Here's a different kind of trust company. In this clear, informative web page, New Convenant Trust Company treats self-trusteeship as the default option:

What is a Revocable Trust?Admittedly, New Covenant Trust Company is not your usual, for-profit, trust institution. A wing of the Presbyterian Foundation, the company specializes in charitable remainder trusts and such. (In the case of an everyday revocable trusts, New Covenant requires the grantor to leave 10% of the trust fund, up to $250,000, to a Presbyterian or Presbyterian-related charity.)

A revocable trust is created to accept ownership of your assets during your lifetime. This is appealing for several reasons:

• You may retain complete management, control, use and distribution of your trust assets. If you prefer, you can designate someone else to serve as trustee for you.

• You select an alternative trustee in the event you become incapacitated. The trustee will manage the trust funds for you. The trust should clearly state how to determine incapacity.

• You can add or remove assets from the trust or change any of the terms at any time as you determine in your sole discretion.

• At your death, the trust becomes irrevocable and provides for the distribution or the continued management of the remaining assets in the trust by the successor trustee. The distribution is private; no involvement of probate.

Should more bank trust departments be marketing standby trusts as a primary product?

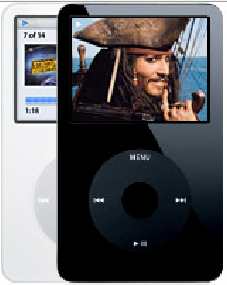

Before you answer "No," remember that sometimes the pros are wrong and the customers are right. Steve Jobs once thought a video iPod was a really stupid idea.

No comments:

Post a Comment