The Journal looks on the bright side: Nations we've flooded with dollars now have something (banks) to buy with them.

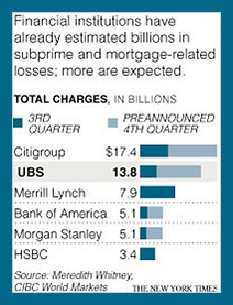

The Times, in this table, shows that UBS at least lost less (so far) than Citi (so far).

The Times, in this table, shows that UBS at least lost less (so far) than Citi (so far).Still, the $13.8 billion lost by UBS is no small sum. Multi-billion-dollar losses have become common, and we'll be seeing more of them, but even taken individually, they are enormous.

Imagine, please, that you are given $13.8 billion. You head straight for Vegas, determined to lose your vast fortune at the rate of $1 million a day. Seven days a week, week after week, month after month, year after year, you lose a million every day.

How long will it take you to lose all $13.8 billion? Twenty years? Thirty years?

Even longer! More than a third of a century will pass until, sometime in 2045, you finally go broke.

2 comments:

37 years and 9.5 months, by my reckoning.

I didn't realize that they were making mortgages that fast! To what extent are we seeing a variety of other bad investments being wiped off the books at the same time?

And the Citibank loss alone would take nearly half a century to generate, at $1 million per day.

Post a Comment