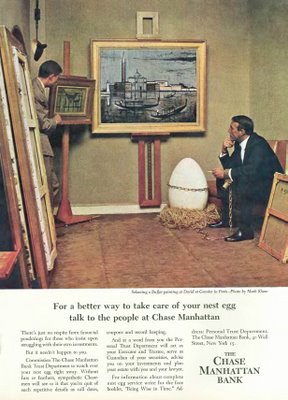

So says an article in yesterday's New York Times. Looks like the right time to share another of Chase Manhattan's classic (and now collectible) nest-egg ads.

Notice the added snob appeal (as it would have been called in the early 1960's) of the credit-line under the photo. No photographer's set-up, this, but rather an actual shot of a Buffet being inspected at the David et Garnier gallery in Paris.

Notice the added snob appeal (as it would have been called in the early 1960's) of the credit-line under the photo. No photographer's set-up, this, but rather an actual shot of a Buffet being inspected at the David et Garnier gallery in Paris.Worried that some of your clients may be investing in art not wisely but too well? Refer them to this Financial Page from The New Yorker:

So should we all dump our shares of ExxonMobil in order to own a few square inches of a Manet canvas? Not quite. . . . [T]he vast majority of paintings that people have bought in the past never make it to resale. According to one estimate, a mere 0.5 per cent of new paintings are worth anything at auction thirty years later. Relying on auction prices to calculate a return on investment for art ignores all the money people spent on the other 99.5 per cent.The market for art, and indeed for anything tangible, heated up in the high-inflation 1970s. Citibank started an art advisory service for wealthy clients in 1979. Seems to be still going, and its site displays more advanced web design than the rest of Citibank Private Bank.

If you browse the site, admire the liberal use of slide shows to create ambience.

1 comment:

The New York Timesis reporting that Ronald Lauder has just paid the most ever for a painting, $135 million for a Klimt.

Post a Comment