Mr. Rogerson, 51, the father of two girls and two boys, has them off to an early start. Six years ago, when they ranged in age from 5 to 15, he and his wife decided to entrust them with $5,000 each year. The children were to invest the money, which would be used for the family’s summer vacation. If the fund prospered, they might “go to Disney World,” he said. “If it stayed flat, we would go around the country and visit family members,” he added. “If the investment fell, there was always a camping trip.”Presumably, Mr. Rogerson was teaching his kids how not to invest. (Surely he wouldn't have gambled a BNY Mellon client's money on stocks as a short-term investment.) With luck, they have learned that equities should be held for the long term.* * *Mr. Rogerson turned his kids into investing guinea pigs in 2001 — a bad year for the domestic stock market, as it turned out. “The kids knew nothing,” he recalled. “They bought stocks like Apple and Hasbro and all these penny stocks at high-tech and toy companies. Their pile went down from $5,000 to $2,000.” That year, he said, “we went camping.”

During the second year, the children were so nervous about “putting Mom and Dad back in a tent again that they eventually put all the money in money market accounts,” he said. “They made $50,” he added. “That year we drove down to Florida to visit family. “Since we were six people, we stayed at Holiday Inns along the way. We spent the money on motels, food and entertainment. My father lived in Daytona and my wife’s mother lives in Naples. Along the way, the kids made decisions about what kinds of restaurants we could go to.”

By the third year, the investing bug had bitten, and the children wondered, “How do we invest so maybe we can do something more fantastic?” he said. They had stocks that were more conservative: a diversified portfolio that included large-capitalization stocks. They also had fixed-income investments like bonds. The young investors earned $600 on their $5,000 that year, and the family rented a catamaran and went boating near Mystic, Conn. (choosing it over Disney World).

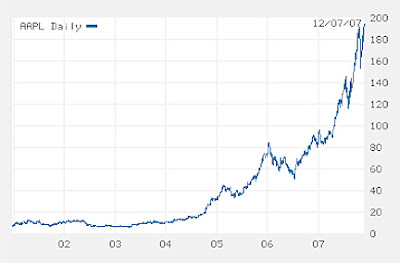

Example: Look what would have happened if the family had skipped its 2001 vacation and held onto the shares of Apple:

1 comment:

Love the Apple chart. I bought a few hundred shares of apple before Jobs returned. Had I kept it up for several years, I could have retired now.

Post a Comment