|

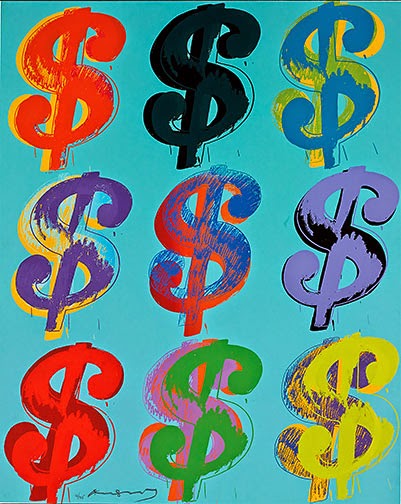

ANDY WARHOL, Dollar Signs $ (9), 1982

|

The wealthiest Americans have grown wealthier since the Great Recession, and many are investing their wealth in art. Especially with bonds and other assets offering rock-bottom yields, the art market — where reports of record-high sales now emerge regularly — has an obvious appeal. According to a survey last year by Deloitte and ArtTactic, an art-research firm, 76 percent of art buyers viewed their acquisitions as investments, compared with 53 percent in 2012.To meet perceived demand, art marketing has gone digital, with online auctions and web sites offering "quotes" on investable works. Thanks to high-tech depositories and storage facilities, today's art investors need not make physical contact with the artworks they trade. Better yet, they can replace one art asset for another without worrying about tax on capital gain. Like real estate investors, they can defer taxes by swapping one "property" for another.

Art investors do have a few nagging worries. Expected profits may vanish if an investor in contemporary art doesn't have an informed feel for value, and one court says that's the investor's loss. Also, tax-deferred swaps are getting too popular. The IRS is taking notice.

Biggest worry: investment fads are too good to last, and art is no exception. If you're not elderly enough to remember the last boom and bust, see this 1993 Times story: What's the Worst Place To Keep Art? A Portfolio.