– Nathan Meyer Rothschild, 1834

Wednesday, August 27, 2008

Rothschild's Recipe for Wealth

“It takes a great deal of boldness and a great deal of caution to make a great fortune; and when you have got it, it requires ten times as much wit to keep it.”

Tuesday, August 26, 2008

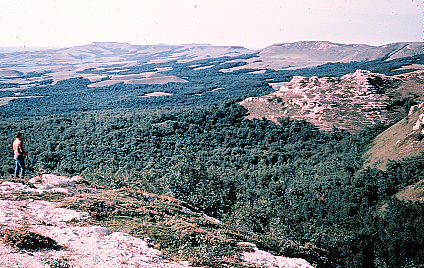

Go North, Young Wealth Manager

Investment advisers who sincerely want to be rich need new clients with new money. Where to find them? North Dakota!

Investment advisers who sincerely want to be rich need new clients with new money. Where to find them? North Dakota!Oil boom is changing the landscape and finances of North Dakota, writes Phillip Sherwell in the Telegraph. America's newest Black Gold Rush is gushing millionaires. What's more, "America's least-visited state is one of just three with a budget in the black - a surplus of $1 billion for its 635,000 residents."

Monday, August 25, 2008

$10 billion for irrevocable inter vivos trusts in 2005

The summer issue of the IRS Statistics of Income includes an analysis of the 2005 gift tax returns. You might think that no one would make taxable gifts when there's a chance that the federal estate tax could be repealed (the chance was much better in 2005), and you'd be almost right. Just over $40 billion in gifts were reported to the IRS, with 97% being not taxable for one reason or another. Still, gift tax collections came to $1.7 billion from 7,664 federal gift tax returns (more than 260,000 gift tax returns were filed overall).

One quarter of the transfers were in trust, or about $10 billion. Most of these, $2.8 billion worth, were simple trusts that pay all their income each year to one beneficiary. Marital trusts were lumped in with personal residence trusts and generation-skipping trusts, and so are not included in that figure. Charitable split-interest trusts came in just under $1 billion.

More women filed gift tax returns than men.

One quarter of the transfers were in trust, or about $10 billion. Most of these, $2.8 billion worth, were simple trusts that pay all their income each year to one beneficiary. Marital trusts were lumped in with personal residence trusts and generation-skipping trusts, and so are not included in that figure. Charitable split-interest trusts came in just under $1 billion.

More women filed gift tax returns than men.

Thursday, August 21, 2008

A concrete example of disinheritance rage

Following up on JLM's observation below, here's the New York Post's coverage of the ugly publicity that has emerged over the estate of Jerry Orbach.

Don't miss estate attorney Joel Schoenmeyer's take on it.

Don't miss estate attorney Joel Schoenmeyer's take on it.

Disinheritance Rage

Where there's a will, there's a war, reports Olivia Gordon in the Telegraph:

Lawyers from across Britain have told the Telegraph that they are handling ever-increasing numbers of will contentions. One northern firm, Brabners Chaffe Street, has reported a 200 per cent rise in the number of contested wills in the past three years alone.Similar trend in the U.S.? Seems likely. Even Trouble, Leona Helmsley's canine heir, couldn't hang on to most of her millions.

While some solicitors cite high property prices, which make an estate well worth fighting over, others put the trend down to our newly litigious society and the fractured nature of modern families.

Monday, August 18, 2008

“Subprime” Takes the Gold

Subprime was voted the word of the year by the American Dialect Society, writes Jack Rosenthal in the NY Times Sunday magazine.

Other new terms we reluctantly became better acquainted with in 2007 include:

Other new terms we reluctantly became better acquainted with in 2007 include:

Liars' loansFinancial jargon is amusing to insiders but utterly baffling to most Americans. When you communicate with clients or prospects, remember the findings of an AARP Financial survey:

Ninja loans (no income, no job or assets)

Jingle mail

And, of course, our personal favorite:

Exploding ARM

Less than one-third of those surveyed said they understood the terms "basis point," "expense ratio," or "index fund" well enough to explain them to a friend or co-worker.

Thursday, August 14, 2008

Prepare for poaching

Financial Planning.com is offering a 23 minute podcast called Trusts: The Next Big Thing. From the description:

Certainly you can recommend a reliable attorney to those clients needing such services. A trust company can do much of this work as well. But your clients will surely want the advisor who's led them through asset accumulation to help them through this important process. Are you prepared to be their guide?How will the trust industry respond to this encroachment? FP points out that two developments will fuel the boom in trust business: the number of affluent household is expanding, while technological advances permit semi-custom service delivery on a mass basis. They state that the average trust has fallen from $5 million to $1 million (I remember when that was the minimum at many places, not the average)

Wednesday, August 13, 2008

Paine Webber Redux?

Reeling from derivatives losses and tax-shelter scandals, UBS ponders breaking itself up. At Investment News, Evan Cooper wonders if that could mean the return of Paine Webber, the venerable wirehouse UBS absorbed not that many years ago. Cooper also offers another reminder that in the financial industry, big can be bad:

The UBS problems just prove the hubris inherent in the idea of a worldwide, universal financial institution that can lend, underwrite and advise, all under one roof. Sure, you can get such creations to work, but why? The gigantic, ponderous beasts aren’t necessarily all that profitable and can create problems of international proportions.

In finance, as in so many businesses, smaller is often better. In the case of UBS, it’s why selling or spinning off the U.S. retail business (that is, PaineWebber) could work.

Tuesday, August 12, 2008

Maybe Nest Eggs Really Are "Worthless"

Last month we told you what the founder of The Merrill Anderson Company, an old Yankee, thought about nest eggs: "Chicken farmers can't afford to leave real eggs in the nests. They use fake eggs. Nest eggs are worthless!"

Maybe he had a point. In his 1967 Wall Street classic, The Money Game, George Goodman writing as Adam Smith tells this story:

Maybe he had a point. In his 1967 Wall Street classic, The Money Game, George Goodman writing as Adam Smith tells this story:

Mr. Smith said to [his wife and children], "Our family owns IBM, which is the greatest growth company in the world. I invested twenty thousand dollars in IBM and that twenty thousand has made me a millionaire. If something happens to me, whatever you do, don't sell the IBM." Mr. Smith himself never sold a share of IBM. Its dividends were meager, naturally, and so Mr. Smith had to work hard at his own business to provide for his growing family. But he did create a marvelous estate. ***IBM truly was an investment colossus in those days. Imagine Google, Apple and Amazon rolled into one. Only the crash of 1987 dispelled the stock's aura of invincibility. (Hope the Smiths didn't sell; by the late 1990s their IBM wealth would have multiplied again.)

Mr. Smith died; the IBM was divided among his children. The estate sold only enough IBM to pay the estate taxes. Otherwise the children—now grown, with children of their own— followed their father's dictum, and never sold a share of IBM. The IBM grew again, made up for what had been amputated to pay estate taxes, and each of the children grew as rich as Mr. Smith had been…. They had to work quite hard at their own businesses, because their families were growing and their only money was in IBM. Only one of them even borrowed on his IBM, to get the down payment for a heavily mortgaged house. And the faithful children were rewarded by seeing IBM multiply and grow. ***

The Smiths are now in their third generation of IBM ownership, and this generation is telling the next, "Whatever you do, don't sell the IBM." And when someone dies, only enough IBM is sold to pay the estate taxes.

In short, for three generations the Smiths have worked as hard as their friends who had no money at all, and they have lived just as if they had no money at all, even though the various branches of the Smith family all put together are very wealthy indeed. And the IBM is there, nursed and watered and fed, the Genii of the House, growing away in the early hours of the morning when everyone is asleep.

Monday, August 11, 2008

Many Fail to See Humor in ‘I Am Rich’

When Jim Gust rants about art, you know something's up. Something about Apple, perhaps?

Ah yes! Th e New York Times reports a to-do over one of the iPhone applications that Apple encourages developers to write. Apple distributes the apps, typically costing next to nothing, at its iTunes app store.

e New York Times reports a to-do over one of the iPhone applications that Apple encourages developers to write. Apple distributes the apps, typically costing next to nothing, at its iTunes app store.

But this particular app, created by Armin Heinrich of Germany, cost $1,000. When downloaded to an iPhone, it displayed the image of a multi-faceted ruby and broadcast the message, "I am rich." That's all.

Ah yes! Th

e New York Times reports a to-do over one of the iPhone applications that Apple encourages developers to write. Apple distributes the apps, typically costing next to nothing, at its iTunes app store.

e New York Times reports a to-do over one of the iPhone applications that Apple encourages developers to write. Apple distributes the apps, typically costing next to nothing, at its iTunes app store.But this particular app, created by Armin Heinrich of Germany, cost $1,000. When downloaded to an iPhone, it displayed the image of a multi-faceted ruby and broadcast the message, "I am rich." That's all.

“I found that some users complain about prices for iPhone applications above 99 cents,” Mr. Heinrich said. “I regard it as art."Apple, it seems, was not amused.

Financial Health Club for the Emerging Affluent

Citigroup has launched myFi, hoping to create a "financial wellness" service for the emerging affluent. Initially, Smith Barney clients with less than $250,000 will be encouraged to move their accounts to the new myFi call center, where they will be served by salaried advisers rather than commissioned salespeople.

Citigroup has launched myFi, hoping to create a "financial wellness" service for the emerging affluent. Initially, Smith Barney clients with less than $250,000 will be encouraged to move their accounts to the new myFi call center, where they will be served by salaried advisers rather than commissioned salespeople.Ultimately, Ron Lieber writes in the NY Times, Citigroup's wealth management unit envisions MyFi as something of a financial health club:

The idea is to use the Web, along with call center teams that will be led by certified financial planners, to help people make sense of and then improve their entire financial lives, not just their investments. The catch? You may have to be willing to pay a monthly subscription fee.At NetBanker, Jim Bruene notes that a long-time Wall Street Journal columnist will play a role in the new venture:

MyFi uses a “wellness” theme in its pitch. Plenty of people pay $50 or $100 a month for gym memberships or personal trainers. Shouldn’t it be worth that much to keep your finances in shape, too?

myFi's director of financial advice is Jonathon Clements, a long-time Wall Street Journal personal finance writer who recently left the paper. If he can instill his pragmatic personal finance outlook to Citi's offering, it would help differentiate it from similar offerings.Ron Lieber writes that myFi is "is still working out the extent to which it can act as a fiduciary, the standard for someone who always acts solely in the client’s best interest.

"MyFi intends to be a fiduciary as far as client investments are concerned. What isn’t yet clear, however, is how far it has to go to be a fiduciary when, for example, advising someone who needs a new mortgage."

• • •

"Darling, guess what. I'm a little bit…fiduciary!"

Saturday, August 09, 2008

What is art, anyway?

Merrill Anderson's quarterly Wealth Management newsletter includes a feature on page 4 called Collector's Corner, in which we report on auction results. We cover collectibles, cars, coins, just about anything, including art. I often have trouble understanding the prices.

Merrill Anderson's quarterly Wealth Management newsletter includes a feature on page 4 called Collector's Corner, in which we report on auction results. We cover collectibles, cars, coins, just about anything, including art. I often have trouble understanding the prices.My wife and I just watched the DVD of the 2007 documentary, My Kid Could Paint That. Two thumbs up, way up, as Siskel and Ebert might say.

The abstract paintings of Marla Olmstead came to the attention of the world when she was just 4 years old. As the documented in the film, she (or her parents) took the art world by storm. Soon her paintings were selling for tens of thousands of dollars. Buyers gushed about the complexity of the work that was, nonetheless, suffused with Marla's inherent innocence.

Were the paintings really that good? Not to my eye—the film is well named. My kid really could paint that, and so could I. But as such, how different is it from the rest of what passes for art today? Really, I'd much prefer a Marla Olmstead in my house to a Jackson Pollack. But I'm a philistine. The film does an excellent job of articulating my skepticism, which is evidently shared by much of the public.

In a stunning proof of the shallowness of "value" or "truth" in modern art, a huge controversy developed over whether Marla was really doing the paintings herself! 60 Minutes did an "expose" that strongly suggested, based upon "hidden camera" footage, that Marla's "best" works had been "polished" by someone else, presumably her father. Paintings that were incredibly valuable if there were really done by a 4-year-old suddenly were worthless if an adult had participated in any way! What an irony—people were paying for the process, not the painting at all! Because, after all, the painting isn't about what is on the canvas?

The Olmsteads proceeded to try to prove that Marla really did do her own work, by videotaping the creation of new paintings from start to finish. You can see examples at their website. The documentary leaves open the question of the "authenticity" of Marla's work, which is to me beside the point. Marla's paintings are still for sale, if not at the stratospheric prices that they once commanded. Wikipedia reports that the painting Marla created for the 60 Minutes hidden camera, the one that child psychologists said proved she was not a prodigy after all, recently sold for $9,000.

But the key point that the film makes without ambiguity is that, at base, modern art is just a fad. Beanie babies for rich people.

Years ago I attended a reception at Sotheby's in New York City during a trust marketing conference. Several of us had trouble reconciling the suggested prices attached to the paintings--the gorgeous old masters seemed way too cheap (at hundreds of thousands of dollars) compared to the millions commanded by some stark, unlovely, downright ugly modern pieces. We corraled a docent and asked him to explain what made a particular piece so valuable.

"Gentlemen," he explained patiently, "there are only two factors that affect the value of a painting. Supply and demand."

Wednesday, August 06, 2008

Protecting the Elderly and their Assets

Alexandra Lebenthal (you know, Alexandra and James) plugs trust companies in this post on the New York Social Diary:

Many banks and investment firms have trust companies which can act as Trustees. If there is a request for the Trust to make a distribution the Trustees must approve it and ensure that it is following the terms of the trust and the beneficiaries. Having had personal experience with this type of structure I can attest to their diligence. It is also possible to have co-trustees who are family members or friends and can act in concert with the co-trustees.

London: More Than 300 Family Offices

London lures family offices of super-rich, reports the Financial Times (free registration required).

London lures family offices of super-rich, reports the Financial Times (free registration required).For more on family offices from FT.com, see

‘Families set up as institutions’

US idea that finally crossed the Atlantic

Photo via Wikipedia

Are Your Bank's Trust Clients Worried?

Interviewed in Barron's, NYU economist Nouriel Roubini sees bad times ahead:

Back in the Mad Men era, when trust clients and beneficiaries remembered hearing of the horrors of the Great Depression and the Bank Holiday from their parents, trust departments had to spread the word that trust securities and other property were held separately from the bank's assets and would not be affected by the bank's failure.

Time to get out the word again?

We are in the second inning of a severe, protracted recession, which started in the first quarter of this year and is going to last at least 18 months, through the middle of next year. A systemic banking crisis will go on for awhile, with hundreds of banks going belly up.Roubini foresaw the housing bubble ending badly and the collapse of subprime mortgages, so we have to take his grim vision seriously. (You can also find the interview on his blog.)

Back in the Mad Men era, when trust clients and beneficiaries remembered hearing of the horrors of the Great Depression and the Bank Holiday from their parents, trust departments had to spread the word that trust securities and other property were held separately from the bank's assets and would not be affected by the bank's failure.

Time to get out the word again?

Monday, August 04, 2008

“A Work of Art, Too Precious to be Meddled With”

Remember Samuel Butler's Erewhonians? Smart cookies.

Entrepreneurs who became insanely rich were, the Erewhonians realized, the true philanthropists:

Another study suggests that the top 25% of households, income-wise, may generate as much as 70% of all personal spending.

Entrepreneurs who became insanely rich were, the Erewhonians realized, the true philanthropists:

He who makes a colossal fortune in the hosiery trade, and by his energy has succeeded in reducing the price of woollen goods by the thousandth part of a penny in the pound—this man is worth ten professional philanthropists. So strongly are the Erewhonians impressed with this, that if a man has made a fortune of over £20,000 a year they exempt him from all taxation, considering him as a work of art, and too precious to be meddled with; they say, “How very much he must have done for society before society could have been prevailed upon to give him so much money;” so magnificent an organisation overawes them; they regard it as a thing dropped from heaven.Today's economists are also beginning to appreciate the contributions of the amply-moneyed. In The Wealth Report, Robert Frank notes that the top 10% of households, ranked by income, are thought to account for nearly a quarter of all economic spending.

Another study suggests that the top 25% of households, income-wise, may generate as much as 70% of all personal spending.

Jane Bryant Quinn on Pre-Nups

"Available wedding dates are few for brides of a certain age. You have to celebrate after your grandchildren get out of school and before your friends go away for the summer."

If, like me, you missed Jane Bryant Quinn's up-close-and-personal column on pre-nups, check it out here.

If, like me, you missed Jane Bryant Quinn's up-close-and-personal column on pre-nups, check it out here.

Friday, August 01, 2008

Accountant Bites Tiger

We've mentioned TIGER 21, the self-help group for multimillionaires, before. According to the group's web site, Michael Sonnenfeldt, its founder, is the Chairman of MUUS & Company, a private investment company headquartered in Westport, CT.

We've mentioned TIGER 21, the self-help group for multimillionaires, before. According to the group's web site, Michael Sonnenfeldt, its founder, is the Chairman of MUUS & Company, a private investment company headquartered in Westport, CT.MUUS & Co. made news today because Noel Lara, a Westport accountant, admitted to stealing more than $1.5 million from MUUS and an unidentified marketing company.

What kind of bling does an embezzling accountant in Westport favor? Watches, according to The Stamford Advocate's story:

The possessions seized at his apartment included TAG Heuer watches with price tags of $6,900 and $2,800, a $295 Prada wallet, a $1,240 Faconnable watch, an Officine Panerai watch worth $8,400, a $1,240 Gucci jacket and dozens more top-shelf items such as sunglasses, bracelets and earrings.

Police also found a 2006 Hummer H2 and a 2007 Audi 4S with Maryland plates registered to Lara, his arrest affidavit stated….

Subscribe to:

Comments (Atom)