I've been struck by the fact that high-visibility billionaires such as Bill Gates Sr. and Warren Buffett have been very vocal about keeping the estate tax. Forces in favor of repeal have appeared to be largely the affluent but not super-rich business owners and farm families.

But according to a new report from Public Citizen much of the push for estate tax repeal has come from 18 "super-wealthy" families who have disguised their actions through creation and funding of business and trade associations.

The effort to repeal the estate tax this year appeared stalled; it will be interesting to see if this new study has political repurcussions.

Saturday, April 29, 2006

Saturday, April 22, 2006

Sorry, A. G. Edwards. There's a better way to care for nest eggs

A. G. Edwards' nest-egg ad campaign pales in comparison with the original, conducted a half-century ago, not by a brokerage but by a trust institution: Chase Manhattan Bank.

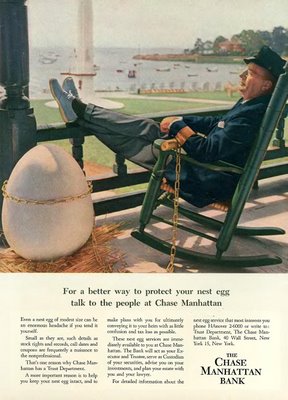

"For a better way to protect your nest egg, talk with the people at Chase Manhattan." The campaign was probably the most attention-grabbing ever conducted to promote trust services.

The ads ran from the 1950's well into the 1960's and seem to be vintage collectibles now. Here's one I spotted on eBay:

Here's a high-resolution version of another. Unlike the owners of A. G Edwards' nest eggs, who are likely to let them roll down the street or allow them to be run through MRI units, the affluent folks of fifty years ago played it safe. They kept their nest eggs securely shackled to their persons.

Wish I remembered what agency did the campaign. Can any senior citizens with sharp memories help out?

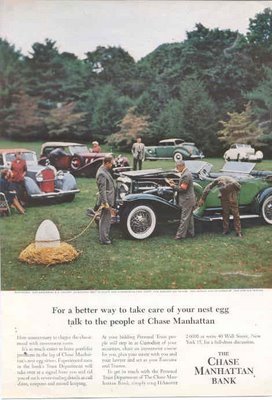

The agency did a great job of keeping the campaign going by finding ever more-intriguing, upscale settings. An antique auto show, in this example:

"For a better way to protect your nest egg, talk with the people at Chase Manhattan." The campaign was probably the most attention-grabbing ever conducted to promote trust services.

The ads ran from the 1950's well into the 1960's and seem to be vintage collectibles now. Here's one I spotted on eBay:

Here's a high-resolution version of another. Unlike the owners of A. G Edwards' nest eggs, who are likely to let them roll down the street or allow them to be run through MRI units, the affluent folks of fifty years ago played it safe. They kept their nest eggs securely shackled to their persons.

Wish I remembered what agency did the campaign. Can any senior citizens with sharp memories help out?

The agency did a great job of keeping the campaign going by finding ever more-intriguing, upscale settings. An antique auto show, in this example:

Friday, April 21, 2006

Stuart Lucas: Carnation heir, wealth manager, author

Stuart Lucas has authored what sounds like a serious discussion of managing wealth. You can check him out in a Business Week video. He also has a web site.

His book is called Wealth : Grow It, Protect It, Spend It, and Share It. Follow the link and you can leaf through it. (Don't you love that feature at Amazon?)

His book is called Wealth : Grow It, Protect It, Spend It, and Share It. Follow the link and you can leaf through it. (Don't you love that feature at Amazon?)

Thursday, April 20, 2006

How to gain new investment management clients

On CNBC's Power Lunch today, they mentioned that wire-house brokers have a problem. Boomers are increasingly deciding to seek investment help from independent advisers, not brokers. Independent advisers now have an estimated 14% of the market.

Actually, affluent boomers should be flocking to the wealth managers at trust institutions. Reason, the robust list of advantages that Bill Ottinger summerized recently in Trusts & Investments.

Ready, set, memorize!

If you're with a community institution, you can offer those advantages with the same personal touch as an independent adviser. If you're part of a megabank, you'll have to work at making your services as human and accessible as possible. Anybody got any tips for success?

Actually, affluent boomers should be flocking to the wealth managers at trust institutions. Reason, the robust list of advantages that Bill Ottinger summerized recently in Trusts & Investments.

Ready, set, memorize!

• portfolio managers who are not driven by the sale of specific products to earn personal compensation

• portfolio managers who are full-time investment professionals, not salespeople pushed to meet sales quotas

• performance-based fees as opposed to sales commissions and hefty bond spreads, i..e., wealth management shares part of the cost risk—“We sit on the same side of the table as our clients.”

• low institutional trading costs for clients on both equities and bonds with no sales commissions, markups, or profit to the bank

• bond selection that is not limited to in-house inventories or the necessity to sell available high-spread bonds to generate sales commissions; the advantage for clients: increased objectivity

• the luxury of ‘staying power’ in portfolios; if portfolio performance is positive, theris no pressure to make trades simply to generate new revenue and sales commissions, so portfolio managers maintain longterm objectivity in managing client assets

• absence of unwarranted risk or speculation in client portfolios, plus the assurance that on-site audits and examinations by external and internal examiners are an annual occurrence

If you're with a community institution, you can offer those advantages with the same personal touch as an independent adviser. If you're part of a megabank, you'll have to work at making your services as human and accessible as possible. Anybody got any tips for success?

Choosing your kid's guardian is hard, but adding a trust may help

In her Fiscally Fit column in today's Wall street Journal, Terri Cullen offers a first-hand report on the difficulty of choosing the right guardian for a child. What if the best choice isn't necessarily the most affluent or financially responsible member of the family?

After some deliberation, Gerry and I decided to update our will and name Melissa and Joe as Gerald's guardians. Still, we worried that they might be in over their heads when it came to managing Gerald's inheritance. Pulling yourself out of a few thousand dollars in debt is one thing; managing hundreds of thousands of dollars in assets over decades of our son's lifetime is something else.Terri notes that she and her husband had found it easy to put off estate planning, until September 11, 2001. More than three dozen residents of their New Jersey town died in the World Trade Center.

Estate-planning attorney Stuart Schneider recommended that we take the additional step of setting up a testamentary trust -- a trust whose terms are set within a will, and which doesn't take effect until you die. Should we die, assets such as our retirement savings and life-insurance payout, as well as proceeds from the sale of our home and other physical assets, would be held in trust and managed by a family member or another trusted person as trustee. The trustee would decide on a budget for Melissa to pay Gerald's continuing costs, and decide whether requests for larger expenditures make sense.

Monday, April 17, 2006

Time to exit the bond market?

That's what some of the pros seem to think. As the yield curve comes out of its inversion, investors at the longer end of the spectrum are losing money.

The average long-term-government-bond fund had lost 2.25% in the past four weeks and 4.23% in the past three months, according to Chicago-based Morningstar Inc.

Saturday, April 15, 2006

Did you know the Titanic sank on April 15th?

Trivia from today's Wall Street Journal:

"April 15 is officially tax day, but it is also: Leonardo da Vinci's birthday, the day Abraham Lincoln died, the day General Electric was incorporated, the day the Titanic sank and the day that McDonald's served its first hamburger. "

"April 15 is officially tax day, but it is also: Leonardo da Vinci's birthday, the day Abraham Lincoln died, the day General Electric was incorporated, the day the Titanic sank and the day that McDonald's served its first hamburger. "

Friday, April 14, 2006

Keep paying until April 26

That's "Tax Freedom" day this year, calculated byThe Tax Foundation. It seems like just two or three years ago that Tax Freedom day was April 16, the earliest date in the last quarter century for fulfilling our obligations to the government.

According to Bruce Bartlett, citing a different Tax Foundation study, 24% of Americans think that the appropriate aggregate tax burden should be less than 10% of person's income. 43% vote for 10% to 20%, and 22% say no more than 30%. Put another way, fully 89% of the country believes that the government claim on family income should not exceed 30%.

Which is just about where the aggregate tax burden is, at 28.5% of GDP.

Ah well, at least we're not quite at the modern record, set in 2000, of a Tax Freedom day of May 3. But if the Congress continues to dither about the Alternative Minimum Tax, that could quickly change.

According to Bruce Bartlett, citing a different Tax Foundation study, 24% of Americans think that the appropriate aggregate tax burden should be less than 10% of person's income. 43% vote for 10% to 20%, and 22% say no more than 30%. Put another way, fully 89% of the country believes that the government claim on family income should not exceed 30%.

Which is just about where the aggregate tax burden is, at 28.5% of GDP.

Ah well, at least we're not quite at the modern record, set in 2000, of a Tax Freedom day of May 3. But if the Congress continues to dither about the Alternative Minimum Tax, that could quickly change.

If things are so bad, then why are they so good?

That's the observation Larry Kudlow concludes this commentary with, linking to a Forbes piece by Rich Karlgard.

Apparently roughly 60% of Americans think that the economy is doing poorly. Which is hard to reconcile with:

• GDP growing at 3.7%;

• unemployment persistently well below 5%, a feat once thought impossible;

• the budget deficit, as a percentage of GDP, is at the middle of the range over the last 30 years.

Karlgard concludes that we're mostly uncomfortable with the accelerating rate of change, a phenomenon that shows no sign of slowing.

Change is certainly a two-edged sword.

Apparently roughly 60% of Americans think that the economy is doing poorly. Which is hard to reconcile with:

• GDP growing at 3.7%;

• unemployment persistently well below 5%, a feat once thought impossible;

• the budget deficit, as a percentage of GDP, is at the middle of the range over the last 30 years.

Karlgard concludes that we're mostly uncomfortable with the accelerating rate of change, a phenomenon that shows no sign of slowing.

Change is certainly a two-edged sword.

An unqualified endorsement

I am the proud new owner of one of the Intel-based iMacs. It is terrific. Front Row, the new application for displaying photos or listening to iTunes, has the bugs worked out, so far as I can tell.

And the Internet seems to go so much faster now.

And the Internet seems to go so much faster now.

Thursday, April 13, 2006

Unitrusts: a nice idea that doesn't work?

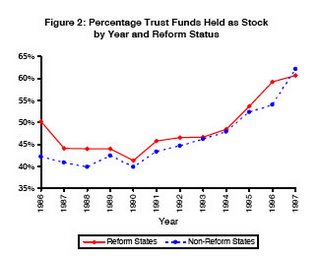

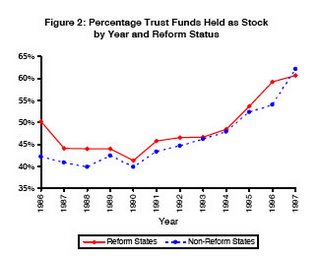

When I read the study linked by Jim Gust in a recent post, Prudent Investing of Trust Assets, I realized I shouldn't have skipped that Statistics course. Still, it looks like the introduction of the reform known as the Uniform Prudent Investing Act in some states had little effect on the more general growth o t stocks as trust investments.

t stocks as trust investments.

Too bad the authors of the study couldn't find useful data for the 1998-2004 period, when unitrusts began to get more recognition. But I'm guessing the lines on the chart shown here would have simply moved on up, with little divergence, through 1999, then headed down.

I've assumed that unitrusts were a useful idea, expecially in recent years, when both bond yields and dividend yields gave income beneficiaries slim pickings. But that was before I came across this article from last year's Real Property, Probate and Trust Journal, by Joel C. Dobris.

The author's particular quarrel is with the widely-used unitrust withdrawal rate of 5%. Dobris rightly argues that the rate is too high and likely to shortchange the remainder beneficiaries in the long run.

If Dobris writes short articles, this isn't one of them. Even so, give it a read when you have time. He touches on a lot of the psychological quirks that lead investors, and trust settlors, to illogical assumptions.

t stocks as trust investments.

t stocks as trust investments.Too bad the authors of the study couldn't find useful data for the 1998-2004 period, when unitrusts began to get more recognition. But I'm guessing the lines on the chart shown here would have simply moved on up, with little divergence, through 1999, then headed down.

I've assumed that unitrusts were a useful idea, expecially in recent years, when both bond yields and dividend yields gave income beneficiaries slim pickings. But that was before I came across this article from last year's Real Property, Probate and Trust Journal, by Joel C. Dobris.

The author's particular quarrel is with the widely-used unitrust withdrawal rate of 5%. Dobris rightly argues that the rate is too high and likely to shortchange the remainder beneficiaries in the long run.

If Dobris writes short articles, this isn't one of them. Even so, give it a read when you have time. He touches on a lot of the psychological quirks that lead investors, and trust settlors, to illogical assumptions.

Monday, April 10, 2006

When she died, was Marilyn Monroe a Californian or a New Yorker?

The answer to that question could be worth millions, as explained in "A battle erupts over the right to market Marilyn."

The reason: unlike copyrights, which are protected by federal law, publicity rights are a creature of state laws, resulting in a legal patchwork. Some states, including New York, refuse to acknowledge or protect the publicity rights of dead celebrities, so they cannot be bequeathed in a will. California does grant postmortem publicity rights, making it possible for heirs to pursue profits for decadeAnd where was Marilyn Monroe's will probated? New York!

Sunday, April 09, 2006

"Sell me a more expensive index fund, please!"

From time to time the Senior Assistant Blogger sounds off about the high expenses imposed on investors. Here's a good reason to pay him no heed, from Mark Hulburt's column in The New York Times:

MANY index funds track the Standard & Poor's 500, but they differ from one another in one major respect: their fees. You'd think that it would be obvious to investors to pick the fund that charges the least. But you'd be wrong.If the best and brightest at our graduate schools of business can't grasp mutual fund costs, what chance has the average investor?

In fact, this truth was anything but obvious to a group of elite students. In an elaborate simulation created by several researchers, many students at Harvard and the Wharton School of the University of Pennsylvania failed to select the lowest-cost index fund for their portfolios, even when they were all but spoon-fed the right answer.

Friday, April 07, 2006

Financial Advice for the 'Mass Affluent'

Plenty of food for thought in this New York Times article, "Financial Advice for the 'Mass Affluent'."

Some 22 million American households have between $100,000 and $1 million to invest. Many of them will be joining the ranks of U.S. millionaires.

"These investors don't want packaged products, " says financial planner Debra Brede. "They want a tailored suit at a good price. They want value. This segment is so underserved that they are turning to their accountant or insurance agent for financial assistance and they end up getting sold whole life insurance instead of a personalized financial plan."

Many Mass Affluents don't see themselves as Merrill Lynch clients. They're not likely to look up the brokerage or wealth-management people at a large bank, either.

How can these households be provided with the the long-term guidance they want and need?

How can they be served without high fees and commissions that eat up too much of their nest eggs?

What marketing tools can be devised to attract these investors in a cost-controlled manner?

(Hey, nobody said this business was easy!)

Some 22 million American households have between $100,000 and $1 million to invest. Many of them will be joining the ranks of U.S. millionaires.

"These investors don't want packaged products, " says financial planner Debra Brede. "They want a tailored suit at a good price. They want value. This segment is so underserved that they are turning to their accountant or insurance agent for financial assistance and they end up getting sold whole life insurance instead of a personalized financial plan."

Many Mass Affluents don't see themselves as Merrill Lynch clients. They're not likely to look up the brokerage or wealth-management people at a large bank, either.

How can these households be provided with the the long-term guidance they want and need?

How can they be served without high fees and commissions that eat up too much of their nest eggs?

What marketing tools can be devised to attract these investors in a cost-controlled manner?

(Hey, nobody said this business was easy!)

Thursday, April 06, 2006

The Fed looks at the wealthy. Read all about it

Check out Currents and Undercurrents: Changes in the Distribution of Wealth, 1989-2004 for all you need to know about the size and shape of your market.

Looking for business from the cream of the market, the top 1% of wealthholders? Then you're looking for those with a minimum of $6 million!

Looking for business from the cream of the market, the top 1% of wealthholders? Then you're looking for those with a minimum of $6 million!

Wednesday, April 05, 2006

Prudent investing of trust assets

In 1994 the Uniform Prudent Investor Act (UPIA) was promulgated, and has since been adopted in 49 states. UPIA includes an explicit duty to diversify trust assets, and provides that a “trustee’s investment and management decisions respecting individual assets are evaluated not in isolation, but in the context of the trust portfolio as a whole and as a part of an overall investment strategy having risk and return objectives reasonably suited to the trust.”

UPIA applied to existing trusts as well as trusts created after its adoption. If prior law constrained professional fiduciaries and encouraged overly conservative investments, the change in law could have led to a shift in investment strategies as the constraints were removed. Is that what happened?

That’s the question that law professors Max M. Schanzenbach and Robert H. Sitkoff examined in “Did Reform of Prudent Trust Investment Laws Change Trust Portfolio Allocation?” (December 2005,).

Study results

The professors crunched data from the Federal Financial Institutions Research Council and the FDIC for the period from 1986-1997, so investment practices from before and after UPIA adoption are represented. These reports break down trust holdings into ten categories. One of these categories includes stocks and mutual fund shares. Following exhaustive statistical analysis, the professors concluded that:

• After a state adopted UPIA, the gross stock investments of trusts increased by from 1.5% to 4.5%, compared to states that had not yet reformed their law.

• Before reform, stock investments averaged 41% of trust assets, and after reform the share rose to 47%.

• During the period studied there was also a strong shift toward stocks independent of the adoption of UPIA, an increase of from 10 to 17 percentage points. This may be attributable in part to the bull market during the study period.

UPIA applied to existing trusts as well as trusts created after its adoption. If prior law constrained professional fiduciaries and encouraged overly conservative investments, the change in law could have led to a shift in investment strategies as the constraints were removed. Is that what happened?

That’s the question that law professors Max M. Schanzenbach and Robert H. Sitkoff examined in “Did Reform of Prudent Trust Investment Laws Change Trust Portfolio Allocation?” (December 2005,).

Study results

The professors crunched data from the Federal Financial Institutions Research Council and the FDIC for the period from 1986-1997, so investment practices from before and after UPIA adoption are represented. These reports break down trust holdings into ten categories. One of these categories includes stocks and mutual fund shares. Following exhaustive statistical analysis, the professors concluded that:

• After a state adopted UPIA, the gross stock investments of trusts increased by from 1.5% to 4.5%, compared to states that had not yet reformed their law.

• Before reform, stock investments averaged 41% of trust assets, and after reform the share rose to 47%.

• During the period studied there was also a strong shift toward stocks independent of the adoption of UPIA, an increase of from 10 to 17 percentage points. This may be attributable in part to the bull market during the study period.

Saturday, April 01, 2006

A suspicious will, a not-quite widow, and now—murder!

From the front page of the Portsmouth, New Hampshire Herald comes this story. (Remember, Peyton Place was set in New Hampshire!)

From the front page of the Portsmouth, New Hampshire Herald comes this story. (Remember, Peyton Place was set in New Hampshire!)Police suspect Sheila LaBarre murdered a recent arrival at her Epping, New Hampshire farm, inherited from her late "husband," and burned up the body.

While they look for her, a number of questions remain unanswered.

Did the late Wilfred LaBarre really intend to disinherit his kids? If so, why did he leave money for them hidden around his house? And how did Sheila LaBarre find that money if she was off living with another guy?

We'll just have to wait for futher chapters in the saga.

Subscribe to:

Posts (Atom)