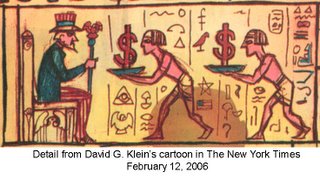

David G. Klein dreamed up a great illustration for the Sunday New York Times feature on taxes. You can see only a thumbnail here, so I've posted a detail from a scan.

David G. Klein dreamed up a great illustration for the Sunday New York Times feature on taxes. You can see only a thumbnail here, so I've posted a detail from a scan.The Times cites projections that the cumulative cost of extending the Bush tax cuts, presumably including repeal of the estate tax, would grow to $1.3 trillion by 2015.

The cumulative “cost” of repealing the Alternative Minimum Tax would also grow to more than $1 trillion.

How do the Administration and Congress get out of this mess? Possibly by taking a serious swing at tax reform. If reform eliminated enough special tax breaks, Congress could vote for lower tax rates in a package that would raise more revenue. But even a “stealth” tax increase is probably too risky to consider before 2007.

Meanwhile, although the federal estate tax exemption has moved up to $2 million. note this warning in another Times article:

In more than a dozen states — including New York, New Jersey, Maine, Maryland, Massachusetts, Minnesota, Kansas, Nebraska, Ohio, Oklahoma, Oregon, Rhode Island and Wisconsin — there are still state taxes on estates worth under $2 million. There is a tax on estates in this range in the District of Columbia, as well.

1 comment:

It would likely be less "expensive" to repeal the regular income tax and keep the AMT. I think that this is already true if you use the "nonindexed" AMT exclusion amounts. Might simplfy filing, too.

Post a Comment