Bloomberg Wealth Manager has published its second annual review of multi-family offices (PDF download required). Assets managed by these competitors to trust departments grew by 26.6% last year. These are major firms--the mean amount under management was $1.0 billion, the median $2.8 billion. The account minimum ranges from $750,000 to $100 million, with $10 million being most typical.

Part of the growth in the last year came from the phenomenon of single family offices becoming clients of multifamily offices, presumably because it was too hard to keep up with the technological requirements on a standalone basis.

Although these organizations are primarily about asset management, 63% of them also offer trust management in-house, and 27% provide trust service on an out-sourced basis. Have any of you, our trust and private banking department clients, run into these companies? Do you consider them important competitors?

Wednesday, August 31, 2005

Monday, August 29, 2005

John Roberts, probate realist

Roberts quote from today's New York Times article on the Supreme Court nominee:

“. . . probate disputes begin with a death but have a way of never dying themselves.”

“. . . probate disputes begin with a death but have a way of never dying themselves.”

Thursday, August 25, 2005

From the databank: hedge funds

Number of hedge funds reported by The Wall Street Journal to have set up shop in Greenwich, Connecticut, in the last few years:

More than 100*

*The office of Bayou Funds was located just over the Greenwich border on the Stamford shoreline.

The New York Times estimate of the total number of hedge funds at year-end 2004:

3,307

Total number of hedge funds as estimated in today's Wall Street Journal (subscribers only):

Over 8,000

Total assets held in hedge funds at end of 2004:

Over $1,000,000,000,000

Average earnings of a top-25 hedge-fund manager in 2001:

Almost $136,000,000

Average earnings of a top-25 hedge-fund manager in 2004:

$251,000,000

Amount earned last year by Greenwich resident Edward Lambert, called world's highest-paid hedge-fund manager by Institutional Investor:

$1,200,000,000

Number of cases brought by the SEC, 2000-2004, alleging fraud by hedge-fund advisers:

51

Total amount that the SEC alleges hedge-fund investors lost through fraud:

Over $1,100,000,000

More than 100*

*The office of Bayou Funds was located just over the Greenwich border on the Stamford shoreline.

The New York Times estimate of the total number of hedge funds at year-end 2004:

3,307

Total number of hedge funds as estimated in today's Wall Street Journal (subscribers only):

Over 8,000

Total assets held in hedge funds at end of 2004:

Over $1,000,000,000,000

Average earnings of a top-25 hedge-fund manager in 2001:

Almost $136,000,000

Average earnings of a top-25 hedge-fund manager in 2004:

$251,000,000

Amount earned last year by Greenwich resident Edward Lambert, called world's highest-paid hedge-fund manager by Institutional Investor:

$1,200,000,000

Number of cases brought by the SEC, 2000-2004, alleging fraud by hedge-fund advisers:

51

Total amount that the SEC alleges hedge-fund investors lost through fraud:

Over $1,100,000,000

How long a retirement should we plan for?

Half of today's college students will live to be 100 years old, according Nobel Prize winning economist Robert Fogel, as reported by Robert Samuelson. That's well above the prediction of today's actuarial tables, which Fogel believes are too conservative. He says that in the late 1920s, life insurers "put a cap of 65 on life expectancy." We all know how wrong that is.

One who enters the workforce at age 25, retires at 65 and lives to 100 will spend nearly one half of his or her adult life in retirement, not working. Is that economically tenable? Samuelson advocates the politically unpopular solution of raising the retirement age to 70 over time. I think he's on the right track.

Do today's trust prospects have a good understanding of their likely longevity?

One who enters the workforce at age 25, retires at 65 and lives to 100 will spend nearly one half of his or her adult life in retirement, not working. Is that economically tenable? Samuelson advocates the politically unpopular solution of raising the retirement age to 70 over time. I think he's on the right track.

Do today's trust prospects have a good understanding of their likely longevity?

Thursday, August 18, 2005

Personal finance blogs in the spotlight

The Wall Street Journal today offers a roundup of noteworthy blogs covering investment and money management subjects. Only one or two of the mentioned blogs seem even indirectly related to financial services marketing. The value of blogging in this arena remains to be demonstrated, though I think that the potential is huge.

Wednesday, August 17, 2005

Circular 230 will plague us for some time

The flyer for the 40th Heckerling Institute on Estate Planning (the "Miami Institute" to the old-timers) just came in today. You can find more information here. I note with interest a brand new topic, one of the special sessions: The Gathering Storm—Circular 230: What Does It Mean and What Do We Do? Among the questions to be explored: "Should every item of paper and electronic mail generated by a law or accounting firm contain a statement that it cannot be used to avoid tax penalties?"

I submit that to reasonable men, the question answers itself. When disclaimers get plastered on everything, they soon mean nothing. However, it seems that to the regulators (and those who must follow their commands), there's no such thing as too much information.

I submit that to reasonable men, the question answers itself. When disclaimers get plastered on everything, they soon mean nothing. However, it seems that to the regulators (and those who must follow their commands), there's no such thing as too much information.

Another blog about estate planning

Law professors have been prolific pathbreakers in the blogosphere, and lawyers are entering the fray as well. You and Yours Blawg contains the observations of a New Jersey lawyer about estate planning, among threads. Although the blog (or blawg, as some lawyers seem to prefer) doesn't solicit business, I suspect that it could be a valuable practice development tool.

Sunday, August 14, 2005

Repent! The end is nigh

Funny thing happened on the way to the teller window at the bank the other day. Picked up a muni fund prospectus and saw there was a sales load of 4.5%. Gosh, I thought, when you added in the first year's fees and expenses, a hapless investor would lose one-twentieth of his money at the start. How terrible!

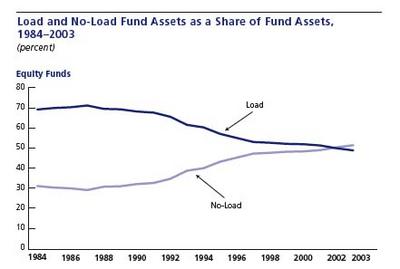

A generation ago, that thought never would have occured to most investors. Load funds were the norm. Without brokers, mutual funds never would have gained traction in the first place. Now the tide is turning, as this chart from the Mutual Fund Fact Book shows.

A generation ago, that thought never would have occured to most investors. Load funds were the norm. Without brokers, mutual funds never would have gained traction in the first place. Now the tide is turning, as this chart from the Mutual Fund Fact Book shows.

But managers of no-load funds, except for index funds, shouldn't feel smug. Take a look at the new book by David Swensen, Yale's all-star endowment manager. Here's an excerpt from the publisher's blurb:

A generation ago, that thought never would have occured to most investors. Load funds were the norm. Without brokers, mutual funds never would have gained traction in the first place. Now the tide is turning, as this chart from the Mutual Fund Fact Book shows.

A generation ago, that thought never would have occured to most investors. Load funds were the norm. Without brokers, mutual funds never would have gained traction in the first place. Now the tide is turning, as this chart from the Mutual Fund Fact Book shows.But managers of no-load funds, except for index funds, shouldn't feel smug. Take a look at the new book by David Swensen, Yale's all-star endowment manager. Here's an excerpt from the publisher's blurb:

In Unconventional Success, investment legend David F. Swensen offers incontrovertible evidence that the for-profit mutual-fund industry consistently fails the average investor. From excessive management fees to the frequent "churning" of portfolios, the relentless pursuit of profits by mutual-fund management companies harms individual clients. Perhaps most destructive of all are the hidden schemes that limit investor choice and reduce returns, including "pay-to-play" product-placement fees, stale-price trading scams, soft-dollar kickbacks, and 12b-1 distribution charges.To read more about Swenson, see Joseph Nocera's column in The New York Times.

Friday, August 12, 2005

Estate Tax: Exempt $3.5 million and tax the rest at 15% ?

According to today's Washington Post, that's the leading alternative to repeal at the moment.

By the way, why do reporters keep writing about the estate tax affecting "only the top 1%"? That top one percent represents those who leave the estates from which the tax is extracted. Being dead at the time, they don't really "pay" anything. Basically, their heirs pay. Mightn't an estate have two or three, six or eight, or even 10 or 12 heirs?

By the way, why do reporters keep writing about the estate tax affecting "only the top 1%"? That top one percent represents those who leave the estates from which the tax is extracted. Being dead at the time, they don't really "pay" anything. Basically, their heirs pay. Mightn't an estate have two or three, six or eight, or even 10 or 12 heirs?

Monday, August 01, 2005

Banking's black eye: How did deferred annuities get misdelivered?

Seemed like a good idea: Wrap mutual fund shares in an annuity contract for tax deferral. Sell the packages to high-tax-bracket investors who have maxxed out their 401(k) and IRA contributions. Sellers would get high but inconspicuous sales commissions; buyers who invested aggressively and held for 20 years might make a buck.

One problem: When the others in your foursome are talking hedge funds, do you want to confess to buying an annuity?

A worse problem arrived with the Bush tax cuts. When you can pay 15% tax now on realized gains and dividends, why pay ordinary income tax of 30% or more later?

The marketing of variable annuities needed rethinking. Apparent result: A new target market consisting of unsophisticated senior citizens who chafed at low CD yields and liked the sound of "Your heirs will get back every cent you invest, guaranteed!"

To make sure the new market wouldn't refuse delivery, sales commissions were revved up. In his June 8 column, Jonathan Clements of The Wall Street Journal marveled at how much "annuity gladiators" could rake in:

Can someone explain how banks got caught up in this sorry mess? Suicidal tendencies? A sick urge to get rid of customers over 65? Bank of America certainly didn't help its public image. Neither did Citizens, a Royal Bank of Scotland unit that's $3 million poorer as a result. Can regulators save banks and other annuity sales channels from themselves, or will stronger steps be necessary?

If that question sounds over-dramatic, read on.

This year, 2005, marks the centennial of the beverage we know today as Classic Coke. In 1905 people probably thought of it as New Coke.

This year, 2005, marks the centennial of the beverage we know today as Classic Coke. In 1905 people probably thought of it as New Coke.

The original Coca-Cola had been formulated in Atlanta a generation earlier, in 1886, and the Coca-Cola Company quickly became the Google of its time. From 1890 to 1900, sales of Coca-Cola syrup increased by 4000%!

Despite, or perhaps because of, this smashing success, in 1905 the Coca-Cola Company revamped its formula. No more cocaine.

Please note that "cocaine" was not a loaded word in the 19th century. Cocaine was merely a routine stimulant, found not only in soda-fountain tonics but also in painkillers, including Bayer Aspirin. Only when cocaine became widely abused by addicts was it outlawed.

Today, one response to annuity sales abuse would be to make variable annuities a "controlled investment product." No sales to investors over 50 without a prescription. To be valid, the prescription would have to be signed jointly by the investor's lawyer, a tax accountant and a trust officer or wealth manager.

Waddiyathink?

Free plug: The old delivery truck shown above is actually a toy coin bank, available from the Coca-Cola store.

One problem: When the others in your foursome are talking hedge funds, do you want to confess to buying an annuity?

A worse problem arrived with the Bush tax cuts. When you can pay 15% tax now on realized gains and dividends, why pay ordinary income tax of 30% or more later?

The marketing of variable annuities needed rethinking. Apparent result: A new target market consisting of unsophisticated senior citizens who chafed at low CD yields and liked the sound of "Your heirs will get back every cent you invest, guaranteed!"

To make sure the new market wouldn't refuse delivery, sales commissions were revved up. In his June 8 column, Jonathan Clements of The Wall Street Journal marveled at how much "annuity gladiators" could rake in:

I can't recall precisely when I got my first message, and I have no idea how I got on this particular email distribution list. But at some point last year, I started receiving emails aimed at insurance agents, offering to pay me commissions of 8%, 10% and even 13% for selling annuities.The results have been disastrous. Horror stories abound, like this one from a Jane Bryant Quinn column last year. The selling of variable annuities made a list of Top Ten Investment Scams. An elder law center discusses annuity sales in the same breath as Ponzi schemes. (Rumors that the ghost of Charles Ponzi is suing for libel could not be confirmed.)

Can someone explain how banks got caught up in this sorry mess? Suicidal tendencies? A sick urge to get rid of customers over 65? Bank of America certainly didn't help its public image. Neither did Citizens, a Royal Bank of Scotland unit that's $3 million poorer as a result. Can regulators save banks and other annuity sales channels from themselves, or will stronger steps be necessary?

If that question sounds over-dramatic, read on.

This year, 2005, marks the centennial of the beverage we know today as Classic Coke. In 1905 people probably thought of it as New Coke.

This year, 2005, marks the centennial of the beverage we know today as Classic Coke. In 1905 people probably thought of it as New Coke.The original Coca-Cola had been formulated in Atlanta a generation earlier, in 1886, and the Coca-Cola Company quickly became the Google of its time. From 1890 to 1900, sales of Coca-Cola syrup increased by 4000%!

Despite, or perhaps because of, this smashing success, in 1905 the Coca-Cola Company revamped its formula. No more cocaine.

Please note that "cocaine" was not a loaded word in the 19th century. Cocaine was merely a routine stimulant, found not only in soda-fountain tonics but also in painkillers, including Bayer Aspirin. Only when cocaine became widely abused by addicts was it outlawed.

Today, one response to annuity sales abuse would be to make variable annuities a "controlled investment product." No sales to investors over 50 without a prescription. To be valid, the prescription would have to be signed jointly by the investor's lawyer, a tax accountant and a trust officer or wealth manager.

Waddiyathink?

Free plug: The old delivery truck shown above is actually a toy coin bank, available from the Coca-Cola store.

Subscribe to:

Comments (Atom)