Wednesday, February 28, 2007

Big or Boutique for Super-Rich

Today the idea flourishes under the heading of multi-family office. As this Financial Times report reveals, MFOs come in various shapes and sizes, sort of like luxury hotels.

Brothers Battle: “Take My Inheritance, Please!”

In How Scots Invented the Modern World, Arthur Herman describes how philosopher Francis Hutcheson moved beyond dour Calvinism to evolve an enlightened view of human morality.

In How Scots Invented the Modern World, Arthur Herman describes how philosopher Francis Hutcheson moved beyond dour Calvinism to evolve an enlightened view of human morality."For Hutcheson," Herman writes, "our emotional lives reach out, instinctively, toward others . . . . The basic rules of morality, including Christianity's rules, teach us how to act in the world, so that we can make as many others happy as possible."

[Hutcheson] knew people could behave viciously, and hurt others . . . . But, he was asserting, that is not their true nature. As God's creatures, they carry within them the image of His infinite goodness. By using their reason and listening to their heart, they will choose right over wrong, and the good of others rather than gratification for themselves.

The proof of this had come, interestingly enough, in his own life. When his grandfather Alexander died, he had left his house and estate to Francis, his favorite grandchild, bypassing in his will the eldest grandson, Hans. Francis very properly turned it down, although it would have raised his standard of living substantially. When Hans learned what his brother Francis had done for his benefit, then he, too, refused, insisting that their grandfather's original wishes be carried out. The brothers spend the next several months arguing back and forth, each trying to force on the other the good fortune left to them by their grandfather — as perfect an example of altruism in action as Shaftesbury ["the suave aristocrat of English philosophers"] or anyone else could ask.

Ultimately, writes Herman, the brothers agreed to split the estate.

Tales from the 20th Century: “Going Out of Business”

In the 1960s, a number of small stores around that intersection sold dubious cameras, fake Oriental r

ugs, strange exotic gifts and the latest electronics (transistor radios!). Competition appeared to be fierce: two or three stores always seemed to have "GOING OUT OF BUSINESS" banners stretched across the tops of their display windows.

ugs, strange exotic gifts and the latest electronics (transistor radios!). Competition appeared to be fierce: two or three stores always seemed to have "GOING OUT OF BUSINESS" banners stretched across the tops of their display windows.Funny, though. When you walked by Henry's Electronics months after his sale, Henry was still there. And next time you passed, there was the "GOING OUT OF BUSINESS" banner again.

Eventually, New York City decided to stop such nonsense. A new ordnance required retailers who claimed to go out of business to actually stay out of business a year or two.

Fat chance.

Henry probably hated the bother of reincorporating annually: Alma's Electronics, Burt and Hank's Electronics, H&B Electronics, etc. But a man's got to do what a man's got to do to . . . stay in business.

And the moral is . . .

In 1973-4, the stock market held a “GOING OUT OF BUSINESS” sale so convincing that many an affluent trust or investment client swore he would never own stocks again.

Much more recently, when the tech bubble burst, Nasdaq held its own GOOB sale. It was a killer.

Yet the DJIA starts this potentially exciting Wednesday over 12,000. And lots of tech stocks aren't exactly languishing.

Are we about to see another "everything must go" sale in the stock market? Dunno. But if we do, remember Henry.

Previous Tales from the 20th Century:

Borrowing Trouble.

Tuesday, February 27, 2007

A new tax blog from the Wall Street Journal

Today's posts are about the IRS' "dirty dozen" list of the worst tax scams. New for this year, excess claims for the telephone tax refund. Some taxpayers are apparently claiming a credit for the entire amount of their long distance bills, not just the improperly assessed 3% tax. The problem may be systematic; the Service has reportedly conducted raids on tax return preparers in seven cities.

Prescient, Mr Macdonald

About 1.5 billion shares have traded on the Big Board so far today [at 3:19 pm], with declining volume accounting for about 1.46 billion of that, for more than a 50-to-one ratio in favor of declining volume, for the widest spread since Oct. 27, 1997, when it hit a mammoth 167 to 1.It sure didn't take long to validate Jim's blog observation from last night.

Monday, February 26, 2007

Stock Turnover: Will Speed Kill?

From Ahead of the Tape (subscribers only) in today's WSJ:

From Ahead of the Tape (subscribers only) in today's WSJ:According to Sanford C. Bernstein chief investment officer Vadim Zlotnikov, the average holding period for stocks on the New York Stock Exchange and American Stock Exchange last year was less than seven months.

In 1999 -- stereotyped as a time of rapid-fire day trading -- the average holding period was more than a year.

Last time stocks were being held for as short a period as they are now: 1929.

Wednesday, February 21, 2007

“Are You Being Serviced?”

Good reminder that trying to talk like a corporatee honcho instead of a person is perilous.

"Serve" is a basic verb that doesn't leave much wiggle room. "Service" must have been a misguided effort to sound more corporate. But what do you suppose it meant?

The verb to service has several meanings. Two come into play here. Let's call them the suburban meaning and the rural meaning.

In the suburbs, the verb means to maintain or repair. We take the SUV to be serviced. If the laptop crashes, it may need to be serviced ("Had to put in a new motherboard"). Doesn't seem likely that JetBlue wants to change its customers' oil or replace their hard drives.

That leaves the rural meaning. If you heard faint gales of laughter wafting your way from the great horse farms of Virginia, Kentucky or Florida, now you know why.

In rural parlance, to service is to do what Barbaro looked forward to doing. Had the 2006 Derby winner not succumbed to his tragic injury, he might even now be lining up dates with dozens and dozens of grateful mares.

So I guess that's what the JetBlue exec meant: “We're going to [service] you like you've never been [serviced] before.”

Think I'd rather fly Delta.

Lesson for marketers

Words matter, especially in this multitasking age when nobody seems to be paying full attention, and nobody has time to really listen. Whether you’re composing a sales pitch, a brochure on asset-protection trusts or (perish the thought) an apology, plain, clear writing and plain, clear talk will serve you well.

Granted, achieving "plain and clear" often translates into hard work. Sometimes it even requires thinking. But imagine how much happier JetBlue would be today if it had thought more about its operations as well as its words.

Recommended reading

Strunk and White's The Elements of Style. We should consult this classic at least once a year, just to cleanse our minds of all the consultant-speak that seeps in. The 1979 edition is the last edited by E.B. White, and that's the one I'm going to try to get for my granddaughters. You can easily apply his rules to 21st-century words that the author of Charlotte's Web never heard.

Abraham Lincoln's presidential speeches. Oratory got pretty florid in the 19th century. Lincoln excelled by turning to plain talk that a country bumpkin could understand, and that writers and poets still admire.

Far as I know, Abe never proposed to have a single citizen "serviced."

Barbaro family note

Barbaro is survived by his parents and a little brother. Another foal is expected this spring. Siblings of Thoroughbred superstars almost never turn out to have the same great gifts. But wouldn't it be fun?

Sunday, February 18, 2007

Muni Bond taxation under fire.

The decision of the Commonwealth Of Kentucky Court of Appeals is here. The Department of Revenue has filed for certiorari from the U.S. Supreme Court, and the taxpayer has asked that cert be denied. An Ohio court considered the question and found no consitutional violation, a decision that was distinguished by the Kentucky panel. The split of opinions makes it more likely that the U.S. Supreme Court will accept the case. For a debate about the correctness of the Kentucky Court's reasoning, try this.

I think that the Kentucky Court is clearly correct. The problem is that the constitutional remedy is either exempt all muni bond income or tax it all, and given the government's craving for cash, it's likely to more taxes for everyone. If the U.S. Supreme Court upholds the Kentucky decision and applies it nationally, there will be a quick round of refunds for all open tax years for the unconstitutionally collected taxes.

By the way, my understanding is that there is no constitutional impediment to the federal government taxing municipal bonds. I would cheerfully give up that tax preference in order to kill off the AMT. However, that's not on the table yet, so far as I know.

Friday, February 16, 2007

The Deservedly Hated AMT

Interesting that the capital gains tax almost ties the estate tax for second place.

Interesting that the capital gains tax almost ties the estate tax for second place.As online WSJ subscribers can read today, President Bush may be willing to increase income taxes on the rich in order to pay for a fix to the AMT.

For instance, one proposal would pay for a two-year AMT fix with a package that included higher income tax on those making over $400,000.

For the longer term, the WSJ reports, Democrats are considering defanging the AMT by exempting taxpayers with incomes no greater than $250,000.

Thursday, February 15, 2007

Is 2 grams enough?

Using the Presidential portraits for the coins is a good idea, and may lead to better public acceptance of the dollar coin--had federal officials taken this approach instead of first promoting Susan B. Anthony and then Sacagawea, they may have had more success. Still better would have been to do the Presidents in reverse chronology, therefore starting with Reagan (only dead Presidents will be honored). They would have had a lot of trouble keeping up with demand for a Reagan dollar, I suspect, but he's now at the end of the line.

But the fundamental problem remains, and its an obvious one, the new dollar is far too easily confused with a quarter. It's not the consumer's fault, a quarter weighs 6 grams, the new dollar 8 grams, an almost imperceptible difference (for reference, an ounce is 28.3 grams). Though humans have a hard time telling the difference, it's enough for vending machines to distinguish, and the investment that owners of vending machines made to retool for the Sacagawea dollar was given as the reason why the Presidential dollars couldn't be upsized to a more appropriate weight, say double the quarter.

According to the Times, the financials behind printing dollar bills are more complicated that you might think, so there hasn't been a rush to retire Washington's paper portraits.

Wednesday, February 14, 2007

A tricky estate planning case

Olive is the daughter of Thomas Watson, Jr., son of the founder of IBM and himself the IBM President from 1952 to 1971. His estate plan included a trust for his surviving spouse for life, with remainder interests for the couple's grandchildren. Not at all remarkable, until the adult adoption comes into play.

Olive and Patricia are no longer together—in fact, they broke up a year after the adoption. The surviving spouse died in 2004, and Patricia is now pressing her claim for a share of the trust, arguing that she remains a grandchild under the law. Reportedly, millions of dollars are at stake. The Watson family is attempting to have the adoption annulled in Maine on the grounds that neither Olive nor Patricia were Maine residents at the time and such adoptions were not then legal in their home states; gay rights groups are supporting Patricia.

Watson died in 1993, two years after the adoption. If he knew about the adoption, and objected to Patricia as an heir, he could have and should have amended the plan. However, his understanding of the arrangement hasn't been included in the news reports, and it's similarly unclear whether Olive fully understood the financial magnitude of her gesture.

A surge in private banking?

Whenever I interview private-banking chiefs and wealth managers, they almost always ask me the same question: “Do you know any good hires?” Salaries for experienced bankers are soaring. Banks are increasingly poaching each other’s top talent. And training programs for wealth managers and private bankers are popping up around the world.The biggest shortages are apparently in Asia and the Middle East.

Tuesday, February 13, 2007

Banking Goes Short

Citi has also acquired the UK online bank Egg, and is said to be considering opening brick-and-mortar Egg offices.

Citi has also acquired the UK online bank Egg, and is said to be considering opening brick-and-mortar Egg offices.

Looks like its time for a new, trendy, nationwide trust company. We can call it . . .

Anna Nicole's unsettled estate

We knew that it was too good to be true

The bill apparently enjoys strong bipartisan support.

Monday, February 12, 2007

Mutiny at Pirate

Here's a swash- buckling tale from the Stamford, CT Advocate. Just too good to pass up, considering the names involved.

Here's a swash- buckling tale from the Stamford, CT Advocate. Just too good to pass up, considering the names involved.Captain Hudson is Thomas R. Hudson, Jr. Pirate Capital LLC seems to run a number of hedge funds and used to boast of returns over 30%.

Then came 2006!

Who wants retirement education?

Are employees interested in the Roth 401(k)? 44% said yes, they would rather pay taxes now than during retirement. Unfortunately, only 11% of employers were offering the Roth 401(k) at the time the survey was taken.

Hey, Big Spenders!

Russ Prince surveyed 52 self-made Asian UHNWs. Median net worth: $500 million. Here's what each spent on various categories of luxury goods last year:

Fine art and collectibles: $12.4 million

Jewelry: $3.9 million

Fashion and Accessories: $1.8 million

Watches: $962,000

Luxury cars: $674,000

Spas: $597,000

Wall Street Daddies are Weird!

Dear Diary:

As I was heading out of my Upper East Side apartment building to a leisurely breakfast, I happened across a neighbor whose husband is a well-known stock trader on Wall Street. Her darling 5-year old-son had overheard Daddy on the phone with a client, and was quite concerned.

“I know Daddy sells things at his job,” he remarked with consternation, “but why, oh why, did he say he would sell my shorts?”

Sunday, February 11, 2007

What Investors Need vs. What Investors Want

A decade ago, Bogle notes, equity index funds represented only about 5% of the market value in the equity mutual fund universe. Now it's 17%. But the market share of conventional index funds, such as the Vanguard 500 Index Fund, has flattened off at about 10%. The new growth is coming from exchange-traded funds (ETFs).

ETFs such as "spiders" are a perfectly acceptable substitute for conventional index funds as long-term holdings, Bogle concedes. Trouble is, most ETFs focus on narrow market segments. (Would you believe a "HealthShares Emerging Cancer" ETF?) And speculators are trading them like mad.

The resulting commission costs and taxes, not to mention the inevitable poor timing, lead to inferior returns for the great majority of ETF traders.

Bogle hopes serious investors eventually will realize this is no way to make money. On the other hand, there's human nature to contend with:

Surely the amazing growth of ETFs says something about the focus of money managers on gathering assets, the marketing power of brokerage firms, the activities of financial advisers, the energy of Wall Street's financial entrepreneurs, and the willingness -- nay, eagerness -- of investors to favor complexity over simplicity, continuing to believe, against all odds, that they can beat the market.What investors need to prosper is not, alas, necessarily what they want. You can see this conflict embodied in Jim Cramer himself, says Henry Blodget in this Slate column.

The Good Cramer, the Harvard Law grad who writes astute columns and apparently did OK running a hedge fund, is an adviser any long-term investor might want to seek out. But the Bad Cramer, the clowning TV showman who blends hot tips with sound effects, is the one that draws multitudes of viewers. To Blodget, the clash between needs and wants is clear:

The two Cramers—brilliant James J. and vaudeville comic Jim—embody the essential conflict in the American financial industry:the war between intelligent investing (patient, scientific, boring) and successful investment media (frenetic, personality-driven, entertaining).Basically, that leaves us with two questions to ponder:

How do you give investors what they need without looking like such a do-nothing dullard that you lose their business?

How do you give investors what they want without doing irreparable damage to their financial health?

Do we hear any answers?

Friday, February 09, 2007

Permanent charitable IRA rollovers?

Meanwhile, charities are lobbying for more. They would like the $100,000 cap eliminated, and the permitted age for excludable transfers dropped to 59.

Query: Has anyone written about how these rollovers mesh with the Medicaid look-back rules?

Thursday, February 08, 2007

Art Market Up, Antiques Down

At Sotheby's and Christie's, sales of Impressionist and modern art are booming. At Sotheby's, Soutine's "The Man in the Red Scarf," expected to sell for less than $10 million, changed hands for $17.2 million.

At Sotheby's and Christie's, sales of Impressionist and modern art are booming. At Sotheby's, Soutine's "The Man in the Red Scarf," expected to sell for less than $10 million, changed hands for $17.2 million.Sotheby's sale of contemporary art set a record-breaking pace, too.

Reportedly, hedge-fund managers with wheelbarrows of money have been among the big spenders on art recently. Outside the art world, it's hard for them to find household decorations selling for impress-the-neighbors prices in excess of $10 million.

Antiques are another story, reports The New York Times:

“‘Incredibly beautiful antique pieces are going for almost nothing,’ said Robert Couturier, an interior designer and architect in New York. ‘It’s very sad.’ Bargains are particularly plentiful, he said, in 18th-century pieces.

“The antiques market is depressed not just in the United States but in other countries as well, according to Antique Collecting magazine. The managing editor, John Andrews, said prices at British antique shops have fallen about 30 percent since 2002, based on his annual survey of hundreds of dealers, which he has conducted since 1968. It is the worst decline he has seen in 40 years, he said.‘American and French dealers have not fared much better,’ he said. ‘There’s a marked drop in turnover.’”

Victorian pieces and all but museum-quality 18th-century pieces seem to go begging because today's affluents want to come home to comfy, well-upholstered furniture. (Who wants Victorian love seats in their home theater?)

Bottom line: Beneficiaries of estates containing good 19th and 20th-century art works should be feeling pretty happy. Beneficiaries of grandmothers who preferred Sheraton and Chippendale may have to lower their expectations.

Wednesday, February 07, 2007

Estate Planning Tips from Malaysia

It's All in the Planning is the work of Quah Seng-Sun, a former investments and estate planning banker. A former wealth manager, in other words.

It's All in the Planning is the work of Quah Seng-Sun, a former investments and estate planning banker. A former wealth manager, in other words.Estate planning in Penang is complicated because many inhabitants are of Chinese origin while a similar number are Muslim. Special rules of inheritance apply to Muslims' estates. You'll have to study those rules for yourself. One problem seems to be the situation where a rich uncle might leave the bulk of his estate to a favorite nephew. If he's a Muslim, rules of inheritance might require him to split the estate among all 17 of his nephews.

In a post about a new, Muslim trust company, Mr. Quah cites the problems that arise:

In many cases, [trust company chairman Salleh Abas said], assets have to be shared among many descendents. And when they fail to get everyone’s consent to develop their assets, they risk losing the commercial value.Mr. Quah has a number of interesting posts under the heading of estate planning, including a convincing explanation of the advantages of Corporate Trustees as Executor.

He gave as a very good example Kampung Baru, the oldest Malay residential area in Kuala Lumpur.

While high-rise developments have taken and are still taking place all around Kuala Lumpur, Kampung Baru itself — sitting on prime land in the heart of the city — is oblivious to new development and seems to have been bypassed.

This, according to as-Salihin’s chairman, was primarily due to two reasons: one, some descendents are sharing lots as small as 1.8 sq ft* and two, land there has lost its value because many joint owners could not reach agreement on developing it.

Sunday, February 04, 2007

"Death Tax" Repeal: Can It Work in the U.K.?

Super Bowl Indicator

One of Wall Street's most beloved -- and surprisingly accurate -- market predictors says the stock market's direction for the year is foretold by which team wins the Super Bowl.Just relax and enjoy the game!

This year, in an unusual twist, we can tell you the prognostication even before today's kickoff: Stocks are headed up.

That's because both the Bears and the Colts were in the National Football League prior to its 1970 merger with the American Football League.

Legend has it that a win for one of the 16 "original" NFL teams or a National Football Conference expansion team signals a market gain for the year, while a win for one of the 10 AFL teams or an American Football Conference expansion team predicts a decline.

Saturday, February 03, 2007

The Case of the Treacherous Trust Fund.

Life in the early 20th century was a ball for artist Rudolph Bauer, painter of wildly abstract works. His lover was a Baroness, his patron was Solomon Guggenheim, and he became wealthy enough to own a number of grand automobiles.

In 1937, Bauer left Germany and journeyed to the Duesenburg factory in Auburn, Indiana. He ordered a long wheelbase, supercharged chassis to be shipped back to Germany, where he intended to turn it into 20 feet of dream car.

Soon after returning to Hitler's Germany, Bauer was imprisoned. Guggenheim put up enough money to rescue him, and by 1939 Bauer was in the U.S.

Bauer's cup seemeth to run over. Guggenheim showered him with a trust fund and a seaside mansion. All Bauer had to do was sign a contract with the Guggenheim Foundation.

Bauer knew no English. When he discovered he had signed over any and all of his future works to the foundation, he was furious:

Rudolf Bauer lived out his final years in bitter isolation, and never painted again. But he did create one final piece of abstract art, his crowning achievement, a work so outrageous, imposing and flamboyant that its value today far exceeds that of any of his paintings1 – SJ-397, the Last Duesenberg – and he would treasure it until his death in 1953.Bauer's Duesenburg, in magnificant, unrestored condition and with 10,000 original miles on the speedometer, last month sold at the RM Auctions sale for $2,805,000.

Where the High-Net-Worth Boys Are

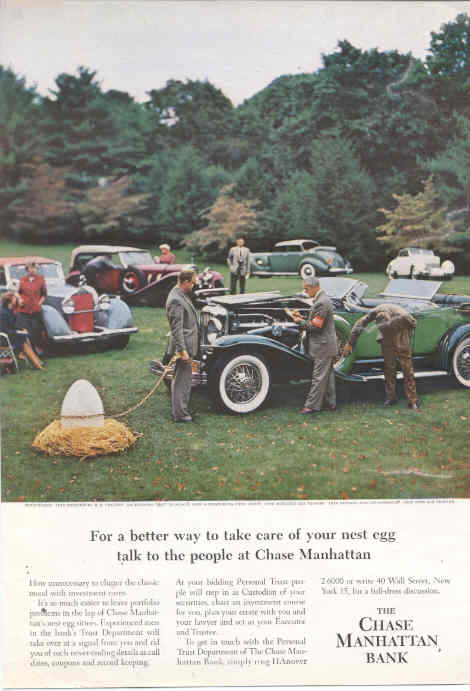

Half a century ago, when the Chase Manhatten Bank wanted an appealing setting for one of its now-famed nest egg ads, it chose an old-car show.

Half a century ago, when the Chase Manhatten Bank wanted an appealing setting for one of its now-famed nest egg ads, it chose an old-car show.Vintage automobiles continue to be like catnip when it comes to attracting well-to-do males.

If you're wooing metrosexuals and HNW women, top-of-the-line antique shows work well. Wachovia's wealth managers reportedly held an event at the recent NYC antiques show..

But it's automobiles that best seem to draw men, though the definition of vintage car evolves as the years roll by.

This 1955 Packard Carribean was cutting edge when that nest-egg ad ran. Last month, as a vintage vehicle in RM auctions' Arizona sale, it sold for $110,000, well above the pre-sale estimate.

What's your favorite way to woo high-net-worth clients and prospects?

What's your favorite way to woo high-net-worth clients and prospects?

Friday, February 02, 2007

Estate Planners, Take a Bow!

In his Wealth Report column in The Wall Street Journal, Robert Frank suggests that the fall is so sharp that others factors may have contributed. Estate planning, for instance:

While tax planning for the wealthy has been lucrative for years, it has accelerated with the recent advent of complex trust structures, family limited partnerships, grantor trusts, various investment products, hybrid life-insurance policies and charitable-giving vehicles. The tax-strategy business has become an important component of the wealth-management business.Rising exemptions and a drop in the top estate tax rate haven't hurt the inheritances of charities. From 2000 to 2005, charitable deductions rose more than 20%.

David Handler, a trust-and-estate attorney with Kirkland & Ellis in Chicago, believes that most of the drop in estate taxes is because of the rising wealth threshold. But he says more sophisticated tax advice has also helped reduce total collections.

"The investment firms have really put estate planning on the front burner," says Mr. Handler. "People in my business are always coming up with new structures and adding all sort of technical tweaks."

SunTrust vs. Heirs of Conductor Robert Shaw

This is not just another “failure to diversify” dispute. The stock in question is that of the Coca-Cola Company, an Atlanta institution. And SunTrust's predecessor, The Trust Company of Georgia, was widely regarded as the Coca-Cola bank.

Central to t

he litigation is SunTrusts’ decades-old relationship with the Coca-Cola Co.—one of its largest and oldest clients—and whether bank executives could be relied on to manage its clients’ trust portfolios impartially, given the bank’s own extensive holdings of Coke stock which date back to the company’s formation.

According to Hitz’s and Shaw’s pleadings, the trusts that SunTrust manages contain more than 68 million shares of Coke stock. In addition, according to Securities and Exchange Commission filings, SunTrust in 2005 held more than 48 million shares of Coke stock worth more than $2 billion. Together, the bank’s corporate and trust holdings total more than 116 million Coke shares, making it among the soft drink company’s largest shareholders.

At stake are millions of dollars in losses sustained by the Sauls trust—which, in 2000, was divided into a number of smaller trusts—as a result of its concentration of Coke stock. Since 1998, Coke stock has plunged in value from its all time high of $88.94 a share to its current price of $48.10 at the close of business Thursday.

The trusts were established byH. Cliff Sauls, a prominent Atlanta physician. Robert Shaw married Sauls' daughter.

Thursday, February 01, 2007

The Wife of a Banker

Born of uncertain parentage to an "actress" who slept around, this little girl starts life upon the wicked stage and succeeds well enough to catch the eye of playwright Richard Brinsley Sheridan.

Thanks to a solid career at Drury Lane, Harriot becomes a young woman of independent means. Catches the eye of a shabby old gent. He turns out to be wealthy Thomas Coutts, banker to the Royals. (If you decide to marry, m'dear, he advised her, first be sure to put your money in trust.)

Four days after the death of his first wife, 80-year-old Coutts marries his young mist

ress. At his death seven years later, he leaves a will disinheriting his daughters and leaving “all I might possess or that I hereafter might acquire or be entitled to at my death, wholly & solely to my dear wife, irrevocably.”

ress. At his death seven years later, he leaves a will disinheriting his daughters and leaving “all I might possess or that I hereafter might acquire or be entitled to at my death, wholly & solely to my dear wife, irrevocably.”Harriot becomes senior partner of the bank, founded in 1629, and a noted partygiver.

There's much more to the story, including how Harriot winds up as the Dutchess of St. Albans. You can read more here.

Harriot was one of the prettiest bankers you would ever want to meet. And when she died, she left Coutts' granddaughter a fortune twice as large as she had received from old Thomas.

Updated April 13, 2011