Wednesday, August 29, 2007

Best Pet Trust Ever

Two grandchildren were disinherited entirely, two others will get $5 million each outright plus a $5 million trust, provided they visit their father's grave every year.

Hat tip to Professor Beyer, who surmises that, because an expected billion-dollar residuary estate will pass to charity the trust for the dog won't be challenged.

Tales from the 20th Century: Shutting Down the Stock Exchange

As reported earlier, the Senior Assistant Blogger spent his pre-college summer of 1949 working on Wall Street. Yet at 3:30 on a hot August weekday afternoon, we find him forty miles away in Connecticut. He's sitting on the sand sipping a Coke, watching kids jump off the high board at the Noroton Bay Beach.

As reported earlier, the Senior Assistant Blogger spent his pre-college summer of 1949 working on Wall Street. Yet at 3:30 on a hot August weekday afternoon, we find him forty miles away in Connecticut. He's sitting on the sand sipping a Coke, watching kids jump off the high board at the Noroton Bay Beach.Why wasn't he at work? Because much of Wall Street wasn't yet air-conditioned. On that August day, the heat became so unbearable that The New York Stock Exchange closed after lunch and everybody went home.

Air conditioning was a transforming invention of the 20th century. The way the market's been acting lately, that transformation may have a down side.

Yesterday, August 28th, was another of those now familiar occasions when program trading sent stock prices plummeting in the last hour of trading. Some Wall Streeters, including Muriel Siebert, blame the SEC's recent elimination of the uptick rule on short sales:

This regulation was put in place in 1938 to defang so-called bear raids on stocks, when sellers ganged up on companies' shares and profited by driving them down.Usually the computer-driven plunges in stock prices are followed by a bounce back up the following morning. Looks like that's happening in the early going today. Mindless volatility is good for traders, Siebert admits, but she believes it scares individual investors.

The uptick rule required that anyone shorting a stock - selling shares he or she does not own in hope of making a profit - can do so only on an uptick in its price. But the SEC got rid of the rule July 6, after it concluded that such restrictions "modestly reduce liquidity and do not appear necessary to prevent manipulation."

The commission drew its conclusions after years of study, analysis and discussion, of course. But Siebert said that with the rule no longer in place, it was easier for sellers to overwhelm stocks on down days.

* * *

Her second concern relates to the influence of electronic trading in big-name stocks. The specialist system - in which a human being with capital at stake is obligated to use it to maintain orderly markets - has been in decline for years. But Siebert said that the recent down days in the stock market might have a lot to do with the fact that the New York Stock Exchange is now dominated by computerized trading. Unlike specialists, machines that match orders don't have to put up capital to stabilize disorderly markets.

Maybe The New York Stock Exchange should take this afternoon off. Better yet, declare a long weekend and reopen after Labor Day.

All in favor say, "Hit the beach!"

Previous Tales from the 20th Century:

Good Brokers

"Going Out of Business"

Saturday, August 25, 2007

Ben Stein Hacks at Hedgies

Hedge funds are largely a fraud.* * *The model hedge fund is not a means to outperform the market. It is a means to outcharge the investor.* * *For anyone at all familiar with rich people, the idea that to be rich is to be sophisticated is almost laughable. Rich people become rich generally in ways that have zero to do with sophistication in investing. I have seen this in spades this week with all of the shrieking from my rich pals about their investment losses.* * *The junk bonds that Drexel Burnham Lambert once ginned up were supposed to be loans to less-qualified borrowers that would pay higher rates of interest, but not be subject to default rates that offset those gains. They weren’t . . . . Subprime was supposed to be, in effect, a Milken junk bond . . . .

Asset Protecton Trusts

The judge who weathered accusations of sleeping in court is now accused of fraudulently shielding her husband's assets from creditors.

Rockingham County Superior Court Judge Patricia Coffey has allegedly compromised the integrity of the judiciary by creating a trust to put the assets of her husband -- John Coffey -- out of reach of creditors.

One of the creditors is the Professional Conduct Committee, which has been seeking legal fees relating to John Coffey's 2005 disbarment for exploiting a client suffering from dementia. Coffey was accused of acquiring the woman's beachside Rye cottage in 1998 as payment for $50,000 in legal bills.* * *Coffey allegedly helped establish the trust while her husband's disbarment proceedings were pending, and she had reason to know he might be facing large legal bills.

In a sworn statement to the committee, Patricia Coffey denied the trust was established to avoid collection of debt for the committee, but did acknowledge the timing appears compromising.

Thursday, August 23, 2007

Astor Estate: JPMorgan Plays the Tax Card

[Anthony] Marshall criticized JPMorgan for challenging the 2003 transfer to him of Mrs. Astor’s seaside home in Maine, and $5 million from her. Mr. Marshall’s court papers pointed out that the bank had recently notified his lawyers that they had filed amended tax forms for Mrs. Astor, naming the items taxable income rather than gifts. Consequently, Mr. Marshall could face millions of dollars more in income tax.No wonder Mr. Marshall isn't keen to see JPMorgan/Chase appointed as an administrator of his mother's estate!

Wednesday, August 22, 2007

Yet Another Asset Class: Jewelry

Stocks and bonds might be the most valuable items in an investor's portfolio, but they're not always the most precious. Large Wall Street brokerages, private banks and boutique wealth-management firms . . . are expanding their services to help the well-heeled manage jewelry collection that can run from thousands to millions of dollars apiece.Jewelry is selling for record prices. At Christie's last fall, actress Ellen Barkin sold the rocks and baubles her ex-husband had given her for more than $20 million.

mounted in silver and 18k rose gold,

sold at Christie's for $710,400.

The Journal calls attention to some financial-planning problems jewelry can provoke. Disputes over which daughter gets the diamond bracelet, of course. Some buyers need reminding that expensive jewels require special insurance coverage. Gift tax issues may arise if valuable baubles are given to daughters or granddaughters.

How does the estate-tax auditor know grandmother gave away an emerald ring? It was still listed on her insurance rider!

Addictive returns

Here's one person's reaction.

I wonder how Yale did? I wonder how they are faring this month?

Tuesday, August 21, 2007

Guess what else you can google?

The two burglars had the passcodes to get into the office, and the combination to the safe. But it turned out that the safe was trickier to open than a school locker. When the burglars ran into trouble they turned to a computer left on in the office to google for an answer—and they found it.

Black Swan Beats Genius Quants!

Fifty years ago on Wall Street, guys boasted they could beat the market because they had a "system."

Fifty years ago on Wall Street, guys boasted they could beat the market because they had a "system."Five years ago on Wall Street, managers of quant hedge funds boasted they could not only beat the market but produce positive investment returns no matter what. They had "algorithms."

The systems worked, but only sometimes. Pretty much the same deal for the algorithms, as The Washington Post reports in this page one story:

Instead of veteran, market-savvy traders waving fistfuls of sell slips, the elite quant funds employ Nobel nerds with math PhDs, often divorced from the real world. It's not for nothing that they are called "black-box" funds -- opaque to outsiders, the boxes contain investment magic understood by only the wizards who conjured it up.

But the 387-point drop in the Dow Jones industrial average Aug. 9 and the continuing turmoil in the markets, in part attributed to massive sell-offs by the quant funds, have tarnished some of the quants' glimmering intellectual credentials and shown that, when push comes to shove, they can rush toward the exits as fast as a novice investor.* * *

As elegant as the [qaunts'] models are, they cannot predict unpredictable events, or human panic, some traders say. Further, some say, too many quant funds are full of myopic brainiacs, overly reliant on their tools."Most are idiot savants brought to industrial proportion," Nassim Nicholas Taleb, former quant-jock and bestselling contrarian author, said by phone from Scotland, where he is promoting his new book on improbability, "The Black Swan."

"They are very smart in front of a textbook but not smart enough to understand very elementary things in reality," he said.

The investment world is full of bell curves, charts showing us what usually happens and allowing us to calculate the odds on unusual happenings. All too easily, the improbable becomes reclassified as impossible.

Talab calls this error the black swan theory. Throughout most of human history, everyone but a few aborigines down under "knew" all swans were white. There could be no such bird as a black swan.

Not until the 1600's did Europeans discover black swans in Australia. Whoops!

Bird call update. The heading for this post originally referred to "Black Honkers." Bad guess. Geese honk, not swans. Some swans trumpet; others are mute. The black swan has a musical trumpeting call.

Identity thieves become still more brazen

In one case, where $1 million worth of stock was ordered sold from a Fidelity Investments account, a co-conspirator went to Fidelity's San Jose office with a counterfeit power of attorney to facilitate the transaction. The money was eventually traced to a Russian bank account.

The tactics employed were worthy of a novel.

The year-long investigation into the criminal conspiracy broke open when an investigator with the Manhattan District Attorney's Identity Theft Unit went undercover, taking on the online identity of a Klopov accomplice and pursuing an on-line relationship with him.

The DA's office reported that the undercover investigation revealed that Klopov created dossiers of background research on his targeted victims and even hired private investigators to provide him with additional information on his targets. He used on-line job hunting sites, such as Monster.com and CareerBuilder.com, to recruit accomplices. The DA also noted that he provided his co-conspirators with fake identification and documents, background information on the identity theft victims, and even made all their travel arrangements, including reservations at five-star hotels and town car limo services.

Monday, August 20, 2007

Perils of acquisition

Advisers leaving U.S. Trust “are looking for a high-end service model they can provide their clients,” said Scott Chaisson, a Boca Raton, Fla.-based managing director for Stanford, which to date has hired at least 20 U.S. Trust professionals for offices in Florida and North Carolina who have brought with them clients estimated to have close to $6 billion. Stanford is “actively seeking” to expand its presence in the Southeast, he said.

Apparently the service offerings are weakest for your $10 million+ client who expects truly personal service. The article concludes that B of A remains confident that it can retain 80% of the account assets of U.S. Trust, which seems like a lot to lose.

Sunday, August 19, 2007

Victimized by a "Trust Mill"

Also distressing, the column's closing comment: "Trust mills are not the only culprits. Banks that switch seniors into deferred annuities when their certificates of deposit are coming due are close behind."

Friday, August 17, 2007

Brooke Astor: And Now, the Will Contest

Yesterday The New York Times reported that "the court-appointed guardians of Brooke Astor have filed legal papers saying that the will she signed in 1997 should be the valid one. They argue that she was not mentally competent or was unduly influenced when she signed her last will in 2002 and several amendments to it over the following two years."

The 1997 will is said to leave half the residuary estate in a trust to pay Mrs. Astor's son, Anthony Marshall, 5 percent of its market value yearly. The 2002 will as amended by its codicils reportedly leaves Mr. Marshall, age 83, the entire residuary estate outright.

What might happen to the remaining Astor fortune after Mr. Marshall's death is not clear from news reports. If he received the residuary estate outright, he might leave all or part of it to his wife, Charlene, age 61. If the trust called for the earlier will is established, presumably the remainder beneficiaries might include Brooke Astor's only grandchildren, Mr. Marshall's twin sons, now age 54.

Thursday, August 16, 2007

H-E-D-G-E, by Merle Hazard

On YouTube, Merle Hazard has a song for them.

Great Moments in Stock Analysis

Shares of the mortgage-market bellwether [Countrywide] fell 13% as a Merrill Lynch analyst downgraded the stock to "sell" and speculated that the company could possibly file for bankruptcy. The analyst, Kenneth Bruce, had reiterated a "buy" rating on the stock just a couple of days ago, but decided he had underestimated the company's risks.

Wednesday, August 15, 2007

Financial Entrepreneurs. Are They Evildoers?

America is the greatest entrepreneurial nation in the world. But there are really two kinds of entrepreneurs here — product entrepreneurs and financial entrepreneurs — and only the first kind really builds the economy.

Product entrepreneurs find new ways of satisfying customers. Financial entrepreneurs find new ways of. . . making money.

Thirty years ago, finance was the handmaiden of American industry. Now industry is run by finance and we're paying the price.

Rich Kids

Frank also blogged on the subject in The Wealth Report, and his July 30 post (subscription) is still high on the Online Journal's list of this month's most read blog postings.

Lot of interest in the subject, obviously. Top wealth-holders – the top one or two percent – really worry about their kids. The rest of us like to read about rich kids' problems.

You know, rich kids. Remember the guy who roared into freshman year at college in his Porsche while you were unloading stuff from your parents' Grand Caravan?

Tuesday, August 14, 2007

Wealth Management Trends

From Brooke Astor, a Thought for the Day

Vincent Astor, her third husband, left her $60 million and about an equal amount for a charitable foundation. Mrs. Astor took the job of giving money away seriously. She also found it fun:

With a wink and a sly smile, she liked to quote the leading character in Thornton Wilder’s play “The Matchmaker,” saying, “Money is like manure; it’s not worth a thing unless it’s spread around.”The New York Times was clearly determined not to have Brooke Astor remembered primarily as "a victimized dowager at the center of a very public family battle over her care and fortune." Marilyn Berger's excellent obituary features Astor's philanthropy. If Bill and Melinda Gates can dispense their billions (and Warren Buffet's) with half as much care and enthusiasm as she demonstrated, they'll do well.

Brooke Astor was a hands-on philanthropist. (Well, almost. Ladies of her generation never stepped onto a New York City street without putting on gloves.)

She made it her duty to evaluate for herself every organization or group that sought help from the Vincent Astor Foundation. In her chauffeur-driven Mercedes-Benz, she traveled all over New York to visit the tenements and churches and neighborhood programs she was considering for foundation grants. Many times a welcoming lunch awaited her on paper plates and plastic folding tables set up for the occasion. She would exclaim over what she called the “delicious sauces”: deli mustard and pickle relish.Because of her philanthropic zeal, major cultural institutions have the Astor name chiseled on their walls. Other gifts went unmarked but not unremembered: "new windows for a nursing home on Riverside Drive, fire escapes for a homeless residence in the Bronx, a boiler for a youth center in the Williamsburg section of Brooklyn."

The Times has created an extensive online tribute to Brooke Astor. You'll find it here.

Monday, August 13, 2007

How to Buy a $1,500,000 Car

According to the multimillionaire buyer of a Bugatti Veyron interviewed for this NY Times column, it's smarter not to pay cash:

According to the multimillionaire buyer of a Bugatti Veyron interviewed for this NY Times column, it's smarter not to pay cash:The companion review in the Times notes that the Veyron is the world's fastest production car. Nevertheless, half the initial production run of 300 vehicles remain unsold.Why would [financier Timothy S. Durham] submit to the paperwork and other obligations of leasing when he could simply write a check for the full amount?

In Mr. Durham’s case, there were two important benefits: he had other uses for the money and, by stretching the payments over several years, he could put off paying some of the sales tax. For a car in this price bracket, taxes alone can run to $130,000 or more, depending on where the deal is struck.

“One of the biggest things is you’re deferring your tax because the sales tax is getting stretched over some period of time,” said Mr. Durham, whose investment firm, Obsidian Enterprises, controls several industrial companies as well as National Lampoon.

Although he expects to buy the Bugatti by the end of the five-year lease term — at an additional cost of several hundred thousand dollars — Mr. Durham said he would rather invest the difference in the meantime. He also said he expected that in coming years the Bugatti would be worth more than he has agreed to pay for it.

One possible reason: The Bugatti brand is being revived by Volkswagen. Although VW also produces Bentleys, it's still thought of as a mass-market manufacturer.

VW's problem is not unlike the challenge facing a mass-market bank when it launches a wealth-management unit catering to people of ultra-high net worth.

P.S. For the price of a Veyron, you could buy ten Audi R8 Quatros.

Friday, August 10, 2007

Read My Lips: "Liquidity" "Risk Assessment"

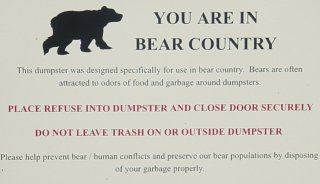

We should have known from the start. The bears have left the campgrounds and headed for Wall Street.

We should have known from the start. The bears have left the campgrounds and headed for Wall Street.The morning after the Dow's first 3% drop, President Bush and his economic advisers marched out to urge investors to stay calm.

Why so much fuss over a 3% drop, not even a third of the way to a market correction?

Did the White House know something the rest of us did not?

In further urging calm this week, the President gave up plain, Texas talk, as The New York Times reported:

Mr. Bush, who has a master’s degree in business administration from Harvard, confidently used phrases like liquidity, risk assessment and market adjustment to describe complex economic conditions. Asked about collapsing housing markets, and the risk of them declining further, Mr. Bush said: “In a way it’s a necessary reaction to a flood of liquidity that came into the market in the past couple years.” That was financial jargon referring to the past several years of easy money, some of it from overseas, at low interest rates.All that liquidity encouraged borrowing against a classically illiquid asset. Most times the owner of, say, a $700,000 home can sell it fairly easily, given good location, etc. Occasionally, though, the real estate market dies. In a few years the house will probably again be saleable for $700,000 or more. But for the moment: no bidders. At any price. That's illiquidity.

Stocks and bonds, by contrast, are liquid assets. They trade daily in volumes our ancestors could not imagine. Investors hopes and fears may cause prices to fluctuate wildly, but marketable securities can always be bought or sold.

Well, almost always. Packages of subprime mortgages and derivative securities suddenly seem as illiquid as . . . houses. From Paul Krugman's NY Times column($):

What’s been happening in financial markets over the past few days is something that truly scares monetary economists: liquidity has dried up. That is, markets in stuff that is normally traded all the time — in particular, financial instruments backed by home mortgages — have shut down because there are no buyers. This could turn out to be nothing more than a brief scare. At worst, however, it could cause a chain reaction of debt defaults.The President expects "risk assessment" (better late than never!) will allow such securities to be traded again. But that assessment could produce a lot of downside volatility and make a lot of hedge funds and investment firms look considerably poorer.

Opportunity knocking?

For investment counselors seeking new clients, volatility is a plus, in moderation. Gyrating markets rattle the cages of affluent investors who, in calmer times, feel disinclined to seek help.

Too much volatility is another story. If investors panic, typically they want to do nothing but sell out and park their cash in money market funds.

If they read this Wall Street Journal story, even MMFs may be too scary. Turns out that some of the commercial paper bought by money market funds was sold by "conduits" and backed by, yes! subprime mortgages.

Wednesday, August 08, 2007

Voice of experience

—Art Buchwald, Too Soon to Say Goodbye, 2006

Tuesday, August 07, 2007

Online Banks Get More Good Press

If you didn't take that question seriously, see Break the bank: Go online in this month's Money magazine.

"A Farewell to Alms"

Clark believes that evolution played an important role.

The change was one in which people gradually developed the strange new behaviors required to make a modern economy work. The middle-class values of nonviolence, literacy, long working hours and a willingness to save emerged only recently in human history, Dr. Clark argues.Why did this happen in England, rather than Japan or China? Because, according to Clark, the wealthiest classes in Japan and China were relatively unfertile, while in England the rich were outbreeding the poor. When that phenomenon was coupled with downward mobility, a middle class was born.Because they grew more common in the centuries before 1800, whether by cultural transmission or evolutionary adaptation, the English population at last became productive enough to escape from poverty, followed quickly by other countries with the same long agrarian past.

In fact, Clark suggests that there might be a genetic component to the behaviors that underlie capitalism. Not very politically correct. I'm going to keep an eye on this one.

Monday, August 06, 2007

Family Megafeud: A Matter of Trusts?

It sounded like a scene from a bad spy novel: a former MIT professor and wealthy businessman is ambushed in a dark parking lot and shot by two masked men with Russian accents.The professor said his son arranged the hit. The son and his siblings say dad faked it.

At first, John J. Donovan Sr. seemed to be the victim of a harrowing attempt on his life. Five months later, he was indicted for allegedly making it all up.

The financial stakes? Control of various trusts holding a fortune in New England real estate.

This wasn't the first time Professor Donovan claimed his kids were attempting to kill him. You can read the back story in the Boston Globe archive (subscription).

Donovan's bench trial began today in Cambridge Superior Court:

He is accused of falsely claiming that two men attacked him on the night of Dec. 16, 2005, as he left his Cambridge company and then telling investigators that he believed his son James orchestrated the shooting. Prosecutors allege that the Hamilton resident carefully composed the crime scene in which a car window was shattered by a bullet and spent .22-caliber cartridges were scattered in the parking lot to make it appear that he had been targeted for murder by his family.

One Picture is Worth a Thousand C.D.O.s

Excellent example: This Spectator's Guide to Housing Busts and Hedge Fund Meltdowns, created by Bill Marsh and Vikas Bajaj for The New York Times.

Sunday, August 05, 2007

Affluent Families Having More Kids

In Darien and other affluent suburbs, according to NPR's Weekend Edition, the ability to afford child-rearing expenses and Ivy League tuitions has become a status symbol. To display that status baby-wise, 4 is the new two.

Ain't it grand? Twice as many trust fund babies!

IRS Gets Tough on 'Rollover' Time Limits

Lots of people do, and the IRS has been tolerant of those who mess up and miss the 60-day deadline. No longer, according to this Wall Street Journal item (subscription):

Until recently, the IRS had a soft spot for people who broke the 60-day rule. If a person could show that he or she intended to complete the rollover within the specified period -- but had fallen victim to a bank's error, for example -- then the investor often was given time to complete the transfer without penalty.Wealth managers may need to warn some clients not to take the 60-day rule lightly.

More recently, though, says Ed Slott, an IRA consultant in Rockville Centre, N.Y., Uncle Sam has been denying requests for extensions. That's because investors, according to Mr. Slott, are using withdrawals for a variety of purposes and can't prove that "a true intent to do a rollover" existed in the first place.

"A few million doesn't go as far as it used to."

It's all a matter of context (others are making more), and experience, evidently.

Yet like other working-class millionaires of Silicon Valley, she harbors anxieties about her financial future. Ms. Baranski — who was briefly worth as much as $200 million in 2000 but cashed out only $1 million before the collapse of the tech bubble — returned to work in March.

That's a lot to lose, even if only on paper.

Saturday, August 04, 2007

Private Trust Companies are Multiplying

"It isn't enough to have a trust fund any more," writes Rachel Emma Silverman in The Wall Street Journal (subscription). "The next step is to have your own trust company."

"It isn't enough to have a trust fund any more," writes Rachel Emma Silverman in The Wall Street Journal (subscription). "The next step is to have your own trust company."A small but increasing number of the super rich are setting up their own trust companies -- boutique trust firms owned or controlled by wealthy families themselves. Some want more say over how their trust assets are handled; others want to consolidate a bunch of family trusts under one umbrella.

This isn't a game for the average trust-fund baby. Families typically should have at least $100 million to set one up, and most that do have at least $250 million. Experts estimate there are only a couple hundred private trust companies in the U.S.

Still, their numbers have increased in the past decade as trust lawyers begin to tout their benefits. John P.C. Duncan, a Chicago lawyer who specializes in private trust companies, is setting up 16 this year, compared with only five four years ago. The South Dakota Trust Co., Sioux Falls, which provides back-office and other services for private trust companies, is helping to administer 12 private trust companies this year, up from five last year.The last wave of private trust companies crested about a century ago, as the tycoons of the Gilded Age planned their estates. Bessemer Trust, for instance, was founded by Andrew Carnegie's steel-company partner, Henry Phipps.

A generation ago, Bessemer began seeking non-Phipps clients. Will a new wave of trust companies go non-private in this century?

Friday, August 03, 2007

Winners For a Few Hedgies, Wedgies For Others

Making the wrong bets, alas, has been causing hedgies headaches around the world, as Reuters reports here.

That didn't stop a whole herd of hedgies from gathering at the Wynn Las Vegas Resort recently. You can read all about it in the Time report, Hedge Fund Confidential.

Chocoholic postscript

Circa 1920, before my father gave up half ownership of a Stutz Bearcat for marriage, he enjoyed a brief career on Wall Street. Something about cocoa. He'd be gratified to know that at least one hedgie says cocoa is again a hot commodity:

"[D]emand continues to be strong across the board, along with new demand for dark chocolate because of the health benefits of flavanols. Dark-chocolate sales in Britain alone are up 25% this year."

Like Full Body Armor?

American Civil Liberties Union with

all the rights and privileges of Membership