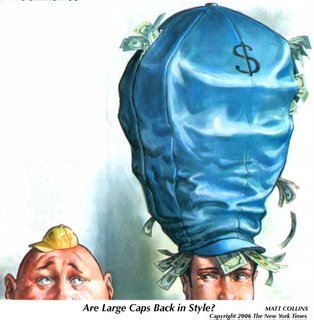

Cassingham has some satellite interests as well, including a web site for airing customer service war stories. He publicized it in this week's newsletter. This week banks are in the cross hairs, and there are indeed some nasty anecdotes. Here's the link: Cranky Customer: At My Bank, NSF = Non-Sufficient Friendliness

Be sure to click through for the comments, there are some tough stories there for bank marketers to overcome. An excerpt I appreciated:

I took all of our spare change, went to the trouble of counting it and putting it in sleeves (my grandfather used to work at a bank, so I knew this would be expected), took to the bank, and was told there would be something like a 20% charge to accept it. I wonder if you bring in large amounts of cash money if they tell you the same thing... I told them that was ridiculous, and took my change and left. We ended up using the sleeved change at the post office and fast food drive thrus. We were running several errands the day we tried to deposit the change at the bank, and the next stop was at the post office next door. Before offering it as payment, we asked the clerk "is it ok if we pay in wrapped change?" and he said "It's money isn't it?"

Yeah, that's what I thought before I went to the bank.

Perhaps the customer should have gone to Saturday Night Live's First National Change Bank?