Remember when financial security during retirement rested on a three-legged stool?

One leg, Social Security, is shaky but doesn't matter too much to the HNW market.

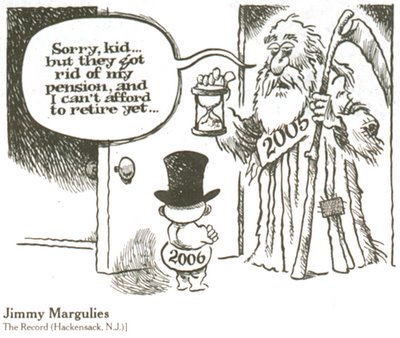

The second leg, pensions, is another matter. Many highly-paid executives count on funded and unfunded employer pensions to help support a jet-set retirement lifestyle.

With pensions in jeopardy, that leaves personal savings and investments to carry the retirement load.

Sounds like professional wealth management is a must, wouldn't you say?

3 comments:

Aren't nonqualified pension plans a major source of retirement income for the HNW market? That should be at least as important as private savings.

Question for Jim Gust: When your favorite U.S. airtline or automaker runs out of money and has to drop its qualified plan, where do you expect it to find the billions needed to make the payments called for by its unfunded, nonqualfied plans?

Because nonqualified plans cover so many fewer people, the costs are vastly less than qualified pensions. Somehow, management seems to get theirs. But the point is well taken, an unfunded plan would be vulnerable in a bankruptcy. In at-risk industries, the focus may shift away from deferred compensation, lending support for your call for strategies to help the HNWs to salt some of that compenstion away.

Post a Comment