Clark's Will

Huguette Clark, the wealthy recluse who died recently at age 104, left her Monet "Water Lily" painting, valued at $25 million, to the Corcoran Gallery of Art. The rest of her extensive art collection will be transferred to the Bellosguardo Foundation, to be established at her Santa Barbara estate.

Huguette Clark, the wealthy recluse who died recently at age 104, left her Monet "Water Lily" painting, valued at $25 million, to the Corcoran Gallery of Art. The rest of her extensive art collection will be transferred to the Bellosguardo Foundation, to be established at her Santa Barbara estate.In addition, Huguette's will leaves $34 million to the Brooklyn nurse who looked after her for the last 20 years.

Update: Read Clark's will here.

Finally!

House to Vote by Week's End on Bill Barring Tax Patents ($).

Only new tax patents would be affected. The House version may protect 160 pending tax patents, the Senate version did not. So the two bills will have to be reconciled.

Here's the proposition. I know of a legal way for you to cut your taxes by $100, but before you do it you have to pay me $25 because I thought of it before you did. Why would we ever allow this? Why would courts enforce my claim? Worse, once this idiocy has been identified, why would it take so many years to undo it?

Only new tax patents would be affected. The House version may protect 160 pending tax patents, the Senate version did not. So the two bills will have to be reconciled.

Here's the proposition. I know of a legal way for you to cut your taxes by $100, but before you do it you have to pay me $25 because I thought of it before you did. Why would we ever allow this? Why would courts enforce my claim? Worse, once this idiocy has been identified, why would it take so many years to undo it?

Tuesday, June 21, 2011

Why Is American Taxation Such a Mess?

Fifteen years ago John Steele Gordon explored that question in American Heritage. His leisurely trip through tax history is recommended summer reading. Little has happened since 1996 to invalidate Gordon's verdict on our attempts at taxation with representation:

[T]he means by which the federal government raises revenue violates every single principle of sound taxation developed over the more than five thousand years in which taxes have been collected. These principles are no great mystery. Adam Smith listed four of them in the Wealth of Nations more than two hundred years ago. “I. The subjects of every state ought to contribute towards the support of the government . . . in proportion to the revenue which they respectively enjoy under the protection of the state. . . . II. The tax which each individual is bound to pay ought to be certain, and not arbitrary. . . . III. Every tax ought to be levied at the time, or in the manner, in which it is most likely to be convenient for the contributor to pay it. . . . IV. Every tax ought to be so contrived as both to take out and to keep out of the pockets of the people as little as possible, over and above what it brings into the public treasury of the state.”Gordon explains the origin of such nuttiness as the double taxation of dividends. He also reminds us that the urge to tax the rich existed long before today's income multimillionaires. Back in the 19th century, "Felix Adler, the founder of the Ethical Culture movement, called for a 100 percent tax rate on incomes above the amount needed 'to supply all the comforts and true refinements of life.'”

Monday, June 20, 2011

Spotlight On Income Multimillionaires

|

| Source: Washington Post |

Prompted by new research, Americans with the highest incomes are receiving unusual, and certainly unsolicited, media coverage:

With executive pay, rich pull away from rest of America. The Washington Post features a study revealing that corporate CEOs are plentiful at the top of the income pyramid. In the 1970s the CEO of a major company might make a million or two in today's dollars. Today a CEO making less than $10 million per annum is the object of sympathy.

Paychecks as Big as Tajikistan. Gretchen Morgenson of the NY Times discusses a study comparing the compensation of CEOs and other top execs at S&P 500 companies to performance benchmarks and other company expenditures.

Total executive pay increased by 13.9 percent in 2010 among the 483 companies where data was available for the analysis. The total pay for those companies’ 2,591 named executives, before taxes, was $14.3 billion. *** …the total is almost equal to the gross domestic product of Tajikistan, which has a population of more than 7 million.Why the rich want to get richer. Once you're making a million or two a year (so I'm told) additional millions are almost more burden than boon. "People sometimes ask what CEOs need with all this money," writes The Washington Post's Ezra Klein. "The answer is they don't need it. But they need to not be making less money than other CEOs. If they are making less, then what does that say about them?"

After the Great Depression, conspicuous wealthiness became unseemly. (Never would Merrill Anderson's marketing materials have used such an arriviste term as "wealth management" in the 1960s or '70s.) Then Gordon Gecko declared, "Greed is good."

In the wake of the Great Recession, could attitudes be shifting again?

Friday, June 17, 2011

Spanish Banker's Taxing Inheritance

When a former IT specialist at HSBC revealed a list of undeclared Swiss bank accounts, he shook a lot of money trees. Among those now under investigation for tax evasion, the NY Times reports, is Spain's most prominent banker, Emilio Botin of Banco Santander.

When a former IT specialist at HSBC revealed a list of undeclared Swiss bank accounts, he shook a lot of money trees. Among those now under investigation for tax evasion, the NY Times reports, is Spain's most prominent banker, Emilio Botin of Banco Santander.Botin and his family apparently inherited their tax problems from accounts that date back to the days of For Whom the Bell Tolls.

Mr. Botín’s father, Emilio, opened an account in Switzerland after the start of the Spanish Civil War when he left Spain for London. The elder Mr. Botín died in 1993 … his son and other heirs were told only last year by the Spanish authorities of the money kept in Switzerland."Switzerland is a small, steep country," Hemingway once wrote, "much more up and down than sideways, and is all stuck over with large brown hotels…." Far as I know, he didn't mention the banks.

Thursday, June 16, 2011

Best Investment Move? Take the Summer Off

A few months ago things seemed to be looking up. What happened? According to a new CNN/Opinion Research poll, roughly five out of ten respondents expect 25% unemployment within a year. Widespread bank failures. Millions of Americans without food or shelter. In short, another Great Depression!

Given the public mood, maybe "Sell in May and go away" was this spring's best investment idea. Long-term investors don't even need to sell. Just grab their nest eggs and go cruise for the summer. The world and its worries will still be here when they return in the fall.

Given the public mood, maybe "Sell in May and go away" was this spring's best investment idea. Long-term investors don't even need to sell. Just grab their nest eggs and go cruise for the summer. The world and its worries will still be here when they return in the fall.

|

| Chase Manhattan ad, 1961 |

Wednesday, June 15, 2011

Just Enough Rich People

|

| Spelling mansion |

Millionaires are more prevalent in Congress. Among the 87 new Republican members, The Washington Post reports, at least 24 are millionaires.

Even so, have-nots outnumber haves: "At least 30 had liabilities [other than home mortgage debt] totaling $50,000 or more in 2010."

The U.S. probably does have enough rich people. But I wish many more Boomers were going to retire as millionaires.

No Estate Tax Repeal, Exemption Stays At $5 Million?

Tuesday, June 14, 2011

A Dark View of Estate Planning

Where Have All the Estate Planning Lawyers Gone? Stephen Dunn believes they've turned to protecting doctors' assets or sunk to fleecing old folks: "… I would say that planning to qualify clients for Medicaid coverage of nursing home care has surpassed estate tax avoidance as an objective of estate planning."

He's wrong, I hope. Isn't he?

Update. For her hopeful heirs, any old Medicaid nursing home sounds fine for Grandma. The reality? See Gerry Beyer's post: Nursing Home Statistics. (The statistics don't take deficit-reducing cuts in Medicaid into account. Sorry, Grandma.)

He's wrong, I hope. Isn't he?

Update. For her hopeful heirs, any old Medicaid nursing home sounds fine for Grandma. The reality? See Gerry Beyer's post: Nursing Home Statistics. (The statistics don't take deficit-reducing cuts in Medicaid into account. Sorry, Grandma.)

Video plugs “Inheritance Trusts”

Check out this video from SmartMoney. Almost sprightly, compared to most primers on trusts. Includes a plug for a bank as co-trustee.

Friday, June 10, 2011

Does Taxing Inheritance Harm Growth?

The Atlantic's Megan McArdle pondered the question, Why Not End Inheritance? Her colleague Daniel Indiviglio discusses the alternative, Tim Pawlenty's proposal for ending the estate tax.

Wednesday, June 08, 2011

How Individual Trustees Botch Things Up

Barron's generously let me read this article for free. Maybe they'll do the same for you. See The Five Biggest Ways To Bungle a Trust.

The five ways?

Three failures:

…to keep records

…to diversify

…to treat current beneficiaries and remaindermen fairly

And two unreasonable expectations::

The family won't mind if I take a fee

Nobody will sue me

Marketing trustee services for a bank or trust company? Add this article to your tool kit.

The five ways?

Three failures:

…to keep records

…to diversify

…to treat current beneficiaries and remaindermen fairly

And two unreasonable expectations::

The family won't mind if I take a fee

Nobody will sue me

Marketing trustee services for a bank or trust company? Add this article to your tool kit.

If You’d Like Another Good Scare . . .

Don't let catastrophic floods be your only worry. The troubled housing market could be much, much sicker than we've been allowed to believe:

Consumer borrowing is so rampant in America that most people who took out a mortgage last year to buy a home ended up spending more than a third of their income to pay that loan and other debts.

Consumer borrowing is so rampant in America that most people who took out a mortgage last year to buy a home ended up spending more than a third of their income to pay that loan and other debts.

“Stop Me Before I Trade Again!”

Many men (and some women) with millions to invest are too flighty. If they're not switiching advisers on a whim, they're trading too often for their own good.

A Barclays Wealth study spotlights this "trading paradox." Some wealthy investors feel compelled to keep buying and selling even though they know their wealth suffers as a consequence.

Related post: What Investors Need vs. What Investors Want

A Barclays Wealth study spotlights this "trading paradox." Some wealthy investors feel compelled to keep buying and selling even though they know their wealth suffers as a consequence.

“This trading paradox exists, to one degree or another, everywhere in the world,” Greg B. Davies, the head of behavioral and quantitative finance at Barclays Wealth, said.…. “Not everyone is prone to frequent trading, but among those who feel that they must trade frequently to do well, there is a substantial proportion who are troubled by their behavior.”A U.S. News column notes that two groups of wealthy investors tend to behave more rationally:

For older investors and retirees, the report found substantial improvement in investment decisions as people aged. Compared with younger investors, older investors were much less likely to trade too often, to try to time the market, or base investments on short-term considerations. They were also more satisfied with their financial situation.Could that be why the clients of prudent trust institutions so often turn out to be retirees and/or female?

… women are better long-term investors than men. Men tend to take more risks and are more likely to favor frequent trading and efforts to time the market. "Women tend to have lower composure and a greater desire for financial self-control, which is associated with a desire to use self-control strategies," the report said. "Women are also more likely to believe that these strategies are effective." As a consequence, women tended to trade less and earn higher returns over time.

Related post: What Investors Need vs. What Investors Want

If you'd like a good scare . . .

. . . read this post on the chances of massive flooding of the Mississippi.

When I saw the reference to "spring flooding" I had to recheck the dates, because I assumed spring flooding was long over this year. Apparently not so for parts of Montana that feed into the Missouri river.

The domino effect of bursting dams makes Hollywood apocalypse movies seem tame by comparison. It would make Katrina seem like a mild summer storm.

Let's hope that this is hype.

When I saw the reference to "spring flooding" I had to recheck the dates, because I assumed spring flooding was long over this year. Apparently not so for parts of Montana that feed into the Missouri river.

The domino effect of bursting dams makes Hollywood apocalypse movies seem tame by comparison. It would make Katrina seem like a mild summer storm.

Let's hope that this is hype.

Tuesday, June 07, 2011

Churn

According to a new Spectrem study, released in late May, "10% of ultra-wealthy respondents changed advisors [in 2010], compared with the 6% who did so in 2009. Also, 15% changed their primary financial institution." So, client retention is more important than ever.

At the same time, the wealthy have grown somewhat weary of playing the market. In 2009, 69% of those with more than $1 million to invest wanted to be involved in portfolio management on a daily basis. That fell to 65% in 2010, then to 47% in 2011.

Give the job to the professionals!

At the same time, the wealthy have grown somewhat weary of playing the market. In 2009, 69% of those with more than $1 million to invest wanted to be involved in portfolio management on a daily basis. That fell to 65% in 2010, then to 47% in 2011.

Give the job to the professionals!

“Buy Republican! More Fat Cats, Less Taxes!”

Among GOP, anti-tax orthodoxy runs deep, reports The Washington Post:

Coke Low Taxes." My head knows effective tax rates will be hiked anyway, perhaps via "tax reform." Reason: The U.S. Treasury needs the money. And the money would start to flow immediately, as taxpayers hurry to accelerate bonuses and realize gains before low rates vanish.

[T}oday’s GOP adheres to a “no new taxes” orthodoxy that has proved far more powerful than the desire to balance the budget. *** This orthodoxy is now woven so deeply into the party’s identity that all but 13 of 288 GOP lawmakers in Congress have signed a formal pledge not to raise taxes. The strategist who invented the pledge, Grover G. Norquist, compares it to a brand, like Coca-Cola, built on “quality control” so that Republican voters know they will get “the same thing every time.”My heart loves the brand's unique selling proposition: "Things Go Better With

Monday, June 06, 2011

Why Not End Inheritance?

When estate planners have nightmares, do they dream that estates – inheritable chunks of wealth – have ceased to exist?

When estate planners have nightmares, do they dream that estates – inheritable chunks of wealth – have ceased to exist?Or do they dream that estate tax – the great estate-planning motivator – has been repealed?

In the wide-awake world, the first option appears alive and well for liberal thinkers. See Kevin Drum: Why Not Let the Dead Pay for Medicare?

Drum's post prompted The Atlantic's Megan McArdle to wonder, Why Do We Allow Inheritance At All?

Happily, estate planners need not toss and turn in their beds. After considering the obvious exceptions a 100-percent estate tax would require, not to mention the inevitable loopholes, McArdle ran into Chesterton's Fence.

Sunday, June 05, 2011

The Solution that Became the Problem

Why did this 1971 brokerage ad deal with such dull subjects as error-reduction and bookkeeping? Because all heck had broken loose at brokerage firms in the late 1960s. As "gunslinger" fund managers snapped up hot stocks at unprecedented rates, antiquated back offices collapsed under mountains of paper.

Why did this 1971 brokerage ad deal with such dull subjects as error-reduction and bookkeeping? Because all heck had broken loose at brokerage firms in the late 1960s. As "gunslinger" fund managers snapped up hot stocks at unprecedented rates, antiquated back offices collapsed under mountains of paper."Wall street in 1968," wrote John Brooks in The Go-Go Years, "…cut its own throat through its complacency, greed, and lack of foresight."

Can't have been pretty in 1971, either. Some formerly hot stocks plunged 40 percent or more as the gunslingers ran for the exit.

Computers eventually solved the problem. A 20-million-share day may have shook Wall Street back then. Now a one-billion-share day is routine.

But the 20th-century solution has bred a 21st-century hazard. Wall Street finds itself under attack by program traders wielding metaphorical death rays rather than Colt revolvers. This week's 60 Minutes devoted a segment to How speed traders are changing Wall Street.

Most people don't know it, but the majority of the stock trades in the United States are no longer being made by human beings. They're being made by robot computers, capable of buying and selling thousands of different securities in the time it takes you to blink an eye.Should computers telling other computers to execute zillions of instant trades worry you? Yes, according to a current and a former senator. See Preventing the Next Flash Crash.

The marketing question is, does program trading worry investors? Do they feel threatened by the prospect of a major flash crash?

Thursday, June 02, 2011

Should Everybody Pay Income Tax?

Most Americans can vote to raise income taxes at no cost to themselves. That's because most Americans don't pay income tax.

Bad situation, blogs Scott Adams. "My recommendation for putting a safeguard on the state of the union is that every adult citizen should pay federal income taxes, even if it is just one dollar per year."

Do you agree?

Bad situation, blogs Scott Adams. "My recommendation for putting a safeguard on the state of the union is that every adult citizen should pay federal income taxes, even if it is just one dollar per year."

Do you agree?

I'm proud to pay taxes in the United States;

the only thing is, I could be just as proud for half the money.

– Arthur Godfrey

Why Private Investors Need Fiduciary-Quality Advice

Wall Street's investment research still leaves a lot to be desired. See Jesse Eisinger's column on ex-BofA analyst David Maris: For Whistle-Blowers, No Good Deed Goes Unpunished.

(Jesse Eisinger and Jake Bernstein won a 2011 Pulitzer for their Wall Street reporting.)

(Jesse Eisinger and Jake Bernstein won a 2011 Pulitzer for their Wall Street reporting.)

* * *

CLSA, where Maris now works, created this cool salute to The Year of the Rabbit. Click on thumbnail for larger version.

Wednesday, June 01, 2011

Car Dealer's Mistress Ain't Down Yet

Remember when it looked like Anne Melican, mistress of Georgia car dealer Harvey Strother, might receive $6 million or more from his estate? The Georgia Supreme Court dashed that hope in 2009. Undaunted, Melican kept fighting. The Georgia court now rules she's entitled to $1.36 million, the proceeds from the sale of a condo Strother devised to her.

Can You Pronounce “Kosciuszko”?

A few years ago we called your attention to A Friend of Liberty and His Unfaithful Executor. Tadeusz Kosciuszko would be remembered as fondly as Lafayette, we suggested, if only Americans could spell his name.

Or pronounce it.

On this score, a NY Times article offers help. There's a Kosciuszko Bridge in New York – a modest span, due to be replaced with something grander. To pronounce Kosciuszko more or less properly, you simply sneeze: “Ka-SHOO-sko.”

Or pronounce it.

On this score, a NY Times article offers help. There's a Kosciuszko Bridge in New York – a modest span, due to be replaced with something grander. To pronounce Kosciuszko more or less properly, you simply sneeze: “Ka-SHOO-sko.”

Subscribe to:

Posts (Atom)