Sunday, December 31, 2006

New Blogger

Friday, December 29, 2006

May Jambhala Favor You in the New Year

Earlier this month, Jambhala, the Tibetan Buddhist deity of wealth, adorned a thoughtful article on the nature of giving by Holland Cotter in The New York Times ($).

Earlier this month, Jambhala, the Tibetan Buddhist deity of wealth, adorned a thoughtful article on the nature of giving by Holland Cotter in The New York Times ($).“Generosity means different things to different people,” writes Cotter. “For some it’s a fixed sum, a payment of moral dues; an act of charity. For others it’s qualified; a negotiated transaction: I will do this for you now if you will do that for me later. For still others it is a frame of mind, an ethical condition, a sustained discipline.”

Jambhala, I gather, is meant to remind us that wealth is good, but only as a means to an end. Prosperity means we worry less about the next mortgage payment. That should free us to concentrate more attention on matters spiritual.

So here's hoping Jambhala brings you a wealthy new year. Just don't mistake him for the guy who said “greed is good.” Cotter warns that Jambhala “is part of an elaborate system of karmic checks and balances in which avarice is inevitably punished, by Jambhala himself in payback mode, and acts of selfless generosity may actually win you the jackpot.”

Thursday, December 28, 2006

The Longer This Estate Squabble Lasts, the Richer the Heirs Get!

What did people do before television? They read The Saturday Evening Post. And they cherished the Americana pictured on the Post's covers, most famously by Norman Rockwell.

What did people do before television? They read The Saturday Evening Post. And they cherished the Americana pictured on the Post's covers, most famously by Norman Rockwell.Rockwell and the Post's art director, Ken Stuart, became good buddies. Over the years Stuart took more than a dozen Rockwell paintings home with him.

So what happens now that Post covers by Rockwell are worth millions? An estate battle that seems to have everything, including an elderly, "cognitively impaired" testator, three feuding sons, and charges that one son dipped into the estate to live well at his siblings' expense.

Plus a unique feature. according to this report in The New York Times. Though assorted lawyers are surely getting richer as the fight drags on, so are the three feuding heirs, thanks to the skyrocketing value of Rockwell's Post cover paintings, such as "Saying Grace," shown here.

When the urbane Mr. Stuart died in 1993, he left everything to his three sons — Ken Jr., William and Jonathan — in equal shares. The artwork was the crown jewel of an otherwise middle-class man’s estate, and by all rights, dividing three paintings among three brothers ought not to have been hard.The remnants of the Curtis Publishing Company must have changed hands more than once since the Post's heyday. Some years back, the current owners sought to recover the paintings Rockwell had presumably sold to the Post's publisher. Too late, says the NY Times: "In September, a federal judge said that Curtis had waited too long to cry foul . . . ."

But two of the brothers, William and Jonathan, have spent 13 years fighting in court against their older brother, Ken Jr., saying that he took advantage of their ailing father, forcing him to sign papers to gain control of the entire fortune. The younger Stuarts charge that Ken Jr., who has been self-employed since 1991, used estate assets to enrich himself at their expense and support a lifestyle that included alimony for his first wife, a $5,000 Rolex for his soon-to-be second wife, $44,500 for a cello and bow for his daughter, and a $16,000 time-share for himself in New Orleans.

A judge ruled largely in Jonathan and William’s favor in 2004, but Ken Jr. has appealed. He contends the money he took was “for services rendered” and has also filed for bankruptcy protection. The only way his brothers will get paid, he says, is by selling the paintings, which they are resisting.

This epic family feud has ambled through five different courts, piling up more than 20,000 pages of documentary evidence. But unlike other situations in which litigation begets litigation and only the lawyers win, the longer the brothers squabble, the richer they all get, as the art increases in value. Last month, the owner of “Breaking Home Ties,” thought to be the second-most popular Rockwell cover after “Saying Grace,” had it auctioned by Sotheby’s. The painting fetched a record $15.4 million.

Saturday, December 23, 2006

“A Pear Tree! Darling, Wasn't That Expensive?”

Each year, PNC Wealth Management, based in Pittsburgh, tabulates how much it costs to acquire the gifts listed in the song, using a Christmas Price Index that typically mirrors the federal inflation-tracking Consumer Price Index.

This year —no surprise — the song’s gift list is more expensive than ever, mostly because the leaping lords, piping pipers, drumming drummers and dancing ladies ran up the bill.

It was the first time in nine years that the rise in labor costs outstripped inflation, said Jeffrey N. Kleintop, PNC’s chief investment strategist, who oversees the index.

“After years of stagnation, wages for skilled workers, including the song’s dancers and musicians, have increased as the labor market has tightened,” Mr. Kleintop said.

The 12 gifts would cost a total of $18,920.59, up 3.1 percent from last year. That is less than the 6.1 percent rise chalked up last year over 2004, though, when the threat of avian flu kicked fowl prices up.

Marketing note: PNC Wealth Management gets a good bit of free brand exposure from this annual survey of Christmas prices. Sometimes a little whimsey pays off in ink, airtime and pixels.

Who is Fiction's Best Known Executor?

"[Jacob Marley's] sole executor, his sole administrator, his sole assign, his sole residuary legatee, his sole friend and sole mourner" was . . . Ebeneezer Scrooge.

Flinty old coot, Ebeneezer Scrooge. Happily, the Christmas spirit(s) set him right.

"It was always said of him," Dickens tells us, "that he knew how to keep Christmas well, if any man alive possessed the knowledge.

"May that be truly said of us, and all of us!"

Tuesday, December 19, 2006

The English Gave Us More than Plum Pudding

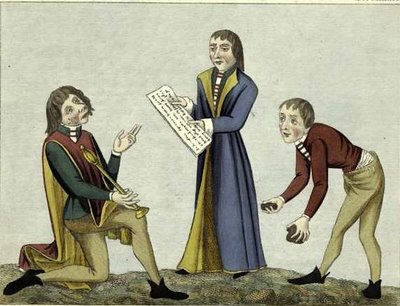

During the early 1500's in England landowners found it advantageous to convey the legal title of their land to third parties while retaining the benefits of ownership. Because they were not the real "owners" of the land, and wealth was primarily measured by the amount of land owned, they were immune from creditors and may have absolved themselves of some feudal obligations. While feudal concerns no longer exist and wealth is held in many forms other than land (i.e., stocks, bonds, bank accounts), the idea of placing property in third party hands for the benefit of another has survived and prospered. This is the idea of a trust which has survived and prospered.

The illustration is from The New York Public Library Digital Gallery.

The text is clipped from the Trusts and Estates overview at Wex, the legal enclycopia and dictionary sponsored by The Legal Information Institute at Cornell. At this time of year, Wex would not object if you chose to make a donation to support their collaborative effort.

Good news on the GLB front

Trust Updates reports good news today. Responding to Congressional push-back, the SEC has relented, and trust departments can go about their fiduciary business in their traditional manner.

The proposed rules would allow a bank, subject to certain conditions, to continue to conduct securities transactions for customers as part of its trust and fiduciary, custodial and deposit "sweep" functions, and to refer customers to a securities broker-dealer under a networking arrangement.

Copies of the proposed rule are available at http://www.sec.gov/rules/proposed/2006/34-54946.pdf and at http://www.sec.gov/rules/proposed/2006/34-54947.pdf .

Monday, December 18, 2006

Life settlements in the news

The practice is known in some circles as "life settlements," and should not be confused with "viatical settlements" of life insurance. The latter involve terminably ill persons who wanted to cash out their life insurance to meet medical payments. One useful medical advance and suddenly the viatical settlement market has many disappointed investors, if it means that insureds move from "hopeless" status to "will remain alive indefinitely." With life settlements, the insureds must be healthy, putting the purchases of the insurance policies on a sounder actuarial footing.

For insureds, a life settlement means a more financially secure retirement. The investors take over premium payments, collect the proceeds eventually, and expect to have an above-market rate of return.

Sounds like a win-win, but then we get to the insurance companies. The dirty little secret of the insurance industry is that most life insurance policies never pay off, which is why the premiums can be so low. Policies that investors take on won't be lapsed, and that development has not been in the equation. Says the Times:

Well, it's hard to have a lot of sympathy for the insurance companies. But the Times also reports on speculator-initiated life insurance, or "spin-life" policies, in which investors lend money to the insured to buy policies, with an agreement to buy the policy back at a stated date in the future. That strategy would seem to me to be vulnerable to the insurable interest rule.Life insurance companies, in particular, rely on policies lapsing before the policyholder dies. Last year, for instance, insurance companies reduced their financial exposure by $1.1 trillion when 19.8 million policyholders stopped paying premiums, according to the Insurance Information Institute. In comparison, the industry paid death benefits on only 2.2 million policies.

If those lapsed policies had been sold to investors rather than canceled, insurance companies could have eventually paid out as much as a trillion dollars, say analysts.

Saturday, December 16, 2006

The Fight for HNW Referrals Heats Up

Often, from the ranks of retail banking customers referred by customer service representatives or tellers.

Financial services marketers work hard to promote the referral process. See, for example, Winning Trust, mentioned by Jim Gust in a recent post.

The bank's commissioned sales force for annuities, mutual funds and other in

vestment products also seeks new clients, and also relies heavily on referrals.

vestment products also seeks new clients, and also relies heavily on referrals.So far, many banks have minimized conflicts by dividing referrals according to wealth level. Brokers selling on commission get the emerging affluents. Fee-based wealth managers get the customers with net worths of $1 million or more.

Under new rules relating to bank broker provisions of the Securities Exchange Act of 1934, proposed by the SEC, the fight for HNW prospects may heat up:

The Exchange Act provides that banks may pay unregistered employees “nominal” incentive compensation for making these referrals. The proposed rules would define “nominal,” “incentive compensation,” and certain other terms. To accommodate banks’ customary bonus plans, the definition of “incentive compensation” would specifically exclude qualifying discretionary compensation paid under these bonus plans. The proposal also would allow banks to pay more than nominal fees for referrals of certain institutional customers and high net worth customers to a broker or dealer, if the bank and broker-dealer satisfy conditions to protect these customers.Investment News notes that trust departments will benefit from another provision:

The proposal, which affects thousands of banks, also ensures that banks will continue to be able to accept 12(b)-1 fees for mutual funds used in defined contribution retirement plans managed by bank trust departments.

Friday, December 15, 2006

Good News for Wealth Managers

More than half of American households owned stocks and mutual funds in 2005. The 91 million individuals in those households had a median age of 51 and a median household income of $65,000.

That might help explain a shift in what college freshmen described as their primary personal objectives. In 1970, 79 percent said their goal was developing a meaningful philosophy of life. By 2005, 75 percent said their primary objective was to be financially very well off.

Thursday, December 14, 2006

Maybe Your Bank Isn't So Bad

Hedge Funds Move Upmarket

Will the higher minimum actually enhance hedge-fund ownership as a status symbol?

Wonder if the higher minimum will apply to Goldman Sachs’ new "virtual" fund of hedge funds? The firm's Absolute Return Tracker Index aims to replicate hedge fund returns for an annual fee of 1.01%. According to the chatter on CNBC, private bankers should be salivating at the chance to package the ART index.

In any case, hedge funds continue to grab the public fancy. Why else would John Wiley & Sons have published "Hedge Funds for Dummies"?

You and your not-dumb clients will find a decent briefing on the subject here, written by Lord William Rees-Mogg, the former editor-in-chief of The Times.

Tuesday, December 12, 2006

Is This Any Way to Market Revocable Trusts?

Here's a different kind of trust company. In this clear, informative web page, New Convenant Trust Company treats self-trusteeship as the default option:

What is a Revocable Trust?Admittedly, New Covenant Trust Company is not your usual, for-profit, trust institution. A wing of the Presbyterian Foundation, the company specializes in charitable remainder trusts and such. (In the case of an everyday revocable trusts, New Covenant requires the grantor to leave 10% of the trust fund, up to $250,000, to a Presbyterian or Presbyterian-related charity.)

A revocable trust is created to accept ownership of your assets during your lifetime. This is appealing for several reasons:

• You may retain complete management, control, use and distribution of your trust assets. If you prefer, you can designate someone else to serve as trustee for you.

• You select an alternative trustee in the event you become incapacitated. The trustee will manage the trust funds for you. The trust should clearly state how to determine incapacity.

• You can add or remove assets from the trust or change any of the terms at any time as you determine in your sole discretion.

• At your death, the trust becomes irrevocable and provides for the distribution or the continued management of the remaining assets in the trust by the successor trustee. The distribution is private; no involvement of probate.

Should more bank trust departments be marketing standby trusts as a primary product?

Before you answer "No," remember that sometimes the pros are wrong and the customers are right. Steve Jobs once thought a video iPod was a really stupid idea.

Monday, December 11, 2006

Childless? Don't be Caught Dead in Texas!

Texas needs more hassles, according to this article in the Austin American-Statesman.

Theme of the special report : "Texas estate laws make stealing from the dead an easy crime."

Sunday, December 10, 2006

When sunk costs trump anchoring

The reason seems to be that low initial prices attract more bidders, and more bidding means that more people have invested more time in the auction. That, in turn, justifies the higher price in the successful bidder's final offer.

Saturday, December 09, 2006

Expanded HSAs

There's something here that I'm not getting. Couldn't this change effectively make all medical expenses fully deductible, provided only that they are channeled through an HSA? I guess not, if an employer's health program is not structured as an HSA. Still, the 10-year cost of eliminating the cap on deductions is a scant $712 million, which must assume that no one will be switching to the HSA format in the future. Why won't everyone take that approach now?

In a contrasting revenue projection, allowing the deduction of sales taxes in those states without an income tax for only two years, 2006 and 2007, has a ten-year cost of $5.5 billion. That seems way too high.

I'll be watching for the new HSA marketing plans.

Friday, December 08, 2006

Tax extenders pass in the House

After the Crash: How Wall Street Preserved a Football Legacy

Many joined the new Downtown Athletic Club. In the Depression years the club became a popular place to work out, socialize and sit around cursing FDR's New Deal.

Club members became become fervent fans of college football, thanks to a touchdown club organiized by the club's athletic director. When the club decided to award a trophy to each year's best player, members proposed naming it for the athletic director, who had been a famed coach in his day.

He didn't think much of the award idea and declined.

After the athletic director's death in 1936, the Downtown Athletic Club named the award for him anyway.

The Heisman trophy will be awarded tomorrow for the 72nd time.

When the Senior Assistant Blogger's daughter entered Oberlin, he was astonished to learn that Heisman had been the college's first coach.

John William Heisman (1869-1936) was the first professional football coach at Oberlin College. In 1892, he led the Yeomen football team to a perfect 7-0 record. In those days of high-powered football, the '92 Oberlin grid squad defeated both Ohio State and Michigan . . .Heisman coached lots of other places. Along the way he helped invent the game.

Most notably, says today's New York Times, he may have saved the game from self-destructing.

To prevent football from deteriorating into nothing but savage scrimmaging, Heisman coaxed the Father of the Game, Yale's sainted Walter Camp, into adopting the forward pass.

Give a cheer, then, to the battered Wall Streeters who raised their depressed spirits by following football. And tell the young footballers in your family to read up on Heisman. He's worth remembering.

Thursday, December 07, 2006

Hedge Funds Need “Christmas Miracle”

[H}edge funds will need a Christmas miracle to reach double-digits this year, as the [Hedge Fund Research] HFRX Global index sits at 7.56% year-to-date. The broad-market S&P500, on the other hand, is up 12.2% YTD.

On the bright side, only one of the eight strategies tracked by HFR was in the red last month: equity-market neutral, which dipped 0.53% and has returned only 3.82% YTD.

Old Congress Ends with a Whimper (and Tax Extenders?)

The tax extenders? The bill has been festooned with unrelated goodies, including measures relating to oil and gas royalties and timber.

Nevertheless, on CNBC, the Boston Globe's Rick Klein predicts that enough junk will be pruned from the bill to allow the extenders to pass.

Hanging on to the old money

Mellon's wealth management group oversees some $92 billion for wealthy families, while BoNY manages $60 billion. None of the client contact folks at either bank are in jeopardy from the merger, according to the article, because keeping that staff is one key to keeping clients happy. There's already enough pressure from the younger generation for finding new financial advisors without increasing the churn of the bank's contact people.

"It is a goal of every financial adviser, every private bank, every community foundation and every charity to retain a connection to the next generation to help them achieve their goals," says Paul G. Schervish, director of the Center on Wealth and Philanthropy at Boston College.

In a conference call with investors, Robert P. Kelly, Mellon's president and chief executive, said the banks would work hard to keep clients through the merger: " 'Lose no customers' is our rallying cry."

Tuesday, December 05, 2006

Trust Advertising in 1956

From a November, 1956 New Yorker, here's a glimpse of what a typical trust ad from a NY trust institution looked like in those days.

From a November, 1956 New Yorker, here's a glimpse of what a typical trust ad from a NY trust institution looked like in those days.The Guaranty ad gives you a greater appreciation of the creativity that went into the Chase nest egg ads from the same era, as seen here and here.

No wonder those old Chase nest-egg ads now sell as collectibles on eBay.

Monday, December 04, 2006

This is the week for the tax extenders

A new extenders bill needs to be introduced and passed in the House, before going on to the Senate. Favored provisions will get just two years of life, that is, retroactively for 2006 and ahead for only 2007. Some trade and health-related provisions may be included in the bill as well.

As to the Alternative Minimum Tax for next year, the silence is deafening, in contrast to last year at this time.

The Bank of New York Reinvents Itself

Today The Bank of New York announced the acquisition of Mellon Financial.

Today The Bank of New York announced the acquisition of Mellon Financial.Generations ago, BONY maintained a strong presence in trusts and wealth management. Lately the bank has been best known for its corporate services.

Earlier this year, BONY divested its retail branches in exchange for Chase's corporate trust business.

Now BONY is opening new private banking offices, pretty well blanketing the greater New York metropolitan area, plus outposts in Florida and Boston.

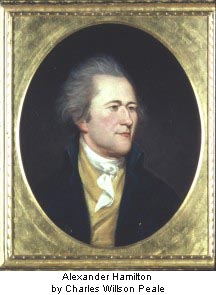

The bank has also launched an award-winning ad campaign for private banking. The campaign plays up BONY's long history, such as this bit of trust lore from the ad running in today's New York Times:

“Generation after generation, The Private Bank of The Bank of New York has been acquiring financial wisdom and serving its clients with unwavering commitment.

“This is the home of the nation's first trust, created for the wife and seven children of our founder, Alexander Hamilton. And this is where we have continued to serve our clients and their families ever since.”