Last spring the first post on the Trust and Wealth Management Marketing blog concerned Apple computer. So it's none too soon to go slightly off-topic again.

Last spring the first post on the Trust and Wealth Management Marketing blog concerned Apple computer. So it's none too soon to go slightly off-topic again.For Christmas your Senior Assistant Blogger received an iPod. Not a video one, not even a Nano. Just a big, old, monochrome-screen iPod. I was expecting something clunky. Instead, there in my hand was a white-and-silver art object of surpassing beauty, demanding to be caressed and cherished. Wow!

Now I see why Apple's market value has soared past Dell's. And why Jonathan Ive, the London-born designer of the iPod, was just honored by his Queen.

The lesson of the iPod, I guess, is that sometimes form is function, and I'm not sure how that applies to marketing financial services. But I do detect a useful reminder in Steve Jobs’ successful marketing of Macintosh computers.

The new "Intel inside" iMacs Steve announced last week run twice as fast as the previous G5 model. The new MacBook laptop is said to run four or five times as fast as the G4 Powerbook it replaces. Yet it wasn't that long ago that Steve was tweaking test statistics to demonstrate that the old models were just as fast as Intel PCs for practical purposes. And the old models were so cool, so convenient and relatively reliable to use, that folks were willing to believe the hyperbole. Macs survived and began to prosper.

Reminds me of our old friend Knute Alphanot, at Lake Woebegone B&T. His trust department's investment performance is never more than mediocre (though rarely less than). But Knute has a winning way of adjusting his returns for volatility, currency fluctuations, and maybe even windage. By the time he's through, he can show his clients he's always above average. Top Quartile, usually.

OK, maybe most of the clients don't believe him. But as many a consultant has pointed out, you can get away with merely decent investment performance if you do the very best you can for your clients in all other respects. Knute's department runs like a Rolex, and client communications — from thoughtful notes and phone calls to newsletters and seminars — are never neglected.

Moral: You don't need great investment returns as long as you offer your clients insanely great service. Make them feel as cherished as . . . an iPod!

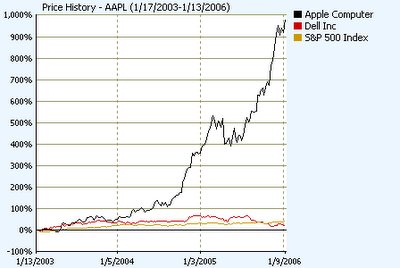

P.S. I hope your investment people bought Apple, not Dell!

No comments:

Post a Comment