Op-ed in yesterday's New York Times:

No Accounting Skills? No Moral Reckoning

Business news item in today's New York Times:

Bank Finds a Mistake: $4 Billion Less Capital

Tuesday, April 29, 2014

Monday, April 28, 2014

The Age of Asset Management

Finally got around to reading Bloomberg Businessweek's Asset Managers are the New Banks. Should have been more prompt.

Read Haldane's speech. Conventional asset management, where funds are managed by stock and bond pickers, is being squeezed between high-cost alternatives, such as hedge funds and private equity, and low-cost index funds and ETFs. Old-fashioned prudent investing seems to have succumbed to the temptation of market timing. Just like the much maligned small investor, many pension funds tend to buy high, sell low.

The good news: Asset management should continue to boom globally. "In China and India, personal financial assets have grown at a rate of 25% per year for the past 20 years."

One of the more disquieting parts of covering banking regulation is how often, in an interview, either a regulator or a banker will say something like this: Regulators have to treat banks with some respect. If they clamp down too hard, the money will go somewhere else, to a place we only dimly understand. Beyond the banks, the logic goes, there be monsters.

In a speech last week to a group of asset managers in London, Andrew

Haldane, in charge of financial stability for the Bank of England, began to map out the land of the monsters. The number of people saving money in the world has grown larger, older, and richer, he said. Life expectancy is rising—as is population and per-capita GDP. And all these rich old people need to put their savings somewhere. It is not going into savings accounts but instead into a category known as assets under management, or AUM: pension funds, exchange-traded funds, hedge funds, private equity.

AUM in the U.S. was about half of GDP in the 1940s; it has now grown to almost two and a half times GDP.

Read Haldane's speech. Conventional asset management, where funds are managed by stock and bond pickers, is being squeezed between high-cost alternatives, such as hedge funds and private equity, and low-cost index funds and ETFs. Old-fashioned prudent investing seems to have succumbed to the temptation of market timing. Just like the much maligned small investor, many pension funds tend to buy high, sell low.

The good news: Asset management should continue to boom globally. "In China and India, personal financial assets have grown at a rate of 25% per year for the past 20 years."

Saturday, April 26, 2014

The Status of Tax Reform

Carl Hulse in The New York Times:

As Congress prepares to return from a two-week spring break on Monday, the capital is frozen in the shadow of the midterm elections, with large tasks such as revising the tax code dismissed with hardly a hearing.

Thursday, April 24, 2014

Executors and Their Troubles

| ||

| Oleg Cassini |

Thereafter Cassini's widow seems to have lost interest in settling the estate. A Manhattan probate judge has suspended her as executor, pending a decision as to whether she should be replaced.

Fireman's executor overwhelmed. Nearly three years after a volunteer fireman in New Jersey died, "none of the beneficiaries have received their disbursements from his estate. The lack of action — and alleged dearth of communication with the executor — prompted borough officials to file a lawsuit compelling executor John Benensky of Madison to fulfill his fiduciary duty and give a formal accounting of the estate."

The estate includes a business and is valued at over $1 million. Agreeing to serve, says the overwhelmed executor, was "a spur of the moment” decision. He had no idea the job would be so complicated.

Replaced executor fights for the job. A few months before she died, an elderly widow executed a codicil to her 2010 will. Her amendment made no changes to the disposition of her $22 million estate; the codicil merely replaced the lawyer she had named as her executor with three new co-executors.

After the widow's death the lawyer fought to regain his appointment as executor (and as successor trustee of the widow's living trust). Failing in probate court, he appealed. Now the appeals court has rebuffed him:

A person who was named as an executor in a will cannot contest a codicil by which the testator named someone else to that position.

•

Estate settlement is a task that sometimes involves big money and often stirs strong emotions. Maybe naming a dull, disinterested bank as executor isn't such a bad idea.Wednesday, April 23, 2014

Happy 450th, Will!

William Shakespeare was born 450 years ago today, and we're still not too sure what he looked like. Wikipedia illustrates these three candidates.

More certain, according to the Financial Times, is that the Bard was a better entrepreneur and investor than most playwrights.

Related post: Brush Up Your Shakespeare – and See His Last Will

More certain, according to the Financial Times, is that the Bard was a better entrepreneur and investor than most playwrights.

Related post: Brush Up Your Shakespeare – and See His Last Will

Tuesday, April 22, 2014

Remembering Alex Porter and “Hedged” Funds

Alex Porter, who worked at the first hedge fund, A. W. Jones & Co., and later ran his own successful firm, died April 18.

As one of “the last practitioners from the A.W. Jones era,” Porter carried the long-ago notion of a “hedged” fund as one that is “long and short and thereby inured to the vicissitudes of the overall market,” said James Grant, a friend and colleague who publishes Grant’s Interest Rate Observer.For Porter, less volatility didn't mean lesser performance. From 1976 until 1993, his first fund reportedly generated a net compound annual return of about 20 percent .

Today, by contrast, the term “hedge” suggests “leveraged and long” investing, he said, which often amplifies rather than cushions market swings.

Monday, April 14, 2014

Bulls, Bears and Bucks

|

| Bull and Bear at Frankfurt Stock Exchange |

The financial world is a veritable zoo, Forsyth observes: dogs and pigs (who get slaughtered) and penguins and black swans and, of course, bulls and bears.

Our founder, Merrill Anderson himself, pointed out that nest eggs are fake. Forsyth concurs:A 1490 edition of Aesop’s Fables contains an extra story never seen before. It’s about two guys who make a deal to sell a bearskin to apes, before having actually obtained a bear. They reckon that bear hunting must be easy, but when it’s time to hunt they both flee in fear, one climbing a tree and the other playing dead.The moral of the fable: Don’t sell the skin till you have caught the bear. Any financier, though, will recognize the principle of the naked short. This maxim was so well known in the 18th century that those who sold speculatively were known as bearskin jobbers, and then simply as bears

The nest egg that we’re taught to store away? It is a perfectly real thing among chicken farmers, who insert a fake egg into a nest. The hen won’t leave until the egg hatches, and in the meantime she lays a bunch of real eggs of her own. Thus the nest egg is the capital, the real egg’s the interest.Like to make a few bucks? "The only reason that anyone has ever made a buck," Forsyth writes, "is that Native Americans had no interest in coins or checks, and preferred to be paid in buckskins."

Sunday, April 13, 2014

The Art of Saving Sales or Use Tax

At Business Insider, 9 Pieces of Good Advice From Notorious Business People reminded me of Tyco's former CEO, Dennis Koslowski, and his tax evasion conviction.

At Business Insider, 9 Pieces of Good Advice From Notorious Business People reminded me of Tyco's former CEO, Dennis Koslowski, and his tax evasion conviction.To avoid New York State sales tax, Koslowski had paintings that he or his wife purchased for his New York apartment (the one with the $6,000 shower curtain) shipped to his New Hampshire home. The shipments turned out to be empty boxes.

Even if Koslowski (who recently finished his jail term for his misbehavior at Tyco) had been a New York resident who purchased art in another state, he would have been subject to NY use tax. Today's art collectors are luckier.

As The New York Times reports, collectors have discovered a "send it out of state" strategy that works. See Buyers Find Tax Break on Art: Let It Hang Awhile in Oregon.

To avoid use tax, purchased artworks are shipped to museums in Oregon or other tax friendly states (New Hampshire qualifies) on loan. After a period on exhibit, the purchases drift home tax free. The Times diagrams it for you here.

Marketing Wall Street to Mad Men

As Mad Men begins its last season (actually, its penultimate half season) brush up on the era with three ads from April, 1969.

By 1969 growth stocks had become a craze. So-called Gunslingers frantically traded speculative go-go stocks, creating avalanches of paper that overwhelmed brokers' back offices. Merrill Lynch ran this apologetic ad. "Paperwork, we've got it …. And, quite frankly, service problems, too."

The surge in growth stocks reflected real economic progress. Many a Salaried Man, including those in advertising and network TV, went from entry-level affluent to investment-management prospect. Merrill Anderson produced this ad for U.S. Trust, featuring a clever John Northcross illustration.

Not everyone approved of members of the Greatest Generation who became salaried men. Where was their get up and go, their entreprenurial spirit? Happily, many did launch businesses and some succeeded beyond their expectations. They were the target market for this Chemical Bank ad:

By 1969 growth stocks had become a craze. So-called Gunslingers frantically traded speculative go-go stocks, creating avalanches of paper that overwhelmed brokers' back offices. Merrill Lynch ran this apologetic ad. "Paperwork, we've got it …. And, quite frankly, service problems, too."

The surge in growth stocks reflected real economic progress. Many a Salaried Man, including those in advertising and network TV, went from entry-level affluent to investment-management prospect. Merrill Anderson produced this ad for U.S. Trust, featuring a clever John Northcross illustration.

Not everyone approved of members of the Greatest Generation who became salaried men. Where was their get up and go, their entreprenurial spirit? Happily, many did launch businesses and some succeeded beyond their expectations. They were the target market for this Chemical Bank ad:

Saturday, April 12, 2014

Today the blog begins its tenth year

The first post was nine years ago today. We've had nearly 2,500 posts, of which I'd guess at least 80% must be credited to JLM. Certainly, all the best posts, the ones that have attracted the most hits for the blog, are his, according to Google Analytics. His post at the end of March on Paul Krugman and estate taxes had 120 page views within a week. Sure, the Instapundit does that in an average minute, but he's writing for the whole universe. My posts take years to break into three figures for page views.

Thanks again, JLM, for sharing your thoughts and your wisdom!

Thanks again, JLM, for sharing your thoughts and your wisdom!

Thursday, April 10, 2014

Life and Taxes in Mad Men Days

Mad Men starts its last season Sunday. Heralding the event is a poster by a real Mad Man, Milton Glaser, still active at 84.

Times Machine, the new, improved portal to New York Times archives going all the way back to the 1800's, offers subscribers an easy way to relive Mad Men days. I'm struck by how the ads tell you as much about the era as the articles.

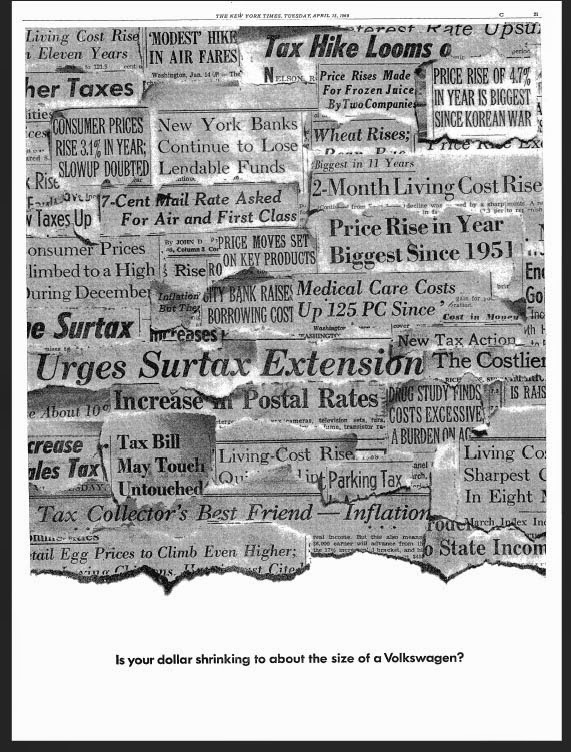

Here, for instance, is an offbeat Volkswagen ad from tax time, 1969.

The Consumer Price Index had increased by less than 2% a year from 1958 through 1965, so the 4% rise in 1968 was cause for alarm. These days, believers in growth through inflation might welcome it.

Times Machine, the new, improved portal to New York Times archives going all the way back to the 1800's, offers subscribers an easy way to relive Mad Men days. I'm struck by how the ads tell you as much about the era as the articles.

Here, for instance, is an offbeat Volkswagen ad from tax time, 1969.

The Consumer Price Index had increased by less than 2% a year from 1958 through 1965, so the 4% rise in 1968 was cause for alarm. These days, believers in growth through inflation might welcome it.

Tuesday, April 01, 2014

How Low Should the CFPB Stoop?

From American Banker, How the CFPB Seeks to Shape the Message.

Some of the actions the CFPB makes, like late night embargoes, are also strategies frequently employed by banks…. But that, say critics of its public relations tactics, is precisely the point. The CFPB should be held to a higher standard….

Subscribe to:

Posts (Atom)